as-19-lectue-3

advertisement

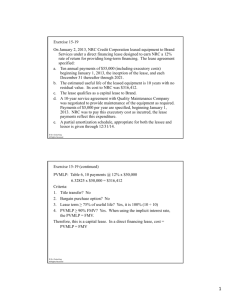

9. Books of Lessor -Financial Lease Following Entries are Journalized : i) Lease Receivable a/c Dr To Asset a/c To Sale a/c ( Being asset transferred on Financial Lease ) Amount will be calculated as Follows : Net Investment = PV of Agreed Lease Rentals + PV GRV Lessor + PV of UGRV + Net Investment (NI ) = PV of Gross investment Gross Investment (GI ) = MLP Lessor + UGRV MLP Lessor : Agreed Lease Rentals Add: Guaranteed Residual value by lessee or on his behalf GRV Lessor : Whichever is Higher : Guaranteed by Lessee OR On his Behalf OR By 3rd Party which is financially capable. UGRV = Residual Value UEFI - GRV Lessor = Gross Investment - Net Investment UEFI = Unearned Finance Income GRV = Guaranteed Residual Value UGRV = Unguaranteed Residual Value ------------------********* ii) Expences on Lease : Expences a/c Dr To Bank a/c ( Being Expence Incurred) ( Written in P&L a/c) iii) Depretiation will not be claimed in accounts by lessor. iv) Bank a/c Dr To Lease Rental a/c ( Being amount received) v) Lease Rentals a/c Dr To Lease Receivable ( Being amount Adjusted) vi) Lease Receivable a/c Dr To Finance Income ( Being Income recorded) Note : • Lease Receivable will always be shown as Net Investment in each Year. • For this purpose revised & New GRV will be considered. • Finance Income will be computed as Follows : Lease Receivable : Closing Balance (Dr Bal) Add: Available Balance in Ledger Finance Income ------------****** vii) Lease Rentals a/c Dr To Lease Receivable ( Being amount adjusted) Note: • Under tax law Depreciation is allowed as expense to lessor and lease rentals are considered as income. • Hence there can be DTA/ DTL in case of lessor also. 10. Disclosure Requirements i) Statement of lease Rentals : (Exemption) Period Amount Present Value 0 – 12 Month -----------------12 – 60 Month -----------------60 & Beyond -----------------******** ******** ii) Disclose : UEFI = Unearned Finance Income UGRV = Unguaranteed Residual Value Provision for Uncollectable Rents iii) Genenral Description of Leasing Policies.