Crystallized Intelligence (Financial Literacy)

advertisement

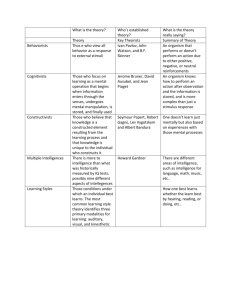

Consumer Finance Across the Lifespan Eric J. Johnson Marketing Division, the Center for Decision Sciences and the Consumer Financial Protection Bureau Supported by NSF Grant SES-0352062, National Institute for Aging with support from the Social Security Administration The Russell Sage and the Alfred P. Sloan Foundation The National Endowment for Financial Education. FRB Atlanta July 23, 2014 A Grey Tsunami ● The over 65 population of the world will double by 2035 ● One in five Americans will be over 65 by 2030. Why does this matter? ………………………………………………………………………………………………………………………………………… Source: 2011 Survey of Income and Program Participation ………………………………………………………………………………………………………………………………………… ………………………………………………………………………………………………………………………………………… Consumers’ decisions to spend and save. ●Every day we make decisions that will affect our future financial well beings. –In economics, the workhorse model for consumer financial decisions is the permanent income/life cycle savings hypothesis. –What can consumer research and psychology add to this? ………………………………………………………………………………………………………………………………………… The Permanent Income / Life Cycle Savings Hypothesis ● People save and spend based on estimated future income ● Goal is to ‘bounce the last check you write’ ● Involves: – Exponential Discounting – Expectation of future income and spending – Usually Solved by Backward Induction ………………………………………………………………………………………………………………………………………… In contrast….. ………………………………………………………………………………………………………………………………………… ………………………………………………………………………………………………………………………………………… Source: Salthouse 2010 JUNE 10, 2011, 2:52 PM ET Declining Cognitive Ability Presents Challenges to Attracted Popular and Academic Interest. Boomer Finances As Baby Boomers age, policy makers and economists may be served by looking at the condition of not just their nest eggs, but the health of their brains. So says economist David Laibson, of Harvard University in a speech called “The Age of Reason.” Prof. Laibson spoke at Morningstar’s annual conference in Chicago before hundreds of financial advisers and asset managers — industries grappling with the inevitable shift of assets from workers accumulating money to those trying to live on it as they grow older. JUNE 10, 2011, 2:52 PM ET Declining Cognitive Ability Presents Challenges to Boomer Finances Prof. Laibson opened with an image of the famously wealthy Brooke Astor. “One of our most remarkable individuals ended up in this terrible state” because of a lack of cognitive abilities, he said. As Baby Boomers age, policy makers and eggs, but the health of their brains. ● Targets Getty Images About 35% of wealth is controlled by those 65 or older, Prof. The late Brooke Astor is an example of the dangers of declining cognitive function. economists may by will looking the condition of not just their nest Laibson said,be andserved that number grow asat boomers age. The total balance sheet of U.S. households is $53 trillion, he says. As about $18 trillion hang in the balance among seniors, the question is, what will be done to help aging people from becoming another Brooke Astor? for fraud So says economist David Laibson, of Harvard University in a intelligence — that is intelligence displayed in things like memory tests — decreases dramatically with age. In speech called “The Age of Reason.” Prof. Laibson Fluid spoke at fact, “it’s all downhill from age 20” Prof. Laibson said. “What about the 80-year-olds? It’s the 80-years-olds who have Morningstar’s annual conference in Chicago before hundreds of the million dollar IRAs. Not the 20-year-olds.” financial advisers and asset managers — industries grappling with But clearly, there’s a lot more to life than fluid intelligence. Crystallized intelligence — memory, wisdom and so on — the inevitable shift of assets from workers accumulating money to does increase over time, but less so, on average, in senior years. those trying to live on it as they grow older. ● Concern from industry – Are customers capable of making informed decisions? – Are they liable for detecting decreased capability? All told, the point at which we make the best financial choices is 53 years old, according to his data. “Of course there are exceptions,” Prof. Laibson said. “I would take Warren Buffett at 81 over most 50-year-olds.” (But he also famously wealthy acknowledges he would take a fiftysomething Buffett over one in his 80s.) Prof. Laibson opened with an image of the Brooke Astor. “One of our most remarkable individuals ended up in Many seniors end up in a state called cognitive impairment without dementia that isn’t quite dementia, but still (as the this terrible state” because of a lack of cognitive abilities, he said. ● Obvious implication for public policy and decumulation decisions name implies) a deterioration of memory. In spite of this, people still may make financial decisions on their own. Prof. Getty Images Labison estimated that 16% of those 71-79 years old, 29.2% of 80-89 year olds, some 38.8% of those over 90 years older, Prof. The late Brooke Astor is an example of the dangers of old are in such a state. About 35% of wealth is controlled by those 65 or declining cognitive function. Laibson said, and that number will grow as boomers age. The total Those people are at great risk for financial abuse. Some 17% of professional care staff report committing psychological balance sheet of U.S. households is $53 trillion, heabuse says. andAs 10%about physical abuse, Prof. Laibson said. $18 trillion hang in the balance among seniors, the question is, what will be done to help aging people from becoming Those over the age of 50 end up paying higher interest rates, even though on average they had better FICO scores and ………………………………………………………………………………………………………………………………………… another Brooke Astor? lower default rates, Prof. Laibson said. “Middle aged people get better deals,” he said. In terms of risk-adjusted returns ● Independent of Dementia on investments, the young do relatively well, but the “old are doing absolutely abysmal,” paying more in fees and Fluid intelligence — that is intelligence displayed in things like memory tests — decreases dramatically with age. In fact, “it’s all downhill from age 20” Prof. Laibson said. “What about the 80-year-olds? It’s the 80-years-olds who have ………………………………………………………………………………………………………………………………………… Can Crystallized Intelligence Compensate? ● Crystallized intelligence is what we learn about the world, usually through experience and instruction ● Not determined only by IQ ● Cattell saw this as intellectual capital ………………………………………………………………………………………………………………………………………… Compensating Cognitive Competencies (CCC) Hypothesis Crystallized Intelligence Positive Effect of Age c Age Decision performance Negative Effect of Age Fluid Intelligence ………………………………………………………………………………………………………………………………………… 12 Fluid intelligence declines with age Changes with age… Fluid intelligence (Gf) is the ability to generate and transform information on the fly - Seems critical for decision making! Fluid intelligence ………………………………………………………………………………………………………………………………………… Salthouse, 2010 Perhaps experience is compensating Changes with age… Crystallized Intelligence Crystallized intelligence (Gc) is a stable depository of knowledge acquired through culture, education, and life experience (Carroll, 1993; Cattell, 1971, 1987) Salthouse, 2010 ………………………………………………………………………………………………………………………………………… 14 Crystallized Intelligence (Financial Literacy) FL1. Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, would you be able to buy more than, exactly the same as, or less than today with the money in this account? – More than today – Exactly the same as today – Less than today – Do not know Over 1/3 of Americans say they don’t know or get the wrong answer ………………………………………………………………………………………………………………………………………… So, What Did We Find? ● Crystalized intelligence helps. ● It overcomes the decline in fluid intelligence ● Older people are better decision makers. – Example: Given the same income, education, fluid intelligence, crystalized intelligence boost credit scores. ………………………………………………………………………………………………………………………………………… 8 64 &(. , Crystallized Intelligence ! "#$%&''()*+,, D o m a in G c fa c to rs c o r e 0 .8 %#0).4" -. %*''(/*. 0*, Positive 12 3, Effect 0 0 .0 %#%" − 0 .4 3 0 (% " 5 0 A g e ,JKLMNNN, *%" 7 0 ! "#$ %"& Age Credit Score #$%&&&" ; /*, <-! I , ' #( "%& #' ( ) &&" G ffa c to rs c o r e JDOON, Fluid <'=(+,, Intelligence %0 #.0 %" -. %*''(/*. 0*, Negative 12 :3, − 0 .5 +% #, " 0 (3 % " 5 0 A g e *%" 7 0 Effect ………………………………………………………………………………………………………………………………………… Consider Ann, a college graduate who earns $50,000 and average cognitive ability. ● In our data we would predict a credit score of 693. ● What happens if we increase – Fluid Intelligence by 10 IQ points? 713 – Crystalized Intelligence by the same amount? 750 The effect of Crystalized Intelligence is the equivalent of 25 years of normal aging. Ann’s mortgage rate goes from 4.22% to 3.82%, saving her $24,879 over the life of a loan! ………………………………………………………………………………………………………………………………………… Where are we….. ● Financial Decisions in older people are better than the young BUT for different reasons – They DO lack Fluid Intelligence – But are improved by Crystalized Intelligence, particularly financial literacy. ● BUT: – A paradox: Financial literacy helps, but financial literacy education does not! – Decreases in Fluid Intelligence continue, increases in Crystalized Intelligence slow down. ………………………………………………………………………………………………………………………………………… What happens over the full life course? 1 Patience Financial Literacy Predicted z-Score 0.5 Debt Literacy 0 20 -0.5 30 40 Age 50 60 70 80 -1 -1.5 -2 • “Golden Age of Reason” (Agarwal et al. 2010) • Fortune 500 CEOs avg. age of 56 • U.S. Presidents inaugurated at 55 ………………………………………………………………………………………………………………………………………… Implications for Public Policy ● We have created good savings plans for retirement for the uninterested (The SMarT Plan, Target Date Funds, etc.) ● How about using that savings? – What does “Decumulation for Dummies” look like? – When should you make decisions about drawing down for retirement? ● Financial Service Firms need to develop suitable products, Government(s) need to facilitate their creation. …………………………………………………………………………………………………………………………………………