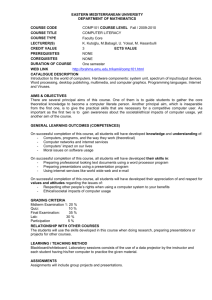

Course Learning Outcomes - College of Business and Economics

advertisement

Finan 411 – Capital Budgeting and Planning – Fall 2010 Section 001 – MW 1:40 – 2:55 p.m. – B312 Instructor: Office Phone: Office Hours: Office: L. Dwayne Barney B-213-E E-mail: 426-3429 Ldbarney@boisestate.edu MW 5:00 pm – 6:30 pm, Th 3:00 pm – 6:00 pm, and by appointment Text: No text required. Calculator: A financial calculator will be needed to succeed in this course. My recommendation is the HP-12-C. However, any financial calculator should do. COBE Core Curriculum Student Learning Goals and Objectives: Students in this class will learn or practice the COBE Core Curriculum concepts, methods, and skills detailed below. o o o o o o o o Understand and apply analytical and disciplinary concepts and methods related to: Accounting Business Policy and Strategy Economics Finance Information Technology Management International Environment of Business Marketing Mathematics and Statistics Communicate effectively: Write messages and documents that are clear, concise, and compelling Solve problems, including unstructured problems, related to business and economics Use effective teamwork and collaboration skills Course Learning Outcomes: The topics to be covered in this course include the following: Wealth maximization and the goal of the firm How wealth is created How the capital investment process is used to value and identify wealth creating investment projects How to estimate the value of financial assets How to estimate the value of the firm How to use the project investment evaluation criteria (NPV, IRR, etc.) Understand the importance of the duration of investment projects How to estimate the cash flows to an investment project How to incorporate inflation into investment project analysis Understand the concept of risk as it applies to investment analysis How to measure and apply the measures of risk in capital budgeting How to estimate the cost of capital for a capital budgeting project Understand the factors that influence the capital structure decision of the firm Finan 411 – Sec. 001 – Boise State University – Fall 2010 – Barney 1 of 3 Schedule: The anticipated schedule of activities is shown below. It may be necessary to alter the schedule over the course of the semester. AUGUST AND SEPTEMBER Review of interest and compounding, present value and future value, annuities, continuous compounding of interest, effective and stated interest rates, bonds and bond valuation, yield curves, the term structure of interest rates, bond duration, interest rate risk management in a financial institution, stock valuation, the Gordon equation, net present value, internal rate of return, multiple IRRs, the modified internal rate of return Exam 1: September 29 OCTOBER Operating cash-flow approach to NPV, equity residual method of calculating NPV, cash-flow estimation, project-specific financing and interest rate risk, the cost of capital, comparing mutually exclusive projects, equivalent annual annuity, replacement chain, payback period, the cost of capital, the cost of debt, the cost of preferred stock, the cost of equity Exam 2: November 1 NOVEMBER Measuring risk and return, geometric mean, arithmetic mean, historical returns to investments, expected return associated with a stock, variance of returns, standard deviation of returns, covariance of returns, combining stocks into portfolios, portfolio expected return, portfolio standard deviation, efficient portfolios, the Capital Asset Pricing Model, beta coefficients Exam 3: November 29 DECEMBER Return duration of a capital budgeting project (Article by Barney and Danielson), Project Scale (Article by Beaves and Stolz). Wednesday December 15th at 1:00 PM: Comprehensive Final Exam Course Reference Materials: “Project-Specific Financing and Interest Rate Risk in Capital Budgeting,” The Engineering Economist, Vol. 48, No. 2, 2003. “Ranking Mutually Exclusive Projects: The Role of Duration” by L. Dwayne Barney and Morris G. Danielson, The Engineering Economist, Vol. 49, No. 1, pages 43-61. “Technical Note: Defining Project Scale” by Robert G. Beaves and Richard W. Stolz, The Engineering Economist, Vol. 50, No. 3, pages 295-302. Fundamentals of Financial Management: Concise 6th Edition. By Eugene F. Brigham and Joel F. Houston. South-Western, 2009. Grading: Your final grade will be determined on the basis of classroom participation, two midterm exams, and a comprehensive final exam. When computing your final grade the weights given to each component are as follows: Finan 411 – Sec. 001 – Boise State University – Fall 2010 – Barney 2 of 3 GRADE COMPONENT WEIGHT Classroom Participation 10% Midterm Exam #1 30% Midterm Exam #2 30% Final Exam 30% Three midterm exams will be given. You will be allowed to drop your low score from the three midterm exams. Thus, two of the midterms will count towards your final grade. As you get to drop an exam, there will be no makeup exams given. The only exception to this rule is in the case of university approved absences, where a student will be allowed to take a makeup exam. Throughout the semester a student will earn a percentage score for each of the components. At the conclusion of the semester the student’s final percentage for the course will be calculated by applying the aforementioned weights. Then, the final grade for the course will be determined according to the following scale: Percentage 90—100% Final Grade A 80—89% B 70—79% C 60—69% D Below 60% F Example of Grade Calculation: Suppose John Doe receives the following scores for each of the grade components: Classroom Participation: Midterm Exam #1: Midterm Exam #2: Final Examination: 60% 81% 78% 80% John’s final percentage for the course is determined as follows: Final Percentage for the Course = 0.10(60%) + 0.30(81%) + 0.30(78%) + 0.30(80%) Final Percentage for the Course = 78% Thus, John Doe’s final course grade will be a C. Other Grading Considerations: Of course, cheating on exams or disruptive behavior in class will result in a grade of F for the semester. Finan 411 – Sec. 001 – Boise State University – Fall 2010 – Barney 3 of 3