Chapter 5 Strategies in Action - Home

advertisement

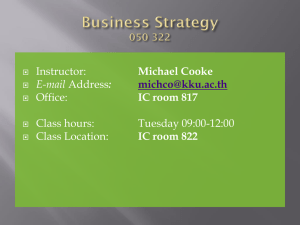

Business Strategy 050 322 Week 9 Instructor: E-mail Address: Office: Michael Cooke michco@kku.ac.th IC room 817 Class hours: Class Location: Friday 09:00-12:00 IC room 822 Term Project • Likely Project Topics – Thai silk – Thai rubber and rubber products – Thai rice – Thai shrimp – Thai cassava – Thai tourist industry • • • • • Choose a topic and a partner by 7-December Advise 10-15 minute presentation form, papers accepted Look at the business using the Five Forces framework Suggest and support a strategy Due 1 February Alliances and cooperation Joint ventures ◦ Globalization is often a driver ◦ Need clear agreements to succeed Merger / acquisition First mover advantages Outsourcing Ch 5 -3 Cooperation among Competitors http://news.cnet.com/8301-13579_3-57561556-37/apple-to-move-a6x-production-from-samsung-to-tsmc-report/?tag=nl.e703&s_cid=e703 In November 2012 Samsung has hiked the price of its mobile processors by 20 percent, but to only one of the Korean technology giant's customers: Apple. Apple bought roughly 130 million Samsung-made mobile processors last year (2011) and more than 200 million chips this year to keep up with demand for the iPhone 5 and the new iPads. Apple first disapproved it, but finding no replacement supplier, it accepted the increase. Apple and TSMC will be testing the waters to see if TMSC can deliver enough solid processors to handle demand and accommodate Apple's notoriously high standards for chip quality. If TSMC can pull it off, Samsung might be pushed out. If not, Apple might have to go back to the drawing board. http://news.cnet.com/8301-13579_3-57548260-37/samsung-toapple-our-chips-will-cost-you-more/?tag=nl.e703&s_cid=e703 The way Microsoft works with its hardware manufacturers changed with the release of Windows RT. Longtime partners are thinking about how to react. Windows RT and the chips running the operating system are different from past software and hardware. Microsoft had to control the partners. Successful products, like those from Apple, have integration of hardware and software. Microsoft took control of partners working with the new Windows RT for low-power ARM chips. ◦ It held regular meetings with the companies in its development program and dictated their collaborators. ◦ Microsoft demanded partner hardware product designs and samples. ◦ "We were required at various points to get their approval on designs and on the development of our product," one hardware executive said. Yet Microsoft was secretly developing its own Surface tablet which would compete with the partners'. Microsoft invited companies to a mysterious press event in June, where it revealed it was working on the Surface tablet. The Surface would be the company's first push into making computer hardware. The news shocked Microsoft's chip and PC partners. Some knew Microsoft was working on its own hardware to sell in its stores, but Microsoft didn't say anything about a tablet or using Windows RT. "We were absolutely surprised they were doing that," another hardware executive said. "Compete with us if you like, but you need to provide a higher degree of clarity in where the line is drawn between the guys...who are our friends and those who are not.“ ◦ For the PC makers, it means their relationship with Microsoft and consumers will change. ◦ While many executives said they want more clarity on when Microsoft is a rival and when it's a friend, Microsoft isn't likely to share details about its future products with partners. In a July regulatory filing MSFT said Surface will compete with the other RT device makers and may reduce computer makers' commitment to Windows. In contrast, Google works with partners to create Google-brand devices instead of building their own. If a PC maker wants to move away from Microsoft, the options are limited. http://news.cnet.com/8301-10805_3-57561849-75/how-microsoft-became-a-control-freak-withtablet-makers/?tag=nl.e703&s_cid=e703 Cooperation among Competitors To succeed both firms must contribute something Contributions might be complementary, such as one firm has distribution capabilities while the other has manufacturing capacity Globalization may cause competitors to enter into an alliance US companies use cross-border alliances try to reduce the cost of entering markets Asian firms tend to use alliances as a means of learning from partners Due to high cost of product development, companies might pool resources Some alliances involve distribution channels and trademarks Kimberly Clarks Huggies are made and distributed through an alliance with Lever Brothers in India In other instances a company will buy another for access to distribution Dangers are unintended information transfers (employees working together) and changes in the nature of the rivalry Alliance agreements might be vague or incomplete Company firewalls might crumble (a firewall is supposed to keep one part of a company from influencing another part) Changes in the balance of power between the companies Strategic Alliances Coalition of organizations to achieve goals for mutual benefit Can be licensing, joint ventures, R&D partnerships Can be informal Types of Strategic Alliances Simple licensing agreements between two partners Market-based alliances (distribution channels, trademarks) Operations and logistics alliances Operations-based alliances (sharing of manufacturing ideas) The Logic Behind Strategic Alliances Defend leading position by access to new ideas, markets, etc Catch-Up by joining forces Remain in a leading business that is not core to the parent Restructure a non-core business (which may be acquired by the alliance partner) Success factors Partners of equal strength Alliance must have independent management with authority Shared vision and support from top management in the parent organizations 8 Licensor receives royalties for use of knowledge assets Licensee pays royalties fees to use the assets Cross licensing is where companies share intellectual property With patent cross licensing each company has a portfolio of patents Rather than have endless and costly ‘patent wars’ companies agree to cross license These agreements are common among technology firms Benefits of licensing ◦ Low commitment of resources ◦ Appealing to small companies that lack resources ◦ No import barriers ◦ Low exposure to political and economic risks ◦ Rapid penetration of global markets Risks from licensing ◦ Revenue may be lower than with other entry modes ◦ Licensee may not be committed ◦ Lack of control over licensee can result in bad image ◦ Licensee may become a future competitor Reduce risks through patents, trademarks, analysis, and carefully worded contracts 9 Other Means to Achieve Strategies Patent Litigation What was said to be a fight over whether the Samsung infringed specific Apple patents, was appropriately seen as corporate warfare waged through courts. This was a consequence of Steve Jobs’ vow to “go thermonuclear” on Google’s Android operating system, which powers Samsung phones. Today it’s practically impossible to build anything without violating a patent of some kind—and risking a multimilliondollar lawsuit for your troubles. Large companies built patent stockpiles as a defensive measure. They were hesitated to sue one another because they knew their target likely had patents that covered similar territory and they could be countersued quickly. “Typically there’s a cross-license that keeps companies from having to assert literally 10,000 or 20,000 patents against each other,” Google general counsel Kent Walker says. Companies have begun banding together to buy costly patent portfolios at the expense of a rival. In 2011 while telecom giant Nortel Networks was going bankrupt, it was valued at less than a billion dollars. Its patents ended up selling at auction for $4.5 billion to a group of companies The group included Microsoft and Apple, two companies famous for their rivalry. Google, a third competitor, dropped out of the bidding at $3.14 billion. Trolling is a multibillion-dollar industry in which Non-performing Entities (NPEs) buy patents. A famous patent-troll case came in 2006, when an NPE said that the RIM BlackBerry infringed on patents. RIM asked the Patent Office to reexamine the patents, Before the patent office could reach a decision, the judge had to decide whether to grant an injunction, which could have shut down RIM’s entire business. Fearing the worst, RIM settled for $612.5 million. Not long after the case was settled, the Patent Office ruled that many of the disputed patents were indeed invalid. http://www.wired.com/opinion/2012/11/ff-steven-levy-the-patent-problem/all/ Tax Strategies and Government Support Grant Thornton tax accountant Peter Vale, who works with multinationals in Ireland says the corporate tax rate of 12.5% may not be a critical factor for companies like Google. Google uses Ireland as a conduit for revenues that end up going to another country where the intellectual property is registered. For Google this country is Bermuda. An investigation conducted by Bloomberg and UK-based tax accountant Richard Murphy last year uncovered a highly efficient tax structure across six territories that meant Google paid just 2.4% tax on operations outside the US. (1) Note: The US tax rate is 35%. Google, the owner of the world's most popular search engine, uses a strategy that is popular among such companies as Facebook Inc. and Microsoft Corp. The method takes advantage of Irish tax law to legally shuttle profits into and out of subsidiaries there, largely escaping the country's 12.5% income tax. The earnings wind up in island havens that levy no corporate income taxes at all. Google's transfer pricing contributed to international tax benefits that boosted its earnings by 26% last year, company filings show. (Bloomberg News 10-21-10) The tactics of Google and Facebook depend on "transfer pricing," paper transactions among corporate subsidiaries that allocate income to low tax areas and attribute expenses to higher-tax countries. This typically involves registering intellectual property in low tax areas such as Cayman Islands. The attraction of Ireland for some companies is that Irish tax law allows flexibility in transfer pricing, in addition to relatively low tax rates and some incentives to locate R&D in Ireland. Global companies retain tax advisory firms (ref. GTLaw.com) to stay within complex home country and Irish laws. Tech companies are able to easily shift “intellectual property, and the profit that goes along with it, to tax havens,” said a former Treasury Department economist, Martin A. Sullivan. “Apple went out of its way to try and ensure that its tax savings didn’t attract too much public attention, because tax avoidance of that magnitude — even though it’s legal and permissible — isn’t in keeping with the image of a socially progressive company.” (NY Times 3-1-13) US Senate investigators are looking into the technology industry, to see if have been broken. The subcommittee is known to be looking at Apple, Google, Hewlett-Packard, Microsoft and firms in such fields as biotechnology. Governments and regions often provide incentives or support to investors or businesses. Sometime the support is indirect. For instance, large banks enjoy an implicit government subsidy from low cost of funds due to the ‘too big to fail’ concept. Recently, the Japanese government has proposed buying factories from Japanese companies in distress, and then leasing those factories back. Political jurisdictions from China to US states offer loans or subsidies for certain types of investment. (1) http://www.guardian.co.uk/business/ireland-business-blog-with-lisa-ocarroll/2011/mar/24/google-irelandtax-reasons-bermuda Franchisor gets royalty payments for use of intellectual property in a designated area for a specific time Franchisee pays royalties and other payments ◦ Note the supply chain clause in Papa John’s (Exhibit 9-6) ◦ Potential for mark-up, also ensures quality of goods Master franchising is often used in foreign markets ◦ Master franchise gets right to sell local franchises in a territory ◦ Master franchise usually commits to a target number ◦ CP All has the master franchise for 7-11 Thailand Benefits: Risks: ◦ Expansion with a minimum investment ◦ Franchisees’ profits tied to their efforts ◦ Access to local franchisees’ knowledge of the local laws and customs – – – – – – Revenues may be lower than with other modes of expansion Lack of a master franchisee in certain markets Limited franchising opportunities in some locations Lack of control over the franchisees’ operations Cultural problems Physical distance 12 Exhibit 9-6: International Franchising with Papa John’s Chapter 9 Copyright (c) 2007 John Wiley & Sons, Inc. 13 Business Process Outsourcing involves functional operations ◦ ◦ ◦ ◦ ◦ ◦ Allows firm to focus on core competencies Flexibility (if needs shift) May be less expensive or of higher quality than internal providers (possible comparison shopping) Can be difficult to unwind a relationship These must be actively managed and control of information might be an issue Total costs might be higher than expected, and quality lower Companies specialize in manufacturing for other companies ◦ ◦ Benefits: Labor cost advantages Tax, energy, raw materials, and overhead savings Lower political and economic risk Focus on core competencies (such as product design, marketing) Access to manufacturing expertise Quicker access to markets (no need to build factories) Risks: Contract manufacturer may become a future competitor Conflicts of interest if the manufacturer has products May lack flexibility (contractor often has other commitments) Backlash from the company’s home-market employees regarding HR and labor issues Issues of quality and production standards ◦ Reducing the risks Keep proprietary design item manufacture in-house Have contingency plans for changes in demand 14 Contract Manufacturing (Outsourcing) Qualities of An Ideal Subcontractor: Flexible/geared toward just-in-time delivery Able to integrate with company’s business Able to meet quality standards Solid financial footings Must have contingency plans for changes in demand Contract manufacturers typically have multiple clients In most cases the manufacturer has to balance client needs No conflicts of interest Major contract manufacturers (electronics total $360bb in 2011): Hon Hai (Foxconn) Taiwan Electronics $102BB Flextronics Singapore Electronics $29BB Jabil Circuit USA Electronics $17BB TSMC Taiwan Semiconductors $14BB Celestica Canada Electronics $7BB Catalent USA Pharma $2BB 15 Joint Ventures Cooperative joint venture No equity in the venture Involves collaboration Common among large multinationals with emerging market partners Equity joint venture – partners have equity stakes JV Benefits: Higher rate of return and more control over the operations Shared capital and risk Sharing of expertise and other resources Access to host country distribution networks Contact with local suppliers and government officials JV Risks: Lack of control Government restrictions often forbid majority stake Multinationals can deploy expatriates for greater control Partner can become competitor Conflicts arising over matters such as strategies, resource allocation, transfer pricing, and ownership of assets like technologies and brand names (Exhibit 9-7) Well planned agreements help reduce conflict Exhibit 9-7: Conflicting Objectives in Chinese Joint Ventures Chapter 9 Copyright (c) 2007 John Wiley & Sons, Inc. 17 Successful Joint Ventures Screen for the right partner (Exhibit 9-8) Obtain information about the partner See if the partner has similar investment objectives Establish clear objectives from the beginning Bridge cultural gaps (perhaps with a middleman) Gain top managerial commitment and respect Use an incremental approach (start on small scale) Create a launch team during the launch phase: (1) Build and maintain strategic alignment (2) Create a system for parent company oversight (3) Manage the compensation of each parent (4) Build the organization for the joint venture (assign responsibilities) 18 Exhibit 9-8: Starbuck’s Coffee’s Partner Criteria Chapter 9 Copyright (c) 2007 John Wiley & Sons, Inc. 19 Wholly Owned Subsidiaries • Acquisitions and Mergers – Merger is when companies of similar size unit • Mergers come with issues about control of the resulting entity. • Can be a defensive move against a powerful rival. – An acquisition is when one company acquires another. • Usually no question about control • Management or private investors might ‘take a company private’ in an LBO • A hostile takeover is when management or the BOD of the target firm is against the transaction – Quick access to local markets by buying an existing company – Synergies, or economies of scale are often cited reasons for mergers – Cross border acquisitions are a way to get access to local brands or distribution networks – Funding is a key to acquisitions • Cash (either from borrowing or retained earnings) • Equity (use of shares as currency) • A combination of cash and equity is most common • A company with high share price may use the price to purchase weaker companies • If a earnings per share rise the acquisition is said to be accretive to EPS • Greenfield Operations – Entire operation is developed by the multinational – Offers the company more flexibility than acquisitions in the areas of human resources, suppliers, logistics, plant layout, and manufacturing technology. 20 Starbucks’ Comments to the IASB • Our business model is built on a dynamic portfolio of numerous, relatively small locations in a given market. Option periods enable us to lock in a site while preserving flexibility to exit the location if circumstances dictate. It is not a foregone conclusion that an option period will be exercised, and the assessment conducted near the end of the original lease term is very specific to the individual site, based not only on that store’s performance but also other factors such as a more desirable location becoming available nearby, changing traffic patterns, and the impact of other stores in the area. Consequently, the effort to assess the “more likely than not” lease term would be a very timeconsuming and imprecise process, involving several hours of work for each lease at inception and again when a renewal or other trigger requires re-evaluation. The goal of achieving comparability across companies – or even among divisions of an individual company – would be difficult to obtain. * • Recall the bankruptcy of Tully’s, burdened with property when demand changed. • Businesses like flexibility, but an option (right to buy or sell that is not an obligation) always comes with consideration for the other party (cost) since they are giving up their own flexibility. • Options to buy or sell are commonly used in of business strategy. A company might place an option to buy on a property, for example. * Financial Times 3-1 -13 Different means to strategy bring different degrees of control ◦ In general lower investment brings less control ◦ Higher investment brings more control ◦ Firms with IP or brand equity tend to want control Flexibility is an important consideration ◦ Contractual arrangements or major investments might be hard to unwind ◦ Note Starbucks approach to retail locations Firms differ in their tolerance and taste for financial loss ◦ Higher investment of resources can bring higher loss (risk) ◦ A wealthy and diversified firm operating in familiar and stable environments can make bigger investments A Summary of Risk and Control Control Financial risk Licensing – low control Low cost = low risk Franchising – low control Little invested = low risk Contract – limited control Low investment = low risk JV – limited control Risk sharing with partner Acquisition – high control High risk Henkel’s Entry into the USA • Henkel AG founded in Germany 1876 – Silicate detergents – First major international expansion 1883 • Armour and Company begins to make soap in Chicago 1888 – By-product of Armour’s meat packing business • Note similarities with P&G’s origins in Cincinnati • Dial soap became very popular in the 1950s – Armour acquired by Greyhound Corporation 1970 • Armour-Dial was the consumer products division • HQ moved from Chicago to Arizona in 1971 – Dial Corporation created in 1996 restructuring – 1997- 2004 Dial Corporation had several top management changes • Henkel buys Dial Corporation in 2004 for $2.9BB (Dial sales $1.3BB) – Value for money segment * – Products well suited to developing markets • Dial soaps and detergents introduced in Russia and China 2005 • Purchase of certain Proctor and Gamble product lines for $275MM in 2006 * http://www.businessweek.com/stories/2005-06-26/online-extra-henkel-dial-ing-for-growth 24 A first mover enters a market or develops a product before others Products are not always pioneered in the home market Firms tend to be early market entrants when ◦ ◦ ◦ ◦ ◦ ◦ They are large firms They have international expertise They have a broad scope of products or services When host countries have favorable risk dimensions When market entry requires little capital Firms tend to enter markets similar to markets in which they already have experience ◦ Note all of the above factors tend to reduce risk to the firm A firm can be a slow mover when products are easily imitated ◦ First mover advantages when firms have similar resources ◦ A larger company can often wait while a small first mover makes mistakes Late entrants may have more favorable business conditions in developing countries 25 Exhibit 9-10: Wal-Mart’s International Expansion Chapter 9 Copyright (c) 2007 John Wiley & Sons, Inc. 26 Strategy Analysis David Chapter 6 Strategy formulation generally encompasses three stages: Input stage (such as external and internal factors) Matching stage (SWOT, BCG, and other tools) Decision stage Formulation should not be mechanical. Factor weightings require judgment Analytical tools should facilitate communication Admit the possibility of bad data Follow up on anomalies in data “The hierarchy of command in an organization, combined with the career aspirations of different people and the need to allocate scarce resources, guarantees the formation of coalitions of individuals who strive to take care of themselves first and the organization second or third.” (David p. 228) “Successful strategists interject new faces and new views in the consideration of major changes. This is important because new employees and new managers have more enthusiasm… new employees do not act as screens against change.” (David p 229) When firms merge, cultures may clash and plans must consider the linking of cultures and strategy. Competitive Analysis SWOT • Strengths, Weaknesses, Opportunities, and Threats analysis (See SWOT Exhibit 8-6.) isolates issues that will be important to the future of the firm • SWOT analysis looks at internal and external factors, followed by matching. • Matching is difficult and requires judgment. – The purpose is to generate feasible alternatives. – Not all scenarios will be used. • Executives can construct alternative strategies from SWOT analysis. – For more on how to do SWOT analysis see David p 210. – SWOT is static (a view frozen in time) and will not show how to achieve advantage in dynamic environments. – Interrelationships among factors need consideration Chapter 8 Copyright (c) 2009 John Wiley & Sons, Inc. 29 The BCG model is based on classification of products or business units into four categories based on market growth and market share relative to the largest competitor. (1) The model is used in multi-division firms. ◦ Divisions may compete in different industries ◦ Focus on relative market-share position & industry growth rates Each product has a product life cycle and each stage in product's life-cycle represents a different profile of risk and return. According to the model a company should maintain a balanced portfolio of products. Having a balanced product portfolio includes both high-growth products as well as low-growth products. However: ◦ Portfolio theory states that companies do not need to diversity, investors do (market cap of less diversified AAPL is 15x HPQ’s). ◦ Subsidizing one product with profit from another can expose the profitable product to competitor pricing action. (1) http://www.maxi-pedia.com/BCG+matrix+model http://www-rohan.sdsu.edu/~renglish/370/notes/chapt11/index.htm STARS (high growth, high market share) - High market share in a growing market. - Stars need a lot of support for promotion and placement. - Stars may become cash cows later in the PLC. QUESTION MARKS (high growth, low market share) - Low market share in growing market. - These are new products and buyers have yet to discover them. - The marketing strategy is to get markets to adopt these products. - Resource intensive and low returns due to low market share. - Need to increase market share quickly or they become dogs. - Need investment to gain market share or need to divest them. CASH COWS (low growth, high market share) - High market share in a mature market. - Cash cows may have high profit margins and generate a lot of cash. - Because of the low growth additional marketing investment is low. - Investments in supporting infrastructure can improve efficiency and cash flow. - Cash cows are the products that businesses strive for. DOGS (low growth, low market share) - Dogs are in low growth markets and have low market share. - Dogs should be avoided and minimized. - Expensive turnaround efforts may be futile. http://www.maxi-pedia.com/BCG+matrix+model http://www.valuebasedmanagement.net/methods_bcgmatrix.htmlh 5 -33