Title of Chapter

advertisement

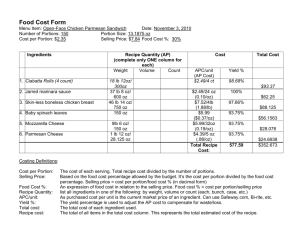

Calculating Food Cost 3 OH 2-1 2-1 Chapter Learning Objectives Define food costs and explain how managers track and analyze food costs. Explain how to calculate the cost of sales, and how to calculate the actual cost of sales. Describe how to calculate the food cost percentage. Explain the importance of standardized recipes to cost control and product consistency. Contrast the three types of standardized recipe files. Describe why and how managers create recipe cost cards. Outline the process for calculating plate cost. Explain how managers calculate food costs for buffets. OH 2-2 Food Cost The actual dollar value of the food used in a foodservice operation Often referred to as “cost of food sold” OH 2-3 Food Cost continued Includes the cost of food sold to customers Also includes the value of food that is given away, wasted, or even stolen OH 2-4 Theft Increases Food Cost Employee theft can be difficult to prevent, but its control is vitally important to ensuring profitability. OH 2-5 Adjustments to Food Cost Because the actual costs of food used in an operation includes costs not related to the sales generated many establishments adjust their food cost When these adjustments are made the costs still exist so they must be charged to some other expense category Common categories would be: Labor cost (employee meals) Promotions or Marketing (comp meals) OH 2-6 Reductions from Cost of Food Employee meals The actual cost of the food served to employees is subtracted from cost of food. Complimentary (“Comp”) meals The actual cost of the food that is given away (not its selling price) is subtracted from cost of food. OH 2-7 Reductions from Cost of Food continued Grease sales Payments from sales of used oil or grease, bones, and fat scraps are subtracted from food cost. Transfers to other units If an operation has more than one unit, transfers TO another unit are subtracted from food cost. Transfers INTO a unit are added to its food cost. OH 2-8 Bar Transfers Food to Bar Transfers The value of items transferred to the bar for making drinks is subtracted from food cost. Typical products transferred to the bar include nonalcoholic beverages, fruits, vegetables, spices, juices, and dairy products. OH 2-9 Bar Transfers continued In a busy bar, the amount of food that is transferred from the kitchen to the bar can be significant. OH 2-10 The Food Cost Formula Opening inventory + Purchases Total food available – Closing inventory Cost of food sold OH 2-11 The Food Cost Formula in Use Opening inventory + Purchases $5,000 + Total food available – Closing inventory Cost of food sold OH 2-12 $30,000 $35,000 – $4,000 $31,000 Physical Inventory To accurately calculate cost of food sold, managers must take a physical inventory. OH 2-13 Food Cost Formula Definitions Opening inventory Dollar value of the physical inventory at the beginning of an accounting period Purchases Dollar value of all food purchased (less any appropriate subtractions) during the accounting period Closing inventory Dollar value of the physical inventory counted at end of the accounting period OH 2-14 Applying Adjustments to Food Cost If cost of food sold = $31,000, and: $155 in sales was recorded as employee meals (at 30% food cost) $125 in sales was comped for an upset guest (at 30% food cost) $300 was transferred to the bar Calculate the new adjusted cost of food sold In which accounts would you reflect these costs? OH 2-15 The Food Cost Percentage Formula Food cost ÷ OH 2-16 Sales = Food cost percentage The Food Cost Percentage Formula in Use Food cost ÷ $7,000 OH 2-17 ÷ Sales = $25,000 = Food cost percentage 0.28 or 28.0% Two Ways to Make a Decimal Conversion Method One Method Two Move the decimal Multiply by 100. .35 = 35% 0.35 x 100 = 35% two places to the right. OH 2-18 Food Cost Percentage Allows managers in one restaurant to compare their food usage efficiency to that of previous time periods Can be used to compare the food usage efficiency of one restaurant to another Allows comparison to the restaurant’s budgeted food cost percentage or other standard OH 2-19 Industry Standards Restaurants typically run in the low to mid 30% Italian - ~ 28% Multi Unit - ~ 32% American/Regional - ~35% Steak - ~ 40% Fine Dining Labor Food Cost Vs. Fast Food OH 2-20 Food Cost Labor Food Cost Percentage continued Is the proportion of the restaurant’s sales that is used to pay for food Means “out of each dollar” A 35% food cost percentage means that “out of each dollar” of sales, the restaurant pays $0.35 for food. Must be controlled by management OH 2-21 Costs and Sales Affect Food Cost Percentage Food cost is a variable cost, so it should increase when sales increase and decrease when sales decrease. If controls and standards are in place, food cost will go up and down in direct proportion to sales. If controls and standards are not in place, it will not! OH 2-22 How Costs and Sales Affect Food Cost Percentage A food cost percentage is computed using both a food cost (the numerator) and sales (the denominator). An equal percentage increase (or decrease) in each of these will result in an unchanged food cost percentage. OH 2-23 Ten Percent Increase in Sales and Cost of Food Original cost of food $1,000 Original sales $3,000 Food cost percentage 33% With 10% increase in sales and food cost New cost of food $1,100 New sales $3,300 Food cost percentage OH 2-24 33% Ten Percent Decrease in Sales and Cost of Food Original cost of food $1,000 Original sales $3,000 Food cost percentage 33% With a 10% decrease in sales and food cost New cost of food $ 900 New sales $2,700 Food cost percentage OH 2-25 33% The ABCs of Food Cost Percentage (A/B = C) Where: A = Food Cost B = Sales C = Food Cost Percentage 1. If A stays the same, and B increases, C decreases. 2. If A stays the same and B decreases, C increases. OH 2-26 ABCs of Food Cost Percentage (A/B = C) continued 3. If A decreases, and B stays the same, C decreases. 4. If A increases, and B stays the same, C increases. 5. If A increases at the same proportional rate that B increases, C stays the same. OH 2-27 Food Cost Percentage Should be controlled Should not be allowed to fall far below the restaurant’s standard OH 2-28 Food Cost Percentage continued If food cost percentages are allowed to drop too far below the restaurant’s standards, the guests’ perceptions of value may be negatively affected. OH 2-29 Finding Cost , Sales, or Percentage Cost Sales OH 2-30 X % Examples OH 2-31 1. Your Cost for a catered event is $610 and the Sales were $2,000…………what is your Food Cost Percentage? 2. Sales for the day at the deli counter was $4,100 and your Food Cost % is 21%.......what was your Food Cost? 3. Cost for the rib eye for the event is $1,115 and you run a 35% Food Cost……what should your selling price (sales) be? One more example: If food and beverage sales are $35,000 and 60% of that is food. You run at 30% food cost and a 10% beverage cost, find: Food Cost _________ Beverage Cost __________ OH 2-32 Another way to figure Food Cost Percentage If we know the cost of our menu item and we know the selling price we can also determine the food cost percentage using the following formula: Item cost ÷ Selling price Example: Our Chicken Cordon Bleu costs us $2.50 to make and we sell it for $11.75, what is our food cost percentage for that item? $2.50 ÷ $11.75 = 21.28% food cost percentage OH 2-33 Chapter 3 Calculating Food Cost OH 2-34 Benefits of Standardized Recipes Consistency in Food Quality Customer satisfaction Predictable Yields Preparation method consistent Standard portion sizes (weight, volume or count) Service method consistency Food Cost Control OH 2-35 What Difference Does It Make??? Mexi Beef Casserole: 35lb ground beef for 200 people 25 - 5 x 5 portions per ½ steam table pan. Mexi Beef Casserole Mexi Beef Casserole Difference in Cost Cost/serving with 35l b Cost/serving with 40 lb Per Serving $0.76 $0.85 +$0.09 Not a big deal right? Annual impact for 3 times per week $0.09 per serving x 200 servings x 156 = $2,808 OH 2-36 What Difference Does It Make??? What if the pan was cut 4 x 5? Servings per pan Cost per serving 20 servings $0.95 25 servings $0.76 Difference $0.19 Annual impact for 3 times per week $0.19 per serving x 200 servings x 156 = $5,928 OH 2-37 Benefits of Standardized Recipes Accurate Purchasing Quantities defined and controlled Helps ensure compliance with “Truth In Menu” laws Consistent nutrient content Identification of food alergens Assists in training new employees OH 2-38 What Difference Does It Make??? Nutrient Facts 25 servings per pan 20 servings per pan Serving size 6.5 oz 8.1 oz Calories 255 318 Protein 12.7 g 15.9 g Carbohydrate 22.5 g 28.2 g Total Fat 12.5 g 15.6 g Saturated Fat 5.0 g 6.2 g Cholesterol 44.0 g 55.0 g U. S. Department of Agriculture, Food and Nutrition Service, with the National Food Service Management Institute. (2002). Measuring success with standardized recipes. University, MS: National Food Service Management Institute. OH 2-39 Developing Standardized Recipes OH 2-40 Recipe Standardization Process Recipe verification Prepare recipe, verify yields Product evaluation Recipe modification & quantity adjustments Adjusting yields and/or ingredient amounts Cost recipe based on final standardized recipe OH 2-41 Standardized Recipes Identify Recipe Title Ingredient details (quality) Volume (number) of portions (Recipe Yield) Ingredient weights and measures Necessary equipment and tools Procedures OH 2-42 Standardized Recipes also Include Preparation time Cooking method(s) Cooking/baking time and temperature Portioning, plating and garnishing Storage and preparation information OH 2-43 Sample Standardized Recipe OH 2-44 Chapter 3 Calculating Food Cost OH 2-45 Chapter 3 Calculating Food Cost OH 2-46 Recipe Ingredient Costing Alternatives As Purchased (AP) method Price of an item before any trim or waste are considered Example—unpeeled, whole potatoes Edible Portion (EP) method Price of an item after all trim and waste has been taken into account Example—peeled, cubed potatoes OH 2-47 AP and EP As Purchased (AP) refers to products as the restaurant receives them. Edible Portion (EP) refers to products as the guests receive them. OH 2-48 Comparison of AP and EP Weights OH 2-49 Managers Must 1. 2. OH 2-50 Determine if recipe ingredients are listed in AP or EP formats. Apply the correct costing method to the ingredients. 3. Use the information to price menu items. 4. Periodically re-cost recipe ingredients. EP Amounts Because many food items shrink when they are cooked, managers must know exactly how much cooking loss to expect. OH 2-51 Ways to Estimate Yields Butcher’s tests To measure loss from deboning, trimming, and portioning meats, fish, and poultry Cooking loss tests To measure loss from the actual cooking process Conversion charts Tell the expected or average loss of an item from (AP) to (EP) OH 2-52 Yield and Loss % AP Amount – Loss = Yield 25lb – 18lb = 7lb Yield 18lb = 72% Yield = % Yield AP total Loss AP total OH 2-53 25lb = % Loss 7lb = 28% Loss 25lb Butcher Test Also known as “yield test” Used to determine EP meat costs Results vary, based upon the AP quality of meat purchased Measures losses from Fat removal Bone removal Trim and packaging removal Portioning OH 2-54 Butcher’s Yield Tests Determine actual costs associated with buying larger cuts of meat and fabricating Some will just calculate the cost based on the final end products and use that for pricing others factor value for each utilization Utilization of byproducts (100% or less?) Weigh each component Determine market value for components used OH 2-55 Butcher’s Yield Tests Total trim weight and value Subtract trim weight from AP weight to determine yield of item (fabricated EP weight) Subtract trim value from AP Cost to determine net price (fabricated EP cost) Divide net price by yield of item to get Cost Per Pound EP Also consider labor & cooking loss OH 2-56 Work this Butcher’s Yield Problem A 19.50lb short loin breaks down as follows: Fat - 2 lb @ $0.00/lb Bone- 6lb @ $0.85/lb Trim- 12oz @$2.15/lb Other- 2oz @$0.00/lb The original AP price was $4.25/lb, then it goes up to $4.46/lb this week Solve for the EP cost per pound based on the original and the current price OH 2-57 If cut into 8oz steaks how much would each cost? Butcher’s Yield Tests Consider another example Review the Butchers Yield Card under OH 2-58 Learning Materials Cost Factor When price of original product changes use cost factor to determine new costs instead of repeating butcher yield test each time EP cost per pound ÷ AP cost per pound Multiply new cost by cost factor to get new EP cost/lb. Creating Recipe Cost Cards Step 1 – Copy the ingredients from the standardized recipe card to the cost card. Step 2 – List the amount of each ingredient used. Step 3 – Indicate the cost of each ingredient as listed on the invoice. OH 2-59 Creating Recipe Cost Cards continued Step 4 – Convert the cost of the invoice unit to the cost of the recipe unit. Example Milk purchased by the gallon for $2.80 Yields eight recipe-ready (EP) pints at $0.35 each. ($2.80 ÷ 8 pints = $0.35 per pint) or sixteen recipe-ready (EP) cups at $0.175 each ($2.80 ÷ 16 cups = $0.175 per cup) OH 2-60 Creating Recipe Cost Cards continued Step 5 – Multiply the recipe unit cost by the amount required in the recipe. Example Recipe amount required—3 pints Cost per pint—$0.35 Ingredient cost—$1.05 (3 pints x $0.35 per pint = $1.05) OH 2-61 Creating Recipe Cost Cards continued Step 6 – Add the cost of all ingredients. OH 2-62 Creating Recipe Cost Cards continued Step 7 – Divide the total recipe cost by the number of portions produced. Example Total recipe cost—$145.50 Total recipe yield—50 portions Cost per portion—$2.91 ($145.50 ÷ 50 portions = $2.91 per portion) OH 2-63 Chapter 3 Calculating Food Cost OH 2-64 Spice Factor Can be used instead of costing out every spice, herb and seasoning A way to account for “to taste” spices in a recipe Spreads the cost of spices, herbs and seasonings over all menu items so those that require a larger quantity do not bear the entire cost of the spices Can also include garnishes or “lost” items as a result of chef error OH 2-65 Spice Factor, continued Determining a spice factor Consider which items to include Calculate the value of all selected items over a period of time After the value is calculated determine the spice factor as follows: Spice factor = Value of spice factor items (over time) Value of total food purchases (over same time) Adjust recipe’s cost by increasing the total cost by the spice factor percent - mulitplying by spice factor OH 2-66 Spice Factor, continued Example: If the spice factor items cost $2,000 for a six month period and the total food purchases over the same period of time are $60,000, what is the spice factor? $2,000/$60,000 = .0333 or 3.33% If the total recipe cost for Chicken Parmesan which serves 12 people is $53.75, what is the spice-factor adjusted recipe cost? $53.75 x (1 + .0333) = $55.54 OH 2-67 Q Factor A method to account for side dishes, add-ons or other freebies that come with entrée dishes. Only factor for the entrées offered by the business Determine cost of each of the side or add-on possibilities Identify the most expensive options that could be selected Add this cost to every entrée OH 2-68 Q Factor, continued Example: A business offers entrées that include a choice of soup or salad, choice of vegetable or starch, bread and butter. What is the Q factor if the costs are: OH 2-69 Tomato soup French onion soup House salad Caesar salad Broccoli side Carrot side Green bean side Smashed potato Angel hair pasta Bread Butter $0.85 $0.65 $0.92 $1.35 $0.43 $0.16 $0.25 $0.53 $0.35 $0.11 $0.08 Q Factor, continued Q Factor of $2.07 should be added to all entrées for this business that offer the same add-ons If a business uses both Spice Factor and Q Factor, the spice factor should only be added once for each entrée. Add the Q factor and then add the spice factor So, for our Chicken Parmesan what is the cost per portion using both the Spice factor and the Q factor? OH 2-70 Spice Factor & Q Factor Chicken Parmesan serving 12 people cost of recipe = $53.75 Spice Factor = 3.33% Q Factor = $2.07 $53.75 x 1.0333 = $55.54 recipe cost with spice factor Cost per portion: $55.54/12 = $4.63 Add Q factor: $4.63 + $2.07 = $6.70 cost of entree OH 2-71 How Would You Answer the Following Questions? OH 2-72 1. The cost of employee meals should be (subtracted/added) to the cost of food before computing a food cost percentage. 2. A restaurant’s food cost percentage should increase when sales increase and decrease when sales decrease. (True/False) 3. Which best describes food cost as an expense? A. It is fixed B. It is semivariable C. It is variable D. It is noncontrollable 4. A manager’s job is to reduce the food cost percentage as much a possible. (True/False) Chapter 3 Calculating Food Cost Key Terms: As purchased (AP) method A method used to cost an ingredient at the purchase price prior to any trim or waste being taken into account. Butcher’s yield test A method used to measure the amount of shrinkage that occurs during the trimming of a meat product. Closing inventory The value of how much food product exists at the end of a given period. Cooking loss test A way to measure the amount of product shrinkage during the cooking or roasting process. Credits to cost of sales A category of credits including such items as employee meals, complimentary meals served to guests, or grease sales sold to rendering companies. Edible portion (EP) cost A method used to cost an ingredient after it has been trimmed and waste has been removed so that only the usable portion of the item is reflected. OH 2-73 Chapter 3 Calculating Food Cost Key Terms continued: Ideal food cost The target cost an operation is aiming for. Opening inventory The value of how much food product exists at the start of a given period. Plate cost The total sum of product costs included in a single meal, or plate, served to a guest. Portion size The size of an item’s individual serving, such as “six ounces of fish fillet.” Price-per-person model Pricing determined by calculating the food cost for all the items included on a buffet and the backup inventory used to replenish theThe buffet during serviceofperiod. Productivity quality andthe quantity output compared to the amount of input, such as labor hours, needed to generate it. Product specifications Descriptions of the quality requirements of the products that are purchased. OH 2-74 Chapter 3 Calculating Food Cost Key Terms continued: OH Purchases The value of how much an operation spent on food products in a given period. Recipe cost card A tool used to calculate the standard portion cost for a menu item, or the exact amount that one serving or portion of a food item should cost when prepared according to the item’s standardized recipe. Sales mix The percentage of sales volume each menu item contributes to total sales. Standardized recipe A formalized, consistent guide to preparing menu items, which lists the ingredients and quantities needed for a menu item, the methods used to produce it, and its appropriate Standardizedportion recipe size. form A set of directions for preparing a food or beverage item, along with a list of ingredients. Standard portion cost The exact amount that one serving or portion of a food item should cost when prepared according to 2-75 the item’s standardized recipe. Chapter 3 Calculating Food Cost Key Terms continued: Yield test A test used to measure the amount of shrinkage that occurs during trimming and cutting products that are not cooked, such as produce. OH 2-76