Confidential 1

advertisement

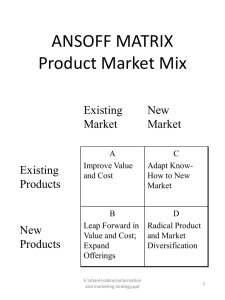

Pharmaceutical Coalition Transparency in Pharmaceutical Purchasing Solutions (TIPPS) October 10, 2007 Confidential 1 10228PH001MG.PPT/008-17-49183 5/2005 Today’s Discussion – TIPPS Standards & Objectives – Review of 2008 Bidding Requirements – Presentation by Robert I. Garis, Ph. D. – Future of AWP – Lunch – Recap of 2008 TIPPS Process – Refining TIPPS Standards and Coalition Objectives for 2009 – Update of Compliance Project Confidential 2 10228PH001MG.PPT/008-17-49183 5/2005 Coalition Leadership & Staff Sidney Banwart Vice President, Human Services Division, Caterpillar, Inc. Chairman, Pharmaceutical Purchasing Coalition Todd Bisping Caterpillar, Inc. Marisa Milton HR Policy Association Steve Wetzell Health Care Policy Roundtable Confidential 3 10228PH001MG.PPT/008-17-49183 5/2005 Hewitt’s Project Support Joshua Golden National TIPPS Project Leader Kristin Begley, Pharm. D. Senior Pharmacy Consultant Confidential 4 10228PH001MG.PPT/008-17-49183 5/2005 TIPPS Coalition Member Companies ACS ALCOA Inc. Apple Computer Armstrong World Industries AT&T, Inc. BAE Systems Caterpillar Inc. Cinergy Corporation Cox Enterprises, Inc. DTE Energy Company Eaton Corporation EMC Corporation Emerson Electric Company Exelon Corporation Federal-Mogul Corporation First Data Corporation FMC Corporation FMC Technologies Ford Motor Corporation FPL Group Inc. General Dynamics General Mills HCA Inc. Hewitt Associates Hilton Hotels Corporation The Home Depot, USA Inc. Honeywell International Inc. IBM Corporation International Paper Johnson Controls, Inc. KeyCorp Liberty Mutual Insurance Lowe’s Companies, Inc. Lucent Technologies Maersk Marathon Petroleum Marathon Oil Corporation McDonald’s Corporation Motorola, Inc. Northrup Grumman Confidential Northwestern Mutual PepsiCo, Incorporated PPG Industries, Inc Prudential Financial Quest Diagnostics Rolls-Royce North America Shell Oil Company Sodexho, Inc. Starbucks Corporation Sunoco, Inc. Swift Transportation Co. TAP Pharmaceutical Products Temple-Inland Texas Instruments TXU Business Services University of Missouri System United Technologies Verizon Communications Verizon Wireless The Walt Disney Company 5 10228PH001MG.PPT/008-17-49183 5/2005 Pharmaceutical Coalition/TIPPS 2008 Certified PBMs Aetna Pharmacy Management Humana Blue Cross and Blue Shield of Alabama Medco Health Solutions, Inc. Prime Therapeutics, LLC CVS Caremark RESTAT PBM LLC Catalyst Rx, A HealthExtras Company CIGNA Pharmacy Management Express Scripts, Inc. SXC Health Solutions, Inc. Walgreens Health Initiatives, Inc. WellPoint NextRx Confidential 6 10228PH001MG.PPT/008-17-49183 5/2005 Washington Post Ad Confidential 7 10228PH001MG.PPT/008-17-49183 5/2005 Review of TIPPS Standards and Coalition Objectives 10228PH001MG.PPT/008-17-49183 5/2005 The Pharmaceutical Coalition Primary Objective: Leverage the combined purchasing volume of Coalition to change the way pharmaceutical products are purchased – create price transparent environment to encourage competition and consumerism – align incentives of PBMs with employers and patients – establish a platform for value-based purchasing – drive business to certified PBMs that agree with principles Confidential 9 10228PH001MG.PPT/008-17-49183 5/2005 Overview of Bidding Requirements Bidding Requirements Have Been Streamlined – Six principle bidding requirements fundamental in the selection criteria • Format has been streamlined from nine requirements in 2006 • Still designed to capture the ultimate in financial disclosure and service capability, and allow for a true partnership between a PBM and client Confidential 10 10228PH001MG.PPT/008-17-49183 5/2005 Bidding Requirement 1 Acquisition Cost for All Retail Claim Payments – Charge the Participating Group no more than the amount that you pay the pharmacies in your retail network for each claim dispensed – Includes all brand and generic drugs. Confidential 11 10228PH001MG.PPT/008-17-49183 5/2005 Bidding Requirement 2 Acquisition Cost Basis for All Mail Service Claim Payments – Charge no more than the acquisition cost of drugs at the mail order pharmacy, plus a dispensing fee. – Acquisition cost is defined as either: • actual inventoried per unit cost (AAC), or • published Wholesale Acquisition Cost (WAC) – Agree to utilize a MAC list to determine the Participating Group’s cost for any drugs that do not have an associated WAC price Confidential 12 10228PH001MG.PPT/008-17-49183 5/2005 Bidding Requirement 3 Pass-Through of 100% of All Pharmaceutical Manufacturer Revenue – Pass through 100% of any and all formulary rebates, market-share rebates, and other rebate revenue that the Participating Group’s utilization enables you to earn. – Includes Rebate Administrative Fees, Data Sale Revenue, and Compliance/Adherence program revenue Confidential 13 10228PH001MG.PPT/008-17-49183 5/2005 Bidding Requirement 4 Specialty Pharmacy Transparency – Charge no more than the acquisition cost of drugs at the specialty mail order pharmacy, plus a dispensing fee. – Pass through any and all pharmaceutical manufacturer revenue. – Provide dose optimization and consolidation programs, where appropriate. – Provide case management for critical disease states (and not build cost of programs into ingredient cost) – Offer a tool to enable cross-walk billing (i.e., J-Code to NDC conversion) Confidential 14 10228PH001MG.PPT/008-17-49183 5/2005 Bidding Requirement 5 Plan Management/Consumer Engagement – Apply rebate on a per-unit basis specific to NDC-11 at the point of sale (at client’s discretion). – provide members with decision support tools: • web-based formulary lookup tool • web-based drug price comparison tool, with retail pharmacy pricing comparison • web-based or letter-based utilization summary tool that identifies member cost-share savings opportunities – Offer financial performance guarantees to support effective utilization management, by therapeutic class. • Penalties to be assessed on a dollar-for-dollar basis Confidential 15 10228PH001MG.PPT/008-17-49183 5/2005 Bidding Requirement 6 Comprehensive Audit & Disclosure Rights – Offer full audit rights • Audits of Claims/Utilization Data • Audits of Retail Network Contracts • Audits of Rebate Arrangements • Audits of Clinical Savings Criteria – No limitation to specific list of audit firms (“mutually agreeable”) – Allow self-audit by client – Provide claims data with all financial fields – Outsourcing vendors must also allow audits Confidential 16 10228PH001MG.PPT/008-17-49183 5/2005 Exclusion Criteria The following criteria are grounds for exclusion from TIPPS certification: – PBM does not agree to all 2008 bidding requirements – PBM does not complete an RFP response, or submits an incomplete RFP response – PBM’s fee exhibit contradicts their RFP response Confidential 17 10228PH001MG.PPT/008-17-49183 5/2005 Outsourced Services If a vendor outsources ANY core functionality that is relevant to the bidding requirements, that vendor must provide documentation that the outsourced provider ALSO meets the certification criteria. – Includes outsourced mail service, rebate administration, specialty drug management, etc. – This documentation MUST include the Audit Rights bidding requirement – audit rights must extend to the third-party outsourced provider – Letter templates provided with the RFP for each outsourced functionality Confidential 18 10228PH001MG.PPT/008-17-49183 5/2005 Robert I. Garis, Ph.D. “The HR Executive: Optimal Pricing in Pharmacy Benefit Programs” 10228PH001MG.PPT/008-17-49183 5/2005 Future of AWP 10228PH001MG.PPT/008-17-49183 5/2005 Lunch 10228PH001MG.PPT/008-17-49183 5/2005 Recap of 2008 Certification Process 10228PH001MG.PPT/008-17-49183 5/2005 Request for Proposals (RFPs) RFP process went as planned: – RFP distributed broadly to all interested PBMs (based on PBM request) – Core TIPPS Bidding Requirements – Additional Questions on Topics of Interest – Outsourcing Documentation Requirements – Certification proposals received from 16 PBMs – Preliminary certification granted to 14 PBMs – Fee Exhibits released, evaluated – Final Certification granted to 13 PBMs Confidential 23 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses Initial Proposal Review - Process – Initial proposal review conducted with Coalition on July 12th (telephonic meeting) – “Preliminary Certification” status determined for each PBM vendor – Review included a line-item confirmation of all bidding requirement details – Material deviations from bidding requirements identified – Follow-up conducted to resolve deviations where possible/appropriate – Vendors receiving Preliminary Certification were issued a fee exhibit for final approval/certification Confidential 24 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses Initial Proposal Review - Methodology “Green Light” Vendor meets all certification criteria, or criteria deviations are likely to be satisfactorily resolved. All necessary outsourcing documentation has been provided. “Yellow Light” Vendor has significant deviations which may or may not be resolved. Outsourcing documentation may be outstanding. “Red Light” Vendor’s current response includes serious deviations that are not likely to be satisfactorily resolved. Confidential 25 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses Initial Proposal Review - Outcome “Green Light” “Yellow Light” “Red Light” Aetna BCBS Alabama MedImpact Caremark Prime Therapeutics Rx America Catalyst Rx HealthTrans CIGNA RESTAT Express-Scripts SXC Rx Humana Medco Walgreens Health Initiatives Wellpoint NextRx Confidential 26 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses Red Light Bidders – Issues – MedImpact • Refused to provide documentation for outsourced mail service and specialty vendors – Rx America • Documentation not provided for outsourced specialty functionality • Could not provide acquisition cost basis for specialty drugs • Some contracts with network pharmacies and pharmaceutical companies preclude vendor from allowing full audit rights Confidential 27 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses Yellow Light Bidders – Most Common Issue – Missing documentation for outsourced arrangements (with vendor working to provide documentation) • Outsourced specialty vendor • Outsourced mail service vendor • Outsourced rebate contracting – Final certification was contingent on receipt of documentation – All Yellow & Green Light vendors provided documentation by final certification deadline Confidential 28 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses All Bidders – Other Observations – Seven (7) vendors did not currently offer POS rebate administration (agreed to develop within 6 months upon request) – Three (3) vendors would not pass-through revenue from Data Aggregation (but agreed to allow client to opt-out of these programs) – Two (2) vendors did not currently offer acquisition cost basis for mail service (agreed to develop within 6 months upon request) Confidential 29 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses HealthTrans – Withdrawal of Submission “Thank you for allowing HealthTrans to participate in the HRPA/TIPPS 2008 certification process. Please accept this letter as notification that HealthTrans, after careful consideration, has decided not to proceed with certification this year. As a pioneer and a continuing leader in the area of not only transparency, but also a differentiating business model that reflects our philosophy of visibility, value and validation we could not agree more with the principles espoused by HRPA. We appreciate the opportunities that have emerged from our relationship with both Hewitt and HRPA over the recent past, and HealthTrans looks forward to working with you in the future to further the interests of both clients and consumers.” (HealthTrans) Confidential 30 10228PH001MG.PPT/008-17-49183 5/2005 Review of RFP Responses Final Outcome – Thirteen (13) PBM vendors were granted certification: • Aetna Pharmacy Management • Humana Pharmacy • BlueCross and Blue Shield of Alabama • Medco Health Solutions, Inc. • CVS Caremark • Prime Therapeutics LLC • Catalyst Rx, A HealthExtras Company • RESTAT • Cigna Pharmacy Management • SXC Health Solutions, Inc. • Express Scripts • Walgreens Health Initiatives • WellPoint NextRx Confidential 31 10228PH001MG.PPT/008-17-49183 5/2005 RFP - Additional Topics of Interest AWP Alternatives With the possible withdrawal of AWP from the marketplace as an available reference price, please describe your organization’s current “plan of action” as it pertains to pursuing alternative pricing metrics. – “Although none of the options meet all the requirements [of a replacement metric], the WAC has the least amount of challenges surrounding it...” – “Medi-Span maintains their position that their process for deriving AWP will remain unchanged...” – “No change is without its challenges; however [we believe] that WAC is the right alternative…” – “[Our] current choice is WAC, but AMP is also being evaluated…” Confidential 32 10228PH001MG.PPT/008-17-49183 5/2005 RFP - Additional Topics of Interest Follow-On (Generic) Biologics What specific actions is your organization taking to promote the present or future availability of follow-on (generic) biologics? – “CIGNA Pharmacy Management is involved with the coordinated efforts of PCMA and AHIP in lobbying and promoting FDA action to approve the availability of generic biologics.“ – “Express Scripts is among the leaders of the legislative initiative to develop an FDA pathway for follow-on biologics... and published a financial model of the potential savings of such a pathway.” – “Aetna is FOR a regulatory pathway to allow FDA to approve generic biopharmaceuticals… Aetna is OPPOSED to legislation that messes with patents or directs the FDA as to what to review, how to review it and what to decide (we don't want to pre-judge the science).” Confidential 33 10228PH001MG.PPT/008-17-49183 5/2005 RFP - Additional Topics of Interest Fiduciary Responsibility Participating Groups in the TIPPS Coalition may wish to have their PBM serve in various fiduciary roles for their plan. Please state your willingness to act as fiduciary in the following capacities: First Level Appeals, Second/Third Level Appeals, Final Appeal Decision, Clinical (Formulary) Management, Named Co-Fiduciary for Overall Plan Administration, Named Sole Fiduciary for Overall Plan Administration. – Several vendors (Aetna, BCBSAL, MedImpact) agreed to serve as fiduciary in all capacities listed – Several vendors agreed to accept most or all responsibilities after a case-by-case consideration – Many vendors limited their fiduciary roles – Limited to first-level appeals and clinical/formulary management – Would not accept responsibility for medical necessity determinations or overall plan administration – Many vendors offer third-party services to support the appeals process Confidential 34 10228PH001MG.PPT/008-17-49183 5/2005 Evaluating TIPPS Compliance and Savings 10228PH001MG.PPT/008-17-49183 5/2005 Refining TIPPS Standards and Coalition Objectives for 2009 10228PH001MG.PPT/008-17-49183 5/2005 Compliance Project Update 10228PH001MG.PPT/008-17-49183 5/2005