White Collar Crime Presentation

advertisement

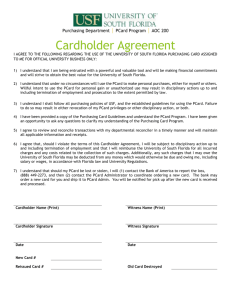

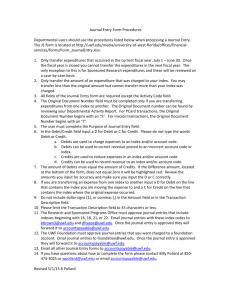

White Collar Crime UWF Employee Symposium Betsy Bowers, Associate Vice President Internal Auditing Overview Fraud Triangle Cash Handling Red Flags of Fraud PCard Responsibilities Special Thanks to the Association of College & University Auditors [ACUA] member institutions for aspects of this presentation. Fraud Triangle Fraud Triangle All Frauds have these three (3) elements: • Financial Pressure ~ This is what causes a person to commit fraud. It is an unsharable financial need (e.g., It’s one where they do not want others, even family, to know the need exists. Examples: unable to pay personal bills, desire for luxury items, gambling, addictions, etc). • Source: Dr. Donald R. Cressey • • Opportunity ~access to monies and ways to conceal their actions. The person must see some way to abuse his/her position of trust to solve their financial problem with a low perceived risk of getting caught. Opportunity is created by weak internal controls, poor management oversight, and/or through use of one’s position and authority. Internal controls and procedures are the only aspects that UWF has control over. Rationalization ~reasons the person committing fraud tells himself that makes his fraud be OK in his mind. Examples are: – – – – I am only “borrowing” the money and I will pay it back. If I don’t do this, I will loose everything (house, car, family) I haven’t received a raise in several years, this money is owed to me. I have to do this to save a family member or loved one. CASH HANDLING Cash Handling – It’s my job Whether you collect lots of money or… ……you collect “pennies”… Cash Handling ……..the principles of good cash handling are basically the same. Segregation of Duties Security Documentation Reconciliation Management Review What is included in “Cash Handling”? It’s not just “cash”. Cash includes the following forms of money: • Coin • Currency • Checks/Traveler’s Checks • Money Orders • Credit Card Transactions • Cash Equivalents • Tokens • Tickets • Stamps • Gift Certificates/Cards Risk? When this occurs with Money-Cash is stolen Cash is lost Statement of Account doesn’t agree with department/units internal records You can expect the following results when cash control is inadequate- No audit trail Finger pointing/Accusations Lost revenues Risk and Controls!! Remember – In the cash collecting process, YOU are just as important as the cash… The controls (rules) that we will discuss are designed to protect both YOU and the cash you are handling. Before cash collection begins….. “The planning checklist” Send written request to Financial Services AVP/Controller (Colleen Asmus) seeking approval for being a cash collection site. Upon approval, Departmental cash handling supervisor develops a plan: Is a change fund needed? How is cash received? Mail or in person? Who is going to collect the cash? Record the cash? How is the cash going to be secured? Who is going to prepare the deposit? How? Where to deposit? When? Frequency? Reconciliation? Management Review? Who needs training? “Making change” Is a change fund needed? DO NOT use coin & currency income to create a change fund!! Never make change from your personal cash! Send written request for change fund to Financial Services AVP/Controller (Colleen Asmus) Keep amount at bare minimum. Talk with the Office of Financial Services…they will help determine how much you need. Keep the cash safe! Change fund money should NEVER be deposited with money (income) collected. = “Collecting the cash” How is cash received? Mail or in person? Who is going to collect the cash? Record the cash? Upon receipt (whether by mail or in person): When a non-vendor (personal) check is received in person, the customer should be requested to show their University ID card or Driver’s License. The ID number should be written on the check. IMMEDIATELY RESTRICTIVELY ENDORSE CHECKS “For Deposit Only, University of West Florida” You can use a stamp with this message or just write it on the back of the check – either is fine. “Collecting the cash” How is cash received? Mail or in person? Who is going to collect the cash? Record the cash? Upon receipt (whether by mail or in person) (continued): Where possible, sound internal controls dictate the Department should direct the vendor to remit any funds directly to the UWF Cashier’s Office. All money received by the unit should be deposited with the Cashiers Office, Bldg 20 East. If a check is received, forward it to the Cashiers Office immediately. DON’T HOLD THE CHECK!! Foundation checks should delivered immediately to the Foundation (Bldg 12). “Collecting the cash” How is cash received? Mail or in person? Who is going to collect the cash? Record the cash? Upon receipt (whether by mail or in person) (continued): For proper segregation of duties, the person collecting cash can not have any other responsibilities related to cash handling. Other cash handling duties that conflict with cash collection include: • balancing change fund and daily collections, • preparing and making deposits, • reconciling statements of account, and • recoding charges and payments to customer accounts. If this is occurring due to lack of staffing, compensating controls such as management oversight and review should be established and used. “Now that we have collected the $$$$$$, what do we do with it?” Secure Balance Deposit Reconcile “Securing the cash” OVER NIGHT STORAGE SAFE Safe is located where it is continually visible for access by unit employees but out of public sight. Change combination ONCE a year or at employee turnover. LOCKING CASH BOX Secure locking cash box in a locking/fire resistant drawer, that is not easily movable, to which access is limited to the person collecting the cash and his/her immediate supervisor. Change location of KEYS periodically. TIP: WHILE IN USE….. Each person collecting cash should have their own change fund so that making change is possible if currency is expected to be collected. Individual change funds should be created from a larger authorized change fund. “Balancing” Comprised of: • Daily Comparison of unit-created records of revenue received with the actual money on hand (e.g.: amount received per cash register total tape/revenue log/pre-numbered receipts book for the day = actual amount of cash, checks and credit card receipts and other cash equivalents collected for the day). • IF , the Balancer investigates and resolves discrepancies. This is called reconciliation. When discrepancies are resolved and/or amounts are equal, the Balancer initials (or signs) & dates the cash register tape, revenue log, or pre-numbered receipts book to document the reconciliation. • To maintain proper segregation of duties, the Balancer should not deposit, collect money, record accounts receivable, or reconcile Statements of Account. “The Deposit” Deposit prepared by someone who didn’t Collect the cash or open the mail. Hand deliver the deposit to the Cashiers Bldg 20 East DAILY (intact) Deposit all funds intact. Intact means the entire amount of money be (income) collected must be deposited so that all receipts are posted as revenue to the Statement(s) of Account. None of the money collected may used for other purposes prior to deposit of the cash. For example, the department/unit cannot use $10 of its money collected to purchase postage and then reduce its deposit by the $10 used. To do so would misrepresent the amount of revenue earned and the amount of expenditures incurred in the department/unit’s accounting records. “Reconciliation” Reconciliation! Management Review! Don’t ever overlook this step!! Reconciliation must be performed by a person with no cash handling responsibilities. Reconcile the deposit ticket to the departmental copy after the deposit has been made. Deposit tickets must be reconciled monthly to the revenue items on the Detail Activity Report. Maintain proof of these reconciliations with initials (or signatures) & date. Reconciling • Verify the processing or recording of transactions to ensure that all transactions are complete, authorized, recorded, & deposited on a timely basis. • Reconciler investigates and resolves discrepancies, then initials (or signs) & dates documentation reconciled. • Reconciler should not collect or deposit money to maintain proper segregation of duties. Management Responsibilities • Establishing an effective internal control system • Delegating responsibility for cash handling duties, maintaining proper segregation of duties • Requiring that staff handling cash be properly trained & follow all procedures of the University’s cash handling & depositing procedures. • Reviewing internal cash records and reconciliations on a regular basis, then initialing (or signing) & dating all documentation reviewed “Management Review” No matter who is collecting, depositing, and reconciling, Management is ultimately accountable. It is management’s responsibility to regularly review the reconciliation process to assure timeliness, accuracy and resolution of all outstanding issues. Segregation of Duties This is the most important control in the cash collection process, and often, the most difficult to manage. A different person should be involved in each step: recording of charges/billing, cash collecting, cash depositing, reconciliation, and management review. Let’s talk about how to manage segregation of duties....... Model – Segregation of the Duties related to cash handling Contact Financial Services to discuss options Reconciliation Billing Receive Cash Deposit Post to Ledger Transporting Cash If you have responsibility for taking the money deposits to the Cashier’s Office, Bldg 20East please use good common sense. • Secure the cash and checks in a locked cash pouch, if available. DO NOT take the key to the pouch with you! • Don’t be conspicuous. To assist you in this, use a backpack, plastic sack or other ordinary receptacle to transport the deposit. • Don’t take the same route or go at exactly the same time every day – don’t be predictable! •See UWF Cash Collection Points and Policy at: •Questions???Contact Coordinator Linda Howard (850-474-2120) OK…… Cash Equivalents If you have the responsibility for cash equivalents such as parking permits, event tickets, stamps or gift cards, remember that they must be treated as if they are cash: • Secure in a locked safe or drawer. • Record the sale. • Balance sale – sales log against the list of available tickets, etc. • Deposit money promptly. • Reconcile sales against statement of accounts. • Resolve all outstanding issues. Departmental Cash Handling Responsibility • Every office handling cash or its equivalent is required to review this presentation. The presentation may be reviewed as a group or individually. • Departmental management must develop their own unit’s cash handling procedures in accordance with these guidelines. These internal procedures should be documented and communicated to the applicable staff. • At a minimum, a unit’s cash handling procedures should be reviewed annually by departmental management for any procedural changes. Your department is responsible for updating its cash handling procedural documentation. • Departmental management must ensure that all current and new staff that handle cash have been adequately trained and meet the requirements of the cash handling guidelines. Red Flags 101 Did you know? • 22% believed that one had to “bend the rules” or act unethically to get ahead, and would do so if they believed they would not get caught. • >40% said they would act unethically if directed by their boss, and would lie to their boss to cover a mistake. • 70% of undergraduates admit at least one instance of cheating. • 20-25% undergraduates admit to five of more instances of cheating. What about Ethics in today’s workforce? 30 Source: Junior Achievement and Deloitte Ethics Surveys What It Means To You • As an employee of this University, be alert to signs of fraud observe the applicable provisions of the Code of Ethics for Public Officers and Employees, to the extent Part III of Chapter 112, Florida Statutes it is essential that all the necessary steps are taken to protect our customer’s from Identity Theft and be there for them, should an instance of ID Theft occur. What are Fraud Red Flags? Indicators of Possible Fraud New-found “wealth” Secretive Absenteeism/ never taking vacation Regular ill health / “shaky” appearance Easily making/ breaking promises and commitments Series of creative/unreasonable explanations Self Centered Inconsistent or illogical behavior Borrowing money from coworkers Easily annoyed Territorial regarding workspace Family problems Evidence of deceit Very social at work Dissatisfied employee Rewriting records (saying for neatness) Extremely devout Financial pressures Medical bills Family responsibilities A spouse losing a job Divorce Debt requirements (e.g. foreclosure, bankruptcy) Maintaining a current lifestyle Car repairs Addictions Education/Tuition Common Forms of Fraud Falsifying timesheets for a higher amount of pay Pilfering stamps Stealing of any kind (e.g., cash, petty cash, supplies, equipment, tools, data, records, etc.) Forgery Lapping collections on customers’ accounts – Holding out cash and then substituting checks to balance Pocketing payments on customers’ accounts, issuing receipts on self-designed receipt books Not depositing all cash receipts Common Forms of Fraud (cont.) Creating fictitious employees and collecting the paychecks Failing to end personnel assignments for terminated employees and collecting the paychecks Paying for personal expenses with University funds; PCard Increasing vendor invoices through collusion Billing for services not rendered and collecting the cash Seizing/intercepting checks payable to vendors Recording fictitious transactions on the books to cover up theft Fraud Danger Signals High personnel turnover Low employee morale No supporting documentation for adjusting entries Incomplete or untimely bank reconciliations Increased customer complaints Write-offs of inventory shortages with no attempt to determine the cause Unrealistic performance expectations Fraud Danger Signals (cont) Rumors of conflicts of interest Using duplicate invoices to pay vendors Frequent use of sole-source procurement contracts Unreconciled accounts Dormant accounts Failure to deactivate or terminate access after employees have separated from a position, unit or the university Suspicious Documents Documents provided for identification appear to have been altered or forged. The photograph or physical description on the identification is not consistent with the appearance of the applicant or customer presenting the identification. Other information on the identification is not consistent with information provided by the person opening a new covered account or customer presenting the identification. What if you suspect an irregularity? UWF Policy P-10.00-10/04 “Policy Against Fraudulent or Wrongful Acts” says: – Employees, with a reasonable basis for believing such acts have occurred, have a responsibility to report such beliefs to their supervisor, appropriate administrator or the Office of Internal Auditing and Management Consulting (x2636) – Contact UWF Police (x2415) or Silent Witness – http://uwf.edu/uwfpolice/silentwitness.cfm PCard Fraud PCard Fraud: Kid Brother to ID Theft Credit card theft is a much larger menace than Identity Theft because it is an easier crime to commit and affects many more. The growing global reliance on plastic in merchant transactions and especially on the Internet is leading to a natural growth in fraud. ~Michelle J. Holland, CFE PCard Fraud in Higher Ed Georgia Tech (2006-2010) $312,000 over 5 year period: D Gamble http://www.youtube.com/watch?v=Buuen1pwJdo $170,000 (M Harris) 2008; sentenced 10 years University of Washington Medical Center (2011) $252,000 over 2 year period University of Georgia (2011) 2 charged in June 2011 2 charged in April 2009 $4,284.27 Coastal Carolina University $83,508 Credit card fraud, misuse found at Florida universities ~Auditor General Reports Personal items and unallowable items: UF-$13,000; FAMU $12,209; FIU $5,000; USF $4,791; FAU $680, and UWF Primary Defenses • Review credit card transactions monthly, if not weekly. • Keep e-mail addresses and phone numbers updated . (Argus Directory Tab to check) • Sign the card. • When the card is not in use, keep in an accessible but secure location. Primary Defenses • The cardholder whose name appears on the front of the card is the only authorized user of the card • Shred any documents/receipts containing card account information before disposal • If you suspect fraudulent activity, notify our PCard administrator (Eric Engelmeyer 474-2029 or eengelmeyer@uwf.edu ) IMMEDIATELY (minutes count), AND notify our PCard Bank ~JP Morgan at 1-800-316-6056 • Keep abreast of our UWF PCard Users Reference Guide and UWF PCard Account/Business Manager Guide PCard Fraud Indicators • Employee – typically late turning in (or fails to turn in) monthly reconciliations to support the charges made. – fails to attach any receipts at all, claiming they were lost. – attaches a receipt, but not the itemized receipt presented to Employee at the time of purchase. If you catch this fraud early enough, the vendor may be able to provide you with the detailed receipt and you can see exactly what was purchased. – presents multiple monthly reconciliations at one time right before the deadline believing that the documentation will undergo very little scrutiny due to the last minute submittal. – submits receipt with long list of items hoping to bury personal items in the long list makes purchases at restaurants for multiple people, and you see children's dinners ordered, or alcohol purchases that may be against company policy. PCard Fraud Indicators Employee makes multiple gas or food purchases over the weekend when he is not traveling for business. The person in charge of reviewing the PCard purchases has a reporting relationship to the Employee submitting the monthly reconciliations, and simply signs off on the reconciliations in fear of retaliation if the reconciliation is scrutinized or questioned. Similarly, if the Employee submitting the reconciliation is the same person in charge of reviewing the reconciliations, this is a situation of the fox guarding the hen house and must be avoided. For example, the Department Head should not be in charge of reviewing his own reconciliations. was recently placed on probation or knows he is in danger of termination, which may motivate Employee to cheat the Employer out of money pretermination. Fraudulent Charge on YOUR PCard • Check daily PCard charges in Banner to immediately identify any fraudulent activity. • Read PCard Fraud on P&C's internal web site • Approve the Fraud Charge in Banner before the 14-day auto-post date: Reference "Approving Fraud Charges" Key in Fraud Commodity Code: 000FRAUD; Key in Fraud Account Code: 70353; Choose the Vendor ID if the vendor is registered with UWF; If the vendor is not registered, use B00011744 for the vendor number and FRAUD as the vendor name; The Cardholder or Managers are responsible for immediately contacting ALL of the following: Bank - to report theft only. Do NOT order replacement card. 1-800-316-6056 IAMC (BBOWERS@UWF.EDU OR 474-2636) UWF Police (474-2415) PCard Administrator (who will order a replacement card) • Eric Engelmeyer 474-2629 eengelmeyer@uwf.edu Risks range from simple mistakes to "avoidance" of the UWF's procurement policies to misuse, and can include: Personal purchases being made on a PCard "Non-compliant" purchases being made - for example: Materials being purchased on sponsored funds that aren't allowable by the sponsor Food being purchased with State funds Purchases being attributed to the wrong account Lack of compliance with bidding thresholds and UWF purchasing processes Potentially paying more than contract prices if buying from a non-contracted vendor Prescribed Procedures • http://uwf.edu/procurement/internal/pages/PCardWorkflow.pdf PCardholder Responsibilities • Review Cardholder Checklist – http://uwf.edu/procurement/PCard_CardholderChkLst_FillIn.pdf Account/Business Manager If I'm an Account or Business Manager, how can I look out for issues? Carefully review all statements and receipts to be sure that all purchases are properly accounted for. Look at the delivery address for goods. Are they being delivered to a home or non-University address? Are there vendors that look like restaurants or caterers on a PCard? Are there multiple purchases from the same vendor, close together, that look like a "split" order? Are there any duplicate charges where a vendor might have doublecharged the University? Is sales tax paid on any of the orders? Ask questions! If you are uncertain of a purchase, ask the cardholder for more details and note them on the statement if you like. Account/Business Manager • Complete an electronic Application and Agreement (in RouteIt) with their Supervisor’s approval. • Complete the following online training: – Banner Basic, PCard Basic, and PCard Manager • Approve Charges Before 14-Day Auto-Post Date (see Approve Charges) • Ensure that the PCard Program’s requirements and guidelines are followed. (see also PCard Manager Approving Guide). – Failure to use the PCard in compliance with UWF Policy, PCard Reference Guide, Application and Agreement, and training will result in the following consequences: • • • • • reimbursing UWF; retraining; suspension or revocation of the PCard; and, possible disciplinary action as stated in the PCard Policy. Daily Checking & Reporting Account/Business Manager Importance of Responsibilities: Managers can 1. 2. 3. 4. 5. quickly detect stolen card or card numbers; quickly detect and report any fraudulent charges; avoid budget errors by completing and/or updating the required four (4) fields in FAAINVT avoid creating inaccurate UWF reports and possible audit findings by approving charges before the 14-day auto-post date; avoid processing additional paperwork (Journal Entry Form) and creating additional work for employees outside of their department to correct the auto-posting. • Communication: Close communication with the Cardholder is imperative especially regarding new vendors being registered with UWF and obtaining receipts to approve charges in a timely manner. PCard Monthly Account Statements The PCard cannot be used to purchase the following: http://uwf.edu/procurement/internal/pages/PCardReferenceGuide.cfm#ProhRestrItem – – – – – NO Personal items NO Employee personal travel expenses NO Entertainment expenses NO Alcohol or Tobacco products NO Gift cards, funding of the Nautilus Card gift certificates, or other cash equivalents – NO Food except as authorized in the PCard Reference Guide – NO Cash advances, cash refunds, or “store credit” – NO transactions made from units of the University -, the Library, and Parking • Please note: The PCard may be used at outsourced businesses such as the UWF Bookstore Important Contacts Your unit's Business Officer or PCard Coordinator UWF PCard Program Administrator, Eric Engelmeyer at 850-474-2629 Email: eengelmeyer@uwf.edu JP Morgan Chase 24 hour Customer Service: 1-800-316-6056 This PPT will reside at: uwf.edu/iamc Questions?