Checklist 11.4: Accounts Payable Controls Risk Assessment Risk

advertisement

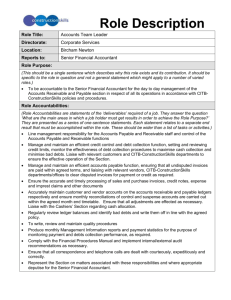

Checklist 11.4: Accounts Payable Controls Risk Assessment Risk Rating Management Controls 1. Does the financial institution log or number vendors invoices as they are received, or use pre-numbered accounts payable vouchers which are subsequently accounted for, in recording amounts due to vendors for goods and services accepted? 2. Do persons, other than those who maintain the records of unmatched items, match receiving documents with vendors’ invoices and follow up on longunmatched receipts? 3. Does a designated official review the results of follow-up on missing documents? 4. Do persons, other than those who maintain the accounts payable control account and subsidiary records, account for completeness of processing of vendors invoices received or purchase vouchers, and follow-up on missing documents? 5. Does a designated official review the results of follow-up on unmatched receipts? 6. Does the financial institution use access control software or application specific access controls, together with appropriate user password procedures and physical controls over access to workstations, LANs, and online terminals, to limit access to accounts payable processing to only those authorized? 7. Does the financial institution use pre-numbered journal entry forms and account for all numbers each period? 8. Has the financial institution established control totals (e.g., totals of appropriate columns in book of original entry) for posting to control accounts before invoices are forwarded to the persons posting to the subsidiary records? 9. Do persons, other than those who prepare purchase orders or receiving records, verify quantities billed by vendors with receiving documents and purchase orders? 10. Do persons, other than those who prepare purchase orders or receiving records, verify invoiced prices with approved purchase orders or agreements? Yes No N/A Risk Rating Management Controls 11. Do persons, other than those who prepare purchase orders or receiving records, verify extensions and footings of invoices? 12. Do financial institution personnel periodically verify the mathematical accuracy of summaries (e.g., by periodic refootings or agreement to independent control totals) used as a basis for general ledger entries? 13. Does the financial institution ensure that invoices have been checked and approved as being valid before posting of amounts to accounts payable control account and subsidiary records? 14. Does a designated official, who did not participate in its preparation, review and approve each journal entry? 15. Does a designated official review and approve vendors’ invoices and vouchers prior to recording as accounts payable? 16. Does a designated official review exception reports on the verification and checking of invoices and vouchers? 17. Do persons, other than those who (1) check or approve accounts payable documents or (2) maintain the accounts payable control account, maintain the accounts payable subsidiary records? 18. Does the financial institution maintain policy statements, procedures manuals, organization charts, and/or other documentation that lists balances, reports, activities, policies, and procedures that are to be substantiated, when they are to be substantiated, how the results should be documented, and to whom they should be communicated? 19. Does the financial institution periodically perform (by computer or users) a reconciliation of the accounts payable subsidiary records with related control accounts? 20. Do supervisory personnel review the results of the reconciliation and investigate any exceptions? 21. Do persons, other than those who (1) maintain a manual accounts payable control account, (2) keep unused checks, (3) prepare checks, (4) handle signed checks, or (5) are involved in computer operations and programming, Yes No N/A Risk Rating Management Controls periodically reconcile accounts payable subsidiary records with related control accounts? 22. Does the financial institution periodically perform a reconciliation of the accounts payable subsidiary records with vendors’ statements by persons with no incompatible duties? 23. Does the financial institution compare recorded amounts of reserves and accruals with subsequent transactions? 24. Does the financial institution maintain policies and procedures to provide prompt follow-up on vendor complaints? 25. Do supervisory personnel periodically compare recorded balances with budgeted amounts and prior periods? Comments: Yes No N/A