Derivative Products

advertisement

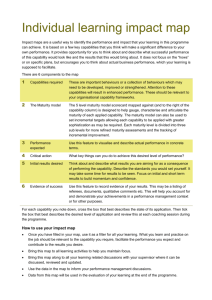

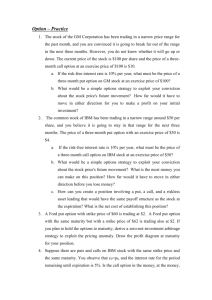

Paola Lucantoni Financial Market Law and Regulation Forward agreements Swaps Options Forward agreements Def: A forward agreement is an agreement between two parties for the consignment of a specific quantity of a certain underlying product at a pre-established price (strike price) and on a pre-established date (maturity date). underlying product financial assets, such as shares, bonds, currency, financial instruments, derivatives, etc; goods, such as oil, gold, grain, etc.. The purchaser of the forward agreement The seller undertakes on maturity to hand over the underlying product in order to receive the strike price a short position. at the time of their finalization, the short and long position are usually equivalent. undertakes on maturuty to pay the strike price in order to receive the underlying products a long position consignment price equal to the forward price forward price = current price of the underlying products (so-called spot price) increased by the financial value of the time running between the date of stipulation and the maturity date Exception: up front over the duration of the agreement, Changes related to the current priceof the underlying product risk/return profile of a forward agreement for the purchaser of the agreement for the seller of the agreement, aims - hedging purpose - speculative purpose - arbitrage purpose The execution of the agreement on maturity physical delivery - effective consignment of the underlying assets by the seller to the purchaser cash settlement - payment of the differential in cash between the current price of the underlying product, on maturity, and the consignment price indicated in the agreement forward contracts OTC Futures standardized and traded on organized markets. Object - the underlying assets of the contract dimension - nominal value of the contract maturity date trading rules the dealing hours; the minimum price change which can be listed on the futures market (so-called tick); the formalities for settling the transactions; the consignment locations. Swaps Def. : two parties agree to exchange payments flows between them (also called cash flows) on certain dates the initial value of the contract is usually 0 Exception: up front Interest rate swaps (IRS): agreements in which two counterparts exchange periodic interest payments, calculated on a sum of money, called notional principal amount, for a preestablished period of time equating to the duration of the agreement (maturity or termination date). Currency swaps "exchange of currency", are agreements where two parties exchange the principal and the interest expressed in one currency against principal and interest expressed in another currency. Credit Default Swaps are agreements where a party (so-called protection buyer), against periodic payments made in favour of the counterpart (so-called protection seller), protects itself from the credit risk associated with the specific underlying product, generally referred to as a reference asset, which may be represented by a specific issue, an issuer or an entire portfolio of financial instruments. Options • Def: an agreement which assigns the right, but not the obligation, to purchase (call option) or sell (put option) a certain quantity of an asset (underlying) at a pre-established price (strike price or exercise price), by a certain date (maturity), in which event we are dealing with an American option, or on reaching said date, in which case we are dealing with a European option.