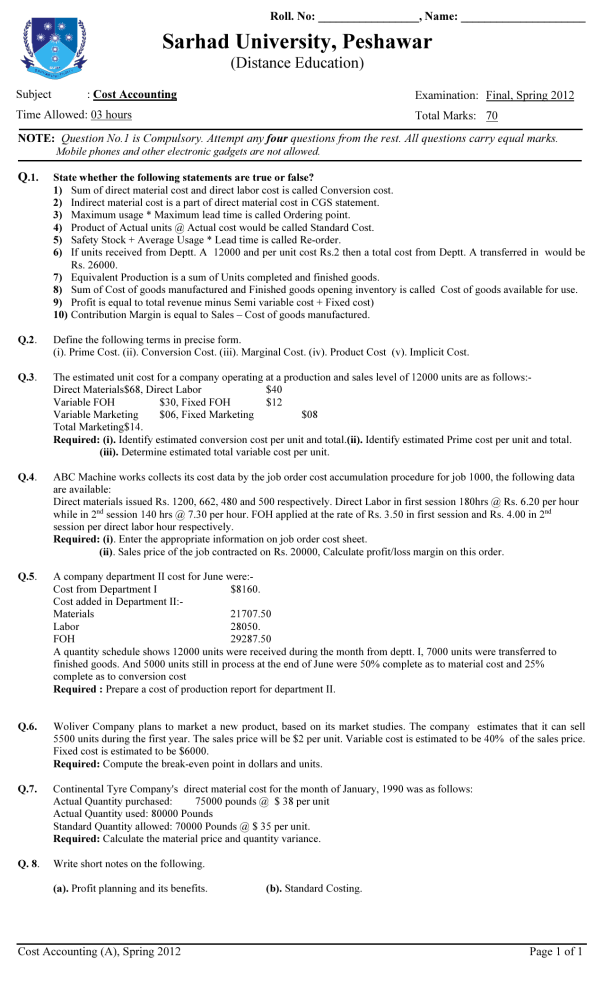

Cost Accounting (A), Spring 2012 - Distance Education

Subject

Roll. No: _________________, Name: _____________________

Sarhad University, Peshawar

:

Cost Accounting

(Distance Education)

Examination: Final, Spring 2012

Time Allowed: 03 hours Total Marks: 70

NOTE: Question No.1 is Compulsory. Attempt any

four

questions from the rest. All questions carry equal marks.

Mobile phones and other electronic gadgets are not allowed.

Q .1. State whether the following statements are true or false?

1) Sum of direct material cost and direct labor cost is called Conversion cost.

2) Indirect material cost is a part of direct material cost in CGS statement.

3) Maximum usage * Maximum lead time is called Ordering point.

4) Product of Actual units @ Actual cost would be called Standard Cost.

5) Safety Stock + Average Usage * Lead time is called Re-order.

6) If units received from Deptt. A 12000 and per unit cost Rs.2 then a total cost from Deptt. A transferred in would be

Rs. 26000.

7) Equivalent Production is a sum of Units completed and finished goods.

8) Sum of Cost of goods manufactured and Finished goods opening inventory is called Cost of goods available for use.

9) Profit is equal to total revenue minus Semi variable cost + Fixed cost)

10) Contribution Margin is equal to Sales – Cost of goods manufactured.

Q.2

. Define the following terms in precise form.

(i). Prime Cost. (ii). Conversion Cost. (iii). Marginal Cost. (iv). Product Cost (v). Implicit Cost.

Q.3

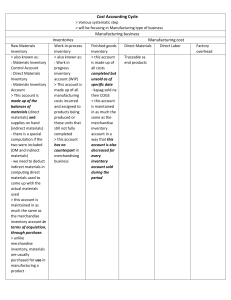

. The estimated unit cost for a company operating at a production and sales level of 12000 units are as follows:-

Direct Materials $68, Direct Labor

Variable FOH $30, Fixed FOH

$40

$12

Variable Marketing $06, Fixed Marketing

Total Marketing $14.

$08

Required: (i).

Identify estimated conversion cost per unit and total.

(ii).

Identify estimated Prime cost per unit and total.

(iii).

Determine estimated total variable cost per unit.

Q.4

. ABC Machine works collects its cost data by the job order cost accumulation procedure for job 1000, the following data are available:

Direct materials issued Rs. 1200, 662, 480 and 500 respectively. Direct Labor in first session 180hrs @ Rs. 6.20 per hour while in 2 nd session 140 hrs @ 7.30 per hour. FOH applied at the rate of Rs. 3.50 in first session and Rs. 4.00 in 2 nd session per direct labor hour respectively.

Required: (i) . Enter the appropriate information on job order cost sheet.

(ii) . Sales price of the job contracted on Rs. 20000, Calculate profit/loss margin on this order.

Q.5

. A company department II cost for June were:-

Cost from Department I

Cost added in Department II:-

$8160.

Materials

Labor

FOH

21707.50

28050.

29287.50

A quantity schedule shows 12000 units were received during the month from deptt. I, 7000 units were transferred to finished goods. And 5000 units still in process at the end of June were 50% complete as to material cost and 25% complete as to conversion cost

Required : Prepare a cost of production report for department II.

Q.6. Woliver Company plans to market a new product, based on its market studies. The company estimates that it can sell

5500 units during the first year. The sales price will be $2 per unit. Variable cost is estimated to be 40% of the sales price.

Fixed cost is estimated to be $6000.

Required: Compute the break-even point in dollars and units.

Q.7. Continental Tyre Company's direct material cost for the month of January, 1990 was as follows:

Actual Quantity purchased: 75000 pounds @ $ 38 per unit

Actual Quantity used: 80000 Pounds

Standard Quantity allowed: 70000 Pounds @ $ 35 per unit.

Required: Calculate the material price and quantity variance.

Q. 8 . Write short notes on the following.

(a).

Profit planning and its benefits. (b).

Standard Costing.

Cost Accounting (A), Spring 2012 Page 1 of 1