January 22-23, 2014 - Office of the Treasurer

advertisement

University of Tennessee

CBO Meeting

Knoxville, TN

January 22-23, 2014

Conference Room – 8th Floor of Andy Holt Tower

January 22, 2014

IRIS Update – Les Mathews

The IRIS Work Plan for Q3/2014 was distributed.

Preparations are underway for the annual security assessment. There will be a physical review.

The System IT Office’s annual security assessment will focus on the areas where IRIS data is

sent. As we interface with other areas (Parking Services, Banner, etc.), it is important to trace

the data to those systems and access the security of IRIS data sitting on the other systems.

Nothing outside of the University will be looked at.

Richard Smith (HR Team Lead) will be retiring on June 30.

CIP codes are expanding from 4 to 6 digits for every faculty member across the state.

There will be a window on the web page used to view paystub information that will be utilized by

the Treasurer’s Office for policy announcements, open enrollments, etc. It should be out by the

end of January. An estimated 9000 employees view their paystubs online.

Business Plan Accomplishments:

● Application of support packs from SAP. Problem: Browsers

● E-Procurement

● Perfect Forms: can pre-populate with IRIS info and will soon interface with Workflow.

● Space Management & ARCHIBUS – all campuses are using

Next Quarter:

● ESS Travel – looking for recommendations

● Studying Tennessee’s new retirement system called Concord

● Faculty recruitment in TALEO

● Get away from Time Sheets

● Upgrade Space Management to current version

● Work to sync IRIS and NET ID passwords

System Contract Items – Blake Reagan

System contracts are up by 10 over last year. The second version of the contract manual is

expected to be complete in March 2014.

1|Page

Multi-Language Contracts – Blake Reagan

To address inevitable translation differences, when a contract is presented in dual or multiple

languages, the Office of General Counsel proposes that the following language be included:

The parties agree that this Agreement has been drafted and signed in English and _________

[foreign language] and that the parties intend for all versions of this Agreement to contain

identical terms and conditions regardless of the language used. Notwithstanding any other

provision of this Agreement which may appear to be to the contrary, in the event that any

version of this Agreement does not contain all of the terms and conditions included in the

English version, or in the event that any version contains any terms and conditions that either

conflict with, are contrary to, or are in addition to the terms and conditions contained in the

English version, then the English version shall prevail over such other versions and be

controlling and legally binding on the parties.

Proposed Future Practice:

1. Contract offices should propose the new language first.

2. As a fallback, the contract offices should propose the “current” language.

3. If neither option is acceptable to the other party or other parties, then the appropriate CBO

and the CFO should determine whether the business risk is acceptable without either

clause.

E-Procurement Update – Mark Paganelli

The purchase agreement reminder system is almost ready. 1000 purchasers, bonds, etc. have

been loaded.

We are in the design process of:

1. Catalog purchases

2. NCJ’s

3. Requisitions (non-catalog orders)

Purchasing Update – Samantha Johnson

Quarterly reviews will be held with PCS and Dell

Working on getting paper contract bids

Research system on RFP is complete. The technical part of the Reverse Transfer RFP is

being opened. An RFP is out there for search firms.

Prevailing Wage Rate – Mark Paganelli/Samantha Johnson

The Prevailing Wage Act protects wage earners from unfair practices regarding pay on statefunded building and highway construction projects.

As of 12-31-13, we no longer have to go to the state to obtain a fair labor wage rate. This raises

the question, “Does each campus need a policy about paying fair labor rates?” We are still

required to pay federal labor rates for federal funding (construction) projects.

2|Page

Audit and Consulting Strategic Plan – Sandy Jansen

For the last several months, Audit has been working on a strategic plan. Several CBOs

provided feedback on the plan and expressed a desire for greater communication.

ACS is committed to the following goals:

1. Meeting stakeholders’ needs and adding value to the university

2. Fostering the professional development of team members

3. Expanding IT audit coverage

4. Expanding grant & contract audit coverage

5. Expanding the use of data analytics to focus audits on high risk areas

6. Ensuring effectiveness and efficiency

Institutional Compliance is committed to the following goals:

1. Enhancing campus compliance program efficiency and effectiveness

2. Promoting an ethical culture

2014 Audit and Compliance Plan – Sandy Jansen

The annual plan includes five areas of work:

1. Audits required by statute, administrative policy, or based on agreements with

management

2. Audits we expect to be in progress on January 1, 2014

3. Unplanned special projects and investigations

4. Planned engagements based on our assessment of risk

5. Other value-added work

The 2014 Areas of Focus include fraud prevention and detection, compliance, controls,

and departmental expenditure audits. Approximate allocation of time will be spent as

follows:

Required Audits

20%

Completion of Risk-Based or Required Engagements

13%

Unscheduled Projects

21 %

Risk-Assessment Projects

46%

Total

100%

2014 Areas of Focus for Institutional Compliance include:

Campus Compliance Committee Facilitation

UTK – follow up on implementation of plans and address next level of risks.

Memphis – finalize and implement plans of corrective action.

UTIA – develop plans for risks identified in risk assessment and begin implementation.

Risk Assessment

UTM – identify compliance officers and complete risk assessment.

UTC – begin identifying compliance officers.

Promotion of Ethical Culture

System-wide communication of Code of Conduct and Compliance Hotline.

3|Page

Prior year audits are currently in progress. The audit plan will be distributed monthly in its

current form; however, fraud investigations will be omitted.

Security Assessment – Sandy Jansen

In response to the audit committee’s request for an external assessment of our IT Security

Function, BerryDunn was hired by the University to complete the assessment. A draft report

was submitted to the Audit Committee in December with recommendations. This information

has been shared with campus chancellors by President DiPietro. UT is average when

compared to other institutions. The COBIT-Modified Maturity Model was used to give us credit

for what we were currently doing. University-wide recommendations are as follows:

1.

2.

3.

4.

5.

6.

Managerial

Policy Authority and Enforcement of Standards

Roles and Responsibilities

Staffing Levels

Strategic Levels

Training and Awareness

Risk Management

Operational

7. Data Ownership

8. Incident Response

9. Patch and Vulnerability Management

10. Software Development Life Cycle (SDLC)

11. Disaster Recovery

Technical

12. Access Management

13. Network Security

14. Physical and Environmental Security

Foundational Recommendations include:

Policy Development and Enforcement – Information Security policy should be

established at the University System level and the Board of Trustees should approve

university-wide policies.

Staffing Resources – The UT System will need to expand the number of

information security personnel to meet the growing need for security services across

the University system.

Data Ownership – The University System should establish a common standard for

data classification that recognizes University data is owned by the University System,

which has responsibility for protection and retention.

Planning and Leadership – University System-wide IT leadership is important to

enable consistent strategic direction and resource planning.

Training and Education – The University System should adopt NIST standards and

guidelines in developing the most effective training and education.

4|Page

Use of University Controlled Property by Non-Affiliated Person – Matthew Scoggins

A new policy has been drafted regarding the use of university-controlled property by

non-affiliated persons. The purpose of this Chapter is to provide a uniform basis on

which the University of Tennessee will regulate the use of University-controlled property

by non-affiliated persons through reasonable, viewpoint neutral regulations consistent

with and in furtherance of the University’s mission. The use of University-controlled

property shall be restricted to University units, students, student organizations,

employees, volunteers, and guests, except as otherwise expressly provided in the

Chapter. University-controlled property shall not be open for use by a non-affiliated

person for free expression activities except as otherwise expressly provided in the

Chapter. Chancellors are to report any changes by Monday, January 27.

Student Activities Fees – Butch Peccolo

A group of individuals were commissioned to study best practices related to use of student

activity fees being used by other institutions. Although campuses are looking at the

recommendations and putting practices into place, we are fearful of what is coming down the

pike through this legislative session. For example, a bill is being proposed that Universities

should distribute student activity fees based on the headcount of students involved in the

organization. Another question is, “What if a student decides to “opt out of the program side of

the fee?” UTC has a reimbursement policy on their campus if a student wants a refund for a

student event. This policy would be problematic for both UTM and UTK. Memphis fees are not

going to student organizations. It is important that capital and student health fees be protected.

CBOs were reminded of the importance of responding to information requests regarding the

fiscal impact of these bills. A video conference will be held tomorrow (January 23) with

chancellors, student affairs officers and provosts for additional discussion.

Sunset Audit Update – Butch Peccolo, Katie High, Catherine Mizell

The draft had seven findings:

● CCTA – Four findings dealt with CCTA provisions. Programs have been designed for

students to start at a junior college and take 41 hours of general education courses and 19

hours of a pre-major. Students could then transfer to a state university and all credits would

transfer. Programs were only built for paths deemed appropriate. We have been instructed to

do all majors.

● Dual Admissions – There is an agreement in place for high school seniors who apply to

Roane State and UT Chattanooga whereby they can be enrolled in classes at both at the same

time. The law says that we must have agreements with all community colleges.

● Promotion of Transfer Pathway – The auditors want changes on the University’s homepage.

● Background checks - The Legislature passed a law that says that housing residents must

pass a background check before being hired. The statute says that we must obtain fingerprints

of all fingers; we have only gotten the thumbprint in the past.

The UT Foundation does not report on the value of the indirect support UT provides.

This information will be provided so that it can be included on their financial report.

5|Page

Our hearing will be held on February 10 in Nashville

Demo COI Forms and Processing – B. J. Roberts, Mark Paganelli, Ron Maples

PerfectForms is currently being used for completion of T-5s (Moving Allowance), and several

others are in the process of being finalized. The Conflict of Interest form has been used for two

years by UTM and was used last year by UTK. Forms are routed to the supervisor’s name

which is entered. The individual who is to take action will get an email every two business days

until the review is complete. If an employee reports no conflicts, the form is routed directly to

Human Resources. A decision needs to be made regarding how to handle duplicate entries due

to computer glitches. Chris mentioned that there was some faculty push back last year due to

security issues (wanted to know where the data was stored); however, this has now been

corrected. Any other campus/institute that wants to participate this year should let the

Treasurer’s Office know the names of individuals for the workflow stops.

Ideas for improvements for next year should be sent to B. J. Roberts.

Capital Projects/Facilities Planning Update – Robbi Stivers

● Current SBC requests are plentiful

● The sale of the President’s home at 940 Cherokee is complete.

● The 7 ½ acres in Chattanooga will be used for expand parking (600 spaces) & reconstruction

● We have retained some gift property and sold some.

● Work is continuing on lease requests

● Have a healthy list of institutional projects: 200 +/- projects of approx. 1.5 billion.

Capital Outlay & Maintenance – Butch Peccolo

Someone devoted to capital outlay budgeting is in the process of being hired to assist all units

with the development of their annual capital outlay and maintenance budget requests. This

individual will be visiting each campus routinely during the process to facilitate campus/units

efforts and keep the process on time. Early indications from the Governor’s Office are that there

will be no money for capital outlay projects.

Agency for Utility Manager Software – Butch Peccolo

The Baker Center at UTK has been selected by the Tennessee Department of Environment and

Conservation (TDEC) to assist in developing a database of energy use in all state buildings

across Tennessee. This plan supports Tennessee’s Customer Focused Government Plan that

sets a goal of reducing energy consumption 10% by 2017, from the 2012 baseline, for State

buildings. They are asking for 24 months of utility use data for each campus by 2/10/14. A

contact from each campus should be chosen and the name given to Butch.

UT Foundation Funding – Butch Peccolo

Chancellors are convening to discuss future funding. The chancellors are suggesting a $3.7M

cut; however, President DiPietro is suggesting a $2.2M cut. The problem is the loss of

approximately $1M/year in funding provided by the Affinity Card program. The Foundation is

struggling to put together a budget and is working to determine what activities they provide that

are no longer necessary. Campuses/Institutes will ultimately have to fund the increased costs.

Butch will engage President DiPietro to include the CBOs in discussions before an agreement is

made.

6|Page

We have a third amendment to our agreement with the Foundation which is ready to go to the

Comptroller’s Office; however, it will not be submitted until after the Sunset Audit has been

issued and we’ve met before the Oversight Committee.

System-to-Campus Budget Meetings – Ron Maples

The President and CFO will visit each campus/institute to discuss the proposed FY2015 budget.

These meetings will occur prior to the June board meeting. Each campus/institute unit may

provide any handouts that help tell their story. There is no mandatory format.

January 23, 2014

Tax Update – Megan Talley

● Clothing Allowance Reimbursement – The result of an IRS audit of Ohio University

determined that 100 percent of the allowance for athletic and police clothing should be

considered as taxable income. If clothing is specifically required as a condition for employment,

or if they are not worn or adaptable for general use, then the allowance is not considered as

taxable income. However, if they can be worn for everyday use, the cost of the clothing should

be reported as income. If you have a question, call Megan.

● The Employee Request for Job Related Tuition Waiver form on the Payroll website

concerning educational assistance has been updated to make sure that we conform with all

changes outlined in Section 132 of the IRC.

● No major payroll changes for 2014; however the Social Security wage base did increase to

$117,000.

● Amazon is now charging sales tax. We are still exempt. The exemption form is on-line.

● In unrelated business taxable income, our fiscal year 2013 tax return, normally due in midNovember, has been extended to a mid-May due date.

HR Policies and Alternative Leave Rollover Suggestion - All

Several new HR policies have been developed to correct part-time wage problems. These will

go into effect on February 1. The new rule states that individuals will be able to use accrued

leave in FY 2014; however, at the end of December 2014, any amount over the new pro-rated

maximums will roll into sick leave.

A handout displaying the cost of paying out leave balances was distributed. This would be a

one-time payout which would get everyone caught up to the new carryover totals. This new

policy only affects part-time employees. A decision needs to be made soon; however, since the

cost mainly affects Memphis, we will wait until Tony proposes a plan.

7|Page

Nancy questioned if we were considering changing the probationary period of new employees

from six months to one year. Mark said that HR had said no, as this is not in the best interest of

the employee. One option would be to request an extension an employee’s six month

probationary period to one year. Ryan said that he would contact the lawyers to see if there are

any legal ramifications of a 12-month probation period.

OMB Circular Update – Ron Maples

The Omni Circular has been released as Final Guidance so it is law. The government took 8

circulars and combined them into 1. The three that affect us are A - 110, A - 21, and A - 133.

Some things were included in the Final Guidance that weren’t in the Proposed Guidance.

It requires Federal awarding agencies to establish Conflict of Interest policy for all Federal

awards and requires disclosure to awarding agencies of potential conflicts in accordance

with the agency’s policies.

Micropurchase – anything under $3000 can be purchased any way. What is unsaid is that

anything over $3000 must have a competitive bid.

There are new requirements for subrecipient monitoring.

There may be some relief in charging administrative/clerical charges to grants and

contracts.

They put in a de minimis F & A rate for those who don’t have an F&A rate. They can now

charge 10%.

One time 4-year extension on F&A rate

Cost Accounting standards were left in

There is no reference to Effort Certification anymore, but it does say that the institution

should proceed with caution when making decisions on this issue. We still report the

number of Effort Certifications that we have to the auditors.

Audit requirements went from $500,000 to $750,000.

When a non-Federal entity uses a Cash Basis of Accounting to pay for leave, the cost of

leave is recognized in the period that the leave is taken and paid for. Payments for used

leave when an employee retires or terminates employment are allowable as indirect costs

in the year of payment. This can mean 1 of 2 things:

1. If it is really an indirect cost, our cost sharing has just gone way up because we won’t

recover any of that money because we are already over the cap and it would be an

administrative cost. If this is what they are implying, then we need to figure out how to

accrue leave as it is charged and charge it to the grant or contract.

8|Page

2. If a school has a terminal leave rate and the terminal leave would be charged as an

indirect cost. If this is what they are talking about, then we will probably get one. We

would negotiate and put in our rate agreements.

These rules go into effect in December, 2014.

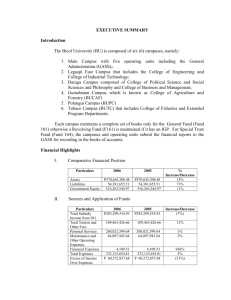

Systems Charge – Ron Maples

The following schedules were presented. Any questions should be directed to Ron Loewen,

Ron Maples, or Butch Peccolo.

9|Page

10 | P a g e

11 | P a g e

12 | P a g e

13 | P a g e

2015 IT Initiative List - All

The following list from James Perry was reviewed. Lack of dollar amounts were noted.

Consensus was that no additional funds should be allocated.

NOTE: When we are ready to go full board on PerfectForms, a server can be purchased to

house information. This would allow for a more secure location of the data. Numerous licenses

can also be purchased for approximately $100,000.

14 | P a g e

TERA Discussion - All

Current System: TERA

7 FTE $642,700

Proposed Research System: EVisions

6 FTE

$213,500 Implementation Fee (David Millhorn has agreed to pay. The suggestion was made

that his office agree to support the Implementation Fee which could increase.)

Annual subscription beginning the 2nd yr: $314,800 split between the campuses

They still need to prove that it will work on multiple campuses.

Possible need: Tableau for reporting @ $47,000

When you look at the net cost, if we go with this hosted system, we should see immediate

savings as well as more after one year. Because it is hosted, we shouldn’t have many

programming needs, mostly communication issues.

The time frame for Proof of Concept is 2-3 weeks for recommendation to the COP.

Vendor Presentation – Dell Representative

Dell is a $60 billion dollar company and Dell Global Services is an $8 billion dollar portion of it.

They are the 3rd largest privately held company in the world. We have a new Sales Team and

contract that takes effect February 1 and will have quarterly meetings with them to discuss any

issues.

David Lynn (Account Rep) David_Lynn@dell.com

Allen Hare (Inside Sales Rep for quotes) Alan_Hare@dell.com

Jason Walton (Specialist-for services & consulting) Jason_Walton@dell.com

New contract:

On-site Systems Engineer: Erin Fortenberry @ OIT

Member purchase program – 2% rebate dollars are available

Printer warranties include lifetime fuser maintenance kits ($300)

Software and peripherals catalog – has Dell and non-branded Dell items

Dell Education Services/On-line training classes

They can streamline the deployment of PC purchases (i.e. If we purchase 100 laptops, they

take care of the set-up of the new and removal of old computers.

Data center operations

Customer support

Specific applications

Microsoft products consulting, deployment, implementation

Cloud computing

{After the presentation, a question was raised regarding the location and expenditure of

rebate money. Butch Peccolo said that a full accounting will be presented at the next

meeting.}

Best Practice Showcase - All

Nancy Yarbrough in Martin said that they are using Perfect Forms to fill out Timesheets and

upload them to IRIS using iPads.

15 | P a g e

Governor’s Budget – Butch Peccolo, Ron Maples

The state is behind about $172 million behind budget projections for this year. Sales tax

revenues are right at or just marginally behind budget. The excise taxes are down 25-30%.

From the state’s perspective, the next 2 or 3 months will be critical in determining how this fiscal

year turns out. There will be no capital outlay. We probably won’t get the full $45 million in

capital maintenance. New money is probably non-existent. They are talking about a 1% COLA

for employees. They are talking about running that through the formula. Because of these

projections, they won’t hold us to the 3% tuition increase. Each campus should determine what

percentage increase is reasonable. The extra money that we’ve asked for for student advising

initiative is not on the table. That would be something that we might want to target for an

incremental tuition increase to cover. They are committed to the Engineering improvements.

They are continuing programs like the Centers for Excellence and the Research Initiative at the

status quo level. So far there are no cuts.

In addition to going to the Governor’s budget hearing, the Senate education budget meeting,

and the House, Ways and Means budget meeting we get to go to the House Education

Committee meeting this year. They’ve asked us series of questions and said that we should

bring the answers with us to the meeting. We need your help with the last two. They are

1.

Do you anticipate the loss of any one-time funding, state or federal, in the FY 2014-15

budget?

2. Is there any impact of Federal sequester on programs?

Please email your responses in the next week or so.

Funding Plant Fund Projects – Butch Peccolo

As projects go forward and are approved by the Building Commission, we want to make sure

that we have the represented funding in place.

State Audit Update – Ron Maples

We have our exit interview on Monday. We still just have the 2 findings: both Financial Aid, one

in Knoxville and one in Martin. The auditors have finished with the NCAA audits, in Knoxville,

Chattanooga, and Martin. They are currently working on an audit to comply with SACs

accreditation for the Health Science Center. Accreditation for Knoxville will include entities

01,02, and18. is coming up and we are hoping for a limited audit.

Fiscal Policy Update – Ron Maples

We are ready to issue the Moving Allowance revision 2/1/14. In CBO review are:

● Student Payments Policy

● Accounts Payable Policy

● Fee Approval Policy

● Surplus Property Policy

● A/P Vendor Policy

● Credit Card Processing Policy

● Independent Contractor Policy

The committee is working on a Gift Card Policy, a Vending and Solicitations Policy, and one for

lotteries, drawings, raffles, and auctions.

16 | P a g e

On the CFO/Treasurer’s Office website there is a link to the minutes to the Fiscal Policy

Committee meetings and all of the CBO meetings. Minutes from other meetings should also be

posted so that they are available to anyone who would like to review them.

Independent Contractor Policy – Mark Paganelli

The due date is the end of January. It is being circulated. We will be requiring a new form to be

completed before a new vendor will be set up for an individual and they will have to sign that

form. This will comply with IRS regulations.

AP Vendor Policy – Mark Paganelli

We are getting out of the check writing business, so when we set up any new vendor we are

going to require them to select between ePayable or ACH Direct Deposit. Checks will be written

on an exception basis. We have paid 25,000 vendors in the last 2 years and we will be sending

letters to those asking them to choose.

Term Employee Discussion – Mark Paganelli, Rob Chance

We’ve done a really good job of cleaning up our Percent of Effort, so we shouldn’t have a big

budget impact when the Affordable Care Act goes into effect. State Insurance was thrilled that

we only have 300. We have a draft policy ready to be circulated this Summer so that we will be

ready to go this Fall, but we have to be in compliance so we are waiting to see if anything

changes. We will have enrolled people and have insurance cards in hand January 2015.

Katie Colocotronis came up with a really good solution for our Term Temporary Employee

situation with retirement and offering other benefits to these long term employees. Rob Chance

will run reports monthly and if they’ve been on the Payroll and paid every pay period for more

than one year, we are going to give that report to HR and we are going to copy the CBOs and

one of three things needs to happen:

1. Move them to regular

2. Terminate them

3. Document in the file why they should remain term

Employee Payroll Debit Cards – Mark Paganelli, Rob Chance

We have about 20 employees who receive their payroll in the form of a debit card. One of our

concerns is that we can’t get our money back if we’ve overpaid them. Also, these cards are

hitting the employees with fees. We are going to do an RFP with Bank of America, First

Tennessee, Regions and others that offer the same thing. We want to protect our employees

by allowing them to go to an ATM without fees, but also allow us to get our money back if we

need to. It would be strictly voluntary.

***********************************************************************************************************

Other points made by Mark Paganelli:

● Risk Management says that the State has agreed to treat any damage from broken pipes, etc.

as one claim.

● Partnership Promise Questionnaires need to be completed by March 15. Biometric screenings

are due July 15.

17 | P a g e

Rob Chance presented information regarding an alternative time collection system, KRONIS,

which would cost $20,000-$30,000 to implement and then $70,000 annually for licenses.

Richard Brown said there is a growing concern among employees that when we do tuition

discounting of differential tuition, employees are now being charged more because we won’t

discount those fees to those specialized programs.

Gail White complimented Susan Wilson in the Treasurer’s Office who works with Procurement

Cards for doing research and making things easier for everyone by accepting scans.

The next meeting will be May 21-22, 2014.

18 | P a g e