Business Law -

advertisement

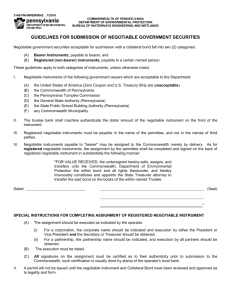

Business Law -- week 7 Negotiable Instruments: a contract to pay money (commercial paper) • Checks • Cashier’s checks • Promissary Notes • Certificate of Deposit Business Law -- week 7 Two categories of Negotiable Instruments • Notes (between 2 people) – Promissary Note – CD • Drafts (3 people -- drawer, drawee, payee) – Check – Cashier’s check Business Law -- week 7 Negotiable vs. Non-negotiable – Depends on how you write it • Pay to the order of …. • Pay to …. • Why is this important? – UCC vs Common Law – A negotiable instrument can be signed over to a designee Business Law -- week 7 Requirements of a negotiable instrument – In writing – Signed – Unconditional – Definite $ amount – Payable “on demand” or “specific date” – Pay to the order of or to bearer Business Law -- week 7 Rules about contradictions on checks Order of precedence: – Words over numbers – Handwritten over typed – Typed over printed Business Law -- week 7 A person who holds a “commercial paper” has the right to be paid if: • Its negotiable • Its been negotiated to that person • That person is a “holder in due course” • The issuer cannot claim any “real defenses” Business Law -- week 7 What is a “holder in due course” and what are these “real defenses?” Business Law -- week 7 A holder in due course: • In possession of the note that has been signed over “to the order of” • Has given something of value for the note • Purchased in “good faith” • Knows of no claims against note – Exception: Shelter Rule Business Law -- week 7 Defenses • Real or personal Busiess Law -- week 7 Real Defenses • Forgery • Bankruptcy • Minority • Alteration • Mental incapacity • Fraud Business Law -- week 7 Personal Defenses • Breach • Lack of consideration • Prior payment • Unauthorized completion • Fraud • Non-delivery Business Law -- week 7 Summary of Negotiable Instruments Notes are a promise between 2 parties,-- I.e. promissary note or CD Drafts involve a third party such as a bank -checks, cashier’s checks. To be negotiable it must be able to be signed over to someone else and only negotiable instruments are covered under UCC. Business Law -- week 7 Liability of Negotiable Instruments Who pays …. when you give someone a check? if there is insufficient funds to cover the check? if the signature has been forged? if the amount has been altered? if the bank teller suspects fraud Business Law -- week 7 Who Pays: Bank (drawee) has primary liability - may pay or dishonor Issuer (drawer) has secondary liability - if bank dishonors must pay Indorser -- liable after drawee and drawer Accommodation Party -- a second signature on a note equally liable to first signator Business Law -- week 7 Who Pays: Forgery: Bank is responsible Imposter: Issuer/Drawer responsible Fictitious Payee: Issuer/Drawer responsible Employer Indorsment: Issuer/Drawer responsible Exception: If bank suspects fraud they have a duty to protect innocent party Business Law -- week 7 A note is discharged … • Payment • Agreement • Cancellation • Certification by bank • Alteration Business Law -- week 7 Protect yourself from check fraud … • Don’t give out Checking account # or information • Report lost/stolen checks • Check statements and accounts regularly • Report irregularities immediately • Give checks time to clear • More at http://www.treas.gov/usss/faq.shtml#faq14 Business Law -- week 7 What responsibility does the bank have … • After wrongfully dishonoring a check • For checks that come in after death of customer • When a customer declared incompetent • Post-dated checks & Stale checks • Stop payment orders Business Law -- week 7 What responsibility does the bank have … • Make funds available from checks deposited to customer per EFAA time limits • Debit -credit cards not active until requested by customer • Must provide customers with documentation of transactions • Must investigate suspected errors