Money Matters! - League of Women Voters

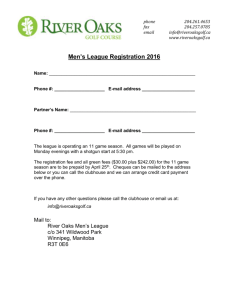

advertisement

Treasure for Treasurers Elaine Wiant Susan Wilson Greg Leatherwood LWVUS Secretary/Treasurer LWVUS Budget Chair LWVUS Director of Finance Convention 2010 What “treasures”are we going to talk about? Part 1: The e-Postcard return Part 2: Stewardship of League finances Part 3: The annual audit or review Part 4: Using education funds effectively Form 990-N The e-Postcard My League is small. Do we need to file the e-Postcard? • Yes. • There are only two exceptions: – Leagues that file Form 990 or Form 990-EZ – Leagues that are included in a group return. • The Form 990 cutoff increases to $50,000 in 2010. Filing is an Easy Four-Step Process 1. Obtain an FEIN for your League, if it doesn’t already have one. 2. NEW!! Telephone the IRS to inform them that your League is a tax exempt organization. 3. Register as a new user on the e-Postcard website. http://epostcard.form990.org/ 4. Create and submit your League’s ePostcard. Does my League need its own Federal Employer Identification Number? • Yes. • The only exception is Leagues covered by a group exemption. • DO NOT use your state League’s FEIN to file your local League’s e-Postcard return. What’s Involved in Getting an FEIN? • Applying for and receiving an FEIN only takes a few minutes; it doesn’t cost anything. • You can apply by mail, but applying online is much quicker and easier -https://sa2.www4.irs.gov/modiein/individual/index.jsp • You must wait up to two weeks after receiving your League’s FEIN before you can use it to file the e-Postcard return. What Information Will I Need to Provide? • Your League’s name • The name, Social Security Number, mailing address and phone number of a responsible contact person • The month and year your League started • A short phrase describing your activities • Whether your League has any employees Step 2: Call the IRS • An officer of your League must call the IRS eight weeks before your League files its first e-postcard. • This is a separate requirement from applying for an FEIN. • The IRS phone number to call is 1-877829-5500, option 2, option 4. Questions the IRS Will Ask 1. Are you an officer? 2. Is your League a distinct legal entity with a governing document? 3. What is your League’s purpose (mission)? 4. Are your League’s gross receipts normally less than $25,000? 5. When does your tax year end? 6. Is your League covered by a group exemption? 7. The name, title and contact information of an officer who will serve as the primary contact. Filing the e-Postcard What Information will my League Need to Provide? • • • • • Its Federal Employer ID number Its tax year-end date Its legal name and mailing address Its website address, if it has one. Confirmation that its annual gross receipts are $25,000 or less. When is the e-Postcard due? • The 15th day of the fifth month following the end of your League’s tax year. • The first e-Postcards were due for tax years ending on or after December 31, 2007. • There is no monetary penalty for filing late. • Three strikes and you’re out – Organizations that fail to file for 3 consecutive years will automatically lose their tax-exempt status. Tips 1. Get started right away. Filing your League’s first e-postcard normally takes 8 weeks. 2. Complete the following tasks in order: – First apply online for an FEIN; – Second, telephone the IRS; – Third, wait eight weeks; and – Fourth, complete your League’s e-postcard. More Tips 3. When applying for an FEIN, specify that your League is a tax-exempt volunteer group. 4. Use a post office box for your League’s mailing addresses. 5. ???? Still More Tips 6. If you need help with the e-postcard form, contact IRS tech support at (866) 2550654 or epostcard@urban.org. 7. Ed funds must file a separate e-postcard return unless they are part of the state or national education fund. Stewardship of League Finances Responsibilities of the League board • Make sure that appropriate internal control policies and procedures are in place. • Recommend adoption of a detailed budget. • Review and understand treasurer's statements. • Make sure that bills are being paid on time. • Approve unbudgeted expenses. • Provide for an annual audit or review. • Consider fidelity bond coverage for those handling money. Responsibilities of the League board --Development! • The League must be adequately financed. • Financial support comes primarily from members. • Support can also come from the community – individuals, foundations, businesses. • Fundraising is a year-round effort built into every activity and project. • Appreciation and recognition help to ensure repeated gifts. Responsibilities of the League board – Budget • Provide input to the committee charged with budget development. • Review the proposed budget prepared by the committee. • Revise it as necessary. • Recommend its adoption by the annual meeting/state convention. The League’s Budget • Reflects all anticipated income and expenses for a fiscal year. • Shows planned growth in members, dues, contributions and League activities. • Includes funds for sending delegates to state and national conventions. • Reflects the League’s obligation to support the League as a whole through the per member payment (PMP) system. Liability Insurance What is It? Insurance against: Negligent acts or omissions • Bodily injury • Property damage • Warranties and exclusions vary Do We Need It? • Evaluate the risks and benefits. • Auditoriums, malls and other public places may require Leagues to have coverage. • Federal law protects volunteers. What Does It Cost? $500 to $750 buys: $1 million per occurrence $2 million annual aggregate $1 million non-owned auto $10,000 of personal property $10,000 of employee dishonesty Where Can We Get It? • Shop around. Most insurance companies and agents offer general liability coverage. • Willis HRH Insurance Telephone: (800) 800-2860 Karen Earp or Robin Rider The Treasurer • • • • • • • • Chief financial officer of the League. Establishes fiscal management procedures. Collects and disburses all League funds. Makes reports to the board and members. Keeps a record of all income and expenditures. Serves as member of budget committee. Forwards PMP to LWVUS and state League. Deposits tax-deductible funds with the appropriate Education Fund. New Treasurer • Receives records from previous treasurer. • Reviews records with previous treasurer. • Registers signatures of treasurer and president at financial institutions. • Learns use of relevant software. • Promptly deposits receipts and pays bills. • Anticipates large expenses. • Assists with annual audit or review. Your League should have WRITTEN financial policies and procedures Internal Controls Procedures to increase likelihood that: • Financial information is reliable • Assets and records are not stolen, misused or destroyed • Policies are followed • Laws and regulations are complied with Internal controls What kinds? Trust is NOT a control Internal controls What kinds? • • • • Authorization and approval Proper documentation Physical security Early detection Recommended Controls • Segregation of duties -- the same person should NOT: – Deposit funds AND record deposits – Write checks AND receive and reconcile bank statements Recommended Controls for income • • • • Open mail promptly. Record, copy and endorse checks upon receipt. Prepare deposit and deliver to bank promptly. Deposit all cash received (don’t use receipts to pay bills or replenish petty cash). • Reconcile income with deposits (not the same person). Recommended controls for expenditures • Board authorizes check signers. • Require more than one signature for checks over a certain amount. • Obtain approval for each transaction, either through the budget or through the board. • Provide and maintain documentation for each check written. Security measures • Checks: – Pre-number checks. – Secure blank checks with a lock. – Limit access to blank checks to authorized person(s). • Computer records – Limit access and protect with passwords. – BACK UP records on a regular basis. – Store backups at another location. The Annual Financial Review or Audit What is the difference between a financial review and an audit? During a financial review, an accountant (or other financially astute person) – Asks questions, – Reviews the financial statements, – Does NOT examine the underlying records. The duties of an auditor include • Verifying that a sample of dues and contributions agrees with the corresponding deposit slips and records • Verifying that a sample of recorded expenses agrees with the corresponding bills and checks • Reviewing internal control systems Steps for Financial Review • Bank statements: – Check recorded receipts against the deposits on bank statements – Investigate discrepancies – Verify bank reconciliations – Account for all checks by number Steps for Financial Review • Dues: – Check dues collected during the year against the current membership total. – Investigate discrepancies (life members, scholarships, etc). Steps for Financial Review • Vouchers – Check records against vouchers. – Are expenses backed by an invoice or voucher? – Are items debited to the proper account? Steps for Financial Review • Budget – Compare income and expenses with budget. • Education Fund – Compare deposits of tax-deductible funds with the records of state or national Ed Fund. – Check transactions with the state or national Ed Fund. Steps for Financial Review • Sample Month – Verify income and expense totals. – Verify individual categories. – Check beginning balance and ending balance. – Make necessary adjustments. Steps for Financial Review • Return to bank statements – Check beginning and ending balances in each account. – Make necessary adjustments. Steps for Financial Review • Prepare report: “We have reviewed the books of the League of Women Voters of _____ as of ______, examined the records of revenue and expenditures and traced beginning and ending cash balances to bank statements. The books are an accurate reflection of the financial condition of the League of Women Voters of _____ as of ______ and the results of its operations and cash flows for the year.” Using Education Fund Money Effectively What is the League’s tax status? The LWVUS is a 501(c)(4) social welfare organization. • The LWVUS carries out lobbying and membership activities. • Dues and contributions to the LWVUS are not tax deductible. The LWVEF is a 501(c)(3) charitable organization. • Its primary activities are educational: – providing election information – hosting public forums – conducting international exchange programs, etc. • Contributions to the LWVEF are tax deductible. How does the LWVEF grant service program operate? • Acts as custodian for charitable gifts raised by your League • Disburses funds to your League upon written request for educational programs • Provides these services free of charge. The LWVEF Carries Out: • Educational projects funded internally • Grant-funded projects (often with passthrough grants for local/state Leagues) The LWVEF sponsors state and local League educational projects through its “grant service” program. Examples of activities that the LWVEF grant service and state or local Ed Funds can sponsor: • Educational forums and materials • Nonpartisan voter service activities • Satisfaction of up to 50% of your League’s per member payment obligation through contributions in lieu of PMP What are the rules for using Ed Fund monies? We recommend that local Leagues participate in already existing state or national education funds, rather than forming their own. Can my League recruit members at an education fund event? • Your League may distribute membership brochures, but the Ed Fund may not pay for creating or printing them. • Speakers can and should urge attendees to join. • Leagues may use the attendee list to solicit members and contributions, but only if the League purchases the list from the Ed Fund at fair value. How do these rules apply to voters guides? A voters guide that is published by or funded by an education fund may include member recruitment information, but that portion of the guide must be paid for by the state or local League. Can we use education fund monies to publicize our voter service activities? • YES. Leagues may use Ed Fund resources to publicize all educational activities, including voter guides, candidate debates, issue forums, voter registration drives, etc. • Make sure the League name, logo and contact information is prominent. League Policy: Ed Fund monies may not be used for “lobbying” as defined by the IRS • Not all advocacy constitutes lobbying. • Lobbying is ONE form of advocacy that – Refers to specific legislation – Includes a “call to action” on that piece of legislation. Ed Fund monies may be used to advocate or present only one side of a policy issue • To educate the public as long as the message does not include a call to action. • To educate legislators as long as legislation has not been introduced May education funds pay delegate expenses for conventions/councils? • Ed Funds may not directly fund delegate expenses. • Ed Funds can provide grants to Leagues to fund participation in educational activities at Convention/Council. • Leagues receiving such grants may only reimburse this kind of delegate expense if delegates document their expenses and attendance at educational sessions. May Ed Funds pay part of the cost of putting on a national or state League convention/council? • Ed Funds may pay for purely educational activities such as panels and other issue-oriented discussions. • Ed Funds may not pay for League governance activities. May our Ed Fund pay for part of the cost of our office space? • Yes. Education funds may pay for their fair share of office space. • Leagues should document what % of their operations are educational. • Prepare a cost-sharing agreement that specifies how costs will be allocated between the League and education fund. May our Ed Fund pay part of the cost of our Voter? • Yes. Ed Funds may underwrite purely educational articles in Voters. • This arrangement should be documented in a written agreement. How can our League pay its PMP through the LWVEF? • Establish an account with the State & Local Grants Service of the LWVEF. • Raise tax deductible monies from members and community and deposit the checks in the grant service account. • Authorize a transfer to the LWVEF operating fund in lieu of PMP. Conclusion 1 File the e-Postcard • Get a tax ID number (FEIN) if your League doesn’t have one. • Call the IRS at least eight weeks before you file the e-Postcard. • Do as much as possible online. It’s quick, easy and free. • Don’t get frustrated — email your questions to epostcard@urban.org or GLeatherwood@lwv.org. Conclusion 2 Pay attention to details • Details of your League’s finances • Details of the internal controls that your League puts in place • Details of the legal issues that affect your League. Conclusion 3 Maximize the use of Ed Funds • Use education funds to cover appropriate portions of operating expenses • Use education funds to help make your League’s educational activities more visible • Remember to ask people to join/donate at educational events Resources – lwv.org • • • • • • League Basics – 5. Money Matters President’s Packet Starting Point (Appendix II.B.4) State and Local League Grants Program Fiscal and Compliance Issues FAQ Education Fund Information