other regulatory and statutory disclosures

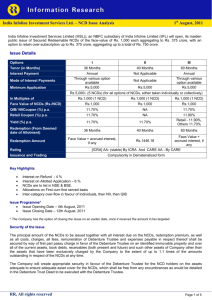

advertisement