Budgetary Policy

advertisement

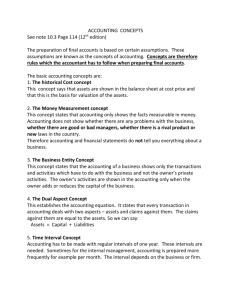

Budgetary Policy Definition Budgetary policy (aka fiscal policy) relates to anticipated changes in the level and composition of federal government revenues (receipts) and expenditures (outlays) for the year ahead. Budgetary policy is regarded as a key macroeconomic policy instrument because the levels of revenues and expenses can have a powerful effect on total expenditure, national production, employment. Features of the tax system Tax mix refers to the balance between direct and indirect taxes as sources of revenue – around 70% is from direct taxation Tax base refers to how broadly the particular tax is applied Tax burden relates to the rates of direct or indirect tax that are applied. Tax burden automatically rises over time due to bracket creep. Principles of Taxation 1. 2. 3. Simplicity – tax should be easy to understand, simple to administer and with minimal compliance costs Fairness – people should be taxed according to their capacity to pay Efficiency – tax should have a fairly neutral impact on the decisions of both consumers and producers Types of Taxation Direct Taxation – is a tax paid directly to the government by the individuals or businesses responsible for the tax. The most important source of direct taxation is: Personal income tax – a tax paid by employed and self employed people according to the amount of income earned. Personal income tax is progressive in nature meaning the more you earn the higher the tax rate. Tax rates 2013-14 The following rates for 2013-14 apply from 1 July 2013. Taxable income 0 - $18,200 $18,201 - $37,000 $37,001 - $80,000 $80,001 - $180,000 $180,001 and over Tax on this income Nil 19c for each $1 over $18,200 $3,572 plus 32.5c for each $1 over $37,000 $17,547 plus 37c for each $1 over $80,000 $54,547 plus 45c for each $1 over $180,000 Types of Taxation Other examples of direct taxation: Company tax is paid on the size of company profit. Capital gains tax: profits gained from the sale of assets such as share, land and investment properties are also taxed Fringe benefits tax is a tax paid by employers on expenditures designed to provide income-inkind to employees such as company cars Minerals resource rent tax is paid by coal and iron ore companies when their profits reach $75M Types of Taxation Indirect taxation is a tax levied on the customer but collected by a third party at the point of sale and subsequently given to the government. Examples include: Goods and Services Tax (GST): 10% on most goods and services added to the price and paid by the customers. It is collected by the business and passed onto the ATO Excise duties – tax levied directly on alcohol, cigarettes, petrol Budget Revenues Budget revenues are the federal government’s incoming receipts of money that help fund government expenditure. Revenue consists of the following types: ◦ Direct taxes levied on the incomes of individuals and companies ◦ Indirect taxes placed on the sale of goods and services and added onto the price of items ◦ Non-tax revenue from sources other than taxation such as the sale of government enterprises or other government owned assets Budget Revenues Budget Expenditures Budget expenditures or outlays represent how the federal government uses the revenue it collects, to provide goods and services for the community. Budget Expenditures Budget Expenditures Budget expenditures are classified in the following ways: ◦ Government consumption expenditure (G1) includes payment of wages and salaries for government employees as well as day-to-day operating expenses for government departments ◦ Government capital expenditure (G2) involves outlays on building new infrastructure ◦ Government transfer payments paid to individuals mainly cover welfare benefits. These are not regarded as G1or G2 because it is the recipient that spends the money. Deficit Budget Outcome When the budget outcome is negative or in deficit. This means the value of government revenues are expected to be less than the value of government expenses Deficit budget: Revenues < Expenses Balanced Budget Outcome A balanced budget outcome is a situation where the value of government revenues is expected to exactly equal the value of expenses Balanced budget: Revenues = Expenses Surplus budget outcome A surplus budget outcome is where the expected value of government revenues is greater than the value of government expenses. Surplus budget: Revenue > Expenses