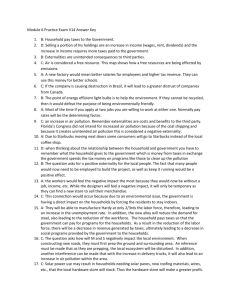

Externalities Ch10

advertisement

Externalities ECO 230 J.F. O’Connor Topics • • • • • Nature of externalities Why do externalities cause market failure Private solutions to an externality problem Failure of private solutions Government policies to solve externality problems Externality • An externality arises when the actions of a person or business have an effect on a third party or bystander. An externality is positive if the effect on the bystander is beneficial and is negative if the effect is harmful • Examples: Acid rain, auto exhaust, barking dogs, basic research, education, loud and nasty music next door, cigarette smoke, wet lands, forests, plant emissions into air or water supplies. Essence of the Problem • Person or firm making the decision does not take account of the effects of its actions on third parties. • Plone producers use a pesticide which gets into the rivers and reduces the volume of fish that are caught • A person investing in education does not take account of the benefits that education to other members of society Private vs. Social Cost • We need to distinguish between the firm’s marginal cost, which we call the private marginal cost (PMC) and society’s marginal cost (SMC) which is the sum of the PMC and the value of the fish lost by the additional unit of output of plones. For a competitive industry, the supply curve is the sum of the private marginal costs of the firms. Market Failure • Market solution: P = PMC • Socially efficient solution, P = SMC • Negative externality, PMC<SMC, so market solution gives more output and a lower price than is efficient. Hence, market failure. • See graph. Market solution: P=$.5, Q=70 Efficient solution: P=$.7, Q=60 Figure1. TheMarket for Plones NegativeExternality 1.2 P r i c e $ p e SMC 1.0 0.8 S 0.6 0.4 , D 0.2 0.0 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95 100 Quantity(bil. lb. per year) Positive Externality • Apple trees provide bees with nectar for making honey. Apple trees generate a positive externality for bee keepers but apple growers don’t take account of that in their decisions. • Now, SMC < PMC. Market solution gives less output and a higher price than is efficient • See graph. Resolving Externality Problems • Key is to internalize the cost or benefit of the externality. • Alternatives: private action or government action. • Private solutions likely to work when bargaining or transaction costs are low. That is the essence of the Coase Theorem Solving the Plone Problem • The plone firms: 1. buy the fishing rights on the affected rivers 2. pay the fishermen $0.3 per unit of plones • Government: 1. Limits the output of plones by means of quotas 2. imposes a tax of $0.3 per unit on plone producers Private Solutions • If the ownership of the fishing rights are clear and they can be purchased without major bargaining cost, then #1 will work. • If fishermen are organized and negotiations between the parties are not too costly, #2 will work. • If both industries are perfectly competitive, transaction costs are likely to be high Government Solutions • Number 1 will be costly to administer and if quotas are not tradable will lead to inefficiencies over time. If trading of quotas is allowed, some of the inefficiencies are eliminated • Number 2 will give a socially efficient outcome Solving the Apple Grower Problem • Apple grower generates a positive externality and the beekeeper generates a positive externality for the apple grower, it seems likely that both can develop a mutually beneficial arrangement without incurring significant transaction cost. • Other cases where private solution might work? Other Examples of Externalities • • • • • • • Education Auto emissions of CO and CO2 Power plant emissions of SO2 Wetlands Forests Dogs – moral suasion? Charitable giving Power Plant Pollution • Command and control – pollution quota or emission permit – sets quantity of pollution • Pigovian taxes – sets price of pollution • Tradable pollution quotas or permits • Note: the optimal level of pollution is not zero • Economists favor taxes because it provides an incentive to find ways to avoid the tax by finding ways to reduce pollution Tradable Pollution Permits • Non tradable permits provide no incentive to reduce pollution beyond the level in the permit. • Steel mill and paper mill are both to reduce pollution to 300 tons of glop per year • Steel mill wants to increase emissions by 100 tons per year. Paper mill is willing to reduce its emission by 100 tons in return for a payment of $5 million. Should EPA allow the trade? (Voluntary trade is mutually beneficial!) Conclusions • • • • Encourage activities with positive externalities Discourage activities with negative externalities Key is to internalize the externality Private solutions likely to work if transaction costs are low • Taxes are usually better than regulations • Tradable permits better than regulations