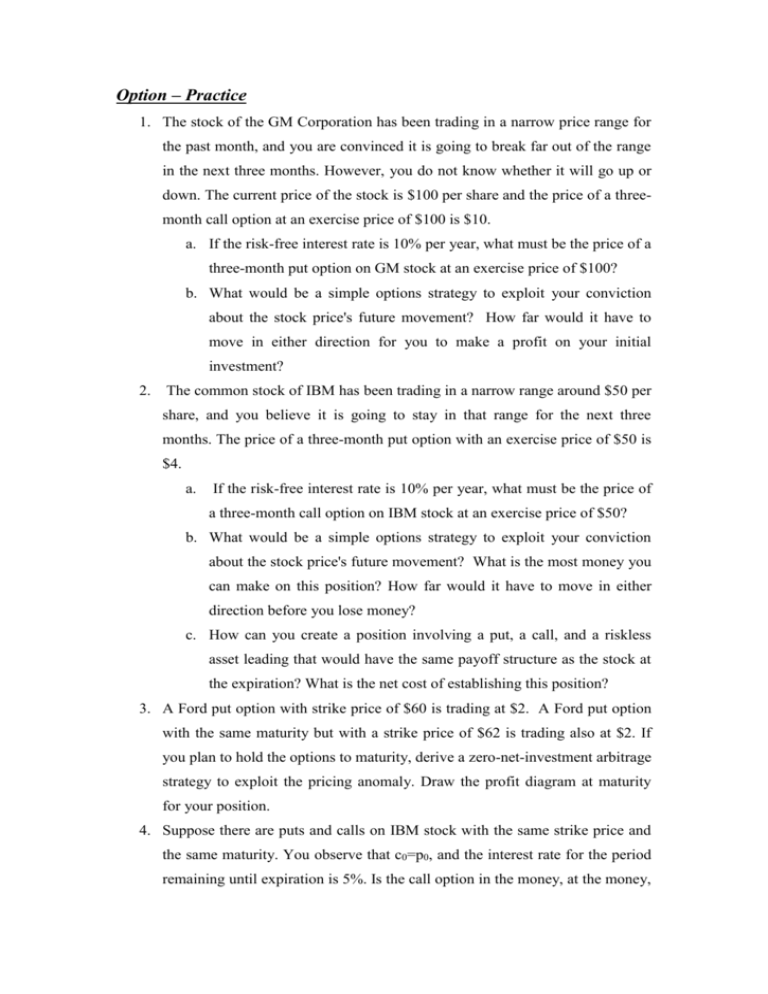

Option – Practice

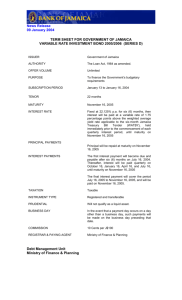

advertisement

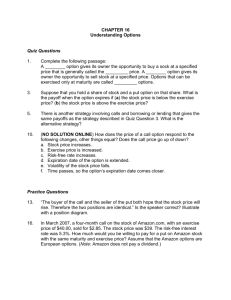

Option – Practice 1. The stock of the GM Corporation has been trading in a narrow price range for the past month, and you are convinced it is going to break far out of the range in the next three months. However, you do not know whether it will go up or down. The current price of the stock is $100 per share and the price of a threemonth call option at an exercise price of $100 is $10. a. If the risk-free interest rate is 10% per year, what must be the price of a three-month put option on GM stock at an exercise price of $100? b. What would be a simple options strategy to exploit your conviction about the stock price's future movement? How far would it have to move in either direction for you to make a profit on your initial investment? 2. The common stock of IBM has been trading in a narrow range around $50 per share, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $50 is $4. a. If the risk-free interest rate is 10% per year, what must be the price of a three-month call option on IBM stock at an exercise price of $50? b. What would be a simple options strategy to exploit your conviction about the stock price's future movement? What is the most money you can make on this position? How far would it have to move in either direction before you lose money? c. How can you create a position involving a put, a call, and a riskless asset leading that would have the same payoff structure as the stock at the expiration? What is the net cost of establishing this position? 3. A Ford put option with strike price of $60 is trading at $2. A Ford put option with the same maturity but with a strike price of $62 is trading also at $2. If you plan to hold the options to maturity, derive a zero-net-investment arbitrage strategy to exploit the pricing anomaly. Draw the profit diagram at maturity for your position. 4. Suppose there are puts and calls on IBM stock with the same strike price and the same maturity. You observe that c0=p0, and the interest rate for the period remaining until expiration is 5%. Is the call option in the money, at the money, or out of the money? Is the put option in the money, at the money, or out of the money? Explain. 5. Suppose that IBM stock sells at $100, and the price will either increase to $130 or fall to $80 by the end of three months. The annual risk-free interest rate is 8%. What should be the price of a call option on IBM stock with a strike price of $110 and three months to maturity? What is the hedge ratio of this option? What should be the price of a put option with the same parameters? 6. Use B&S formula to find the value of a call option with the following data: Time to maturity = 6 month Standard deviation = 30% Exercise price = $50 Stock price = $50 Interest rate = 10%. What is the hedge ratio? b. How the hedge ratio will change if the stock price will increase to $60? c. How the hedge ratio will change if the standard deviation will increase to 40%? 7. Use the following data to calculate the value of a call option on $/£ exchange rate: Time to maturity = 6 month Standard deviation = 15% Exercise price = $1.8/£ Current exchange rate = $1.75/£ U.S. interest rate = 2.5% U.K. interest rate = 4%