October 9—How is your current economic situation similar and

Read the article and take notes on the following:

Causes of the stock market crash

Public reaction

Broker’s reactions

Government’s response

Optimism about rebuilding of stock market and aiding investors

Speculated short-term and long-term economic effects

Speculated political and social effects

October 11—How is our current economic situation similar and different to what occurred during the Great Depression?

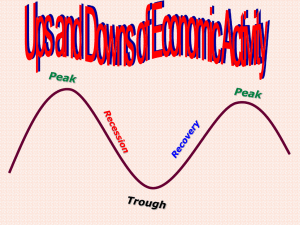

The Great Depression vs. The Great Recession

Stock Market Crash-1929

October 28—DOW dropped 13%

October 29 (Black Tuesday)—it plunged

12% more.

Over the next 3 years, the US stock market declined 89%.

The index didn’t regain its 1929 peak until

1954.

Stock Market Crash-1929

Stock Market

http://www.google.com/finance?client=ob

&q=INDEXDJX:DJI

Purchasing Power

During Great Depression deflation was the major issue.

2010 estimated inflation = 1.6%

Purchasing Power

1929—More than half of US families lived on the edge of or below the minimum subsistence level

Poverty rate in 2009 =14.3% which is 43.6 million Americans

2008 = 13.2 percent, up from 12.5 percent in 2007.

There were 39.8 million people in poverty in

2008, up from 37.3 million in 2007.

Purchasing Power

As of 2008, Household debt increased from about 50% of the GDP in 1980 to a peak of

100% in 2006. Households owe as much as the entire US economy can produce in a year.

Household income dropped 9.8% from

December 2007 to June 2011. Income dropped more after the recession officially ended in June 2009.

Income dropped 3.2% Dec 2007-June 2009

Purchasing Power—Source: NY

Times

US Poverty Thresholds

One person--$10,590

Under 65 years--

$10,787

65 years and over--

$9,944

Two people--$13,540

Householder under 65 years--$13,954

Householder 65 years and over--$12,550

Three people--$16,530

Four people--$21,203

Five people--$25,080

Six people--$28,323

Seven people--$32,233

Eight people--$35,816

Nine people or more--

$42,739

Income inequality— http://motherjones.com/politics/2011/0

2/income-inequality-in-america-chartgraph

Income inequality

Income Inequality

A Harvard business prof and a behavioral economist recently asked more than 5,000 Americans how they thought wealth is distributed in the United States. Most thought that it’s more balanced than it actually is. Asked to choose their ideal distribution of wealth, 92% picked one that was even more equitable.

Income inequality

US International Trade

1929—Demand for US goods declines

2008—Our number one export is our debt.

We sell $700 billion of our debt a year to foreigners.

http://www.usdebtclock.org/

US Debt = 62.3% of GDP as of 2010

US Trade

As of December 2008, U.S. exports of goods and services grew by 12.0% in

2008 to $1.84 trillion, while imports increased 7.4% to $2.52 trillion.

Exports comprised 13.1% of U.S. GDP in

2008. To put in historical terms, exports were 9.5% of U.S. GDP five years earlier

(2003), and 5.3% 40 years ago (1968).

US Exports

Credit Structure

1929-US allies could not pay their debt because Germany and Austria could not pay the reparations and the US was not willing to forgive or reduce the debt.

About 4 million homes have been repossessed since 2006.

4.2 million loans are currently delinquent. It would take 4 years for the market to absorb those houses.

2008

Home Foreclosures

2010

Tariffs

1929—Protective Tariffs

Today—Free trade

International Economy

Great Depression--European banks began to fail in 1931. Germany had high inflation.

2008—Stocks plunge in Europe and Asia.

Tokyo market falls 9.4% on October 8 which is its worse decline since the 1987 crash.

2009—Much like the US, international stock markets have stabilized.

International Economy Today

European Union debt, especially PIIGS

(Portugal, Ireland, Italy, Greece and

Spain)

http://www.economist.com/node/1583802

9

Japanese earthquake and tsunami

Bank Failures during Great

Depression

Bank failures Today

By 2007 the financial sector’s debt was equivalent to 116% of the GDP, compared with a mere 21% in 1980.

To date, US banks have admitted to $334 billion in losses and write-downs. They were able to raise $235 billion in new capital but that is still a $99 billion net loss.

140 banks failed as in 2009

156 banks failed in 2010

74 banks failed in 2011 as of September

2011.

Interest Rates during the Great

Depression

Interest Rates Today

Since the credit crunch began in August 2007,

Bernanke has repeatedly cut the federal funds rate from 5.25% down to an effective rate at one point last week of about 0.25%.

The Federal Reserve has pumped about $1.1 trillion into the financial system in the past 13 months.

Fed said it would leave the interest rate at 0.25% for

“an extended period.”

Policy makers also announced that they would stretch out the Fed’s program to buy up almost $1.5 trillion worth of mortgage-related securities through the end of March. That program is aimed at keeping mortgage rates low and propping up the housing market.

US GNP

Gross National Product = an economic statistic that include GDP plus any income earned by residents from overseas investments minus income made by overseas residents

1929—plummeted from over $104 billion to $76.4 billion in 1932

Today- $13.13 trillion

US GNP

US Unemployment

25% of US workforce was unemployed by

1932 and it never dropped below 15% the rest of the decade.

US unemployment rate as of August 2008 is 6.1%.

US unemployment rate as of August 2009 is 9.7%.

US unemployment rate as of August 2011 is 9.1%

US unemployment during Great

Depression

US Unemployment during Great

Recession

The average length of time a person who lost a job was unemployed increased to

24.1 weeks in June 2009, from 16.6 weeks in December 2007, according to the federal Bureau of Labor Statistics.

Since the end of the recession, that figure has continued to increase, reaching 40.5 weeks in September, the longest in more than 60 years.

US unemployment during Great

Recession

http://www.google.com/publicdata/explor e?ds=z1ebjpgk2654c1_&met_y=unemploy ment_rate&tdim=true&fdim_y=seasonalit y:S&dl=en&hl=en&q=us+unemployment+ rate#ctype=l&strail=false&nselm=h&met_ y=unemployment_rate&fdim_y=seasonalit y:S&scale_y=lin&ind_y=false&rdim=state

&ifdim=state&tdim=true&hl=en&dl=en

Make a venn diagram comparing the Great Depression and the current recession. Use this discussion and notes from class.

How did the Great Depression affect African Americans?

They experience more unemployment, homelessness, malnutrition, and disease than they had in the past and more than whites experience.

More than half still lived in the South, but approx. 400,000 moved to the North.

2 million, half the African American population of the US—were on some form of relief by 1932.

How did the Great Depression affect Latinos?

Approx. half a million Latinos left the US for Mexico in the first few years of the

Great Depression.

How did the Great Depression affect women?

By the end of the Depression, 25% more women were working than had been at the beginning.

Black women suffered massive unemployment because of the decline in domestic service jobs.

As many as half of all African American women lost their jobs in the 1930s.

UN p. 753-760

Herbert Hoover

Agricultural Marketing Act

Hawley-Smoot Tariff

International financial panic of the spring of 1931

Reconstruction Finance Corporation (RFC)

“Bonus Army”

AP p. 795-801

Election of 1932

Emergency Banking Relief Act of 1933

Glass-Steagall Banking Reform Act

UN Ch 26

UN 761-774

Emergency Banking Act

Economy Act

Glass-Steagall Act

Agricultural Adjustment

Act

National Industry

Recovery Act

Tennessee Valley

Authority

Federal Emergency Relief

Administration (FERA)

UN p. 775-789

Second New Deal

National Labor Relations

Act

Social Security Act

Works Progress

Administration (WPA)

“Court-packing plan”

Recession of 1937

Limits and legacies of

New Deal

Fair Labor Standards Act