10 Myths of Personal Finance: What Wise Stewards Know

advertisement

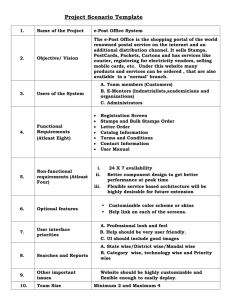

Personal Finance: Another Perspective Bringing Christ into your Personal Finances: Ten Myths of Personal Finance and What Wise Stewards Know August 18, 2015 Bryan Sudweeks, Ph.D., CFA From the BYU Marriott School of Management website on Personal Finance at http://personalfinance.byu.edu 1 Abstract • Some have felt personal finance was just about them, about money, a temporal matter, not required for spiritual growth, and totally separate from the gospel of Jesus Christ. These and other myths abound that are not only wrong, but detrimental to your financial and spiritual health. The reality is that personal finance is simply part of the gospel of Jesus Christ and is an important part of this life experience here on earth. Individuals who have not fallen for these myths have learned important habits that have helped them become wiser financial stewards and better prepared for the inevitable challenges and storms of life ahead. They have learned what “wise stewards know.” 2 3 4 5 6 7 Ten Myths of Personal Finance • • • • • • • • • • Myth 1: The Gospel is hard and expensive Myth 2: Life revolves around me Myth 3: It’s about money Myth 4: It’s all mine Myth 5: Finances are a temporal matter Myth 6: Finance is a man’s responsibility Myth 7: Consumer and credit card debt is OK Myth 8: Budgets are for college students Myth 9: I can start saving getting out of debt later Myth 10: I pay tithing--I have nothing to worry about 8 Myth 1. The Gospel is Hard and Expensive • Some have felt that ‘living the gospel” is hard, that it is too much work and too expensive • They think life would be easier without: • The need to pay tithes and offerings • The need to obey the commandments • The need to share with others • The need to do their visiting and home teaching • The need to serve and work in the church • The reality is different 9 Reality 1. Life is hard (but the gospel makes it easier) • Life is what’s hard • It is making decisions, growing up, overcoming challenges, earning a living, raising children, etc. • But the Gospel makes us free: • Free to make choices and change consistent with who we truly are, children of God • Free to be our best self with a correct vision of who we really are and not blinded by the world • Free from the enticements of the world to forsake all in search of pleasure, pay, power, and prestige • Free from the world’s addictions including illegal 10 drugs, pornography, tobacco, alcohol, and debt Life is Hard (continued) • In fact, living the gospel is very cost effective • While you do pay tithes and offerings: • You live on a budget and live within your means • You earn interest instead of paying it • You know your goals, spend money only on things that you value, and learn to get by on less • You do not waste money on addictive behaviors including debt and interest costs • You do not try to keep up with the neighbors • You spend less money on food as you buy less processed food and more fruits and vegetables • You exercise so you spend less on medical costs11 Myth 2. Life Revolves Around Me • Some believe the statement “it’s all about me” • They think life is: • Only about them • What they want is right, regardless • They decide what they should do • They can do whatever they want, because they don’t have to account to anyone • The reality is different 12 Reality 2. Life is About Others • Thoughtful consideration causes us to think: • • • • Who created us? Who loves us the most? What is our purpose here on earth? Where do we find the most joy? • And when we think longer-term • Who forgives our sins? • Who allows us to live eternally with our families? • Who will judge us at the last day? 13 Life is About Others (continued) • The more we think, the more we realized that this life is not about us, its about what we do with our life • Life is a test, training, or probationary time to show where our heart and our will really are (Alma 42:4) 14 14 Myth 3. It’s All About Money • Some feel personal finance is all about money • Money is the answer to all our problems • We just don’t have enough of it • Someone commented: • If you can solve it with money, it is not a problem • The reality is different 15 15 Reality 3. It's About Faith • 1. It’s about faith • Personal finance is not about money • Its about what the Lord trying to teach us about life and ourselves through personal finance • What lessons can the Lord teach us from personal finance? • The “spiritual and physical” creation • Prioritization (even of good things) • Sacrifice and deferring our wants • Giving and sharing with others • The Law of the Harvest 16 16 It's About Faith (continued) • In most cases, financial problems are behavioral problems, not money problems • We all know what we should do: live on a budget, spend less than we earn, not go into debt, build a reserve, etc. • But other things (ignorance, carelessness, compulsiveness, pride, and necessity) get in the way • For most, it is not a question of knowledge, but of motivation 17 17 It's About Faith (continued) • How do we motivate ourselves and others? • Elder Boyd K. Packer answered this when he said: • True doctrine, understood, changes attitudes and behavior. The study of the doctrines of the gospel will improve behavior quicker than a study of behavior will improve behavior (Boyd K. Packer, “Little Children,” Ensign, Nov. 1986, 16). 18 18 It's About Faith (continued) • The lesson for us then is to understand doctrine • The “doctrine” is we have been commanded in the scriptures and by living prophets to: • Live within our means • Get out of debt • Build a reserve • Save for long-term goals • Teach our children • From this perspective, we see that financial problems are not necessarily problems of money, but problems of faith 19 19 It's About Faith (continued) • 2. It’s about freedom • President Ezra Taft Benson said: • The Lord desires his Saints to be free and independent in the critical days ahead. But no man is truly free who is in financial bondage (“Prepare Ye,” Ensign, Jan. 1974, p. 69). • Obedience to the commandments (which includes the commandment to get and stay out of debt) are critical parts to this freedom promised • And ye shall know the truth, and the truth shall make you free (John 8:32). 20 20 It's About Faith (continued) • 3. It’s about happiness • Happiness is not dependent on the amount of money we earn • Rather, it comes from doing the things that we know are right. The prophet Alma wrote to his wayward son Corianton: • Behold, I say unto you, wickedness never was happiness (Alma 41:10). 21 21 Myth 4: It’s All Mine • Some believe the oft-quoted statement “it’s all mine” • They think they own: • Their belongings • Their education they gained • Their money, savings and investments • They earned these things through their hard work, intellect, effort, sweat, tears, luck and the time they spent • The reality is different 22 22 Reality 4. I Am a Steward 1. Ownership: Everything we have is the Lord’s • The Psalmist wrote: • The earth is the Lord’s, and the fullness thereof; the world, and they that dwell therein (Psalms 24:1). • The Lord is the creator of the earth (Mosiah 2:21), the creator of men and all things (D&C 93:10), the supplier of our breath (2 Nephi 9:26), the giver of our knowledge (Moses 7:32), the provider of our life (Mosiah 2:22), and the giver all we have and are (Mosiah 2:21). 23 23 I Am a Steward (continued) 2. Stewardship: We are stewards over all that the Lord has, is, or will share with us • The Lord said: • Thou shalt be diligent in preserving what thou hast, that thou mayest be a wise steward; for it is the free gift of the Lord thy God, and thou art his steward (D&C 136:27). 24 24 I Am a Steward (continued) 3. Agency: The gift of “choice” is man’s most precious inheritance • President David O. McKay wrote: • Next to the bestowal of life itself, the right to direct that life is God’s greatest gift to man.… Freedom of choice is more to be treasured than any possession earth can give (Conference Report, Apr. 1950, p. 32; italics added). 25 25 I Am a Steward (continued) 4. Accountability: We are accountable for every choice we make • The Lord stated: • For it is required of the Lord, at the hand of every steward, to render an account of his stewardship, both in time and in eternity (D&C 72:3). 26 26 I Am a Steward (continued) • On the questions of what is really ours, Elder Neal A. Maxwell stated: • The submission of one’s will is really the only uniquely personal thing we have to place on God’s altar. The many other things we “give,” brothers and sisters, are actually the things He has already given or loaned to us. However, when you and I finally submit ourselves, by letting our individual wills be swallowed up in God’s will, then we are really giving something to Him! It is the only possession which is truly ours to give! (italics added, “Swallowed Up in the Will of the Father,” Ensign, Nov. 1995, 22). 27 27 Myth 5. Finances are a Temporal Matter • Many think money matters are only temporal matters • They feel that how we manage their money has nothing to do with their spirituality • They feel that scriptures talk only of spiritual things and not temporal issues such as financial matters • Those are left up to them • The reality is different! 28 28 Reality 5. Finances are a Spiritual Matter Money matters are spiritual matters because: • 1. All things are spiritual • The Lord said, “All things unto me are spiritual, and not at any time have I given unto you a law which was temporal” (D&C 29:34) • The Apostle Paul taught that the love of money is evil, not money itself (1 Timothy 6:10) 29 29 Finances are a Spiritual Matter (continued) • 2. Money is a medium of exchange • Elder Sterling W. Sill said: • We can build temples with money, we can send out missionaries with money, we can erect educational institutions, operate hospitals, and pay our tithing with money. … In many ways we can build up the kingdom of God with money (Sterling W. Sill, “A Fortune to Share,” Ensign, Jan. 1974, 60). 30 30 Finances are a Spiritual Matter (continued) • 3. There is no true freedom without financial freedom • President Ezra Taft Benson said: • The Lord desires his Saints to be free and independent in the critical days ahead. But no man is truly free who is in financial bondage (“Prepare Ye,” Ensign, Jan. 1974, p. 69). 31 31 Finances are a Spiritual Matter (continued) • 4. Money is a tool to teach gospel principles • Money is a tool to teach us many things, including the gospel principles of sacrifice, discipline, law of the harvest, and work • Money teaches and reinforces both the spiritual and physical creation, as we develop goals and budgets and work toward them • Money teaches the Law of the Harvest, as we invest for retirement and other goals 32 32 Myth 6. Finance is a Man’s Responsibility • Some think money matters are a priesthood responsibility for married couples • • They think if wives become knowledgeable about financial matters, their husbands will be upset • They reason that since the husband makes the money, husbands get to decide where it goes (This is known as unrighteous dominion) The reality is different! 33 33 Reality 6. Finances are a Shared Responsibility • The Proclamation on the Family states: • By divine design, fathers are to preside over their families in love and righteousness and are responsible to provide the necessities of life and protection for their families. Mothers are primarily responsible for the nurture of their children. In these sacred responsibilities, fathers and mothers are obligated to help one another as equal partners (Proclamation on the Family, 1995). 34 34 A Shared Responsibility (continued) • Marvin J. Ashton counseled: • Management of family finances should be mutual between husband and wife in an attitude of openness and trust. Control of the money by one spouse as a source of power and authority causes inequality in the marriage and is inappropriate. Conversely, if a marriage partner voluntarily removes himself or herself entirely from family financial management, that is an abdication of necessary responsibility (italics added, Marvin J. Ashton, “Guide to Family Finance,” Liahona, Apr. 2000, 42). 35 35 Myth 7. Credit Card, Auto and Consumer Debt is OK • Some consider it is OK for us to go into debt for things, especially things they really want • We can’t have a car without a car payment, can we? • It helps build our credit score—doesn’t it? • The reality is different! 36 36 Reality 7. Debt is Dumb and Slows Growth • Consumer debt slows growth, savings, and is expensive, both economically and spiritually • President James E. Faust stated: • Over the years the wise counsel of our leaders has been to avoid debt except for the purchase of a home or to pay for an education. I have not heard any of the prophets change this counsel (“Doing the Best Things in the Worst Times,” Ensign, Aug. 1984, 41). • Sadly, consumer, auto, and credit card debt not paid off monthly are not included in that short list of acceptable debt 37 37 Debt is Dumb (continued) • President Ezra Taft Benson said: • Pride is a sin that can readily be seen in others but is rarely admitted in ourselves. . . It is manifest in so many ways, such as . . . living beyond our means (italics added, Ezra Taft Benson, “The Faces of Pride,” New Era, Oct. 2003, p. 40). • Perhaps the debt problem is more a problem of pride than it is of money? 38 38 Myth 8: Budgets are only for College Students • Some feel that living on budgets is only for college students • Those more careful with their money, “mature” people like ourselves, don’t need to have a budget • They know where their money goes (it goes to pay their bills, I hope) • The reality is different! 39 39 Reality 8. Every Family Should have a Budget • President Spencer W. Kimball counseled: • Every family should have a budget. Why, we would not think of going one day without a budget in this Church or our businesses. We have to know approximately what we may receive, and we certainly must know what we are going to spend. And one of the successes of the Church would have to be that the Brethren watch these things very carefully, and we do not spend that which we do not have (Conference Report, April 1975, pp. 166-167). 40 40 Every Family Should Have a Budget (continued) • What is a Budget? • It is the single most important tool in helping us attain our personal goals. It is a tool—just like a hammer or a nail • It is the process of planning our spending • It’s making sure our resources are used for the things that matter most—our personal goals • It gives every dollar a name 41 41 Budgeting: The Old Way Income Tithing Expenses Available for Savings Personal Goals 42 42 Budgeting: The Better Way Income Pay the Lord First Pay Yourself Expenses Other Savings Personal Goals 43 43 Every Family Should Have a Budget (continued) Elder L. Tom Perry taught this when he said: • After paying your tithing of 10 percent to the Lord, you pay yourself a predetermined amount directly into savings. That leaves you a balance of your income to budget for taxes, food, clothing, shelter, transportation, etc. It is amazing to me that so many people work all of their lives for the grocer, the landlord, the power company, the automobile salesman, and the bank, and yet think so little of their own efforts that they pay themselves nothing (L. Tom Perry, “Becoming Self-Reliant,” Ensign, Nov. 1991, 64). 44 44 Every Family Should Have a Budget (continued) • Elder Marvin J. Ashton stated: • Some claim living within a budget takes the fun out of life and is too restrictive. But those who avoid the inconvenience of a budget must suffer the pains of living outside of it. The Church operates within a budget. Successful business functions within a budget. Families free of crushing debt have a budget. Budget guidelines encourage better performance and management (italics added, Marvin J. Ashton, “It’s No Fun Being Poor,” Ensign, Sept. 1982, 72). 45 45 Myth 9. I Can Start Later • Some think they do not need to get their finances in order now because they can always start getting our of debt and saving later • It is easy to get out of debt so why worry now, or • I will start saving when I get the “big bucks” later on, or • There is no possible way that I can begin saving now, so why even try • The reality is different 46 46 Reality 9. We must start saving now • If you want to get out of debt, have an adequate retirement, and save for education and missions for yourself and children, you must start now! • You must think long-term now (D&C 43:34) • You cannot put it off saving • Time value of money takes just that--time • The Law of the Harvest is still in effect 47 Myth 10. I Pay my Tithing, I Have Nothing to Worry About Financially • The prophet Malachi said: • Bring ye all the tithes into the storehouse, . . . and prove me now herewith, saith the Lord of hosts, if I will not open you the windows of heaven (Malachi 3:10, 3 Nephi 24:10). • Doesn’t it say that if they pay their tithing, the windows of heaven will open and they will get all the financial blessings they need, regardless of any learning, thought, application, hard work or effort on their part? • The reality is different! 48 48 Reality 10. We Must Learn To Be Financially Wise • The prophet Malachi promised that God will open the windows of heaven • However, there is no promise that the windows of heaven will be financial blessings or that paying tithing will eliminate all our financial problems • We still are stewards over what we have and are, and must learn to live in this increasingly challenging financial world • We have been commanded to be wise: “Oh be wise, what can I say more” (Jacob 6:12) 49 49 We Must Learn to Be Wise (continued) Interesting statistics: • Average per household debt in the U.S. is $14,500 excluding mortgage debt in 2007 • Credit card users pay 12-20% more than cash users • 40% of American families spend more than they earn • The typical family pays $1,200 per year in interest • About 60% of all active credit card accounts are not paid off monthly • Most couples indicate that finances are a major stress on their marriages Source: available upon request 50 50 We Must Learn to Be Wise (continued) • How do to you learn to be wise financially? • There are many sources of good information • It just takes time to sort them out • Let me add two other sources to your list: • 1. The LDS Provident Living Website • www.providentliving.org, then Family Finances • 2. The BYU Marriott School of Management’s Personal Finance website • http://personalfinance.byu.net 51 51 LDS Provident Living Website 52 Provident Living: Finances (continued) 53 The MSM Personal Finance Website 54 www.Personalfinance.byu.edu 55 www.Personalfinance.byu.edu 56 B. Understand What Wise Stewards Know • As I have taught classes in personal finance for over fifteen years, there has come a realization that certain principles are critical in the development of good financial habits • Following are the 10 critical habits that I believe wise men and women should develop about personal finance as they strive to: • Follow our Savior • Keep His commandments, and • Learn the lessons God is trying to teach them • Serve others, and • Stand in holy places 57 57 Wise Stewards Know (continued) • 1. Wise stewards recognize their stewardship • They understand the principles of: • Ownership: everything they have is the Lord’s • Stewardship: they are stewards over all God has blessed them with • Agency: the gift of choice is one of God’s greatest gifts to us • Accountability: they will be held accountable for all their choices, including their financial choices • They recognize that nothing they have is their own—it is all God’s 58 • Then they act accordingly 58 Wise Stewards Know (continued) • 2. Wise stewards have their priorities in order • They seek first the kingdom of God and His righteousness (Matt. 6:33) • They know the best things in life are free: families, relationships, and the gospel of Christ. • Their first goal in life is not wealth, power, or gratification, but eternal life with their families • They seek the true riches first—the kingdom of God and the gift of eternal life • Then they seek the other riches, if they desire, but it is for the intent to do good—to help and 59 bless their families and others (Jacob 2:18-19) 59 Wise Stewards Know (continued) • 3. Wise stewards plan their future early and live their plan (both financial and non financial) • They follow President Ezra Taft Benson’s counsel when he said: “Plan your financial future early, then live your plan” (Ezra Taft Benson, “To the Elderly in the Church,” Ensign, Nov 1989, 4). • They prayerfully establish their goals, live worthy of the Spirit, and with His help achieve their goals • They seek God’s help in all aspects of their lives • This includes planning, setting and achieving goals, budgeting, avoiding debt, building a 60 reserve, and saving for retirement and education 60 Wise Stewards Know (continued) • 4. Wise stewards know it is what they “become” that is most important • They know that money is a tool to teach principles and to help them become more like the Savior • They realize it is not what they “earn”, but what they “save”, that helps them acquire wealth • But more importantly, they know that its not what they “save”, but what they “become,” that makes them more like their Savior • They know that money is only a tool, but an important one, in helping them to learn important lessons in life to help them become more like their 61 Savior Jesus Christ 61 Wise Stewards Know (continued) • 5. Wise stewards know money cannot buy happiness • They know that money can do. It can eliminate a lot of financial and other problems in life and provide security for them and their families • But they know it cannot “buy” them happiness. They must find happiness on their own • They use money to reduce their financial difficulties, be secure in their families, and to bless the lives of others • Then they find happiness in the gospel of Jesus Christ, their families, and serving others 62 62 Wise Stewards Know (continued) • 6. Wise stewards understand assets and liabilities • Assets are things that have value. They are either income-generating (investments, savings, rentals, etc.) or income-consuming (cars, toys, houses, etc.) • They know their choice of assets will largely determine how they will live their lives • Liabilities are things they have borrowed for • Except for an education and a modest home, liabilities should be eliminated • They maximize income-generating assets, minimize income-consuming assets, and eliminate liabilities 63 63 Wise Stewards Know (continued) • 7. Wise stewards understand income • They understand the different types of income • Earned income is income from their job • Passive income is income from investments, generally businesses or real estate. They generally need to do less work to earn this income • Portfolio income is income from financial investments. They do not need to do any work to earn income from these investments • They realize that the best income is not earned income, but portfolio and passive income 64 64 Wise Stewards Know (continued) • 8. Wise stewards know they are responsible • You were given two great gifts: your mind and your time. It is up to you to do what you please with both. With each dollar bill that enters your hand, you and only you have the power to determine your destiny. Spend it foolishly, you choose to be poor. Spend it on liabilities, you join the middle class. Invest it in your mind and learn how to acquire assets and you will be choosing wealth as your goal and your future. The choice is yours and only yours. Every day with every dollar, you decided to be rich, poor, or middle class (Robert Kiyosaki and Sharon Lechter, Rich Dad Poor Dad, Time Warner Book Group, USA, 1998, p. 197). • They choose the harder path of personal responsibility 65 65 Wise Stewards Know (continued) • 9. Wise stewards know they make a living by what they earn, but a life by what they give • They know that life is not measured by what they have or earn, but what they give • They know there is more to life than money-they learn to give more • “For what shall it profit a man, if he shall gain the whole world, and lose his soul?” (Mark 8:36) • They follow the example of the greatest example and giver of all time, even their Savior Jesus Christ 66 66 Wise Stewards Know (continued) • 10. Wise stewards remember the . . . “ifs” • Wise stewards remember three critical things • These are not just the things they must know, but things they must do! 67 67 Wise Stewards Know (continued) • 1. The scriptures make us wise . . . if we learn to read them and obey the commandments • It is not enough to read the scriptures— we must obey the commandments • O remember, my son, and learn wisdom in thy youth; yea, learn in thy youth to keep the commandments of God (Alma 37:35) 68 Wise Stewards Know (continued) • 2. The Savior makes us holy . . . if we repent and utilize His atonement • It is not enough to have a Savior—we must repent and take advantage of His atonement • For, behold, the Lord your Redeemer suffered death in the flesh; wherefore he suffered the pain of all men, that all men might repent and come unto him. And he hath risen again from the dead, that he might bring all men unto him, on conditions of repentance (D&C 18:11-12). 69 69 Wise Stewards Know (continued) • 3. The storms make us strong . . . if we learn the lessons God wants us to learn • It is not enough to have a storm—we must learn from the storm what God wants us to learn • Nevertheless, . . . thou knowest the greatness of God; and he shall consecrate thine afflictions for thy gain (2 Nephi 2:2). • And if men come unto me I will show unto them their weakness. I give unto men weakness that they may be humble; and my grace is sufficient for all men that humble themselves before me; for if they humble themselves before me, and have faith in me, then will I make weak things become strong 70 unto them (Ether 12:27). 70 Wise Stewards Know (continued) • The Brother of Jared knew about storms • When the brother of Jared came to the ocean on his way to the “promised land,” he had two problems, light and navigation. The Lord helped the brother of Jared with both problems • The Lord touched the stones, which gave light • He will help and give us “light” as well • The Lord sent the storms, to blow Jared and his family toward the “promised land” • The storms which He sends to us (like we have today) will take us where He wants us to be so we can return and be with Him 71 71 Wise Stewards Know (continued) • The Lord is in our storms • He is trying to teach us those things which will take us to our “promised land,” to return to His presence • If we learn the lessons He is trying to teach us, we will become stronger, more valiant in the testimony of Christ, more willing and able to serve, and more ready for the next storm • If we fail to learn the lessons from the storm, then the Lord will need to teach us these lessons some other way • It may take more and even more severe storms until we learn what we need 72 72 Summary • Myth 1. The gospel is hard and expensive Reality: Life is hard, but the gospel makes it easier and cheaper • Myth 2. Life revolves around me • Reality: Life is about others • Myth 3. It’s all mine • Reality: We are stewards • Myth 4. It’s about money • Reality: Its about faith, freedom and happiness • Myth 5. Financial matters are a temporal matter • Reality: Financial matters are spiritual matters 73 73 Summary (continued) • Myth 6. Finance is a man’s responsibility • Reality: Finance is a shared responsibility • Myth 7. Credit card, auto, and consumer debt is OK • Reality: Debt is dumb and slows growth • Myth 8. Only college students need to have a budget • Reality: Every family should have a budget • Myth 9. I can start later to get out of debt and save • Reality: We must start now to save and get out of debt • Myth 10. I pay my tithing, I have nothing to worry about financially • Reality: We need to learn to be financially wise. 74 There are good resources available that can help 74 Summary (continued) • Wise stewards develop good financial habits: • 1. They recognize their stewardship • 2. They have their priorities in order • 3. They plan their future early and live their plan • 4. They know it is what they “become” that is most important • 5. they know money cannot buy happiness 75 75 Summary (continued) • Good habits (continued) • 6. They understand assets and liabilities • 7. They understand income • 8. They know they are responsible • 9. They know they make a living by what they earn, but a life by what they give • 10. They remember the three critical “ifs” • The scriptures make us wise, if . . . • The Savior makes us holy, if . . . • The storms make us strong, if . . . 76 76 Summary (continued) • Though times may be tough, we believe a prophet who said: • I testify to you that our promised blessings are beyond measure. Though the storm clouds may gather, though the rains may pour down upon us, our knowledge of the gospel and our love of our Heavenly Father and of our Savior will comfort and sustain us and bring joy to our hearts as we walk uprightly and keep the commandments. There will be nothing in this world that can defeat us. My beloved brothers and sisters, fear not. Be of good cheer. The future is as bright as your faith (italics added, Thomas S. Monson, 77 “Be of Good Cheer,” Ensign, May 2009, 92). 77 Summary (continued) • Wise stewards also know that if they continually strive to obey the Lord’s commandments and seek to be like their Savior Jesus Christ, they will come to know, in spite of all the storms, that: • For verily, I say unto you, that great things await you (D&C 45:62). For great things truly await you as you continue to live, obey, and enjoy the wonderful commandments 78 and blessings of the gospel of Jesus Christ! 78 79