Document

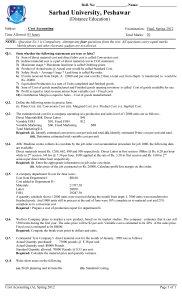

advertisement

CHAPTER 16 Process Costing Cost Accounting Systems determine the costs associated with products (or services). • _________ Cost System (last chapter) used for unique or custom ordered products • _________ Cost System (this chapter) is used for mass produced items Process Costing • Process costing is used to attach cost to units produced that are Identical and low in cost Mass produced Manufactured with an automated and continuous flow of production • _____________ is used when costs cannot be directly traced to each individual unit • _____________ = department or process rather than the individual job. Flow of Costs • We must be able to understand the flow of costs through a process costing system. Remember though The flow of costs is similar to that for a job cost system except • Each department or process has its own WIP inventory account The products may go through several processing departments ________ being transferred to Finished Goods Inventory. Job Order and Process Cost Systems Compared Job Order Cost System Direct materials Job Cost Sheets Dept. A and Dept. B Direct labor Factory overhead Finished goods Process Cost System Direct materials Dept. A Direct Factory labor overhead Dept. B Direct Factory labor overhead Finished goods Both systems: determine a product cost by measuring the amount of direct materials and direct labor used and allocating overhead costs. allocate overhead using a predetermined overhead rate (or activity-based costing). maintain perpetual records with subsidiary ledgers for materials, work in process, and finished goods. Job Costing versus Process Costing Job order costing The cost of goods transferred to finished goods is equal to the sum of all of the completed jobs for that period Process costing The cost of goods transferred to finished goods equals the number of completed units times the _____ _________________ Cost Categories • At its simplest, we use 2 - 3 cost categories in the first department _____________ • added all at the beginning of the process _____________– (direct labor and overhead) • added evenly throughout each process • In a subsequent processing departments, we will have an additional cost category _____________ • costs attaching in all previous departments Flow of Costs in a Process Cost System FOH – Melting Actual costs incurred WIP – Melting Finished Goods DM DL Cost of Goods Sold FOH – Casting Actual costs incurred WIP – Casting DL DM Direct materials used in production DL Direct labor used in production Flow of Costs in a Process Cost System FOH – Melting Actual costs incurred FOHA WIP – Melting Finished Goods DM DL FOHA Cost of Goods Sold FOH – Casting Actual costs incurred WIP – Casting FOHA DL FOHA FOHA Factory overhead applied to work in process Flow of Costs in a Process Cost System FOH – Melting Actual costs incurred FOHA WIP – Melting DM Finished Goods TRAN DL FOHA Cost of Goods Sold FOH – Casting Actual costs incurred FOHA WIP – Casting TRAN DL FOHA TRAN Cost of goods transferred to WIP – Casting Flow of Costs in a Process Cost System FOH – Melting Actual costs incurred FOHA WIP – Melting DM TRAN Finished Goods COGM DL FOHA Cost of Goods Sold FOH – Casting Actual costs incurred FOHA WIP – Casting TRAN COGM DL FOHA COGM Cost of goods manufactured and transferred to finished goods Flow of Costs in a Process Cost System FOH – Melting Actual costs incurred FOHA WIP – Melting DM TRAN Finished Goods COGM SOLD DL FOHA Cost of Goods Sold FOH – Casting Actual costs incurred FOHA WIP – Casting TRAN DL FOHA SOLD Finished goods sold COGM SOLD Flow of Costs in a Process Cost System FOH – Melting Actual costs incurred FOHA WIP – Melting DM TRAN Finished Goods COGM SOLD DL FOHA Cost of Goods Sold FOH – Casting Actual costs incurred FOHA WIP – Casting TRAN COGM DL FOHA Summary of cost flows SOLD Four Step Program • To attach cost to the units worked on during the period, we follow a five step process 1. Summarize the physical flow of units 2. Calculate the equivalent units of production. 3. Calculate Costs per Equivalent Unit for each component of cost. 4. Assign costs to the units completed and transferred out and to the WIP EI units. • After the four steps are completed, we will prepare the production cost report. Beginning and Ending WIP Inventories • We need to make an assumption about how costs flow through a department. _____________ is where we will focus our study and will be used in all of our problems. We will not cover the FIFO method. The Four Steps… • Step 1: Determine the physical flow of goods. We will summarize the actual units that were worked on during the month: Beginning Inventory (BI) + Units Started = Total Number of Units Accounted for Then reconcile to the actual units transferred out to the next dept. during the month: Completed & Transferred Out (C&T Out) + Ending Inventory (EI) = Total Number of Units Accounted for Comments • We make separate unit calculations for direct materials and conversion costs (DL and FOH) because They are typically added at different times. • If direct materials are all added at the beginning of the process, then any units left on hand will be ______% complete with respect to the materials. Step 2: Equivalent units • Compute _________________of Production: In accounting for the units in process during the period, we must compute the equivalent units worth of work done during the period for Material costs Conversion costs • Direct Labor • Factory Overhead Question C2 For the current period, PencilCo started 15,000 units and completed 10,000 units, leaving 5,000 units in process 30 percent complete. How many equivalent units of production did PencilCo have for the period? a. 10,000 b. 11,500 c. 1,500 d. 15,000 Step 3: Calculating Costs per Equivalent Unit • Once you know how many equivalent units of material, labor and OH have been completed on all units in process during the period, you can express _________________________ • Cost incurred to date / equivalent units • Calculate cost/EU for each component of cost direct materials and conversion costs (DL & FOH). Step 3: Calculating Costs per Equivalent Unit (Weighted Average) • We focus on the equivalent units of work done in the previous period and in the current period. • The W/A method combines the Costs of Beginning Inventory in Process with Costs Incurred during the period. Step 4: Assigning & Reconciling Costs • Multiply these unit costs times the equivalent units worth of work done on The units completed and transferred out during the period. The units left in ending inventory • The total of the cost of units completed and transferred out during the period Goes out of WIP(1) and into WIP(2). • The Cost of units left remains in ending WIP inventory Now on to the Sample Problem