Historical Cost Model

advertisement

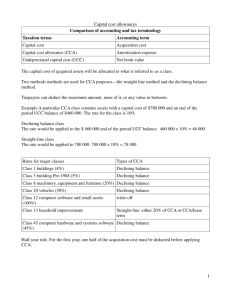

Measurement Model Historical Cost Current Cost (CAA) Prepared by: Carly Wong Ingrid Yeung Carmen Wong Priscilla Wong Historical Cost Model Historical Cost Model The model has been around since the 1400’s Until after WWII, inflation was not really part of our economic environment The essence of the model is that all transactions are recorded at their acquisition or original cost Historical Cost Model (Cont’d) Form of payment is irrelevant Assumes aggregation of monetary units from different periods acceptable Acquisition cost of depreciable assets is allocated over asset’s effective service life – Historical cost depreciation is matched against current dollar revenue creating an illusory net income component Argument for Historical Cost Historical cost is relevant in making economic decisions Decisions making concerning future commitments => need data on past transactions as the basis for judging History cost is relevant for decision making 1. Affecting evaluation and selection of decision rules => historical cost is directly related to past decisions => determine the quality of the past decision => serve as a basis for the forecast 2. Providing input to the “satisficing” notion => decision makers do not seek to optimizes but to satisfice => consider how much earned rather than how much can earn Historical cost is relevant in making economic decisions 3. Imposing on the decision maker by their environment => employed many different contexts e.g. taxable income , cost-plus contracts Historical cost is based on actual, not merely possible transactions Record of the actual transactions =>supporting documents are provided =>determining how effectively management has met its responsibilities =>increasing the accountability-primary objective under stewardship function Current cost or exit price accounting Basis of year end market prices without reference to actual transactions Throughout history, financial statements based on historical cost have been found to be useful Financial reports based on historical cost useful for over the years Modern industrial and managerial accounting practices based on trial and error for many years => not useful => changed The best understanding concept of profit is the excess of selling price over historical cost Profit is accepted as a measure of successful performance Profit requires sufficient use of time , place and form be added to the materials, products or services purchased above the cost Historical cost is the basis idea of profit E.g. decision on whether continue a product line or not depends on the favorable spread between revenue and cost Accountants must guard the integrity of their data against internal modification Historical cost is less subjective to manipulation than current cost or selling price. Littleton => these are still wholly outside the prior decisions and the recorded experience of the enterprise Accountants must guard the integrity of their data against internal modification Mautz => whom would you trust to value the assets of any major company, how are current values to be determined, how would an accountant ascertain that the values are a fair presentation, can an accountant withstand the pressure by managers to accept optimistically valued assets? How useful is income information based on current cost or exist price Is it useful to show as income an increase in the value of an asset that the firm has no intention of selling? If the price of an asset at the end of the year is lower than it was during the year, this encourages criticism of management by shareholders for not having disposal of the asset earlier. How useful is income information based on current cost or exist price Current cost and exist price accounting induce a short-term view of profits. In many cases, management may believe that disposing of assets is not the more profitable alternative – reasons for holding an asset other than realizing an immediate profit. Changes in market prices can be disclosed as supplementary data Historical cost does not differ materially from current cost. – Supplementary data on current prices are a practical and sufficient way of dealing with such information without having to shift from historical cost to a current cost basis. – Adopted by the Australian Accounting Standard setters in 1976. • Supplementary statement in addition to their conventional financial statement Changes in market prices can be disclosed as supplementary data Based on studies of the relationship between accounting data and the market reaction to the data, the efficient markets hypothesis in semistrong form states that security prices always reflect publicly available information. – Implying that the method of disclosing any information including current values, whether shown in the text of the financial statements, as a footnote, or as supplementary data, makes no difference to the market. There is insufficient evidence to justify rejection of historical cost accounting Most of the research studies indicate that current cost data do not provide any more information than historical cost data Traditional accountants argue that there is no persuasive empirical evidence that indicates that current cost or exist price accounting information is more useful than historical cost information Criticisms of historical cost accounting Objective of accounting Provide useful information for economic decision making is taken to mean providing information to the stewardship function of management. – Historical cost accounting reveals that the primary role of accounting is to meet the decision-making needs of users – Forward-looking decision-usefulness approach Objective of accounting Information on the stewardship function does not necessarily restrict accountability to the original amounts invested directly or indirectly by equityholders. Investors are interested in knowing about the increases or decreases in the value of their investments as represented by the net assets of the company Objective of accounting Historical cost system fails in its underlying function of providing objective information. – It is far from objective and is open to manipulation – Monograph 10 questions the validity of the historical cost information and attacks a basic tenet of the system, which is that historical cost information ensures the maintenance of an entity’s capital base. Information for decision making Historical cost=> management needs historical cost data in order to evaluate their past decisions as they contemplate future commitments Past decision was right or wrong must ultimately be ascertained by what happens in the marketplace Historical cost has usefulness, but it is insufficient for the evaluation of business decisions. Information for decision making Historical cost accounting adopts a financial capital concept. However, capital regarded as the nominal dollar investment in the firm rather than the purchasing power of the investment. After the year of acquisition, historical costs do not correlate with the events of the year. Information for decision making (Cont’d) Historical cost overstated income in a time of rising prices because it offsets historical cost against current inflated revenue. Highly questionable for the relevance of historical cost for decision making. Basis of historical cost Historical cost is under the ‘going concern’ assumption Sterling => questions the validity of the assumption – The high rate of business failure would make it difficult to build an evidential case for a projection of continuity. No business has ever continued ‘indefinitely’ into the future. Historical cost under attack Balance sheets contain outdated cost prices or valuations => hardly to say to be true and fair A lot of departures – All non-financial assets of GTEs be measured using ‘deprival value” concepts – Liabilities be measured using present value Departures provide more relevant information than historical cost Notions of investor needs Historical cost cause either a distortion or concealment of important company disclosures=> goal of conventional accounting are ill-conceived – Because accountant: • Have naïve, simplistic view of investor and their needs • Accept old-fashioned, fundamentalist view Share market analysis and corporate analysis are different – Market analysis mainly of trying to ascertain what other investor are thinking – Corporate analysis not really concerned about corporate facts but about the psychology of the market Matching Going concern assumption does not underlie the use of historical cost Matching concept-when revenues are earned, the expenses incurred in earning those revenues are matched (offset) against the revenues to calculate income Conventional accounting puts emphasis on deciding whether a cost should be deducted form revenues in the current period or be deferred to future periods =>responsible for deferred charges and that are not assets and deferred credits that are nor liabilities Matching Decisions are based on the matching principle => in most cases the matching of costs and revenues is a practical impossibility e.g. cost allocation- not capable of being verified or refuted because there is no way to select one method over another except arbitrarily Current Cost Accounting (CCA) Definition of current cost accounting a cost calculated to take into consideration current circumstances of cost and performance levels adjusting to constant purchasing power by using the average inflation rate in the current year Business Profits composes into 2 parts – current operating profit – realizable cost savings Current operating profit: – excess of the current value of the output sold over the current cost of the related inputs Realizable cost saving: – increase in the current cost of the assets held by the firm in the current period – both realized and unrealized cost changes. Business Profits – realizable cost savings = holding gains/losses – Holdings gains: • a saving attributable to the fact that the input was acquired in advance of use • this savings is attributable to holding activities. Why we need to measure separately? Holding assets and liabilities enhance the firm’s market position managers and others want to know if these holding activities are successful Under the conventional accounting gains are only recorded when the assets are disposed impossible to show it unless assets are bought and sold mislead the investor to determine which firm is more efficient Assumption of the CCA Without the measurement of the holding gains/losses confuse the evaluation of management decision hinders the allocation of resources in the economy CCA suggest that separation of holding gains and operation profits gives credit to the appropriate managers Financial Capital Concept vs. Physical Capital Concept CCA provides more useful information than conventional accounting supports can be divided into 2 camps – those who believe in the financial capital concept – those who believe in physical capital concept Difference: “whether or not holding gains or losses are included in income” Financial Capital firm invests financial resources with the expectations that the investment will create a higher level of cash inflow recovery of the amount of financial resources invested is a return of capital cash flows in excess of the amount financial resources invested are a return on capital holding gains cost savings and the increases in future cash flow of the assets Physical capital physical units denoting the firm’s operating capability emphasize on the need to know the firm’s operating capability has been maintained continue in businesses the holding gains capital maintenance adjustment Argument Against CCA Realization principle – it violates the traditional realization principle – because the changes in market price of the assets in use is irrelevant – fixed asset is not more valuable to a firm simply because its current cost has risen – asset value lies in its service potential, not its market value Argument Against CCA (Cont’d) Subjectivity – another problem is the subjectivity of determining the amount of the increase in cost – if there is no reliable secondhand market, current cost must be the new asset expected to replace the old one – adjustment has to be made between the actual asset and the replacement – it is difficult to calculate Argument Against CCA (Cont’d) Subjectivity – another problem is the subjectivity of determining the amount of the increase in cost – if there is no reliable secondhand market, current cost must be the new asset expected to replace the old one – adjustment has to be made between the actual asset and the replacement – it is difficult to calculate Argument Against CCA (Cont’d) viewpoint of exit price – cost implies opportunity cost or sacrifice of the next best alternative – current sacrifice faced by a company is to sell the asset rather than use it – but not to purchase the item because company has already owned it – so current cost, which is the price to purchase, is irrelevant Argument Against CCA (Cont’d) Allocation problem – allocation of current cost is arbitrary and lack in real-world counterparts – backlog depreciation is charged to income or to a capital account – cause difference in amount of income reported Argument Against CCA (Cont’d) Technological changes – improved assets will more than likely replace existing assets – so current operating profits would be poor predicators of future profits – investors would be misled by the current operating profit as a basis for predicting future cash flows Argument Against CCA (Cont’d) Sum up: – current cost information is irrelevant to most investment decisions – it does not focus on the firm’s ability to command financial resources in the firm’s quest to adapt itself to the environment Argument For CCA Recognition principle – current cost accounting violates the conventional principle of recognizing a holding gain only for unrealized holding gains from a financial capital view – unrealized holding gains represent actual economic phenomena occurring in the current period – therefore should be recognized if there is sufficient objective evidence to support the price changes Argument For CCA (Cont’d) Recognition principle (cont’d) – market price of fixed assets are not relevant – however, whether the firm intends to use or sell a fixed asset is not pertinent – the change in the price of the asset is relevant – determination of periodic income should be based on what actually happened in the current period, not on what might occur Argument For CCA (Cont’d) Subjectivity – current cost accounting lacks objectivity? – current cost is not based on actual transactions in which the firm is a participant – however, objectivity is relative – even under conventional accounting, some figures are more objective – therefore, the question is whether current costs meet a certain minimum level of objectivity that the accounting profession is willing to accept Argument For CCA (Cont’d) Subjectivity (cont’d) – market prices are relatively easy to obtain the objectivity of their current costs would be acceptable – E.g current cost of fixed assets can be obtained from secondhand dealers – No market prices are available appraisals, calculations of reproduction costs and use of index numbers Argument For CCA (Cont’d) Viewpoint of exit price – Value at exit price is unusual because the firm is normally a buyer – utilizing exit prices when liquidation is not contemplated is misleading – e.g. a customized asset used by the company is of great value, but when a firm is under liquidation, the value of the asset is greatly reduced as it is customized for the company’s own use Argument For CCA (Cont’d) Viewpoint of exit price (cont’d) – however, the company decides to keep and use its assets rather than sell the asset – because the management of the company believes its value in use is greater than its exit value Argument For CCA (Cont’d) Allocation problem – allocation problem exists in most accounting method, even the conventional historical cost accounting also has the allocation problem Argument For CCA (Cont’d) Technological changes – current operating profit = indication to make a positive long-term contribution to the economy – it also indicates that the production process in use by the firm is effective – if profit > interest earned on the net assets at current cost the existing production process is worth continuing Argument For CCA (Cont’d) Technological changes (cont’d) – current operating profit is primarily representative of the long-term profit capability of the firm under the existing production process, assuming that existing conditions remain relatively the same – the technological changes are not taken into account – When a new machine changes the cost of production, the price of the old must adjust the price of the old asset reflects the technological change Conclusion current cost accounting performs significantly better than historical cost income because historical cost accounting fail to adjust for inflation No doubt, CCA data provide useful information to managers Conclusion (Cont’d) Question: whether benefits exceed the cost of gathering the information? On a cost-benefit basis – historical cost information are almost provided in the capital markets Objectivity: – information obtained from genuine transaction that have occurred – Information is capable of being verified Conclusion: Historical Cost Accounting is better