Document

advertisement

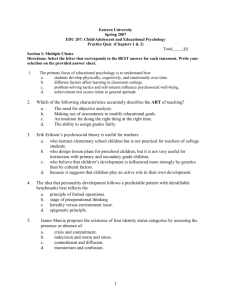

Study Questions for Chapter 1 1. Waverly Company paid $5,000 cash for wages of production workers. This business event would: a. increase total assets and total equity. b. increase one asset account and decrease another asset account. c. decrease total assets and total equity. d. decrease one asset account and increase an equity account. 2. Warren Company makes candy. During the most recent accounting period, Warren paid $3,000 for raw materials, $4,000 for labor, and $2,000 for overhead costs that were incurred to make candy. Warren started and completed 10,000 units of candy, of which 7,000 were sold. Based on this information, Warren would recognize which of the following amounts of expense on the income statement? a. $2,700 b. $6,300 c. $7,200 d. $9,000. 3. Bandera Manufacturing Company paid cash for wages of production workers. Which of the following choices accurately reflects how this event would affect the company’s financial statements? a. b. c. d. 4. = Liab. NA NA NA NA + Equity NA ─ NA ─ Rev. NA NA NA NA Exp. + + NA NA = Net Inc. ─ ─ NA NA Carson Manufacturing Company paid cash for commissions paid to sales staff. Which of the following choices accurately reflects how this event would affect the company’s financial statements? a. b. c. d. 5. Assets + ─ ─ + ─ ─ Assets + ─ ─ ─ + ─ = Liab. NA NA NA NA + Equity NA ─ ─ NA Rev. ─ NA NA NA NA Exp. NA + NA + = Net Inc. NA ─ NA ─ Shelling Company owns $30,000 of manufacturing equipment. The equipment has a 10-year useful life and a $6,000 salvage value. Shelling uses straight-line depreciation. During the most recent annual accounting period the company made 1,200 units of product. Assuming Shelling sold 1,000 units of product, the amount of depreciation that would be included in cost of goods sold is: a. zero. b. $3,000 c. $2,500 d. $2,000 6. Which of the following items is not a product cost? a. Cash paid for wages of production workers. b. Cash paid for salary of production supervisor. c. Cash paid for wages of a maintenance crew that cleans the manufacturing facility. d. All of the above are product costs. 7. Consolidated Company makes cardboard boxes. During the most recent accounting period Consolidated paid $60,000 for raw materials, $48,000 for labor, and $52,000 for overhead costs that were incurred to make boxes. Consolidated started and completed 400,000 boxes. Based on this information, what is the average manufacturing cost per box? a. $0.40 b. $0.56 c. $0.50 d. $0.27 8. Consolidated Company makes cardboard boxes. During the most recent accounting period Consolidated paid $60,000 for raw materials, $48,000 for labor, and $52,000 for overhead costs that were incurred to make boxes. Consolidated started and completed 400,000 boxes. Consolidated desires to earn a gross margin that is equal to 40% of product cost. Based on this information the selling price per box is: a. $0.40 b. $0.56 c. $0.50 d. $0.70 9. Which of the following is a characteristic of managerial accounting information? a. It is historically based. b. It involves continuous reporting. c. It is regulated by the SEC. d. It is directed to external users. 10. Pearson and Associates provides auditing and tax services to its clients. During the most recent annual accounting period, Pearson provided 40,000 hours of auditing service and 50,000 hours of tax service. During the same accounting period, the company incurred $900,000 of overhead costs. Based on this information, a client job that required 800 hours of tax services should be allocated which of the following amounts of overhead? a. $8,000 b. $5,000 c. $3,200 d. $4,000 Study Questions for Chapter 2 Use the following information to answer the next four questions. At lunchtime, Darlene’s Dawgs sells hot dogs, chips, and soft drinks from five portable hot dog carts stationed on busy street corners. The depreciation cost on the carts is $1,000 per year for each cart. The company buys supplies (hot dogs, chips, cups, napkins) as needed. The 5 cart operators are each paid $8,000 per year plus 5% of sales revenue. 1. Relative to the number of hot dogs sold, the depreciation cost is: a. fixed. b. variable. c. mixed. d. strategic. 2. Relative to the number of hot dog carts, the depreciation cost is: a. fixed. b. variable. c. mixed. d. strategic. 3. Relative to the number of hours worked, the total compensation cost for the cart operators is: a. fixed. b. variable. c. mixed. d. strategic. 4. The cost of supplies relative to the number of customers served at a particular hot dog cart and relative to the number of customers served by all five of the hot dog carts is, respectively: a. variable / fixed. b. fixed / fixed. c. variable / fixed. d. variable / variable. 5. At a production and sales level of 3,000 units, Munro Company incurred $60,000 of fixed cost and $36,000 of variable cost. When 4,000 units of product are produced and sold, the company’s total cost is expected to be: a. $116,000. b. $108,000. c. $128,000. d. $96,000. Use the following information to answer the next two questions: Crowder’s Quilts Income Statement For 2011 Sales Revenue (250 @ $600 per unit) Cost of Goods Sold: Variable (250 @ $300 per unit) Fixed Gross Margin Sales Commissions (250 @ $20) Depreciation Net Income $150,000 (75,000) ( 8,000) 67,000 ( 5,000) (10,000) $ 52,000 6. The company’s contribution margin is: a. $67,000. b. $61,000. c. $70,000. d. $141,000. 7. The magnitude of Crowder’s operating leverage is approximately (round to nearest hundredth): a. 1.29. b. 1.15. c. 1.35. d. 2.88. 8. Elegant Dogs and Dogs Are Dazzling are competing canine grooming salons. Each company currently serves 4,500 customers per year. Both companies charge $35 to groom a dog. Elegant Dogs pays its dog groomers fixed salaries. Salary expense totals $45,000 per year. Dogs Are Dazzling pays its groomers $10 per dog groomed. Elegant Dogs lures 2,000 customers from Dogs Are Dazzling by lowering its grooming price to $25. Dogs Are Dazzling maintains its $35 price. Which of the following is true? a. Profits at both companies will decrease. b. Elegant Dog’s profits will increase and Dogs Are Dazzling’s profits will decrease. c. Dogs Are Dazzling will suffer a net loss. d. All the statements are false. 9. At a sales level of $270,000, the magnitude of operating leverage for Donuts Unlimited is 2.8. If sales increase by 15%, profits will increase by: a. 2.8% b. 15% c. 42% d. 18.67% 10. Handy Hiking produces backpacks. In 2011, its highest and lowest production levels occurred in July and January, respectively. In July, it produced 4,000 backpacks at a total cost of $110,000. In January, it produced 2,500 backpacks at a total cost of $87,500. Using the high/low method, the average variable cost of producing a backpack was: a. $15.00 b. $31.25 c. $30.38 d. $27.50 Study Questions for Chapter 3 Use the following information for Boxware Corporation to answer the next four questions: Sales price per unit Variable cost per unit Average production Total fixed costs $190 $ 80 1,500 units per month $55,000 per month 1. What is Boxware's contribution margin per unit? a. $ 80 b. $110 c. $190 d. $270 2. How many units per month must Boxware sell each month to break even? a. 500 b. 1000 c. 1500 d. 2000 3. What amount of sales in dollars must Boxware achieve each month in order to break even? a. $95,000 b. $190,000 c. $285,000 d. $380,000 4. How many units per month must Boxware sell in order to make a $110,000 profit? a. 500 b. 1,000 c. 1,500 d. 2,000 Use the following information to answer the next three questions: Derek's Drum Depot (DDD) wants to add a new line of drumsticks to its product line. The following data apply to the new drumsticks line. Budgeted sales Sales price Variable costs Fixed costs 30,000 sets per year $5 per set $3 per set $10,000 per year 5. The break-even point for the new line is _______ sets per year. a. 500 sets b. $5,000 c. 15,000 sets d. 5,000 sets 6. The margin of safety for DDD is a. 83% b. 15,000 sets c. 19% d. 6,000 sets 7. How many sets of drumsticks must DDD sell to make a profit of $50,000 on the new line? a. 2,000 units b. 10,000 units c. 20,000 units d. 30,000 units Use the following data for Fireware Software Corporation to answer the next three questions: Sales price per unit Variable manufacturing cost per unit Variable sales commissions per unit Variable shipping expense per unit Fixed administrative cost, per month Other fixed costs, per month Average production $44.95 $17.03 $ 3.20 $ 1.14 $12,200 $2,269 2,100 units per month 8. What is the amount of contribution margin per unit, based on this information? a. $21.37 b. $23.58 c. $27.92 d. $24.72 9. How many units must Fireware sell in order to break even? (round to the nearest whole unit) a. 308 b. 500 c. 614 d. 620 10. How many units must Fireware sell in order to make a $50,000 profit? (Round to the nearest whole unit.) a. 505 b. 1,090 c. 1,708 d. 2,734 Study Questions for Chapter 4 1. The process of assigning a cost to two or more designated cost objects is a. cost tracing b. cost allocation c. cost/benefit analysis d. cost classification 2. Of the following statements, which is NOT true concerning indirect costs? a. An allocation rate for an indirect cost is determined by dividing the total cost to be allocated by an appropriate cost driver. b. An indirect cost is a cost that cannot easily be traced to a cost object. c. The informational benefits from tracing an indirect cost are not worth the economic sacrifice incurred in tracing the cost. d. An indirect cost can be fixed but cannot be variable. 3. Logan Corporation has 30 employees, 20 in Department A and 10 in Department B. Logan incurred $180,000 in fringe benefits costs last year. How much in fringe benefit costs should be allocated to Department A? a. $ 60,000 b. $120,000 c. $180,000 d. $90,000 4. Which of the following would be classified as an indirect cost in a department store? Assume the cost object is the children’s department. a. sales commissions b. cost of goods sold c. utility costs d. depreciation on cash registers Use the following data to answer the next two (2) questions: Direct Material Cost Direct Labor Cost Direct Labor Hours Product 1 $25,000 $30,000 1,200 hours Product 2 $30,000 $40,000 1,800 hours Product 3 $35,000 $50,000 2,000 hours Factory overhead is estimated to be $40,000 and is applied based on direct labor dollars. This overhead cost is not traceable to any particular product. 5. Factory overhead allocated to Product 2 is a. $13,333 b. $24,000 c. $20,000 d. $14,400 6. The total cost of Product 1 is a. $55,000 b. $62,500 c. $65,000 d. $83,333 7. Saylind Molding paid $280,000 in rent for the year. The company’s three departments are headrests, armrests, and air ducts. The departments occupy 5,000, 6,300, and 2,700 square feet, respectively. How much of the rent cost should be allocated to the products made in the air ducts department? a. $ 54,000 b. $ 72,000 c. $126,000 d. $128,000 8. Employees of DTI, Inc. worked 1,600 direct labor hours in January and 1,000 direct labor hours in February. DTI expects to use 18,000 direct labor hours during the year, and expects to incur $22,500 of Worker’s Compensation insurance cost for the year. The cash payment for this cost will be paid in April. How much insurance premium should be allocated to products made in January and February? a. $7,200; $5,500 b. $2,000; $1,250 c. $4,000; $2,500 d. $2,000; $5,500 9. Costs that can be traced to objects in a cost-effective manner are called a. allocated costs. b. conversion costs. c. direct costs. d. indirect costs. 10. Which of the following is the most logical cost driver for allocating the telephone bill among four departments? a. square footage of floor space b. direct labor hours c. telephone usage in minutes d. sales volume measured in dollars 11. Alpha Company is selecting a cost driver to use in allocating utilities costs to its departments. The best cost driver a. has a strong cause-and-effect relationship to the cost being allocated. b. is one for which information is readily available. c. seems acceptable and reasonable to the managers of the departments. d. all of the above. Chapter 1 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. B B C B D D A B B A Chapter 2 1. 2. 3. 4. 5. 6. 7. 8. 9. A B C D B C C B C 10. A Chapter 3 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. B A A C D A D B C D Chapter 4 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. B D B C A C A B C C D