Organizational Plan - Charles' e

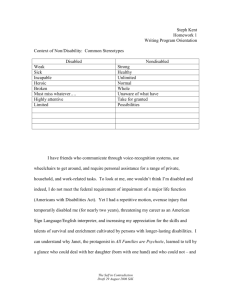

advertisement