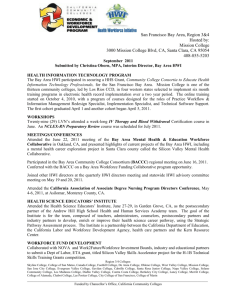

California Economic Condition & the Health of its Municipal Agencies

advertisement

California Economic Condition & the Health of Regions John Husing, Ph.D. Economics & Politics, Inc. 1. General Economy’s Problems Starting To Recede After Losing 8.74 Million Jobs … U.S. Job Creation Is Crawling Back Pattern of Likely Recovery VU Congressional Madness Fiscal Cliff U.S. Economy??? Worst National Unemployment Rates U.S. 8.6% CA 10.9% Pattern of Likely Recovery VU Congressional Madness Fiscal Cliff U.S. Economy??? U.S. & California Unemployment Rates Trend is Down Unemployment History U.S. & California, 2001-2012 14.0% U.S. 13.0% California 12.0% 11.0% 10.0% 10.4% 9.0% 8.0% 7.0% 8.2% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: U.S. Bureau of Labor Statistics, CA Employment Development Department Worst National Unemployment Rates U.S. 8.6% CA 10.9% CA Has Lost Every Job Created Since Mid-1999 Back to 2003 CA Legislature Seems To Have Little Interest In This Fact California’s Job Creation/Losses Defense Cutbacks Dot.Com Great Recession CA Sector Growth & Decline August 2011-2012 Exhibit 8.-Job Growth Advantages & Disadvantages California Job Growth, August 2011-2012 Mgmt & Professions Health Care Employment Agcy Eating & Drinking Retail Trade Distribution & Transport Publish, telecom, Other Construction Admin. Support Financial Activities Higher Education Accommodation Agriculture 1,650 Social Assistance 938 Mining 613 463 Utilities (650) Amusement (763) Manufacturing Other Services (2,988) Local Government (8,538) Federal & State (9,850) Other Education (12,700) 46,163 34,775 32,100 30,825 28,950 18,100 17,113 15,475 15,150 11,500 9,838 8,875 272,525 -35,488 Source: CA Employment Development Department Sacramento I-80 4. 11.4% Bay Area Unemployment by Market Area 1. 8.4% Avg. Jan-Aug 2012 Central Valley 5. 15.1% CA = 10.6% Central Coast 2. 9.6% So. California 3. 10.6% Sacramento I-80 Where Are Job Gains 5. 6,413 0.63% 2.7% Bay Area 2. 75,317 2.40% 31.6% Avg. Jan-Aug 2012 Central Valley Central Coast 4. 16,430 3.00% 6.9% 3. 19,085 1.52% 8.0% CA = 238,196 1.64% So. California 1. 105,197 1.33% 44.2% Gold Mine Theory Secondary Tier Primary Tier Economic Drivers What’s The Status of C D So. California’s “Gold B Mines?”C Bottom Construction B $ Helps Motion Pictures AStrong Computer Games Unstable Regulators Manufacturing ADollar Agriculture B Strong Bio-Tech Inventory Trade Inventory Logistics Incomplete? Unstable Regulators Green C$ May Help Tourism B Strong Information ABoomers Health Care The Great Economic Threat California Grabbing Money From Local Government Long Term: Strangling Growth CA 2. Tax Base Considerations Assessed Valuation CAO/City Manager Counseling Northern FY 2009 to FY 2012 Assessed Valuation % Change 2. -2.2% Sacramento I-80 6. -12.1% Bay Area CA -3.8% 1. -1.3% Central Valley 5. -5.4% Central Coast 3. -2.6% So. California 4. -3.6% Northern FY 2009-2012 Assessed Valuation Decline 6. -$2.0 B 1.1% Sacramento I-80 Bay Area 4. -$14.2 B 8.2% 2. -$47.0 B 27.3% CA -$172 Billion Central Valley 3. -$15.2 B 8.8% Central Coast 5. -$4.9 B 2.8% So. California 1. -$89.0 B 51.7% Percent AV Gains FY 2009 to FY2012 Colusa San Francisco Trinity Humboldt Kings Santa Barbara Mendocino Napa Del Norte Marin Siskiyou Kern San Mateo $679,666,840 $17,375,259,586 $106,696,930 $671,453,335 $244,293,626 $1,545,095,906 $204,025,240 $532,896,981 $29,494,143 $722,357,955 $25,072,560 $425,051,297 $428,634,777 25.8% 12.3% 9.3% 6.3% 2.8% 2.5% 2.1% 2.0% 1.7% 1.3% 0.6% 0.5% 0.3% Largest Percent AV Losses FY 2009 to FY2012 Shasta San Bernardino Placer Madera Sacramento Yuba Plumas Solano Stanislaus San Benito Riverside San Joaquin Merced Calaveras ($1,713,831,183) ($19,646,919,334) ($6,445,290,638) ($1,459,832,632) ($16,766,074,365) ($692,994,373) ($557,756,508) ($6,481,892,146) ($5,630,188,000) ($996,855,852) ($37,655,720,162) ($10,790,493,651) ($3,522,361,333) ($1,363,977,244) -10.4% -10.6% -10.9% -11.9% -12.3% -12.9% -13.0% -14.1% -14.1% -14.9% -15.6% -17.0% -17.7% -19.1% Residential Markets: When Is The End? Underwater Homes San Francisco 14% Santa Clara 19% San Mateo 20% Orange 24% Los Angeles 30% Alameda 31% San Diego 34% Riverside 51% San Bernardino 52% Fresno 53% Madera 54% Sacramento 55% Tulare 57% Kern 58% Imperial 59% San Joaquin 59% Merced 61% Affordability San Bernardino 78 Solano (Vallejo) Merced Kings Madera Sacramento Fresno Riverside Monterey Napa Sonoma Los Angeles Ventura San Diego 77 77 75 74 74 71 65 55 50 49 49 48 44 San Luis Obispo Alameda Orange Santa Cruz Santa Clara Santa Barbara Marin Contra-Costa San Francisco San Mateo 41 38 35 34 32 32 27 26 24 23 North 5. $170,635 Feb-2012 Median Price Coast vs. Inland Sacramento I-80 Bay Area 1. $371,182 4. $175,855 Central Valley Central Coast 2. $291,312 6. $125,584 So. California 3. $272,611 Underwater Inland Empire Homes When Does Foreclosure Crisis End? If No Demand Growth, No Gov’t Solution How This Ends: A Housing Shortage During 2008 thru 2011 California Population Grew by 1,026,471 106,230 Office Vacancy Weak Almost Everywhere! 2005/2006 2009 2012 Inland Empire 10.5% 24.3% 26.9% Sacramento 13.5% 21.4% 22.7% 8.0% 18.0% 20.8% Oakland 16.5% 15.6% 17.8% Los Angeles County 12.2% 16.3% 16.0% 9.0% 19.2% 15.5% Orange County San Diego Fresno 13.8% San Francisco 13.0% 14.9% 9.7% Santa Clara 16.0% 20.5% 9.0% Industrial Vacancy Rate Down Almost Everywhere! 2005/2006 Sacramento 10.5% 2009 12.3% Fresno San Diego 2012 13.4% 9.8% 7.0% 12.0% 9.9% Silicon Valley 14.4% 13.9% 7.6% Inland Empire 2.7% 12.8% 6.6% Oakland 6.0% 8.9% 5.1% Orange County 5.4% 6.5% 3.5% Los Angeles County 2.1% 3.2% 2.7% Assess Valuation Future FY 2013 A Mixed Year 3. Tax Base Considerations Sales Taxes: A Serious Problem CAO/City Manager’s Office Gold Mine Theory Secondary Tier Retail Sales Primary Tier Sacramento I-80 1. 7.9% Bay Area 2. 7.5% 2nd Qtr. 2011-2012 Change In Retail Sales CA = 6.8% Central Valley 4. 6.3% Central Coast 4. 6.3% So. California 3 6.7% Sacramento I-80 4. $100.7 B 7.1% Bay Area 2. $310.7 B 22.0% 2nd Qtr. 2012 Total Retail Sales CA = 1,413.0 B 6.8% Central Valley 3. $137.1 B 9.7% Central Coast 5. $49.7 B 3.5% So. California 1. $752.2 B 53.2% Retail Sales Future 2012 Continued Improvement Still Below Highs 4. Economic Development It is A Competition Who Was Hurt By The Recession 3. Northern 41 Least Hurt = 12 6. Sacramento I-80 52 2. Bay Area Job Worries 30 Take Precedence 5. Central Valley 48 1. Central Coast 28 4. So. California Environmental Issues Take Precedence 45 California Governing Philosophy Command & Control Vs. Markets California Ranks Last in the U.S. For Business Location - Forbes - Unstable Regulatory Commands If A Business Can’t Plan, They Won’t Come or Stay State Taxes Exhibit 72.-State Taxes, 2011 Highest Highest Highest Individual Income State/Local Sales Tax Gasoline Tax 2ndTax per Property capita Highest 8.84% 9.55% 8.25% 46.1 $1,397 Oregon 7.90% 9.00% 0.00% 25.0 $1,167 Arizona 6.97% 4.24% 6.60% 19.0 $1,139 New Mexico 6.40% 4.90% 5.13% 18.8 $589 Utah 5.00% 0.00% 5.95% 24.5 $846 Colorado 4.63% 4.63% 2.90% 22.0 $1,322 Nevada 0.00% 0.00% 6.85% 33.1 $1,344 Texas 0.00% 0.00% 6.25% 20.0 $1,600 Washington 0.00% 0.00% 6.50% 37.5 $1,257 Highest Business Income California Electrify Southern California? Electrical Rates Electrify Southern California? Natural Gas Rates State Mandated Costs Not Found Elsewhere In U.S. Overtime After 8 Hours … Not 40 Hour Week Mandatory Family Leave Dysfunctional State Government California Bond Rating Drops Lower Than Any Other State's Lack of Investment In Aging & Missing Infrastructure Grade Separations Transit Oriented Housing Not Without Tax Increment Financing! Modestly Trained Labor Force K-12 Performance 38th Share of Adults: No College 44.9% Census Bureau, 2010 Education Funding Per Capita 27th Pew Center for States Public Policy Institute How Minnesota Can Avoid the "California Spiral" CA Long Term Future? Command & Control Vs. Markets While Waiting For Complete Recovery…. www.johnhusing.com