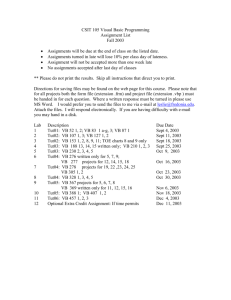

ACC 201-03 - UNC Greensboro

advertisement

University of North Carolina at Greensboro Bryan School of Business and Economics Department of Accounting and Finance ACC 201.03: Financial Accounting (3 credit hours) M/W 3:30-4:45, Bryan 132 Fall Session 2010 Instructor: Ms. Amanda Cromartie, CPA Office: 342 Bryan Building Phone: 256-0127 (no voicemail) E-mail: altesh@uncg.edu (best way to reach me) Office Hours: Mon/Wed 1pm-2pm, Tue 2:30pm-3:30pm, and by appointment Graduate Assistant: Jackie Reed Accounting Tutoring: 330 Bryan Building Important Note: There are high expectations for you in this course. The material is difficult and this is considered a demanding, time-intensive course. The course requires homework assignments that are similar to math problems. It is very important that you regularly attend class, actively participate in class, read the text, complete homework assignments, and develop a sound foundation by mastering the basic concepts in Chapters 1-3 of the text. I also encourage you to take advantage of the tutors located in 330 Bryan. Prerequisite: Any one of the following: MAT 115, 120, 150, 151, 191 or 292. Course Objectives: Demonstrate an understanding of basic accounting terminology and procedures Create the financial statements which flow from the accounting process with emphasis on the balance sheet and income statement Understand the accounting cycle and accounting system Develop an understanding of how business organizations operate and the events which have a financial impact upon them Understand time value of money concepts Facilitate the development of the student’s written communication skills through an essay assignment, essay assessment and/or business memo assignments Contribute toward the Bryan School’s commitment to information technology by requiring students to use the internet, e-mail, word processing software and spreadsheet software where appropriate within the course Course Resources: Text: Financial Accounting (Selected materials from Survey of Accounting and Fundamental Financial Accounting Concepts, both by Edmonds). 2010. ISBN: 10: 0-07-735279-3. This text is compiled especially for UNCG. You may not be able to find it elsewhere. Blackboard: http://blackboard.uncg.edu. Will be used for announcements and posting of materials and information for class. ACC 201.03, Financial Accounting Page 1 of 9 McGraw-Hill Connect (Homework Manager): http://connect.mcgrawhill.com/class/a_cromartie_fall_2010_acc_20103_mw_330. This website will be used for homework assignments. This is required for the course and an access code can be purchased from the bookstore. Textbook Publisher Resources: http://highered.mcgrawhill.com/sites/0073379557/student_view0/. Use this website for practice quizzes, supplementary course information, and Excel templates for some of the Problems in the textbook. A grade will be determined by: 10 Homework Assignments (2% each): 20% Total Class Participation: 10% Total 1 Essay: 10% 2 Mid-term Exams (15% each): 30% Total 1 Final Exam: 30% Grading Scale: A+ = 98-100 B+ = 88-89 C+ = 78-79 D+ = 68-69 F = 59 and below A = 93-97 B = 83-87 C = 73-77 D = 63-67 A- = 90-92 B- = 80-82 C- = 70-72 D- = 60-62 All grades will be posted on Blackboard. It is your responsibility to make sure they are recorded correctly. Please contact me immediately if there is an error. Academic Integrity Policy: Students are expected to know and abide by the Academic Integrity Policy in all matters pertaining to this course. When in doubt about whether or not something violates the code, ask me. http://academicintegrity.uncg.edu/violation/ Student Conduct: Students are expected to know and abide by the Student Code of Conduct. Students who behave in an unprofessional manner will be dismissed from the class. This includes inappropriate postings on Blackboard or rude and unprofessional emails. “An academic community of integrity upholds accountability and depends upon action in the face of wrongdoing. Every member of an academic community—student, group/organization, faculty member, and staff—is responsible for upholding the integrity of the community.” Any successful learning experience requires mutual respect on the part of the student and the instructor. Neither instructor not student should be subject to others’ behavior that is rude, disruptive, intimidating, or demeaning. The instructor has primary responsibility for and control over the classroom behavior and maintenance of academic integrity. ACC 201.03, Financial Accounting Page 2 of 9 Instructor responsibilities: Start and end class on time. Be prepared for class. Treat all students with courtesy and respect. Be open to constructive input from students in the course. Ensure that opportunities to participate are enjoyed equally by all students in the course. Student responsibilities: Come to class and be seated on time, and refrain from packing up belongings before class ends. Be prepared for class. Limit disruptions, including turning off all electronic devices (see policy below). Be quiet and give full respectful attention while either instructor or another student is speaking. When speaking, use courteous, respectful language and keep comments and questions relevant to the topic at hand. Please visit http://studentconduct.uncg.edu/policy/code/ and www.uncg.edu/bae/faculty_student_guidelines.pdf for further information. Student Disabilities - Any request for special accommodations must come through the Office of Disability Services with the appropriate paperwork. Please visit http://ods.dept.uncg.edu/services/ for further information. Students in Distress: UNCG cares about your success as a student. We recognize that students often balance many challenging personal issues and demands. Please take advantage of the University resources designed to help. For assistance accessing these resources, contact the Dean of Students Office at 334-5514 or Student Academic Services at 334-5730. The Counseling and Testing Center is available for mental health assistance, 334-5874. You may also visit me during my office hours. Attendance Policy: Attendance of each class is extremely important to your success in this course. Please bring a pencil, eraser, and calculator to each class. I expect students that attend to pay attention during class. Please be respectful of your fellow students and limit disruptions. If you miss a class, it is your responsibility to get the notes and any missed materials from another student in the class. Electronic Devices in the Classroom: Unless you have permission from the instructor, electronic devices (cell phones, pagers, PDAs, Blackberries, iPods, MP3 players, recording devices, etc.) must be turned off and stored away with your personal belongings during class. Any device being seen or heard will be picked up by the instructor and returned at the end of class. Any such device in the “ON” position during an exam will result in a grade of zero and dismissal from the classroom. Computers in the Classroom: The use of a personal laptop computer is allowed for the taking of notes and working Excel examples during class lectures. The use of a personal laptop computer is not allowed for exams. The use of a personal laptop computer for any non-classroom purpose is strictly prohibited and may result in the student being dismissed from the classroom. ACC 201.03, Financial Accounting Page 3 of 9 Class Handouts: Handouts for class will be posted on Blackboard for use in this course. I encourage you to print out a copy of the problems and the work papers for the problems and bring them to class. I will NOT provide copies in class. Solutions will NOT be posted on Blackboard. If you miss a class, it is your responsibility to get the notes and any missed materials from another student in the class. Homework Policies: All homework is to be completed online through McGraw-Hill Connect. Homework is open book and, as much can be learned through discussions with each other, I encourage students to discuss graded homework with other students, but the final result for all of these should be each student's own work. I recommend that you work assigned problems on paper first then upload your answers into Connect before the assignment is due. You can save homework in Connect allowing you to work on the same assignment at different times, but you must SUBMIT the assignment by the due date to get credit. You are allowed to re-work incorrect homework problems one additional time. Answers to homework assignments will be available in Connect the day after the assignment is due. Please review your answers and make sure you understand the material. Late homework will not be accepted. Class Participation: There is a mandatory 10 minute meeting with me during the first 3 weeks of class to be eligible for class participation points. Please come by during my office hours or email me to make an appointment. After this 10 minute meeting, class participation points can be earned by actively participating in class. During 12 random, unannounced classes I will have an in-class assignment that is to be handed in before the end of class. To earn credit, students must demonstrate that they are paying attention in class and taking the assignment and the class seriously. Students are also expected to participate in small group discussions of the topic if requested. It is your responsibility to put your name on your assignment and ensure that your assignments are handed in before the end of class. In-class assignments will not be accepted after class has ended. I will keep a running total in “My Grades” of how many points you have earned, but this portion of your grade will not be factored in until the end of the semester once all opportunities for class participation points have ended. Any disputes as to points earned must be submitted to me in writing. Class participation percentage points will be awarded as follows: 10-12 Points = 10% 8-9 Points = 8% 6-7 Points = 6% 4-5 Points = 4% 2-3 Points = 2% 0-1 Points = 0% Essay: Grading policies for the essay and the essay assignment will be discussed in class on Wednesday, September 8. The essay is due on Wednesday, October 6 at the beginning of class. No late submissions will be accepted. Any disputes regarding essay grading must be submitted to me in writing for consideration. Exams: Mid-term exams are not cumulative, but are closed book and proctored. The final exam is cumulative and proctored. All exams require a pencil and calculator. You may not share or borrow calculators during exams. Cell phones or other PDAs may not be used in place of calculators. ACC 201.03, Financial Accounting Page 4 of 9 If you for some reason you are unable to take a scheduled mid-term exam you must notify me before the scheduled exam date. Failure to do this may result in an exam grade of zero. Please note that the Final Exam is scheduled for Saturday, December 11 from 3:30-6:30. This schedule is set by the University and cannot be changed. Please plan accordingly. In accordance with UNCG’s policy, only those students with three or more final exams within the 24 hour period surrounding our scheduled final exam and have documentation from the registrar’s office are eligible to take the final exam on the make-up day. Documentation from the registrar’s office must be submitted to me before Monday, December 6. Other Comments: I believe that your education is your primary responsibility. It is your job to prepare for and keep up with assignments. Some students have commented that there is too much work in this course or that it is all due on the same day. Accounting courses in general are difficult as they cover a vast amount of material. Deadlines are set, but it is in your hands as to whether or not you do all the work on the last day or you plan ahead and spread it out. This course is a critically important portion of the business curriculum at UNCG. (If you are an accounting major, you should not take this course, but take ACC 218 instead.) It is also very time intensive. You may find it necessary to read the textbook material more than once to fully absorb it. Please note that the chapter assignments may only represent the minimum amount of work necessary to gain an understanding of the material covered in this course. There are no opportunities for “extra credit” in this course. Each assignment is an opportunity to improve your grade. TENTATIVE SCHEDULE OF CLASS TOPICS AND ASSIGNMENTS Date Chapter Aug 23 Class # 1 Aug 25 2 1 Aug 30 3 1 Sept 1 4 2 1 TOPIC COVERAGE/IN-CLASS EXERCISES Introduction to Course Chapter 1: An Introduction to Accounting Define accounting Accounting careers Elements of financial statements The accounting equation Types of transactions Historical cost and reliability Financial statements (Balance Sheet, Income Statement, Statement of Equity, Statement of Cash Flows) *Handout #1 Horizontal financial statement model Practice with transactions and financial statements Chapter 2: Understanding the Accounting Cycle ACC 201.03, Financial Accounting Assignment Chapter 1 Homework assigned and available in McGraw-Hill Connect (“Connect”) Chapter 2 Homework assigned and available in Page 5 of 9 Sept. 6 Sept 6 Sept 8 5 2 Sept. 12 Sept 13 6 3 Sept 15 7 3 Sept 20 8 3 Sept 22 9 4 Accrual accounting and the Matching Concept Prepaid expenses (Depreciation, Prepaids, Supplies) Unearned revenues Accrued revenues (A/R, Interest receivable) Accrued expenses (A/P, Interest payable) *Handout #2 Chapter 1 Homework Assignment Due by Monday, Sept 6 at 9:00 PM REMINDER: Homework must be completed using Connect Homework Manager software. Homework can be accessed using the website listed on the syllabus. You must SUBMIT the assignment before it is due. Late assignments will not receive credit. Labor Day Holiday – Campus Closed Adjusting entries continued Ethics Essay Assignment Chapter 2 Homework Assignment Due by Sunday, Sept 12 at 9:00 PM Chapter 3: Accounting for Merchandising Businesses Terms Product costs vs. Selling and administrative costs Perpetual vs. Period inventory systems *Handout #3 Transportation costs, purchase returns, cash discounts Gains and losses Multistep income statement Lost, damaged, or stolen inventory Events affecting sales Common size income statement and ratios Chapter 4: Accounting for Inventories Inventory methods: LIFO, FIFO, Weighted Average, Specific Identification *Handout #4 ACC 201.03, Financial Accounting Connect Chapter 1 Homework Assignment Due Chapter 2 Homework Assignment Due Chapter 3 Homework assigned and available in Connect Chapter 4 Homework assigned and available in Connect Page 6 of 9 Sept 26 Sept 27 10 Sept 29 11 4 Oct 4 12 4 Oct 6 13 5 Oct 10 Oct 11 Oct 13 14 5 Oct 18 15 5 Oct 20 16 6 Oct 24 Oct 25 17 6 Oct 27 18 6 Chapter 3 Homework Assignment Due by Sunday, Sept 26 at 9:00 PM Mid-term Exam: Chapters 1, 2, & 3 REMINDER: Bring a pencil with an eraser and a calculator. Notes, scrap paper, and cell phones are NOT allowed during the exam. Internal control systems Accounting for Cash Inventory ratios Wrap-up Chapter 5: Accounting for Receivables Allowance method for uncollectible A/R Direct write-off method vs. the allowance method Estimating uncollectible accounts expense *Handout #5 Chapter 4 Homework Assignment Due by Sunday, Oct 10 at 9:00 PM Fall Break – Campus Closed Accounting for Notes Receivable Credit card sales Essay Due at the beginning of class Costs of credit sales Operating cycle A/R turnover ratio Chapter 6: Accounting for Long-Term Operational Asset (Fixed Assets) Tangible versus intangible assets Determining the cost of long-term assets Methods of recognizing depreciation expense (straight-line, DDB, Units of Production) *Handout #6 Chapter 5 Homework Assignment Due by Sunday, Oct 24 at 9:00 PM Revision of estimates Continuing expenditures for plant assets (capital vs. revenue expenditure) (NOTE: Last day to drop Oct 15) Natural resources Intangible assets ACC 201.03, Financial Accounting Homework Assignment Due Mid-term Exam Chapter 5 Homework assigned and available in Connect Homework Assignment Due Essay Due Chapter 6 Homework assigned and available in Connect Homework Assignment Due Page 7 of 9 Nov 1 Nov 3 Nov 8 Nov 10 19 20 21 22 Nov 15 23 Nov 17 24 Balance sheet presentation Effect of judgment and estimation Oct 31 Chapter 6 Homework Assignment Due by Sunday, Oct 31 at 9:00 PM 7 Chapter 7: Accounting for Liabilities (exclude Current vs. noncurrent pp. 257 Current liabilities (current portion of 266; this Notes Payable, Sales Tax, material Contingent Liabilities, Warranty will be Obligations) covered Covenants in Ch. 8) Ratios *Handout #7 Mid-term Exam: Chapters 4, 5, & 6 REMINDER: Bring a pencil with an eraser and a calculator. Notes, scrap paper, and cell phones are NOT allowed during the exam. Appendix Appendix A: Time Value of Money A Present value and Future value of a single amount Present value and future value of an annuity *Handout #8 Nov 9 Chapter 7 Homework Assignment Due by Tuesday, Nov 9 at 9:00 PM 8 Chapter 8: Accounting for Long-Term Debt (includin Installment notes payable g Line of Credit Appendix Bonds on pp. Security for Loans 308-312) *Handout #9 Nov 14 Appendix A Homework Assignment Due by Sunday, Nov 14 at 9:00 PM 8 Bonds issued at a discount Bonds issued at a premium Bond redemptions 8 Bond interest payments and amortization (Appendix) Financial leverage and tax advantage of debt financing Ratios Nov 21 Chapter 8 Homework Assignment Due by Sunday, Nov 21 at 9:00 PM ACC 201.03, Financial Accounting Homework Assignment Due Chapter 7 Homework assigned and available in Connect Mid-term Exam Appendix A Homework assigned and available in Connect Homework Assignment Due Chapter 8 Homework assigned and available in Connect Homework Assignment Due Homework Assignment Due Page 8 of 9 Nov 22 25 Nov 24 Nov 29 26 Dec 1 27 Dec 6 Dec 11 Dec 15 28 9 Chapter 9: Proprietorships, Partnerships, and Corporations Business forms: sole proprietorship, partnership, corporation Stock: authorized, issued, outstanding Stock: preferred and common *Handout #10 Thanksgiving Holiday – Campus Closed 9 Cumulative dividends and dividends in arrears Accounting for stock transactions on the day of issue 9 Accounting for stock transactions after the date of issue (Treasury Stock, Cash Dividends, Stock Dividends, Stock Splits) Financial statement presentation Ratios Dec 5 Chapter 9 Homework Assignment Due by Sunday, Dec 5 at 9:00 PM Last Day of Class – Review Exam Saturday, Dec. 11 3:30-6:30 Make-up Wednesday, Dec. 15 (Time and Place Exam TBA) NOTE: See EXAM POLICIES on page 3 of the syllabus to determine whether you may be eligible for the make-up final exam date. Chapter 9 Homework assigned and available in Connect Homework Assignment Due NOTE: The above is a tentative schedule. We will cover all of the material in the schedule, but adjustments may be made as to date a topic is covered. The exam dates will not change. In the event that we speed up or slow down a bit, I will adjust the material on the exam, not the date of the exam. ACC 201.03, Financial Accounting Page 9 of 9