Dec-11 - Bank Of India

advertisement

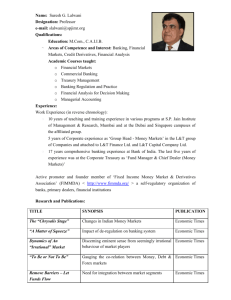

Relationship beyond banking 1 Relationship beyond banking Relationship beyond banking 3 Awards & Accolades Relationship beyond banking 4 Awards & Accolades Relationship beyond banking 5 New Intiatives Relationship beyond banking 6 IT New Intiatives Relationship beyond banking 7 Investor Profile- Shareholding Pattern (%) Mutual Funds, NRIs/FII, 0.43% Corporate 0.62% Bodies, 1.04% Indian Public, 5.58% Dec-11 Promoter(GOI) FI Investor FIs/Banks Insurance Cos, 11.04% Insurance Cos Mutual Funds FIs/Banks, 0.20% Promoter(GOI), 65.86% FI Investor, 15.23% Relationship beyond banking 8 Corporate Bodies NRIs/FII Indian Public Global Footprints – Foreign Branches of the Bank USA (New York & SFO) UK (London + 7branches) Europe -France (Paris) -Belgium (Antwerp) Hong Kong Kowloon Shenzen Singapore Jakarta Ho Chi Minh Japan (Tokyo & Osaka) Phnom Penh Dubai (Representative office) West Indies - Cayman Islands Channel Islands Kenya (Nairobi, Mombasa, Ind Area & Westlands) Tanzania (Subsidiary), Jo’burgh (SA) Relationship beyond banking 9 New Zealand (Subsidiary) Credit Rating - International & Domestic Relationship beyond banking Highlights • Business touched `5,403,668 Mn ( YoY Growth 21.35%) • Deposits stood at `3,072,523 Mn (YoY Growth 21.67%) • CASA at 32.41% • Advances at `2,331,146 Mn (YoY Growth 20.94%) • Operating Profit increased from ` 13,888 Mn to `17,319 Mn (YoY Growth 24.69%) • Net Profit Increased from `6,532 Mn to `7,162Mn (YoY Growth 9.64%) • Net Interest Margin increased from 2.44% to 2.55% (Sequentially) • Non Interest Income increased from ` 6,482 Mn to ` 8,522 Mn (YoY Growth 31.48%) • Gross NPA ratio decreased from 3.02% in Sept 11 to 2.74% in Dec 11 • Net NPA ratio decreased from 1.98% in Sept 11 to 1.78% in Dec 11 • Cost to income ratio reduced from 47.30% in Dec 10 to 40.68% in Dec 11 • ROA improved from 0.56% in Sept 11 to 0.80% in Dec 11 • ROE improved from 12.07% in Sept 11 to 16.97% in Dec 11 Relationship beyond banking 11 Major Business Parameters Quarter ended Dec-10 Mar -11 Jun -11 Sept -11 Dec -11 Business Mix 4,452,795 5,150,401 5,080,339 5,160,250 5,403,668 Deposits 2,525,257 2,988,858 2,930,984 2,990,741 3,072,523 Advances 1,927,538 2,161,543 2,149,355 2,169,509 2,331,146 Operating Profit 13,888 12,053 13,959 15,515 17,319 Net Profit 6,532 4,936 5,175 4,911 7,162 NIM (%) 3.09 2.94 2.19 2.44 2.55 Gross NPA (%) 2.36 2.23 2.69 3.02 2.74 Net NPA (%) 0.88 0.91 1.27 1.98 1.78 Return on Assets(%) 0.89 0.61 0.59 0.56 0.80 Rtn. on Equity (%) 18.50 13.19 13.13 12.07 16.97 Book Value (INR) 274.78 283.24 292.90 301.87 314.96 Relationship beyond banking 12 Deposits Deposits 4.00 3.00 2.53 2.53 3.07 2.99 2.99 2.45 2.15 2.44 Foreign 2.00 Indian 1.00 0.38 0.46 0.55 0.63 0.00 Dec. 10 Relationship beyond banking March 11 Sept.11 13 Dec. 11 Global Domestic Deposits (CASA) 900,000 800,000 692,872 731,385 741,675 587,218 588,384 766,524 785,712 635,129 636,062 700,000 600,000 500,000 556,665 CASA 400,000 SB 300,000 CD 200,000 100,000 0 136,207 144,167 153,291 131,395 149,650 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Relationship beyond banking 14 Domestic Deposits – Category-wise RURAL 286.13 12% SEMIURBAN 299.59 12% Dec'11 METRO 1412.46 58% URBAN 445.03 18% Relationship beyond banking 15 Gross Advances 2.50 FOREIGN INDIAN 1.93 2.00 1.00 2.16 1.63 1.58 0.70 0.59 0.51 0.42 2.33 2.17 1.65 1.51 1.50 0.50 GLOBAL 0.00 Dec'10 Relationship beyond banking March'11 Sept. 11 16 Dec'11 Domestic Advances – Category Wise as on 31.12.2011 Dec 11 RURAL 148.57 9% SEMIURBAN 130.14 8% URBAN 268.07 16% Relationship beyond banking METRO 1086.46 67% 17 Key Sectors (Domestic Credits) Mar-11 Sept. 11 Agriculture 205,400 227,380 196,410 207,799 1.17 SME (Priority & Non Priority) 295,680 300,450 305,240 311,500 5.07 Retail Credit 156,200 166,480 163,950 180,040 15.26 Corporate 851,750 957,160 913,040 933,910 9.65 Relationship beyond banking 18 Dec-11 % Y-o-Y Growth Dec-10 Domestic Credit Sector Dec-10 Mar-11 Sep-11 Dec-11 Gross advances 1,509,020 1,651,470 1,578,640 1,633,250 34,200 33,410 33,090 39,400 15.20% 1,474,820 1,618,060 1,545,550 1,593,850 8.07% 156,200 166,480 163,950 180,040 15.26% -Residential mortgage 75,610 74,780 79,460 85,750 13.41% -Business Mortgage loans 15,190 14,950 16,330 16,710 10.01% -Auto Finance 14,620 14,080 14,940 17,810 21.82% -Educational loan 19,100 19,460 21,340 21,680 13.51% - Others 31,680 43,210 31,880 38,090 20.23% -Food credit -Non-food credit Retail credit Relationship beyond banking 19 % YoY Growth 8.23% Sector Wise Breakup (Non Food Credit) Sector Dec-10 Sep-11 Dec-11 Agriculture 205,400 196,410 207,800 Industry 602,080 635,020 749,150 Services 511,150 550,170 456,860 -Trade 87,200 98,950 108,370 -Others 423,950 451,220 348,490 156,200 163,950 180,040 1,474,830 1,545,550 1,593,850 Retail Credit Total Relationship beyond banking 20 % YoY Growth 1.17% 24.43% -10.62% 24.28% -17.80% 15.26% 8.07% Industry Wise Credit Industry Textiles Dec-10 Sep-11 Dec-11 YoY Growth % 63,690 75,420 77,940 22.37% 39,240 45,150 46,030 17.30% 16,160 20,360 21,410 32.49% 93,390 113,870 120,800 29.35% 23,340 22,750 24,310 4.16% Gems & Jewellery 25,530 30,670 31,470 23.27% Construction 17,730 11,840 9,980 -43.71% Infrastructure 200,980 212,540 254,230 26.50% Other Industries 122,570 155,460 162,980 32.97% Chemicals & Chemical products Rubber , Plastic & their products Basic metal & metal products Vehicles , vehicle parts & Transport equipment Relationship beyond banking 21 Advances to Sensitive Sectors - Domestic SECTOR MAR-11 1,509,030 1,651,472 194,974 203,623 203,490 205,015 207,017 12.68 HOUSING LOAN 75,610 74,783 78,401 79,466 85,756 5.25 MORTGAGE LOAN 15,190 14,950 19,843 17,372 16,709 1.02 COMML. REAL ESTATE 47,013 40,546 38,170 37,297 41,436 2.54 Others(Invest & Indirect) 58,540 73,344 67,076 70,880 63,116 3.86 CAPITAL MARKET 33,044 32,451 34,920 33,896 34,256 2.1 Total Advances REAL ESTATE JUN-11 SEPT.-11 1,611,230 1,578,634 DEC-11 % of Total Advances DEC-10 1,633,251 Out of which Relationship beyond banking 22 RESTRUCTURED ACCOUNTS Includes all facilities of the borrowers Domestic Foreign Global Total Amount Amount Amount > 10 Mn < 10 Mn 78,673 15,451 94,124 12,322 106,446 Additions during Q1 9,000 159 9,159 168 9,327 Less Repayment in Restructured a/c s / Exchange fluctuation -3879 -800 -4679 -79 -4758 83,794 14,810 98,604 12,411 111,015 Additions during Q2 4,396 455 4,851 2,866 7,717 Less Repayment in Restructured a/c s / Exchange fluctuation -6,320 -765 -7,085 -495 -7,580 81,870 14,500 96,370 14,782 111,152 Additions during Q3 21,947 389 22,336 7,769 30,105 Less Repayment in Restructured a/c s / Exchange fluctuation -2,873 -39 -3,912 -608 -4,520 100,944 14,850 114,794 21,943 136,737 As on 31.03.2011 As on 30.06.2011 As on 30.09.2011 As on 31.12.2011 Relationship beyond banking 23 MOVEMENT OF NPA IN RESTRUCTURED ACCOUNTS Domestic > 10 Mn As on 31.03.2011 < 10Mn Foreign Total Amount Amount Global Amount 16,885 1,253 18,138 - 18,138 Additions during Q1 3,591 750 4,341 - 4,341 Less Repayment in Restructured a/c s / Exchange fluctuation -954 -62 -1,016 - -1,016 21,430 1,941 23,371 - 23,371 Additions during Q1 3,271 214 3,485 874 4,359 Less Repayment in Restructured a/c s / Exchange fluctuation 1,044 15 1,059 - 1,059 23,657 2,140 25,797 874 26,671 As on 30.06.2011 As on 30.09.2011 Relationship beyond banking 24 % of Total Restructured A/cs 17.04 21.04 23.20 MOVEMENT OF NPA IN RESTRUCTURED ACCOUNTS Domestic > 10 Mn As on 30.09.2011 < 10Mn Foreign Total Amount Amount Global % of Total Restructured A/cs Amount 23,657 2,140 25,797 874 26,671 23.20 Additions during Q3 5,139 738 5,877 0 5877 - Less Repayment in Restructured a/c s / Exchange fluctuation -299 - -299 -27 -326 - 28,497 2,878 31,375 847 32,222 23.39 As on 31.12.2011 Relationship beyond banking 25 Sector-wise breakup of restructured accounts (>10 Mn) (Domestic) in Q3 SECTOR Agriculture AMOUNT 467.27 Ceramics Chemicals Construction Education Engineering Entertainment Miscellaneous Paper Pharmaceuticals Services Sugar Telecom Textiles Trade Retail Grand Total 437.00 110.55 353.11 141.24 5,688.58 1,911.50 135.90 1,134.42 216.80 377.74 587.97 9,761.96 22.52 268.35 332.72 21,947.63 Relationship beyond banking 26 Restructured A/Cs Slipped (>Rs.10 Mn) –(Domestic) Number of Accounts slipped during Quarter Amount in INR/Mn June 10 Sep t. 10 6 19 6 13 12 22 4 718 2,430 252 972 3,591 3,271 5,139 Relationship beyond banking Dec 10 Mar 11 27 Jun 11 Sept. 11 Dec 11 Sector-wise breakup of restructured accounts Slipped to NPA (>10 Mn) (Domestic) S.No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Sector AGRICULTURE Qtr Dec’10 Qtr Mar’11 Qtr Qtr Qtr Jun’11 Sept.’11 Dec’11 18 15 417 48 40 CHEMICALS 0 14 0 0 0 CRE 0 0 0 0 0 17 103 723 255 0 0 281 1,869 0 0 59 58 409 231 0 0 0 0 0 0 0 354 0 275 0 STEEL 0 88 96 54 0 TEXTILES 0 12 0 1,286 0 TRADING 158 47 77 317 0 CERAMICS 0 0 0 446 0 SUGAR 0 0 0 359 0 Aviation 0 0 0 0 5,112 0 0 0 0 27 252 972 3,591 3,271 5,139 ENGINEERING INFRASTRUCTURE MISC PAPER & PAPER PRODUCTS SERVICES AGGREGATE Relationship beyond banking 28 NPA Movement Dec-10 ( 9 months) Indian Foreign Global Sept. 11 (Half Year) Indian Foreign Global Dec-11 (9 months) Indian Foreig n Global Opening Gross NPA 44,810 4,020 48,830 43,570 4,550 48,120 43,570 4,550 48,120 Total Reduction 20,660 750 21,410 25,300 170 25,470 31,900 200 32,100 Recovery 6,120 220 6,340 5,200 90 5,290 7,890 110 8,000 Upgradation 9,180 170 9,350 2,730 0 2,730 4,000 0 4,000 Write-off 5,360 360 5,720 17,380 80 17,460 20,010 90 20,100 Slippages 17,950 1,180 19,130 42,230 2,830 45,050 46,650 3,600 50,250 Net Addition/Reduction -2,710 430 -2,280 -16,930 -2,650 -19,580 14,750 3,400 18,150 Gross NPA 42,100 4,440 46,540 60,490 7,210 67,700 58,320 7,950 66,260 1,120 0 1,120 2,210 10 2,220 2,390 10 2,400 40,980 4,440 45,420 58,280 7,200 65,480 55,920 7,940 63,860 Less Unrealised Interest on NPA Closing Gross NPA Relationship beyond banking 29 NPA Sequential Ratios Dec-10 Indian Foreign Sept. 11 Global Indian Foreign Dec-11 Global Indian Foreign Global Closing Gross NPA 40,982 4,438 45,421 58,283 7,197 65,480 55,924 7,936 63,860 Total Nettable Credits 27,307 3,200 30,507 18,707 4,328 23,035 18,163 4,766 22,929 19,556 3,185 22,741 12,450 4,266 16,716 11,246 4,714 15,960 7,751 15 7,766 6,257 62 6,319 6,917 52 6,969 15,348 1,254 16,603 39,576 2,869 42,445 37,761 3,170 40,931 Gross NPA Ratio (%) 2.72 1.06 2.36 3.69 1.22 3.02 3.42 1.14 2.74 Net NPA Ratio (%) 1.04 0.30 0.88 2.54 0.49 1.98 2.34 0.46 1.78 74.72 71.74 74.52 59.06 60.14 59.13 60.94 60.06 60.87 NPA Provision Other credits Net NPA Provision Coverage Ratio (%) Relationship beyond banking 30 Sector wise Breakup of NPA - Domestic Agriculture Industry Services Personal Loans DOMESTIC ( TOTAL) FOREIGN GLOBAL (TOTAL) % of Total % of Total NPA Sectoral Advances Dec- 10 Sep- 11 Dec- 11 6,893 11,960 9,153 16.37 4.78 15,753 24,186 22,595 40.41 3.05 12,409 15,785 19,273 34.46 3.54 5,926 6,353 4,900 8.76 3.13 40,982 58,284 55,923 100 - 4,439 7,197 7,936 - - 45,421 65,481 63,859 - Relationship beyond banking 31 - Overseas NPAs Dec -10 Sep- 11 Dec-11 2,169 3,563 3,476 377 768 1,015 REAL ESTATE 1,229 1,424 1,526 OTHERS TOTAL 663 4,438 1,442 7,197 1,919 7,936 TRADE MANUFACTURING Relationship beyond banking 32 Profit – Summary Qtr Dec 2010 Qtr Mar 2011 Qtr Jun 2011 Qtr Sept. 2011 Qtr Dec 2011 Variation Y-o-Y (%) 1 Interest Earned 54,675 63,069 66,335 68,864 71,501 30.77 2 Interest Expended Net Interest Income 3 (1 - 2) 34,806 39,996 47,926 49,825 50,826 46.03 19,869 23,073 18,409 19,039 20,675 4.06 4 Non-Interest Income Total Operating Income 5 (3+4) 6,482 8,231 6,601 8,418 8,522 31.47 26,351 31,304 25,010 27,457 29,197 10.80 6 Operating Expenses 12,463 19,251 11,051 11,942 11,878 -4.69 7 Operating Profit (5 - 6) 13,888 12,053 13,959 15,515 17,319 24.70 8 Total Provision 7,356 7,117 8,784 10,604 10,157 38.08 9 Net Profit 6,532 4,936 5,175 4,911 7,162 9.64 Relationship beyond banking 33 Net Interest Income Qtr Dec-10 Qtr Mar-11 Qtr Jun-11 Qtr Sept.-11 Qtr Dec-11 Variation Y-o-Y (%) TOTAL INTEREST INCOME 54,675 63,069 66,335 68,864 71,501 30.77 INT. INCOME FROM ADVANCES 40,234 43,252 45,959 48,865 51,714 28.53 INT. INCOME FROM INVESTMENTS 12,750 14,119 16,406 18,431 18,414 44.42 1,691 5,698 3,970 1,568 1,373 -18.80 TOTAL INTEREST EXPENDED 34,806 39,996 47,926 49,825 50,826 46.03 INT. EXPENDED ON DEPOSITS 29,879 35,249 43,837 45,055 44,542 49.07 INT. EXPENDED ON BORRROWINGS 2,473 2,340 1,517 2,099 3,564 44.12 INTEREST EXPENSES ON SUBORDINATED DEBT etc. 2,454 2,408 2,470 2,671 2,721 10.88 19,869 23,073 18,409 19,039 20,675 4.06 OTHER INTEREST INCOME NET INTEREST INCOME Relationship beyond banking 34 Non-interest Income Qtr Dec-10 Treasury: Qtr Mar- 11 Qtr Jun- 11 Qtr Sep- 11 Qtr Dec- 11 Variation Y-o-Y (%) 592 1,266 1,097 1,544 712 20.27 1,271 1,334 1,471 1,483 1,239 -2.52 1,863 2,600 2,568 3,027 1,951 4.72 COMMISSION / EXCHANGE / BROKERAGE 2,838 3,468 2,737 3,258 3,204 12.90 OTHER NON-INTEREST INCOME 1,124 1,244 984 1,257 1,509 34.25 3,962 4,712 3,721 4,515 4,713 18.96 658 919 312 876 1,858 182.37 6,483 8,231 6,601 8,418 8,522 31.45 PROFIT FROM SALE OF SECURITIES PROFIT FROM EXCHANGE TRANSACTIONS Sub Total (A) Core-banking Operations: Sub Total (B) RECOVERY IN WRITTEN OFF ACCOUNTS (C) TOTAL NON-INTEREST INCOME (A+B+C) Relationship beyond banking 35 Cost & Yield Ratios –Quarterly Comparison Qtr Dec 10 Qtr Mar 11 Qtr Jun 11 Qtr Sept 11 Qtr Dec 11 INDIAN FOREIGN GLOBAL INDIAN FOREIGN GLOBAL INDIAN FOREIGN GLOBAL INDIAN FOREIGN GLOBAL INDIAN FOREIG GLOBAL N Cost of Deposits 5.61 1.28 4.97 6.08 1.15 5.32 6.87 1.17 6.01 7.07 1.24 6.09 7.06 1.35 5.96 Yield on Advances 10.3 5 3.05 8.78 10.67 2.82 8.81 10.84 2.80 8.89 11.69 2.92 9.41 11.93 3.35 9.45 Yield on 7.93 Investments 4.67 7.71 8.27 4.68 8.04 7.50 4.67 7.37 7.95 4.68 7.82 7.89 4.72 7.74 Yield on Funds 8.29 3.30 7.43 8.71 3.21 7.76 8.58 3.16 7.61 9.20 3.22 8.06 9.27 3.49 7.99 Cost of Funds 5.32 1.89 4.73 5.54 1.95 4.92 6.26 1.97 5.50 6.47 2.04 5.60 6.68 2.17 5.68 N.I.M. 3.49 1.45 3.09 3.38 1.24 2.94 2.43 1.22 2.19 2.77 1.20 2.44 2.91 1.38 2.55 Relationship beyond banking 36 Business Ratios – Quarterly Comparison Dec-10 Mar-11 Jun-11 Sept.-11 Dec-11 Cost to Income Ratio 47.30 61.50 44.19 43.49 40.68 Non Interest income to Operating Expenses 52.01 42.76 59.73 70.49 71.74 Asset Utilization Ratio 1.89 1.48 1.60 1.78 1.94 Return on Assets 0.89 0.61 0.59 0.56 0.80 Return on Equity 18.50 13.19 13.13 12.07 16.97 Earnings Per Share (Basic & Diluted) 12.44 9.37 9.47 8.99 13.10 Book value per share 274.78 283.24 292.90 301.87 314.96 Net worth (Rs. in Mn) 144,511 154,995 160,279 165,191 172,352 Relationship beyond banking 37 Investments Sr . N o. 1 2 Investment Dec-10 Sep- 11 Dec-11 YoY Growth % Domestic 672,539 879,865 820,367 21.98 a) SLR 606,244 681,489 661,117 9.05 b) NON- SLR 66,295 198,376 159,250 140.21 International 44,740 39,930 45,170 0.96 Total (1+2) 717,279 919,795 865,537 20.67 Relationship beyond banking 38 Investments - Domestic Dec-10 AFS 1 SLR INVESTMENTS HTM Dec-11 HFT TOTAL AFS HTM HFT TOTAL 140,070 466,124 50 606,244 1,26,859 5,34,055 203 6,61,117 138,965 464,061 50 603,076 1,25,448 5,32,828 203 6,58,479 1,105 2,063 1,411 1,227 - 2,638 10,311 - 1,59,250 5,44,366 203 8,20,367 OF WHICH: GOVERNMENT SECURITIES OTHER APPROVED SECURITIES M Duration - AFS 2 NON SLR INVESTMENTS - 3,168 2.04 2.33 57,522 M Duration 2.15 TOTAL 197,592 Relationship beyond banking 8,709 64 66,295 1,48,939 0.78 474,833 114 672,539 39 2,75,798 Capital Adequacy –Basel II 31.12.2010 31.03.2011 30.06.2011 30.09.2011 31.12.2011 Tier I Capital 140,700 170,470 170,550 170,840 171,170 Tier II Capital 78,360 78,670 75,630 76,760 78,980 Total Capital 219,060 249,140 246,180 247,600 250,150 Total Assets 2,991,853 3,511,725 3,459,576 3,514,381 3,645,565 Risk Weighted Assets 1,764,450 2,047,620 2,126,990 2,069,270 2,236,300 7.97 8.33 8.02 8.26 7.65 CRAR - Tier II (%) 4.44 3.84 3.55 3.71 3.53 CRAR (%) 12.41 12.17 11.57 11.97 11.18 CRAR - Tier I (%) Relationship beyond banking 40 Productivity 1500 1400 1300 1200 1100 1000 1,464 1,423 1,156 1,239 1,265 1,258 1,310 1,374 1,406 Dec-09Mar-10 Jun-10 Sep-10 Dec-10Mar-11 Jun-11 Sep-11 Dec-11 100 0 91 101 101 103 108 128 125 123 128 Dec-09 Relationship beyond banking Jun-10 Dec-10 41 Jun-11 Dec-11 Way Ahead Relationship beyond banking 42 Relationship beyond banking 43