The Community Capital Investment Initiative and The Bay Area

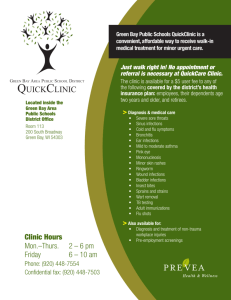

advertisement

The Community Capital Investment Initiative and The Bay Area Family of Funds MetroBusinessNet Miami, Florida – February 17-18, 2005 Elizabeth Y.A. Ferguson, Bay Area Council Victor Hsi, Alliance for Community Development Bay Area Council Business civic organization of the 275 largest employers in the Bay Area, represented by the CEO or highest ranking officer Business community encouraged Bay Area Council to sponsor the Bay Area Family of Funds because: Poverty in many neighborhoods is one of the major challenges to prosperity Sustainable economic development requires engagement of the market since funding from government and foundations is limited and not sustainable Smart Growth requires buy-in from current residents, which means current residents need to share in wealth created Investors in the Bay Area Family of Funds are diverse: Banks, insurance companies, foundations, pension fund, corporations, and individuals Community Capital Investment Initiative Engages business, community, environmental, and government leaders to collaborate in using market forces to reduce poverty and promote smart growth Encourages private investments in or near priority Bay Area low- and moderate-income (LMI) neighborhoods – 80% or less of county household median income Bay Area Family of Funds Bay Area Smart Growth Fund invests in mixed-use, mixedincome, transit-oriented real estate developments Bay Area Equity Fund: A Double Bottom Line Fund invests in businesses that create jobs and wealth in or near priority neighborhoods California Environmental Redevelopment Fund (CERF), statewide environmental clean-up fund with 25% going to the Bay Area Each fund invests in projects or companies located in or near LMI neighborhoods $175 Million raised, with $103.8 Million invested Double Bottom Line First bottom line: risk adjusted market rate of financial return Second bottom line: substantial economic, social, and environmental returns, including: Location: in or near a priority neighborhood Job creation: particularly livable wage jobs for local LMI residents Community benefits: such as affordable housing, joint ventures with community developers, local and minority contracting, and supporting community groups Economic development: stimulation of additional economic activity in the neighborhood Wealth creation: health care, employee ownership, financial education Environmental performance: energy conservation, waste reduction, recycling, pollution prevention, and green building Community participation: such as internships, volunteer programs in schools and neighborhoods Priority Neighborhoods Priority areas are neighborhoods with household median income at 80% or less of county household median income Partner Organizations Community Capital Investment Initiative: Organized as a Business Council, a Community Council, and a Government Advisory Council Co-Chaired by Elizabeth Y. A. Ferguson, Executive Vice President of the Bay Area Council and Juliet Ellis, Executive Director, Urban Habitat Program Bay Area Council: the business-sponsored, CEO-led public policy advocacy organization for the Bay Area Alliance for Community Development: non-profit corporation made up of leaders from community economic development organizations and business associations Structure Community Capital Investment Initiative (CCII) Community Council National Economic Development & Law Center (NEDLC) PolicyLink Urban Habitat Program Business Council Bay Area Council Government Advisory Council State of California Business, Transportation & Housing Agency Bay Area Family of Funds Bay Area Council Bay Area Smart Growth Fund Sponsored by: Bay Area Council California Environmental Redevelopment Fund (CERF) Bay Area Equity Fund Sponsored by: Bay Area Council, Federal Reserve Bank of San Francisco & Los Angeles Chamber of Commerce Sponsored by: Alliance for Community Development Bay Area Council Bay Area Smart Growth Fund Sponsored by the Bay Area Council Managed by Pacific Coast Capital Partners Raised $65.8 million Investing in community shopping centers, affordable homeownership opportunities, commercial and office developments in redevelopment areas Bay Area Smart Growth Fund Investments Oakland Airport Business Park: constructing an office park, with carpenters union as lead tenant, $6.7 million Ascend: rehabbing affordable infill housing, $2.7 million Casa del Prado Townhomes: converted 81 units of rental housing to affordable condos, sold at 85% AMI, $4.1 million Cinema Place: theater/commercial development that is key to Hayward revitalization, $4.3 million Marin City Gateway Retail Center: joint venture with the community to purchase and revitalize a shopping center, $7.9 million North Richmond Land: building 173 units of affordable for sale housing, $2.7 million Pacific Cannery Lofts: constructing 161 units of affordable entry-level homes for sale to 80% of AMI, $7.8 million Santa Clara Industrial Portfolio: undertaking commercial reuse of 7 vacant industrial buildings, $6 million Story King Shopping Center: building a community shopping center, $5 million Vallejo Plaza: repositioning shopping center to serve Asian neighborhood market, $5.2 million Waterstone Condominiums: rehabbing 180 condo units to affordable entry level homes, premarketing sales at 68-83% of AMI, $5.9 million Marin City Gateway Retail Center Shopping Center in Marin City, a low income neighborhood in Marin County Joint venture between Bay Area Smart Growth Fund and community nonprofit – $7.9 million investment Preserved community ownership that provides funding for affordable housing and community services Created joint ventures between Marin City and regional businesses to provide security, painting, landscaping, and maintenance Awarded real estate deal of the year in its category, by S.F. Business Times Alliance for Community Development Co-Sponsor of the Bay Area Equity Fund, Special Limited Partner, and member of the Advisory Committee Providing: Deal referrals Business development assistance Monitoring and evaluation of second bottom line returns Interfacing with neighborhoods where business are located Outreach: recent networking event featured the California Lieutenant Governor and Deputy Insurance Commissioner Bay Area Equity Fund: A Double Bottom Line Fund Sponsored by the Bay Area Council and the Alliance for Community Development, managed by JPMorgan H&Q 90% of the fund investing in emerging growth companies in technology, health care, or specialty consumer 10% of the fund in strategic equity companies that anchor communities Raised $75 million Target of creating 1,500 new jobs, with at least 750 jobs for lowand moderate-income residents Accomplishing The Second Bottom Line Assessment before investment is made to determine 2nd bottom line potential Letter of agreement signed by company to develop/implement 2nd bottom line strategy, choosing from cafeteria plan of best 2nd bottom line practices Consultation to formulate enhanced strategy and action plan On-going joint implementation of the action plan Narrative Evaluations and Impact Reports for individual companies and portfolio as a whole, addressing: Job creation/LMI job creation Wealth creation Community benefits Environmental performance Second Bottom Line Impact Report Summer/Fall 04 Category Projected Actual Winter/Spring 05 Projected Actual Summer/Fall 05 Projected Actual New Jobs Created Low Income Employees Hired* I. Job Creation Salary Range $25,000 - $34,999 $35,000 - $44,999 $45,000 - $54,999 $55,000 – Above Retention/Promotion Low In. Employees Retained Low In. Employees Receiving Upgrade Training Low In. Employees Promoted Employee Benefits II. Wealth Creation Employer Paid Health Care Retirement Plan Financial Management Training Profit Sharing Program Employee Stock Ownership Program Community Benefits Corporate Citizenship Program III. Environment /Workplace Local, Women, and Minority Contractor/Supplier Program Bay Area Green Business Certification Program Green Building Plan (design, construction/retrofit, & operations) Workplace Safety/Ergonomic Efficiency Plan * Low-income employees are defined as individuals who had household incomes that were 80% of the county median income before the individuals were hired Bay Area Equity Fund Investments Elephant Pharmacy: natural health retailer providing both traditional and alternative wellness solutions, $2.2 million Reshape, Inc: Electronic Design Automation software provider for integrated circuit manufacturers, $1.8 million Efficas: developer of nutritional bioactives that maintain health in humans and animals, $2.3 million Expression Diagnostics (XDx): Peninsula Pharmaceuticals: developer of a blood-based molecular diagnostics test to detect rejection in transplant patients for the heart and other organs, $3 million commercializing antibiotics to treat lifethreatening infections, $1 million Five Prime Therapeutics: biotechnology company-therapeutic proteins and antibodies for oncology, immune disorders, diabetes and regenerative medicine, $1 million California Environmental Redevelopment Fund (CERF) Sponsored by Bay Area Council, the Federal Reserve Bank of San Francisco and the Los Angeles Chamber of Commerce Managed by Peter Hollingworth, President and CEO Raised $34.4 million Provider of Cal ReUSE funds Innovative, financing solutions for remediation of brownfields throughout the Bay Area and California CERF Debt & Equity Investments Curtis Park: Sacramento, remediation of contaminated rail yard, $5 million Bugatto: Santa Rosa, remediation for a housing development, $0.8 million Fairfield Independent Business: Fairfield, rehabilitation of an independently owned smog/autobody shop, $0.5 million Pittsburg River Park, LLC: Pittsburg, site acquisition & remediation for new single family housing/retail use, $5 million Habitat for Humanity-SF: San Francisco, environmental remediation and new condominium construction, $1 million South County Housing: Gilroy, acquisition & remediation of contaminated site for LMI housing development, $1.9 million SunQuest: Sun Valley, environmental remediation, pre-development and grading, $5 million Samir: San Bernadino, acquisition & cleanup of gas station, $0.8 million Samir: Colton, acquisition & cleanup of gas station, $0.8 million Surfas, Inc: Culver City, site/building acquisition & facility improvements, $1.8 million Surfas, Inc (II): Culver City, site/building acquisition, site remediation & facility improvements, $5 million Nabil: Redlands, site acquisition and new equipment purchase, $0.6 million St. Clair: Norco, refinance/cleanup, housing development , $7.3 million Stanton: Orange County, site acquisition, facility rehabilitation/equipment purchase for business, $0.6 million Conclusion The success of CCII and the Bay Area Family of Funds demonstrates the regional economic impact that business civic organizations can have by initiating a double bottom line initiative and fund family Based on their success in the Bay Area, the Bay Area Council and the Alliance for Community Development have emerged as national leaders in the emerging field of double bottom line investing