TAX RELIEF ACT OF 2010

advertisement

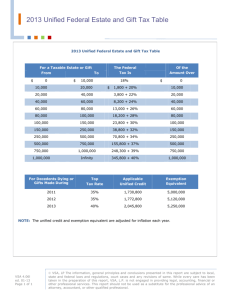

TAX RELIEF ACT OF 2010 presented by R. Nicholas Nanovic, Esq. May 12, 2011 www.thsLaw.com 1611 Pond Road Suite 300 Allentown, PA 18104 ● 610-391-1800 ● 610-391-1779 (fax) 1 Tax Relief Act of 2010 • Official name: Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 • Public Law 111-312 • Signed into law on December 17, 2010 • Affects personal income taxes, business income taxes, and estate/gift taxes 2 Personal Income Tax: Rates • Ordinary Income Tax Rates – 2010 rates extended to 2011 and 2012 2010 2011-2012 2013+ 10% 10% 15% 15% 15% 15% 25% 25% 28% 28% 28% 31% 33% 33% 36% 35% 35% 39.6% 3 Personal Income Tax: Rates • Ordinary Income Tax Rates – 2010 tax brackets Single MFJ 10% $0 - 8,375 $0 - 16,750 15% $8,376 - 34,000 $16,751 -68,000 25% $34,001 - 82,400 $68,001- 137,300 28% $82,401 - 171,850 $137,301 - 209,250 33% $171,851 - 373,650 $209,251 -373,650 35% $373,651+ $373,651+ 4 Personal Income Tax: Rates • Capital Gains Rates – 2010 long term capital gain rates extended to 2011 and 2012 Income Tax Bracket 2010 2011-2012 2013+ 10% (15%) 0% 0% 10% 15% (15%) 0% 0% 10% 25% (28%) 15% 15% 20% 28% (31%) 15% 15% 20% 33% (36%) 15% 15% 20% 35% (39.6%) 15% 15% 20% 5 Personal Income Tax: Rates • Qualified Dividend Rates – 2010 rates extended to 2011 and 2012 – Taxed as ordinary income after 2012 Income tax bracket 2010 2011-2012 2013+ 10% (15%) 0% 0% 15% 15% (15%) 0% 0% 15% 25% (28%) 15% 15% 28% 28% (31%) 15% 15% 31% 33% (36%) 15% 15% 36% 35% (39.6%) 15% 15% 39.6% 6 Personal Income Tax: Rates • Alternative Minimum Tax (AMT) – Alternative minimum tax exemption amounts increased for 2010 and 2011, subject to phaseouts – Phaseouts of $112,500 (Single or HoH), $150,000 (MFJ), and $75,000 (MFS) – Tax rate remains 26% for first $175,000 of postexemption amount and 28% for excess Status 2010 Exemption 2011 Exemption 2012 Exemption Single or HoH $47,450 $48,450 $33,750 MFJ $72,450 $74,450 $45,000 MFS $36,225 $37,225 $22,500 7 Personal Income Tax: Rates • Payroll Tax Holiday (Maximum benefit of $2,136) – Before 2011, 6.2% of employee’s first $106,800 of wages were withheld for social security tax (employer pays matching 6.2%) – In 2011, 4.2% of employee’s first $106,800 of wages are withheld for social security tax (employer still pays 6.2%) – In 2011, self-employment tax decreased from 12.4% to 10.4% for first $106,800 of self-employment income 8 Personal Income Tax: Deductions • Student Loan Interest – Extension of increased phaseout thresholds to 2011 and 2012 • Phaseout if income exceeds $60,000 for individuals and $120,000 for joint filers; Completely phased out if income is $75,000 or $150,000, respectively • Without extension, phaseout if income exceeds $40,000 for individuals and $60,000 for joint filers; Completely phased out if income is $55,000 or $75,000, respectively – Extension of repeal of 60-month limitation on deduction • Without extension, taxpayer could not deduct any student loan interest after 60 months – Maximum deduction still limited to $2,500 9 Personal Income Tax: Deductions • Qualified Tuition and Expenses – Deduction for qualified tuition and expenses extended to 2010 and 2011 – Deduction limited to maximum of $4,000 and subject to phaseout thresholds – Taxpayer must choose either deduction or credit for education expenses 10 Personal Income Tax: Deductions • Personal Exemption – Repeal of phaseout extended for 2011 and 2012 • Phaseout would reduce exemption amount by 2% for every $2,500 in excess of the phaseout threshold • 2009 phaseout thresholds were $166,800 for taxpayers filing single and $250,200 for married taxpayers filing jointly – Exemption amounts: • $3,650 in 2010; $3,700 in 2011 11 Personal Income Tax: Deductions • Standard Deduction – Married taxpayers filing jointly will have standard deduction equal to twice the standard deduction for a single taxpayer for 2011 and 2012 – Single taxpayers allowed a standard deduction of $3,000 (as adjusted for inflation) • $5,700 for 2010; $5,800 for 2011 – Beginning 2013, standard deduction will be $5,000 (as adjusted for inflation) for married taxpayers filing jointly 12 Personal Income Tax: Deductions • Itemized Deductions (State and Local Sales Tax) – Taxpayer may elect to deduct income taxes or sales taxes as an itemized deduction • Option extended to 2010 and 2011 – If deducting sales tax, taxpayer may choose to deduct (1) actual sales tax paid or (2) sales tax determined by IRS tables plus sales tax paid on purchase of motor vehicles and watercraft • Election is useful for taxpayers that make large purchases during the year (i.e. engagement rings) or taxpayers in states without income taxes (i.e. Florida) 13 Personal Income Tax: Deductions • Itemized Deductions (Mortgage Insurance Premium) – Taxpayer pays premiums for home mortgage insurance if unable to pay entire downpayment – Deduction for mortgage insurance premiums extended for 2011 14 Personal Income Tax: Deductions • Itemized Deductions (Phaseouts) – Repeal of phaseout of itemized deductions extended to 2011 and 2012 – Beginning 2013, if income exceeds phaseout threshold, itemized deductions reduced by lesser of: • 3% of taxpayer’s income in excess of phaseout threshold, or • 80% of itemized deductions – Phaseout threshold is $100,000 (as adjusted for inflation) • Threshold was $166,800 in 2009 15 Personal Income Tax: Exclusions • Charitable IRA Distribution – Taxpayer can make distribution of no more than $100,000 to charitable organization without including such amount in reportable income • Extended to 2010 and 2011 – Taxpayer must be 70.5 years old or older – Distribution counts toward required minimum distribution 16 Personal Income Tax: Credits • American Opportunity Credit – Credit extended to 2011 and 2012 – Credit equal to 100% of first $2,000 of qualified tuition and related expenses and 25% of next $2,000 • 40% is refundable; 60% is nonrefundable – Credit applies for student’s first four years of education after high school – Credit phased out if income is between $80,000-90,000 for individuals and $160,000-180,000 for joint filers 17 Personal Income Tax: Credits • Child and Dependent Care Credit – Credit extended to 2011 and 2012 – Credit equal to 35% of qualifying child or dependent care expenses • Maximum credit of $2,100 • Subject to phaseout 18 Personal Income Tax: Credits • Child Tax Credit – Credit extended to 2011 and 2012 – Credit equal to $1,000 per qualifying child • Beginning 2013, credit will be $500 per qualifying child • Subject to phaseouts 19 Personal Income Tax: Credits • Earned Income Tax Credit – Credit extended to 2011 and 2012 for low income taxpayers – Maximum credit of $5,666 for taxpayer with three or more qualifying children; Maximum credit of $457 for taxpayer with no qualifying children • Subject to phaseouts 20 Personal Income Tax: Credits • Energy Credit – Credit extended to 2011 for purchase of nonbusiness energy property (doors, windows, insulation, certain heat pumps, etc.) – Credit limited to 10% of cost of property, for maximum of $500 • 2010 credit was limited to 30% of cost of property for maximum of $1,500 21 Business Income Tax: Rates • No changes 22 Business Income Tax: Deductions • Bonus Depreciation – Extended for qualifying property placed in service before 2013 – If qualified property is purchased after 2007 and placed in service before 2013, additional depreciation equal to 50% of cost of property can be depreciated in first year that property is placed in service – Bonus depreciation of 100% if property acquired after September 8, 2010 and placed in service before 2012 23 Business Income Tax: Deductions • Section 179 Expensing – Increase 2012 limitation from $25,000 to $125,000 • Limitation is $500,000 for 2010 and 2011 • Limitation is $25,000 for 2013 and later – 2012 limitation reduced by amount that Section 179 property placed in service during the year exceeds $500,000 • No expense if company invests $625,000 in Section 179 property • Investment limitation was $2,000,000 for 2010 and 2011; investment limitation is $200,000 for 2013 and later – 2012 limitation amounts of $125,000 and $500,000 to be adjusted later for inflation 24 Business Income Tax: Credits • New Markets Tax Credit – Extended to 2010 and 2011 – Taxpayers allowed credit for investment in qualified community development entities • Credit is 5% of investment for first three years; 6% of investment for subsequent four years – National limitations on credit allowed • $3.5 billion for 2010 and 2011 – Unused amounts may be carried forward until 2016 25 Business Income Tax: Credits • Work Opportunity Credit – Hiring deadline extended to December 31, 2011 • Original hiring deadline was August 31, 2011 – Employer allowed a credit equal to 40% of each employee’s first $6,000 of wages for employees from certain groups • Groups: qualified IV-A recipients, qualified ex-felons, designated community residents, qualified SSI recipients • Credit given for first $3,000 of wages of qualified summer youth employee and first $12,000 of qualified veteran 26 Business Income Tax: Credits • Employer Provided Child Care Credit – Credit extended for 2011 and 2012 – Employer allowed credit equal to 25% of qualified child care expenditures (construction costs, operating costs, contract with child care facility) plus 10% of qualified child care resource and referral expenditures – Credit limited to $150,000 27 Estate & Gift Tax: Overview • Estate Tax – Enacted in 1916 – Taxes accumulated wealth of decedent, less deductions, and subject to credits – 2009 Statistics: • 33,515 returns filed (~1.3% of decedents) • 14,713 returns filed subject to tax (~0.6% of decedents) • $20,643,664,000 tax due (~0.98% of federal revenue) • Gift Tax – Backstop to estate tax: Prevent a person from avoiding estate tax by disposing of entire wealth during lifetime 28 Estate & Gift Tax: Credits • Estate Tax – Gross estate includes all property owned by decedent at death – Deductions allowed for debts, liabilities, administrative and funeral expenses – Deduction for any gifts to charities – Deduction for any distribution to surviving spouse – Estate tax rate applied against taxable estate – Unified credit against estate tax 29 Estate & Gift Tax: Credits • Gift Tax – Backstop to estate tax – Gifts between spouses are not taxable – Gifts to a recipient worth less than the annual exclusion are excluded from tax – Gifts not to spouse and in excess of annual exclusion are subject to gift tax rates – Gift tax reduced by unified credit (not always equal to estate tax unified credit) 30 Estate & Gift Tax: Credits • 2009 Example – Maximum Estate Tax Rate: 45% – Estate Tax Unified Credit: $1,455,800 • Excludes $3.5 million from estate tax – Maximum Gift Tax Rate: 45% – Gift Tax Unified Credit: $330,800 • Excludes $1 million from gift tax – Gift Tax Annual Exclusion: $13,000 • If spouse agrees to split gift, exclusion is $26,000 31 Estate & Gift Tax: Credits • 2009 Example – John dies in 2009 with $10 million of assets • Debts/expenses of $1 million • Left $3 million to his wife, the rest goes to children – John will have taxable estate of $6 million • Exclude additional $3.5 million for unified credit – Estate tax: $1.125 million • 45% of $2.5 million 32 Estate & Gift Tax: Credits • 2009 Example – John gives $3 million to his wife and $6 million to children • Gift to wife is not taxable • If John has 5 children and wife agrees to gift split, $130,000 of children’s gifts are not taxable – Remaining $5,870,000 subject to gift tax – Exclude additional $1 million for unified credit – Gift tax: $2,191,500 • 45% of $4,870,000 33 Estate & Gift Tax: 2010 Estate Tax • 2010 issues before tax bill – NO ESTATE TAX – Maximum gift tax rate is 35% • Gift tax unified credit applicable exclusion amount remains $1 million • Annual exclusion remains $13,000 – Assets transferred to heirs do not receive step-up in basis • If decedent bought stock in 1950s for $5/share and stock is now worth $100/share, heir’s basis in stock remains $5/share. 34 Estate & Gift Tax: 2010 Estate Tax • Notable 2010 deaths – Mary Janet Morse Cargill (widowed) • Heir to family-owned agriculture empire – Dan L. Duncan (married) • Majority owner of Enterprise Products, an oil and gas company – Walter H. Shorenstein (widowed) • Real estate developer – George Steinbrenner (married) • Owner of New York Yankees – John W. Kluge (married) • Television industry mogul 35 Estate & Gift Tax: 2010 Estate Tax • Notable 2010 deaths – Estimated net worth: • • • • • • Cargill – $1.7 billion Duncan – $9 billion Shorenstein – $1.1 billion Steinbrenner – $1.1 billion Kluge – $6.5 billion TOTAL NET WORTH: $19.4 billion – Estate taxes saved: $8.73 billion 36 Estate & Gift Tax: 2010 Estate Tax • 2010 Estate Tax Reinstated – Estate has options for 2010 1. DEFAULT: Estate tax under new 2010 rules • • • • Estate tax due 35% estate tax rate $5 million applicable exclusion amount Heirs receive stepped-up basis in assets 2. ELECTION: No estate tax under original 2010 rules • No estate tax due • Heirs receive carryover basis of assets • $1.3 million of additional basis can be allocated to assets • $3 million of additional basis can be allocated to assets distributed to surviving spouse 37 Estate & Gift Tax: Estate Tax • Estate tax reinstated for 2010 at 35% • Estate tax rates reduced for 2011 and 2012 – Without passage of bill, rate would be 55% • Applicable exclusion amount increased to $5 million – 2012 amount to be adjusted for inflation ESTATE TAX 2009 2010 2011 2012 2013 Rate 45% 35% 35% 35% 55% $3.5M $5M $5M $5M $1M Exclusion 38 Estate & Gift Tax: Estate Tax • Portability – If one person dies without using full unified credit, surviving spouse is able to utilize unused credit • • Both spouses must die in 2011 or 2012, unless new laws extend portability beyond 2012 Surviving spouse able to use unused credit of last deceased spouse – If wife’s husband dies January 2011, she remarries October 2011, her new husband dies in February 2012 and she dies in July 2012, she will only be able to utilize unused credit of second husband 39 Estate & Gift Tax: Gift Tax • Gift tax rate remains 35% for 2010, 2011 and 2012 • Applicable exclusion amount increased to $5 million – 2012 amount to be adjusted for inflation GIFT TAX 2009 2010 2011 2012 2013 Rate 45% 35% 35% 35% 55% Exclusion $1M $5M $5M $5M $1M 40 Thank You R. Nicholas Nanovic, Esq. nnanovic@thslaw.com www.thsLaw.com 1611 Pond Road Suite 300 Allentown, PA 18104 ● 610-391-1800 ● 610-391-1779 (fax) 41 CIRCULAR 230 DISCLOSURE To ensure compliance with requirements imposed by the IRS, we inform you that unless specifically provided otherwise in this communication (including any attachments), any U.S. federal tax advice contained in this communication (including any attachments) does not constitute a “reliance opinion” as defined in IRS Circular 230 and cannot be used for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or taxrelated matter addressed herein. 42