Department of Revenue Update - Georgia Fiscal Management Council

Georgia Department of Revenue

Georgia Department of Revenue

Overview of the Georgia

Department of Revenue

Lynne Riley, Revenue Commissioner

Atlanta locations

Local Government Services,

Processing Center, Motor

Vehicle Division, South Metro

Regional Office, and

Warehouse at Southmeadow

I-20

Training & Organization Development Unit NEO 2015

Headquarters

Century Center

I-20

2

Rome

South Metro

11 Regional Offices

Gainesville

Athens

Atlanta

Macon Augusta

Columbus

Albany

Savannah

Douglas

3

Georgia Department of Revenue

Responsibilities

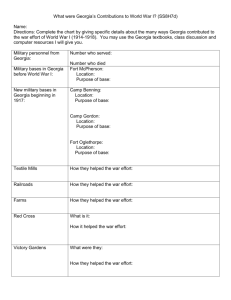

Statewide Tax Administration 4.5 million taxpayers

Alcohol & Tobacco Industry 18,000+ licensees

Regulation

Motor Vehicle registrations

8.9 million

Georgia Department of Revenue

Department of Revenue Strategic Plan

Taxpayer

Services

Modern

Technology

Fair & Efficient Tax

Administration

For Public

Confidence &

Compliance

Organizational

& Operational

Efficiency &

Effectiveness

Workforce

Investment

Safety &

Security

Georgia Department of Revenue

State of Georgia

FY16 Budget (HB76)

$40.9 Billion

14%

33%

53%

State Funds

Federal Funds

Other Funds

Georgia Department of Revenue

Comparative Summary of Net Revenue Collections

FY '12 FY '13 FY '14 FY '15

$ 8,142,693 $ 8,753,712 $ 8,966,125 $ 9,677,987

FY '16 Appropriated *

$ 9,884,056

Tax Revenues:

Income Tax - Individual

Sales and Use Tax - General:

Sales and Use Tax - Gross

Local Distribution

Adjustments \ Refunds

Net Sales and Use Tax - General

Motor Fuel Taxes:

Prepaid Motor Fuel Tax

Motor Fuel Excise Tax

Total Motor Fuel Taxes

Income Tax - Corporate

Tobacco Tax

Alcoholic Beverages Tax

Estate Tax

Property Tax

Motor Vehicle - Tags, Titles & Fees

Total Tax Revenues - Subtotal

Other Revenues:

Other Fees & Taxes

Total Taxes and Other Revenues

$ 10,080,239 $ 10,051,131 $ 9,851,533 $ 10,353,350

$ (4,622,932) $ (4,633,195) $ (4,602,785) $ (4,822,300)

$ (126,960) $ (93,855) $ (78,336) $ (89,638)

$ 5,330,347 $ 5,324,081 $ 5,170,411 $ 5,441,413

$ 573,047 $ 547,172 $ 568,856 $ 564,237

$ 431,564 $ 428,278 $ 448,021 $ 457,185

$ 1,004,611 $ 975,450 $ 1,016,876 $ 1,021,422

$ 589,915 $ 797,255 $ 944,256 $ 1,000,087

$ 227,123 $ 211,448 $ 216,349 $ 215,055

$ 173,635 $ 175,018 $ 178,072

$ 184,374

$ 28 $ (15,352) $ -

$ -

$ 67,417 $ 53,492 $ 38,857 $ 26,799

$ 308,171 $ 453,351 $ 1,079,628 $ 1,166,107

$ 1,366,289 $ 1,675,212 $ 2,457,162 $ 2,592,422

$ 208,597 $ 275,536 $ 272,709 $ 295,281

$ 16,052,536 $ 17,003,992 $ 17,883,284 $ 19,028,524

$ 5,593,609

$ 998,184

$ 995,534

$ 208,934

$ 190,316

$ -

$ 7,000

$ 1,152,601

$ 2,554,385

$ 389,055

$ 19,419,289

Georgia Department of Revenue

Comparative Corporate Income Tax Collections

Corporate Tax Coll ectio ns a nd Ret urns Processed

Corporate Tax Returns (Thousands)

271 268

274

248

180

Corporate Tax Net Collections (Millions)

$965

$889

$682

$626

$669

CY2010 CY2011 CY2012 CY2013 CY2014 CY2010 CY2011 CY2012 CY2013 CY2014

Georgia Department of Revenue

Comparative Individual Income Tax Collections

Individual Inco me Tax Colle ctio ns a nd Ret urns Pro cesse d

Number of Individual Returns Processed

(Thousands)

Net Individual Income Tax Collections

(Millions)

4,396 4,404

4,576

4,357

4,252

$7,323

$7,952 $8,380

$8,879 $9,305

CY2010 CY2011 CY2012 CY2013 CY2014 CY2010 CY2011 CY2012 CY2013 CY2014

Georgia Department of Revenue

Sales and Use Tax Revenues by Business Group (Thousands)

FY2010 FY2011 FY2012 FY2013 FY2014

Accommodations

Car & Automotive

Construction

Food & Grocery

$ 181,437 $ 201,754 $ 208,044 $ 221,696 $ 239,002

$ 831,936 $ 924,001 $ 1,020,368 $ 877,563 $ 283,772

$ 43,217 $ 49,459 $ 60,352 $ 62,041 $ 69,314

$ 1,387,058 $ 1,472,134 $ 1,562,526 $ 1,643,849 $ 1,746,942

General Merchandise $ 1,339,806 $ 1,359,914 $ 1,396,157 $ 1,433,731 $ 1,485,867

Home Furnishings $ 692,166 $ 685,867 $ 699,906 $ 710,159 $ 767,792

Manufacturing $ 553,695 $ 514,814 $ 538,874 $ 534,055 $ 555,161

Miscellaneous Services $ 900,789 $ 923,651 $ 932,264 $ 990,159 $ 1,052,854

Other Retail

Other Services

Utilities

Wholesale

Total

$ 1,090,584 $ 1,118,443 $ 1,169,833 $ 1,158,049 $ 1,239,132

$ 531,718 $ 518,969 $ 560,363 $ 511,939 $ 461,314

$ 1,012,472 $ 1,039,326 $ 1,006,630 $ 974,826 $ 980,271

$ 633,194 $ 810,195 $ 924,923 $ 933,064 $ 970,112

$ 9,198,072 $ 9,618,527 $ 10,080,240 $ 10,051,131 $ 9,567,761

Georgia Department of Revenue

Selected Income Tax Credits Utilized on Tax Returns

2009

Employer's

Credit for

Approved

Employee

Retraining

23,104,423.83

Employer's Job Manufacturer's

Tax Credit and Investment Tax Housing Credit

Mega Credit Credit

Low Income Research Tax Film Tax Credit

Credit

Land

Conservation

Credit

Qualified

Education

Expense Credit

44,309,916.15

8,692,228.00

45,142,998.44

12,545,034.52

45,209,423.00

4,967,239.18

21,979,420.00

2010 25,896,736.00

65,340,238.38

22,399,663.00

93,055,135.00

9,764,330.00

96,770,773.00

15,359,714.70

28,063,237.00

2011 27,988,069.00

63,759,330.57

58,772,684.00

91,249,749.00

12,424,231.97 137,754,766.25

22,226,432.00

36,636,261.00

2012 23,305,267.00

59,903,097.85

12,927,060.00

73,564,465.00

9,426,193.18 225,940,873.01

54,675,413.00

44,776,463.00

2013 24,732,272.00

70,796,665.36

8,245,728.00

68,090,609.00

11,267,612.11 222,141,657.21

18,727,476.00

41,699,277.00

Georgia Department of Revenue

Processing Statistics

Total Returns

Processed

Average Cost to

Process-Paper

Avergae cost to

Process-Electronic

Percentage of total tax returns filed electronically

Cost Per year for

Paper

Cost Per year for

Electronic

Total Cost

2010

6,644,199

$1.5

$0.5

$4,086,182

$1,960,038

$6,046,220

2011

7,367,044

$1.5

$0.5

68%

$3,536,181

$2,504,795

$6,040,976

2012

6,600,000

$1.5

$0.5

2013

6,200,000

$1.5

$0.5

2014

6,536,719

$1.5

$0.5

2015

7,488,690

$1.5

$0.5

78%

$2,178,000

$2,574,000

$4,752,000

86%

$1,302,000

$2,666,000

$3,968,000

$1,659,019

$2,715,353

$4,374,372

85.83%

$1,591,721

$3,213,771

$4,805,492

Georgia Department of Revenue

Telephone Calls Received by Year

Year Tax

2010

2011

2012

2013

2014

755,958

787,685

966,132

791,506

956,110

Georgia Department of Revenue

Compliance Division

A staff of professional tax specialists to audit tax accounts and oversee collection actions of:

• Income Tax

• Sales Tax

• Motor Fuel Taxes

• Alcohol Taxes

14

Georgia Department of Revenue

Enforcement Actions

• Record Liens in County Courthouses

• Issue Liens against Motor Vehicles

• Close Businesses

• Apply Bank Levies

• Garnish Wages

• Seize and Sell Personal Property

15

Georgia Department of Revenue

Legal Affairs and Tax Policy Division

• Publicize rules and regulations for the

Department

• Research and Analysis of legislation

• Hold taxpayer conferences

• Issue policy statements and informational bulletins

• Issue determinations on exemption-related requests

• Protest Conferences and Administrative Hearings

16

Georgia Department of Revenue

Taxpayer Services Division

• Administers Income, Sales and Use, and

Motor Fuel Tax laws

• Administers DOR licenses, registrations and maintains entity information

• Maintains taxpayer accounts receivables and payables information

17

Georgia Department of Revenue

The Georgia Tax Center

• Secure website that allows taxpayers to file returns and pay taxes electronically.

• Taxpayers can set up e-mail notifications when action is taken in regards to their tax return. This allows taxpayers to protect themselves against fraud.

• Allows businesses and individuals to track the status of their returns and refunds.

Georgia Department of Revenue

https://gtc.dor.ga.gov/_/

Georgia Department of Revenue

Georgia Tax Tribunal

• The Georgia Tax Tribunal is dedicated to the resolution of disputes between taxpayers and the Georgia Department of Revenue.

• An autonomous division within the Office of

State Administrative Hearings.

• Their mission is to resolve tax disputes in a prompt, impartial, courteous and thoughtful manner.

Website: http://gataxtribunal.georgia.gov/

20

Georgia Department of Revenue

Alcohol and Tobacco Division

Licenses & Permits

Alcohol Products

Tobacco Products

21

Georgia Department of Revenue

Alcohol and Tobacco Division

Law Enforcement

Compliance with Georgia laws and regulations relating to voluntary compliance and enforcement of:

- Alcohol beverages

- Motor fuel tax

- Motor vehicle registration

- Issuance of citations

-Tobacco products

- Motor carriers

Also provides assistance to federal, state and local governments and their law enforcement agencies

22

Number of Alcohol Agents

Alcohol Inspections

Alcohol Investigations

Alcohol Citations

Underage Alcohol

Investigations

Underage Alcohol Citations

Liquor License

Investigations

Still Seizures

Tobacco Inspections

Tobacco Investigations

Tobacco Citations

Underage Tobacco

Investigations

Executive Orders

Game Inspections

Felony Arrests

Misdemeanor Arrests

Dyed Fuel Inspections

Dyed Fuel Violations

Georgia Department of Revenue

Alcohol and Tobacco Statistics

FY2010 FY2011 FY2012

24

3,820

1,280

2,061

42

4,749

1,336

1,979

41

7,556

1,350

7,556

4,289

699

1,749

1,413

31

140

4,990

112

1,280

-

3,126

36

123

3,372

4,331

753

2,053

4,271

29

228

6,760

167

1,336

7

3,939

15

138

2,284

5,343

617

2,437

3,201

26

162

6,958

155

1,350

2

6,187

7

206

2,065

3,816

300

1,039

2,191

16

125

7,111

50

1,219

3,954

-

37

114

1,339

FY2013

40

5,398

1,219

962

FY2014

32

5,617

1,122

707

3,673

254

1,111

3,293

2

130

6,838

113

1,122

2

4,454

41

329

2,688

Georgia Department of Revenue

Alcohol Law Enforcement - Yesteryear

Georgia Department of Revenue

Alcohol Law Enforcement - Today

» While cases have decreased since the end of prohibition, it still shows up today. It is typically found while cooperating with local or federal law enforcement agencies while investigating other crimes.

25

Georgia Department of Revenue

Local Government Services

Georgia Certification Programs for County

Tax Assessors and Appraisers

. . . train, assist and monitor county tax officials to help ensure that the property tax burden is distributed equitably among taxpayers .

26

Georgia Department of Revenue

Local Government Services

Unclaimed Property Program

Collects from holders any unclaimed property that has been abandoned by its owners, and serves as a custodian of the property until the rightful owners can be found and the property returned

• Last year DOR distributed over $15 million back to rightful owners

• DOR website makes it easy

Website: https://etax.dor.ga.gov/unclaimedproperty/main.aspx

Toll Free:855.329.9863

27

Georgia Department of Revenue

Motor Vehicle Division

Titles

Registrations

License Plates

Insurance Compliance

28

Georgia Department of Revenue

Motor Vehicle Division

Business Units

Call Center

Vehicle Valuation

International Registration Plan (IRP)

Lobby Unit (Customer Service)

Unified Carrier Registration (UCR) &

Permitting

29

Georgia Department of Revenue

Motor Vehicle Division

Dealer Registration

Salvage & Title Processing

Title Imaging Exam

Accounting & Audits

Administrative Support

Warehouse Management

30

Georgia Department of Revenue

Motor Vehicle Registrations

Number of Motor Vehicle Insurance Notifications, Registrations, Tags and Titles Issued

FY2010 FY2011 FY2012

Registrations Issued

Tags Issued

Titles Issued

8,530,981

1,712,390

2,355,137

8,581,400

1,943,324

2,485,374

Insurance Notifications 1,190,894 1,114,935

Number of Motor Vehicle Registrations Issued by Major Category

Passenger Cars

Motorcycles

FY2010

5,394,530

195,647

FY2011

5,441,975

199,253

8,686,939

1,843,323

2,553,854

1,069,300

FY2012

5,531,795

201,206

FY2013

8,785,922

1,563,322

2,390,995

1,087,851

FY2013

5,619,161

199,287

Trucks

Trailers

Bus

Other

Total

1,877,499

1,024,073

39,035

197

8,530,981

1,860,938

1,038,902

40,148

184

8,581,400

1,854,488

1,058,038

41,227

185

8,686,939

1,851,983

1,074,232

41,064

195

8,785,922

FY2014

8,933,714

1,884,228

2,217,497

1,113,877

FY2013

5,734,501

199,445

1,858,415

1,100,063

41,079

211

8,933,714

Georgia Department of Revenue

Motor Vehicle – Active Registrations for Georgia Specialty Plates

Top Ten Specialty Plates

Wildlife (O.C.G.A. § 40-2-86)

Bobwhite Quail (§ 40-2-86)

Educators (§ 40-2-86)

Hobby Antique (§ 40-2-86)

Breast Cancer Awareness (§ 40-2-86)

Wildflower (§ 40-2-86)

Hummingbird (§ 40-2-86)

Golden Labrador Retriever (§ 40-2-86)

Dog & Cat Sterilization (§ 40-2-86)

Certified Firefighter (§ 40-3-86.1)

FY2010

273,914

174,602

52,901

101,897

39,870

59,966

56,471

35,569

37,878

11,855

FY2011

156,660

96,420

39,792

40,182

31,302

36,651

35,368

23,834

24,490

10,460

FY2012

109,178

67,334

32,832

28,117

25,541

26,757

25,631

18,588

18,452

9,814

FY2013

82,176

52,920

27,689

23,409

20,958

20,314

19,629

15,354

20,314

10,268

FY2014

68,206

44,990

24,730

21,339

18,133

16,867

16,791

13,498

12,439

10,640

Georgia Department of Revenue

Office of Special Investigations

• Internal Affairs of the Department

• All issues involving physical security at facilities

• Prevention and investigation of crimes/fraud committed against the Department, including:

• Sales Tax

• Withholding Tax

• Income Tax

• Motor Vehicle Crime – Title Fraud

• Corporate Tax

• Criminal Investigations

33

Fiscal Year

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Georgia Department of Revenue

Fraud Statistics

Number of Blocked Returns

32,987

66,700

15,884

28,887

52,077

109,884

162,427

106,949

47,314

65,982

Amount Blocked

$26,900,000

$42,000,000

$16,500,000

$40,000,000

$41,000,000

$71,600,000

$117,000,000

$53,800,000

$33,624,000

$312,895,381*

Georgia Department of Revenue

Fraud Sweep – April 2015

» Statewide Operation that targeted fraudulent tax preparers and tax evaders

» Had been defrauding both State and Federal governments out of hundreds of thousands of dollars, resulting in multiple felony charges

Georgia Department of Revenue

OSI Fraud Incidents

» Taxpayer sought a $94 million state refund.

OSI flagged her account and worked with her bank to arrest her as she made plans to deposit her refund check.

» Used car dealers rolled back odometers in order to raise the value of vehicles and ultimately defraud taxpayers.

Georgia Department of Revenue

December 2014 at Southmeadow

Georgia Department of Revenue

OSI: Sid Seizure

• Sid assists in investigations regarding untaxed revenues.

Georgia Department of Revenue

New Laws Effective July 1, 2015

• HB 170

– Revises Excise Taxes on Motor Fuels

– State Hotel-Motel Fee

– Annual Fee on Alternative Fuel Vehicles

– Annual Fee on heavy vehicles

– Eliminates income tax credit on zero emission vehicles

Georgia Department of Revenue

New Laws Effective July 1, 2015

• HB 110

– 5% Excise tax on fireworks sold in Georgia.

• HB 147

– Initial two year registration period for certain vehicles.

• SB 100

– Tag offices may issue a Temporary Operating Permit when a vehicle fails emission inspection.

• SB 63

– New rules for brewery and distillery tours, provisions for on premise consumption and allowance for samples to be taken offsite.

Georgia Department of Revenue

New Laws Effective January 1, 2016

• HB63 – GA Employer GED Tax Credit - $1M cap

• HB237 – Extend Angel Investor Tax Credit through 2018

• HB308 – Modifies the Historic Rehabilitation Credit

• HB339 – Extends gaming portion of Film Tax Credit

• HB464 – Modifies select Conservation Credits

• HB457 – Watercraft Inventory tax exemption restored

Georgia Department of Revenue

TAVT Rate for 2016, 2017, and 2018

• HB 386 passed by General Assembly in 2012 - required DOR to evaluate 2014 TAVT revenues in calendar year 2015 to determine if a rate adjustment is to be made.

• 2013 TAVT rate = 6.50%

• 2014 TAVT rate = 6.75%

• 2015 TAVT rate = 7.00%

• DOR calculated the TAVT target collection amount at $556M.

• DOR calculated the TAVT state current collection amount at $838M.

• DOR issued policy bulletin on August 17 th – TAVT rate will remain at

7.00% through 2018.

• DOR will evaluate revenues again in calendar year 2018.

Georgia Department of Revenue

New Rule 560-7-8-.54

• O.C.G.A. 48-2-39

• Income tax credit cap approval or preapproval periods.

• Applies to income tax credits issued on a first-come, first-served basis.

• First day of submission must be a regular business day.

• Submissions on day the cap is reached will be prorated.

• Example: SSO credit applications will be accepted starting at 8:00 am on Monday, January 4, 2016. If cap is reached that day, all applications will be prorated.

Georgia Department of Revenue

House Bill 202 Task Force

• The task force was established to review current

DOR regulations and recommend revisions required to conform to new statutes enacted by

HB 202.

• HB 202 includes significant changes to property valuation and taxation services that are performed by local governments.

• Task force consisted of DOR personnel, legislators, county officials, and professionals in relevant appraisal and taxation fields.

Georgia Department of Revenue

Priority Projects Ahead For DOR

• Enhanced Fraud Prevention Initiatives

– Fraudulent filers & identity theft – national & state efforts

– Fraud Manager software system acquired

• Pilot Projects - targeted sales and income tax audits

– Analysis of ROI for audit staffing and resources

• DRIVES: GRATIS & Drivers Licensing Systems

Modernization

– Multi year project in partnership with Dept. of Driver

Services

– Systems interface with county tag offices

Georgia Department of Revenue

Lynne Riley, Commissioner

1800 Century Boulevard, Suite 15300

Atlanta, GA 30345

Lynne.Riley@dor.ga.gov

404-417-2100