Month End Closing Process

advertisement

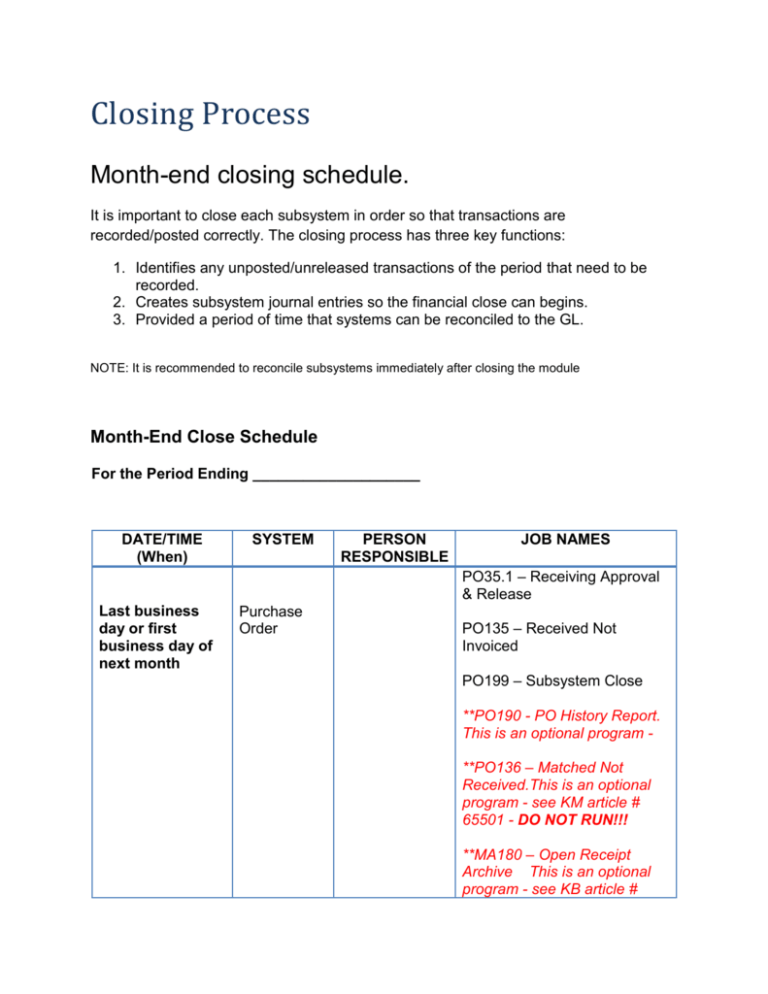

Closing Process Month-end closing schedule. It is important to close each subsystem in order so that transactions are recorded/posted correctly. The closing process has three key functions: 1. Identifies any unposted/unreleased transactions of the period that need to be recorded. 2. Creates subsystem journal entries so the financial close can begins. 3. Provided a period of time that systems can be reconciled to the GL. NOTE: It is recommended to reconcile subsystems immediately after closing the module Month-End Close Schedule For the Period Ending ____________________ DATE/TIME (When) SYSTEM PERSON RESPONSIBLE JOB NAMES PO35.1 – Receiving Approval & Release Last business day or first business day of next month Purchase Order PO135 – Received Not Invoiced PO199 – Subsystem Close **PO190 - PO History Report. This is an optional program **PO136 – Matched Not Received.This is an optional program - see KM article # 65501 - DO NOT RUN!!! **MA180 – Open Receipt Archive This is an optional program - see KB article # 68648 - DO NOT RUN!!! AP193 – Recurring Invoice Update Last business day or first business day of next month Accounts Payable AP170 – Payment Closing AP175 – Invoice Distribution Closing AP190 – Invoice Reinstatement GL190 – Journal Posting GL290 – General Ledger Report ***AP136 – Invoice Accrual Reconciliation AP195 – Period Closing *AP199 – Vendor Balance Year End IC222 – Unreleased Documents Last business day or first business day of next month Inventory Control IC25.1 – Document Release IC130 – GL Interface IC190 – Closing Last business day or first business day of next month IC199 – Subsystem Close CB175 – Bank Transaction Posting Cash Ledger CB180 – Cash Ledger Void Update CB195 – Company Period Close AC190 – Activity Posting TBD Activity Management Capitalize Activities AC195 – System Control AM170 – Processing Release TBD Asset Management AM180 – Depreciation Calculation AM190 – Period Close *AM195 – Year End Close GL170 – Recurring Journal Interface General Ledger GL179 – Recurring Journal Close Cost Allocations GL190 – Journal Posting CA110 – Allocation Calculation CA190 – Allocation Interface CA199 – Allocation Closing GL190 – Journal Posting General Ledger Reports GL291 (Optional) – Trial Balance Month End Close GL292 (Optional) – Balance Sheet GL293 (Optional) – Income Statement **GL199 – Period Closing * Run at year end only. ** For Periods 1 – 11, run with limited close option. *** In application version 8.0.3, the Invoice Accrual Reconciliation Report is found under AP260. For Period 12, run once for each period of last year with final close option. Run again with limited close option for period 12 of the current year. Closing accounting periods can be an important part of managing your accounts payables. Use the following procedures to prepare for and close a period. Preparing for Period Closing There are several important steps that you should complete to prepare for a period closing. Each of these items is conditional, based on your particular way of doing business and the timing of your period close. For example, if you just closed your cash payment cycle, you would not need to run Payment Closing again. Use the following procedure to prepare for period closing. Use the appropriate forms to complete your preparation for period closing. Use the following table to identify the tasks you should perform. Use System Control (GL01.1) To Verify the last period closed for the Accounts Payable application and then check to see that system control is turned on. Basic Invoice (AP20.1) Release any invoice that has a manual payment applied and has a check date that is prior to the period end date. Taxed Invoice (AP20.2) Batch Control (AP25.1) Batch Review (AP25.2) Release all invoices that have a postdate prior to the period end date, or change the posting date using Basic Invoice (AP20.1). Batch Release (AP125) Invoice Release (AP26.1) Mass Invoice Release (AP126) Payment Closing (AP170) Update cash payments, posting all system and manual payments with dates prior to the period end date. Run this program once for a blank process level, and then run it with each or your specific process levels. AP170 also reverses the unrealized gain or loss entry and creates a realized gain or loss general ledger transaction to reflect any exchange rate fluctuation between the invoice date and the payment date. Invoice Distribution Closing (AP175) Post all invoice and tax distributions using a post through date equal to the period end date. If you using intercompany processing, run this program for each company. You must run this program at least once in an accounting period to transfer released invoice distributions to the General Ledger. Standard Cost Calculation (PO139) Calculate and create a reversing journal entry for the difference between the purchase order cost and the standard cost for inventory items. This program is only available for standard cost companies. Paid Invoice Activity Update (AP178) This form is only needed if you are using Billing and Revenue Management and have contracts with the “Exclude Unpaid AP” option set to Yes. List the transactions affected by the payment status updates. If the status indicates that the activity requires payment information to be sent to Project Accounting, AP178 will check if the invoice is paid. If invoices related to distributions have been paid, the Project Accounting API removes the hold-not-paid status from the Activity Transaction records (so the transactions can be included on invoices generated from Billing and Revenue Management). When AP178 is run, the output reflects the selected transactions and lists those that were changed. Invoice Reinstatement (AP190) Reinstate invoices for voided payments. Post all voided payments with a void date prior to the period end date. Unrealized Gain/Loss (AP191) Calculate and create unrealized gain and loss general ledger transactions for payment accrual and unrealized gain and loss accounts for companies that pay nonbase currency invoices. Recurring Invoice Update (AP193) To update recurring invoices. Normally, Payment Closing (AP170) creates the next recurrence of any recurring invoices it processes. If you pay all recurring invoices on or before their due date, you never need to run this program. Run this program if you have any unpaid recurring invoices that are past their due date and want to make sure the liability for the next invoice recurrence posts to the current period to be closed. Employee Advance (EE20.1) Release any advance or expense that has a manual payment applied and has a check date that is prior to the period end date, or remove the payment information. Employee Expense (EE20.2) Company Expense Posting (EE175) Update company-paid employee distributions using the post thru date equal to the period end date. If you use intercompany processing, run this program for each company. Bank Transaction Entry (CB20.1) Release all bank transactions and reconciliation adjustments that have posting dates prior to the period end date, or change the posting date on the transaction. Reconciliation Variance Adjustment (CB30.1) Bill of Exchange Cashing Update (AP180) Update BOE payments for the last year. Bill of Exchange Distribution Posting (AP185) Update BOE distributions. Closing a Period Closing an accounting period is required only if you elected to use closing control in General Ledger. If you are using closing control, you must close your Accounts Payable period before you can close General Ledger. The closing control option is defined in System Control (GL01.1). Use this procedure to close an accounting period. Before you start Before running the period close program, complete the required preparation steps to ensure that your data is ready to be closed (see above section). Steps to close an accounting period 1. Use Period Closing (AP195) to close an accounting period. Consider the following fields. Period Type the general ledger accounting period for which you are processing the accounts payable closing. You define periods on Company (GL10.1). Year Indicate whether the period selected is in the current or next general ledger fiscal year. Update Unreleased Invoices Indicate whether you want to automatically update unreleased invoices with a new posting date. If you have any unreleased invoices with a posting date in the period you are closing, you must do one of the following: • change the posting date to a future period by selecting Yes in this field and running this program, • change the posting date to a future period manually using one of the invoice entry forms, or • release the invoices and run Invoice Distribution Closing (AP175). Update Unapproved Invoices Indicate whether you want to automatically update the posting date on unapproved invoices from PO to allow AP period closing to occur. 2. Use Journal Posting (GL190) to post Accounts Payable journal entries to General Ledger. 3. Use Invoice Accrual Reconciliation (AP136) to reconcile to General Ledger. This program lists the difference between what has been paid (using AP170) and what has been expensed (using AP175). Related Reports and Inquiries To List released invoices for a vendor group, pay group, or invoice company to review invoice totals and details for accuracy Run Open Payable Report (AP230) Create an aged trial balance report for a company, pay group, or vendor group to forecast cash requirement needs Cash Forecasting (AP250) List invoice transactions that make up your invoice accrual account balance as of the date you specify Invoice Accrual Reconciliation (AP136) List invoice payments Cash Payment Register (AP265) List historical invoice distributions processed by Invoice Distribution Closing (AP175) for a company Invoice Distribution History (AP275) List general ledger postings broken down by accounting unit and account Departmental Procurement Expense Report (MM280) Audit posted transactions by period for a specific accounting unit and account Departmental Procurement Expense Inquiry Selection (MM80)