Options Calculator

advertisement

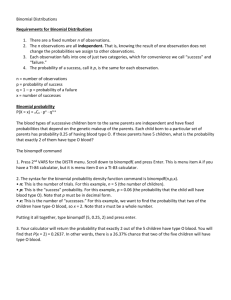

Organization Profile Elind Computers Pvt. Ltd. – Bangalore. • Best for India. • 10 year old company. • Offices in 5 Cities • Clients • Major Stock Exchanges • NSE, BSE, NASDAQ etc. • Products & Partners • • • • OM Technologies,Intel, Microsoft. Equity Exchanges - STRIDE suite. DSTRIDE, IPO-STRIDE, OrderXpress & InvestorNet. NeatXS & NeatIxs –first Internet trading in India. System Configuration • HARDWARE COMPAQ Deskpro Pentium III with 500 MHz 128 MB RAM • SOFTWARE OS : Windows 2000 Developed in : JAVA v3.1 System Overview OPTIONS CALCULATOR DESCRIPTION The options calculator is a service for individuals investors, professional money managers, corporate accounting departments and pension fund managers involved in pricing, performance measurement or risk management of derivative securities. The options calculator performs fast, accurate pricing of a wide variety of European or American style call and put options. This options calculator computes the value of an option using common formulas. The resulting premium values are based on your inputs and the applicable formula. WORKING OF THE OPTIONS CALCULATOR LIBRARY OF FUNCTIONS OPTIONS CALCULATOR Inputs to the calculator Stock Price Risk-free rate Volatility Time to maturity Exercise price Steps Dividends Time to dividend payment OUTPUTS THE: OPTION PRICE ALONG WITH THE DELTA, GAMMA, THETA,VEGA & RHO VALUES WHAT IS AN OPTION? • An option gives the holder the right to do do something. • The holder does not have to exercise this right. • The purchase of an option requires an up-front payment, unlike forward or futures contracts. TYPES OF OPTIONS THERE ARE TWO BASIC TYPES OF OPTIONS: Call Option Put Option CALL OPTION A call option gives the holder the right to buy an asset by a certain date for a certain price. PUT OPTION A put option gives the holder the right to sell an asset by a certain date for a certain price. EXAMPLE OF A CALL OPTION An investor buys a call option to purchase 100 IBM shares Strike price: $40 Current stock price: $38 Price of an option to buy one share = $5 Initial investment is 100 x $5 = $500 The outcome: At the expiration of the option, IBM’s stock price is $55. At this time, the option is exercised for a gain of ($55 - $40) x 100 = $1,500 When the initial cost of the option is taken into account, the net gain is $1,500 - $500 = $1,000 If the stock price is less than $40 the holder will not exercise the right to buy. In this circumstance the investor loses the whole initial investment of $500. EXAMPLE OF A PUT OPTION An investor buys a put option to sell 100 Exxon shares Strike price: $70 Current stock price: $65 Price of an option to buy one share = $7 Initial investment is 100 x $7 = $700 The outcome: At the expiration of the option, Exxon’s stock price is $55. At this time the, the investor buys 100 Exxon shares and, under the terms of the put option, sells them for $70 per share to realize a gain of $15 per share or $1500 in total. When the initial cost of the option is taken into account, the net gain is $1500 - $700 = $800 There’s no guarantee that the investor will make a gain. If the final stock price is above $70, the put option expires worthless and the investor loses $700. OPTIONS CAN BE EITHER American European American options: are options that can be exercised at any time up to expiration date. European options: are options that can only be exercised on the expiration date itself. EXCHANGE –TRADED OPTIONS Options trade on many different exchanges throughout the world. Options can be written on many kinds of assets. The asset upon which an option is based is called underlying asset. The underlying assets include: Stocks (Equity) Options Foreign Currency Options Index Options Futures Options EQUITY One contact gives gives the holder the right to buy or sell 100 shares at a specified strike price. FOREIGN CURRENCY It is specific to the currency of the area. For example, in Britain one contract gives the holder the right to buy or sell 31,250 pounds. Or in Japan one contract enables 6.25 million yen. INDEX One contract gives the holder the right to buy or sell 100 times the index at the specified strike price. For example one share has strike price of $280, if it is exercised when the value of the index is 292 the writer of the contract pays the holder (292-280)x100=$1200 This cash payment is based on the index at the end of the day. FUTURES When the holder of a call option exercises, he or she will get the amount in the futures option plus a cash amount equal to the excess of the futures price over the strike price. When the holder of a put option exercises, he or she will get the amount in the futures option plus a cash amount equal to the excess of the strike price over the futures price. PRICING MODELS A pricing model is used to find out whether the market price of a option is valid or not, so as to be able to make a decision as to buy or sell options. There are two kinds of Pricing Models: Discrete Models Analytical Models Analytical Pricing Models Analytical American (Bjerksund Strensland 1993) American call options with dividends (Roll-Geske Whaley) American Barone-Adesi-Whaley (1987) Discrete Pricing Models Binomial American (Cox-Ross Rubinstein 1979) Binomial American with Discrete Dividends American Trinomial THE INPUTS • Stock Price • Exercise Price • Time to Exercise • Risk-free rate • Dividends • Volatility • Time to Dividends • Steps THE INPUTS • Foreign Risk Free Rate • Dividend Yield THE OUTPUTS • Option Price • Implied Volatility • Delta • Gamma • Theta • Vega • Rho ANALYTICAL PRICING MODELS Analytical American Approximation (Bjerksund & Strensland -1993 ) The Bjerksund Strensland (1993) approximation can be used to price American options on stocks, futures, currencies and index. The code consists of three functions. The first one checks if the option is a call or put. If the option is a put, the function uses the American put-call transformation. The function then calls the main function BSAmericanCallApprox which calculates the option value. The main function uses the GBlackScholes() function. Analytical American Approximation (Roll, Geske & Whaley-1981) This model is applicable to the valuation of American calls on assets paying dividends and was developed in a series of independent papers by Roll (1977), Geske (1979), and Whaley (1981). Analytical American Approximation (Barone – Adesi & Whaley – 1987) In 1987 Giovanni Barone-Adesi and Robert Whaley published an article in the Journal of Finance describing quadratic approximation method of valuing American options. Their goal was to develop an accurate, quick calculation closed-form solution to valuing in American call and put options. The quadratic approximation they developed has become one of the most popular pricing algorithms used by the institutional investors in North America. DISCRETE PRICING MODELS Binomial American (Cox, Ross & Rubinstein – 1979) The Cox, Ross and Rubinstein model was developed using a similar approach to the Black Scholes model, but assumes the underlying instrument follows a binomial distribution. The benefit of the binomial model is that it can be used to evaluate options with an American style exercise. BINOMIAL TREES A useful and very popular technique for pricing an option or other derivative involves constructing what is known as binomial tree. This is a tree that represents possible paths that might be followed by the underlying asset’s price over the life of the derivative. American options can be valued using a binomial tree, the procedure is to work back through the tree from the end to the beginning, testing at each node to see whether early exercise is optimal. ONE-STEP BINOMIAL MODEL Stock price =$22 Option price = $1 Stock price =$20 Stock price =$18 Option price = $0 TWO-STEP BINOMIAL MODEL Su Su2 Fu2 fu Sud S f Fud Sd fd Sd2 Fd2 Binomial American with Discrete Dividends The binomial model is widely used for valuing such options, despite the greater computational expense involved. The attraction of this model is that it is more intuitively appealing than the alternatives; therefore it is more easily understood. It also lends itself to easy derivation of the sensitivities of the option such as Delta, Gamma, etc. Moreover it can be used for both puts and calls on indices that are characterized as paying dividends. Thus it is a versatile model. Trinomial American A useful and popular technique for pricing an option or other derivative involves constructing what is known as a trinomial tree. This is a tree that represents possible paths that might be followed by the underlying asset’s price over the life of the derivative. This model is very much similar to the binomial model, but for the fact that the option sensitivities are not computed. TRINOMIAL MODEL The Trinomial trees can be used as an alternative to binomial trees. The probability of the stock price can move up, down or remain the same. Su2 Su Su S Sd S Sd Sd2 FEATURES OF THE OPTIONS CALCULATOR GRAPHS The Options Calculator enables the user to view how the various input parameters vary against the output parameters with the help of 2D graphs. Over 1,300 graphs have been designed with all possible combinations. SCREEN SHOT FOR GRAPHS – EQUITY, AMERICAN CALL,(BARONE, ADESI & WHALEY – 1987)- ASSET PRICE VS. OPTION PRICE. COMPARATIVE OUTPUTS The Calculator provides the user with the facility to compare the outputs of the other models which fall under the same underlying type and option type. SCREEN SHOT FOR COMPARATIVE OUTPUTS HELP MENU The Help Menu is designed to aide the user to understand the functionality of the Calculator and how to make use of its various features. SCREEN SHOT FOR HELP MENU SCREEN SHOT FOR HELP MENU – QUICK START SCREEN SHOT FOR HELP MENU – USING OPTIONS CALCULATOR SCREEN SHOT FOR HELP MENU – MODEL DESCRIPTIONS SCREEN SHOT FOR HELP MENU – ABOUT OPTIONS CALCULATOR SCREEN SHOT FOR UNDERLYING TYPE SCREEN SHOT FOR OPTION TYPE – AMERICAN CALL SCREEN SHOT FOR PRICING MODELS – EQUITY SCREEN SHOT FOR UNDERLYING TYPE EQUITY, AMERICAN CALL, ANALYTICAL AMERICAN APPROXIMATION (BARONE, ADESI & WHALEY – 1987) SCREEN SHOT FOR UNDERLYING TYPE EQUITY, AMERICAN PUT, ANALYTICAL AMERICAN APPROXIMATION (BJERKSUND & STENSLAND – 1993) SCREEN SHOT FOR UNDERLYING TYPE EQUITY, AMERICAN CALL, ANALYTICAL AMERICAN APPROXIMATION (ROLL, GESKE & WHALEY – 1981) SCREEN SHOT FOR UNDERLYING TYPE FUTURES, AMERICAN PUT, BINOMIAL AMERICAN (COX, ROSS & RUBINSTEIN – 1979) SCREEN SHOT FOR UNDERLYING TYPE EQUITY, AMERICAN PUT, BINOMIAL AMERICAN WITH DISCRETE DIVIDENDS SCREEN SHOT FOR UNDERLYING TYPE CURRENCY, AMERICAN PUT, AMERICAN TRINOMIAL CONCLUSION The Options Calculator application was designed under the requirements of the Security Industry catered by Elind Computers Pvt.,Ltd. The application is developed in Java. It is a product expected to be launched on the Internet in due course. The Calculator can be extended to add more facilities and modified to meet the demands of the user. BIBLIOGRAPHY 1. Patrick Naughton, Herbert Schildt, Java 2-The Complete Reference, Tata McGraw-Hill, 1999. 2. Cay S. Horstmann, Gray Cornell, Core Java Volume II, The Sun Microsystems Press, 2000. 3. Robert W Kolb, Ricardo J Rodriguez, Financial Markets, BlackWell Publishers, Inc., 1996. 4. Jonathan Kundsen, JAVA 2D Graphics, O’Reilly & Associates, Inc.1999. 5. Dr. Satyaraj Pantham, Pure JFC Swing, McMillan Computer Publishing, 1999. 6. Terry J Watsham, Futures and Options in Risk Management, Thomson Business Press, 1998. 7. John Cox and Mark Rubinstein, Options Markets, Prentice-Hall, 1985. 8. John Hull, Options, Futures and other Derivatives, Prentice-Hall, Third Edition, 1998. 9. Paul Wilmott, Jeff Dewynne, and Sam Howison, Option Pricing, Mathematical Models and Computation, Oxford Financial Press, 1994. 10. Milton Abramowiz and Irene A Stegun, Handbook of Mathematical Functions, National Bureau of Standards, 1964.