LRJJChapter 5 forecast sales,cost and gross profit

advertisement

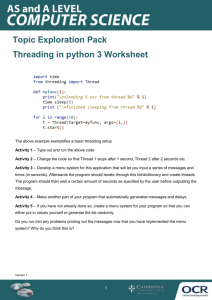

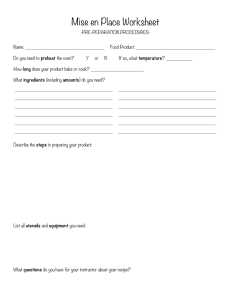

Food and Beverage Management Positioning Your Menus For Business Success 1 Learning Outcome Explain how menus are designed in relation to dayparts. Discuss ways to optimize usage of space resources. Perform calculations to evaluate daypart revenue. Evaluate the importance of food and beverage sales revenue forecasting. Forecast net income. Understand how food and beverage costs is calculated by applying forecasts to standard recipes. Realize the value of forecasts to enable proactive decision making. 2 Dayparts • Dining habits traditionally recognize breakfast, lunch, and dinner as food-service. • Dayparts: • Breakfast between 6:30 AM to 9:30 AM • Lunch between 11:30 AM and 1:30 PM • Dinner between 5:30 PM to 10:00 PM • Averages only 9.5 hours of a 24-hour period – 40% of the day – Facilities are underutilized by nearly 60% – What affects your decision to what extent you will utilize your physical space assets 3 Maximum Utilization of Dayparts • The strategy that involves maximum utilization of your physical space assets are • Plan to capture existing demand for established dayparts • Create product and service offerings that optimize the revenue during existing day parts • Create services that can generate revenue between those established dayparts • Reduce total cost during a percentage of the other hours between those established dayparts • The numerous possibilities point to the need for a wellresearched, market-driven business vision 4 Revenue generation between traditional Dayparts • What options are available to generate revenue or reduce total cost during a percentage of the other hours between those established dayparts. • Strategies can include: – Dining room as rental space for meetings, cooking classes, product launches or other social activities – Offer brunch, afternoon tea, or post-dinner late-night meals – Producing ingredients or recipes for retail sale – Using your kitchen to prepare banquet food to be served offpremises – Casual staff on hour rates – Full timers that work peak period split shifts 5 5.2 Maximized Space Utilization Dayparts • No matter how you use your restaurant during the time available, your menu must support your plan for Seat turnover • The number of customer served during a specific period of time divided by the number of available seats. • Seat turnover needs to be considered based on • Your vision and mission • Your concept • Your financial forecast and financial sustainability The most expensive item in operating your restaurant is the empty seat. 7 The summary of daypart In summary, strategic operators should: Use generally recognized dayparts solely as a guide Conduct market research to identify opportunities to optimize utilization of their physical space and other resources Decide how these opportunities may fit with their existing business vision Enact changes to create an enhanced vision better aligned with the market and their resources 8 Evaluating Daypart Utilization • Average total revenue per daypart • Average food only revenue per daypart • Average beverage only revenue per daypart • More detailed: • Average total revenue per hour • Average food only revenue per hour • Average beverage only revenue per hour • As you calculate operating data to obtain important information that assist you to analyze opportunities for financial improvement. 9 5.3 Calculation of Average Total Revenue per Daypart Placeholder image The Menu Life Cycle 5.4 Calculation of Average Revenue per Hour in Breakfast Daypart Using the data from Figure 5-3 and the methodology from Figure 5-4, calculate average daily revenue per hour for the remaining dayparts. Assume lunch is a 2-hour daypart. Assume dinner is a 4.5-hour daypart Lunch = $2,064.52 Result :2 = $1,032.26 Dinner = $3,548.39 Result :4.5 = $788.53 This are averages looking at each hour in exactly the same way. Dayparts performance can be captured reflecting the actual sales 12 5.6 Captured Average Hourly Breakfast Revenue Evaluating Daypart Utilization What is Prime cost ? Is composed of food cost, beverage cost, and direct labor cost Knowing the prime cost helps operators with? Calculate profitability of daypart The commitment to daypart decisions Group task in class Evaluate the prime cost of serving breakfast per hour use 5.6 data and Breakfast F&B cost 28% of revenue Direct labor cost 35% of revenue Answer if it is profitable to be open from 6:30 AM to 7:30 AM? 14 Calculate Breakfast Daypart Details Total Breakfast Revenue 1129.03 F&B cost 28% 1129.03=:100=11.29x28= 316.12 Labor cost 35% 1129.03=:100=11.29x35= 395.16 Total prime cost daypart breakfast 711.28 Gross profit 417.75 Day part evaluation 6.30 to7.30 am income 60.40$ Food Cost 28% 60.40 = :100= 0.604 x 28 =16.91 (variable cost) Labor Cost 35% 1129.03= :100= 11.290x35: 3 =131.71 (fixed cost) Total prime cost 148.62 15 Forecasting Revenue • Your menu drives revenue and your income. Why is and adequate revenue stream necessary ? • To ensure required cash flow to pay bills. • Because a long-term trend of insufficient revenue is a business killer. • You must be able to predict revenue by using forecasting tools. – Simplest form - a subjective best guess (guesstimate) – Supported with data - a valuable predictive tool 16 A Worksheet For Forecasting Revenue • Once menu items and their prices have been established, a worksheet can be developed for forecasting revenue. • Sales mix • Number forecasted of a particular item (45 pumpkin cheesecake) : the total number of items forecasted (168 desserts) x100 = menu mix % for an item. • 45 Pumpkin cheese cakes sold : 168 x100 total sold desserts =26.78% • Rows 33 and 42 list the same menu item, but at different prices • Row 33 is the standard price, row 42 is the “Happy Hour” price. 17 5.7 Malt Beverages Menu Engineering Worksheet A Worksheet For Forecasting Revenue • For purposes of analysis and menu engineering, a separate worksheet should be prepared for each menu category. • The level of menu categorization should be based on the perceived competition between menu items. • Main courses don’t often compete with appetizers. • Appetizers tend to compete with Soups and Salads. 19 5.8 Appetizers Menu Engineering Worksheet 5.9 Desserts Menu Engineering Worksheet Historical Item Sales, with Adjustments • In Figure 5-9 , you might see a pattern where approximately 45 slices of pumpkin cheesecake are sold during each period. • You might anticipate this level of sales in future forecast periods. • This is a valid assumption only if • customer traffic remains consistent. • The customer base are the same, the menu offerings did not change and the sales staff are not directed to explore different strategies 22 Historical Item Sales, with Adjustments • The objective approach is based on historical customer traffic data. • This technique requires three distinct steps: – Step 1. Forecast total guest traffic for the period. – Step 2. Apply historical demand for individual menu categories to predict total category demand. – Step 3. Apply menu mix history to the predicted category demand. 23 New Forecast Calculation For the actual period (see 5.9) we had 200 guest visiting the restaurant. 168 of this customers selected a dessert (See 5.9) 168 : 200 x 100= 84% of visiting customers purchased a dessert The pumpkin pie represented 26.8% of the sales mix (see 5.9) 168:100x 26.8 = 45 Pumpkin cheesecake Due to bad management a competitor went bankrupt and you predict to get some of the market share. Increase in guest visits of 19 covers (guesstimate) How much pumpkin cheese cake pies will you new sales forecast reflect? You do not forecast any dessert sales % and sales mix % changes 24 New forecast calculation New Guest forecast? 84% of 219 Guest order a dessert How many desserts sold forecasted? 219:100x 84=184 desserts How many pumpkin cheese cake sells forecasted if sales mix is constant with actual sales 26.8% 184:100x 26.8 = 49.3 cheese cake sold New forecast entry 49 cheese cakes The results of these steps can be entered into a menu engineering worksheet to quantify forecasted sales revenue 25 5.11 Dessert Forecasts Entered into a Menu Engineering Worksheet Assess the accuracy of your forecasts • It is important to assess the accuracy of your forecasts periodically. • Sales Ratio • Comparison of forecasted and actual bottled beer sales • Calculate a ratio actual sales : forecasted sales=ratio • Forecast revisions based on historical variances • Multiply forecasted sales by ratio= new sales forecast 27 5.12 Comparison of Forecasted and Actual Bottled Beer Sales 5.13 Forecast Revisions Based on Historical Variances The effect on underestimating Forecasting Forecasting can be imprecise and constant validation against actual will ensure that you learn to predict your business performance. You will get better while doing Effect of Underestimating insufficient inventory operational resources may not be available advertised items and services not available demand exceeds production forecast Outcome customer dissatisfaction staff under unnecessary stress 30 Effect on Forecast overestimating Effect on overestimating excess food and beverage production food spoilage quality loss extra costs excessive labor cost due to inaccurate schedules anticipated revenues that do not materialize can result in a shortage of cash flow 31 Assess the accuracy of your forecasts • It must be noted that the results of any forecasting process should be questioned prior to accepting them and mobilizing purchasing, recipe production, employee scheduling and operational support • Factors that have an effect on forecasting: – Area or regional events … can increase or decrease business – Holidays… can increase or decrease business – Public works construction, e.g. street repair in front of your restaurant – Weather… can increase or decrease business – Managerial intuition (comes with experience supported by understanding historical data) – It is acceptable if not appropriate to modify forecasts! 32 Calculating Net Income • Net income is • The revenue remaining after all costs and expenses have been deducted. • Expenses result from consumption of inventory (food, beverage, and supplies) , labor costs, occupancy costs, taxes, insurance, and other operating costs . • The next element of forecasting involves costing the menu items anticipated being sold during the period. 33 Calculating Food And Beverage Costs To start estimating (potential) food and beverage costs you first need to put a value on your inventory. This is best achieved by capturing the actual purchase price of each item/ ingredient used This process is most effectively accomplished with the help of the suppliers price list or using the actual receiving data information of existing stock. 34 Elaborating Recipes Certain inventory items/ ingredients are cooked or otherwise transformed to become ingredients in recipes. Conversion recipes Whole Oranges to Orange Juices Sup Recipes Chicken bones become chicken stock with the additional use of other ingredients. It is useful to prepare recipe cards for these items and cost them out in units used in other recipes Yield tests/ butcher tests Calculate whole meat cuts that become steaks Conversion/yield and sub recipes ensure that we are applying the correct value to the recipe 35 The Recipes Once the costs of inventory items and subrecipes are established, the next step is to record and cost recipes for all menu items What ever format is used there are fundamental/standard information on a recipe card that should be uniform. What are these? 36 Standard Recipe information Recipe Name Yield is the number of portions produced by this recipe Batch Cost is the total cost to produce all portions on the recipe Portion Cost is the cost to produce one serving portion of the recipe Sales Price is the price a customer will be charged for one portion Cost % is the relationship between Portion Cost and Sales Price (Cost % = (Portion Cost ÷ Sales Price) x 100 Recipe Unit is the volume or weight hat an ingredient is measured by (For accurate calculation this should be in liters & kilogram avoid pcs, cups and spons) Amount is the number of recipe units required to produce the desired recipe yield Unit Cost is the actual cost of one unit of an ingredient Total Ingredient Cost is the cost for the number of ingredients used in the recipe Total Ingredient Cost = Amount (of Ingredients) x Unit Cost (of Ingredients) Preparation Method is the steps required to prepare the recipe 37 Forecast Worksheets Once recipe costs have been calculated they should be updated on a continuous basis. This practice will assure that recipe costs are reflective of the most current ingredient prices. When menu price, food cost, and forecast number of items sold are determined, then that data is entered into a Sales Forecast Worksheet 38 5.18 Forecast Worksheet Forecast Worksheets • Once all the data has been entered into the Sales Forecast Worksheet, the totals for sales of food and cost of sales (food) (and all the other categories) can be entered into the Income Statement . • Cell D30 of Figure 5-20 indicates the dollar amount remaining after Total Cost of Sales have been subtracted from Total Sales. • The difference of this equation is referred to as • gross profit. 40 5.20 Pro Forma Statement of Income with Sample Data (Sales and Cost of Sales Only) Controllable expenses From gross F&B profit to net Profit Other expenses need to be considered for deduction Fixed and or Variable salaries Employee benefits Other controllable expense Marketing, Legal, Consultancy Rent and other occupancy expenses Cleaning, Electricity, Gas, Water, Maintenance Bank and loan Interest Depreciation of Assets Taxes 42 5.19 Hierarchical Linkage of Software Putting It All Together • The importance of positioning your menus within an informed context. – Understand the impact of Dayparts – How menus function at different times of day – The basics of revenue generation – How costs and expenses diminish revenue • If you are able to predict net income prior to each operating period, then your potential for success is improved. 44