Payroll and Short Term Liabilities

advertisement

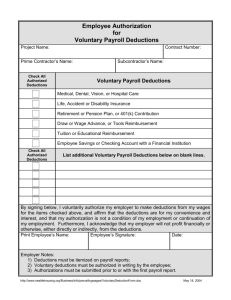

CHAPTER 11 Payroll and Short-Term Liabilities ACCOUNTING FOR CURRENT LIABILITIES A current liability is a debt that can reasonably be expected to be paid 1. from existing current assets or in the creation of other current liabilities and 2. within one year or the operating cycle, whichever is longer. ACCOUNTING FOR CURRENT LIABILITIES Types of liabilities 1) 2) 3) Definite Estimated Contingent CURRENT LIABILITIES 1. Definite Definitely determinable current liabilities include: 1. Operating line of credit 2. Accounts and notes payable 3. Sales tax payable 4. Payroll and employee benefits 5. Unearned revenues 6. Current maturities of long-term debt CURRENT LIABILITIES 2. Estimated Obligation that exists but the amount and timing is uncertain. The company can reasonably estimate the value of the liability. Example: warranty liabilities. PRODUCT WARRANTIES Warranty contracts may lead to future costs for replacement or repair of defective units. Using prior experience with the product, the company estimates what the cost of servicing the warranty will be. Date Particulars costs are accrued Debit Credit Estimated warranty July 31 Warranty Expense 1000 with a Estimated debit to warranty Warranty Payable expense and a 1000 credit to estimated warranty liability. CURRENT LIABILITIES 3. Contingent Contingent liabilities exist when there is uncertainty about the outcome. – Example: a law suit settled against us Contingencies are accrued by a debit to an expense account and a credit to a liability account if and only if: 1. The contingency is likely, and 2. The amount of the contingency can be reasonably estimated. FINANCIAL STATEMENT PRESENTATION Each major type of current liability is listed separately. Often list bank loans, notes payable, and accounts payable first, then other liabilities. COMINCO LTD. Current liabilities (Millions) Bank loans and notes payable Accounts payable and accrued liabilities Income and resource taxes Long-term debt due within one year $ 5 230 36 30 $301 INTERNAL CONTROLS FOR PAYROLL The primary objective of internal accounting control concerning payroll is – To safeguard company assets from unauthorized payrolls. Payroll activities include: 1. 2. 3. 4. Hiring employees Timekeeping Preparing the payroll Paying the payroll 4 Functions of Payroll To prevent fraud, these functions should be assigned to different departments/people. DETERMINING AND PAYING THE PAYROLL Determining the payroll involves calculating 1. gross earnings, 2. payroll deductions, and 3. net pay. GROSS & NET EARNINGS Gross earnings is the total compensation earned by an employee. There are three fixed types of gross earnings: 1. Wages (rate x hours worked) 2. Salaries (set amount) 3. Bonuses (discretionary) Net pay (actually received) = Gross Pay – All deductions. DEDUCTIONS There are two kinds: 1. Mandatory deductions, consisting of: – – 2. Your share (deductions from your paycheque), and Employer’s share (additional contributions and thus additional cost to company) Voluntary Deductions 1. MANDATORY DEDUCTIONS Mandatory deductions consist of: – Canada Pension Plan (CPP, or QPP in Quebec), – Employment insurance (EI) and – Personal Income tax. MANDATORY DEDUCTIONS Your Portion (2010) This is what you pay; it’s deducted from your paycheque by your employer. CPP [(Earnings – 3,500) x 4.95%] • • • • 4.95% of pensionable earnings Max. pensionable earnings are $47,200 Basic exemption is $3,500 So max contribution is $2,163.15 ($47,200 – 3,500) x 4.95% EI (Earnings x 1.73%) • • • • 1.73% of gross pay Max insurable earnings is $43,200 Max. employee contribution $747.36 Max. employer contribution is $1,046.30 ($43,200 x 1.73%) ($747.36 x 1.4) MANDATORY DEDUCTIONS Your Portion (2010) TAX – In Ontario, the tax brackets are as follows: INCOME FED. TAX $0 - $10,382 0% $10,382- $40,970 15% $40,971 - $81,941 INCOME ONT. TAX $0 - $8,943 0% 22% $8,943 - $37,106 5.05% $81,941 – 127,021 26% $37,107 - $74,214 9.15% $127,022+ 29% $74,214 + 11.16% MANDATORY DEDUCTIONS Your Portion (2006) Federal Tax (as an example) is calculated based on a specific rate for each segment of your income. They’re called tax brackets. 120000 29% 100000 As an example, assume this box represents an $80,000 annual salary. 80000 26% 60000 22% 40000 20000 15% 0 0% $80,000 Salary $118,285 + $72,756 - $118,285 $36,378 - $72,756 $9,039 - $36,378 $0 - $9,039 MANDATORY CONTRIBUTIONS Employer’s Share CPP – The employer must match each employee’s CPP contribution. EI – The employer is required to contribute 1.4 times the employee’s EI deductions. Vacation Pay – Accrues at 4% of gross pay Workplace Health, Safety, and Compensation – Employers pay a percentage of their gross payroll for benefits for workers who are injured or disabled in the workplace. 2. VOLUNTARY DEDUCTIONS Voluntary deductions concern: – Charitable donations, – Savings for retirement, and – Other purposes such as union dues etc. The employee must authorize all payroll deductions They do not result in an expense to the employer. PAYROLL An Exercise Calculate the payroll for this month for the following two employees: Employee #1 Annual Salary: $50,000 Employee #2 Hours worked: 160 Hourly rate: $20 Assume worker’s compensation is 2%, union dues is 2%, and pension deductions (RRSP) are 5% of gross pay. JOURNALISING PAYROLL (2010) • Step 1: Record the Payroll expense and recognize all deductions from the employees’ pay cheques. Date July 31 Particulars Debit Credit Salaries Expense 4,166.67 Wages Expense 3,200.00 CPP Payable 324.20 EI Payable 117.64 Payroll Tax Payable 1,243.33 Union Dues Payable 147.33 Pension Contributions Payable 368.33 Salaries and Wages Payable 5,165.80 To record employee payroll deductions for the month and recognize salaries and wages expenses. JOURNALISING PAYROLL • Step 2: Record the employer’s mandatory top-up and contribution costs for CPP, EI, Worker’s Compensation and Vacation Pay. Date July 31 Particulars Employee Benefits Expense CPP Payable EI Payable Worker’s Compensation Payable Vacation Pay Payable Debit Credit 930.92 To record employer payroll costs and contributions for the month. 324.23 164.70 147.33 294.67 JOURNALISING PAYROLL • Step 3: Pay your employees. Date July 31 Particulars Salaries and Wages Payable Cash Debit Credit 5,165.80 To record payment of employees for the month. 5,165.80 JOURNALISING PAYROLL • Step 4: When the time comes, remit the taxes and benefits to the appropriate governments and organizations. Example: Date Aug 31 Particulars CPP Payable EI Payable Payroll Tax Payable Worker’s Compensation Payable Cash Debit Credit 648.45 282.34 1,243.33 147.33 2,321.45 Union Dues Payable Cash 147.33 Pension Contrib. Payable Cash 368.33 147.33 368.33 Do Problems: P11-1A P11-7A P11-8A