Accounting & financial statements

advertisement

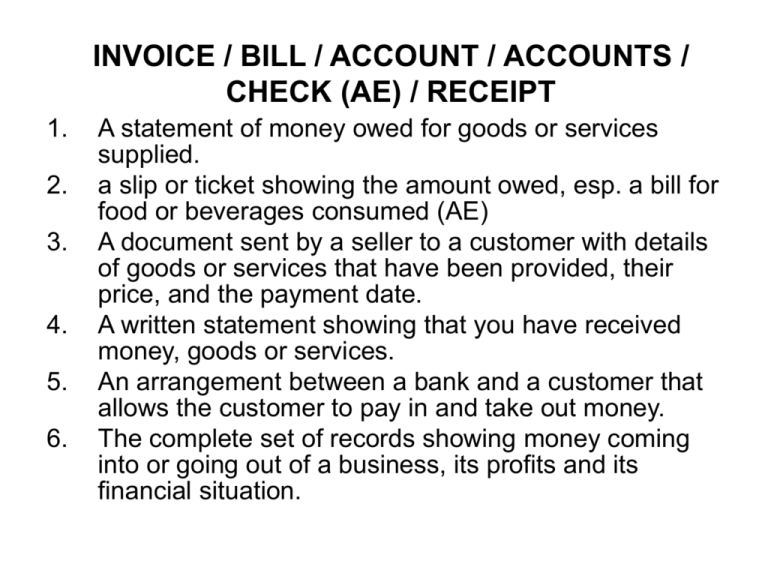

INVOICE / BILL / ACCOUNT / ACCOUNTS / CHECK (AE) / RECEIPT 1. 2. 3. 4. 5. 6. A statement of money owed for goods or services supplied. a slip or ticket showing the amount owed, esp. a bill for food or beverages consumed (AE) A document sent by a seller to a customer with details of goods or services that have been provided, their price, and the payment date. A written statement showing that you have received money, goods or services. An arrangement between a bank and a customer that allows the customer to pay in and take out money. The complete set of records showing money coming into or going out of a business, its profits and its financial situation. INVOICE / BILL / ACCOUNT / ACCOUNTS / CHECK (AE) / RECEIPT 1. A statement of money owed for goods or services supplied. BILL (invoice) 2. A slip or ticket showing the amount owed, esp. a bill for food or beverages consumed (AE). CHECK 3. A document sent by a seller to a customer with details of goods or services that have been provided, their price, and the payment date. INVOICE 4. A written statement showing that you have received money, goods or services. RECEIPT 5. An arrangement between a bank & a customer that allows the customer to pay in & take out money. ACCOUNT 6. The complete set of records showing money coming into or going out of a business, its profits and its financial situation. ACCOUNTS Croatian term: FILL IN THE GAPS. 1. 2. 3. 4. 5. Could we have the __________, check/bill please? bill The _______ for the repairs came to $650. account My salary is paid into my bank ________. bill Have you paid the phone _______? accounts The _________for last year showed a profit of $2 million. invoice 6. The manufacturer sent the __________for two typewriters. receipt for 7. Make sure you are given a _______ everything you buy. Accounting & financial statements • What is accounting? • What skills do accountants need? → MK, p 95, Vocabulary 2 1 cost accounting 2 tax accounting 3 auditing 4 managerial account. 5 creative accounting → comment on the cartoon or window dressing 6 bookkeeping What skills do accountants need? 1 cost accounting 2 tax accounting 3 auditing • analytical ability & mathematical competence • thorough knowledge of tax laws and accounting • strong analytical skills and honesty 4 managerial account. • analytical ability & math 5 creative accounting • strong analytical skills and dishonesty or window dressing • accuracy and concentration, 6 bookkeeping mathematical ability → MK, p 96, Vocabulary 4: Common word combinations • • • • • • • • • Calculate liabilities Calculate taxes Keep records Pay liabilities Pay taxes Receive income Record expenditure Record income Record transactions • Value assets • Value liabilities ACCOUNTING + FINANCING MK, p 95, Vocabulary 1 1B 2B 3B 6C 7A 8B → RB, p 32 Read, fill in the notes Match up words → MK, p 96, Task 3 → RB, p 33 4A 9A 5C 10A THE PROFIT AND LOSS ACCOUNT ncome and e_________. xpenditure • It shows i_______ • It gives figures for total sales in a year or t________ evenue urnover or r________. • It shows c______,ex_________ and ov_______. osts penses erheads • Part of the profit goes to the government in ta________, part to the sh_________ xation areholders as ividend d_________and part is retained by the c____________. ompany → Find Croatian equivalents → RB, p. 34 Balance Sheet 1. 2. 3. 4. 5. 6. 7. inancial The balance sheet shows a company’s f_________ ituation on the last day of the f________ inancial s________ ear y_______. ssets iabilities It lists the company’s a_________, l__________ and hareholders’ f_______ unds s___________ (equity). urrent ixed Assets can be c_________ and f__________. Why do a company’s assets include debtors? oodwill atents Intangible assets include g_________, p________, rademarks c_________ opyrights & t____________. hort-term Liabilities can be s__________ (current) and l___________ . ong-term Owners’ capital (e______) is money received from the quity hares eserves issue of s________ and r_______. →Find Croatian equivalents RB 34 p. 35 Balance sheet, cont. 1. Complete the basic accounting equation: iabilities hareholders’ equity ssets A______ = L________ + S________________ or shareholders’ equity Assets _______ - liabilities ________ = ___________________ Provide opposites: • • • • • • • • • • Short-term liabilities Fixed assets Debtors Tangible Assets Current cost acc. Payables Own Income Net → RB, p 36 • • • • • • • • • • Long-term liabilities Current assets Creditors Intangible Liabilities Historical cost acc. Receivables Owe Expenditure Gross Cash flow statement • Two directions of cash flow: • Three types of company activities: perating f_______ inancing & i________ nvestment activities o_______, • Four examples of sources of funds • Five examples of applications of funds → RB, p 35 – find Croatian equivalents Accounting and Financial Statements • • • • operating, financing and investment activities flow of cash in and out of the business source of funds: application of funds: a) c) e) g) i) trading profits b) purchase of assets sales of assets d) borrowing issuing of shares f) payment of dividends trading losses h) depreciation provisions repayment of loans Accounting and Financial Statements CASH FLOW STATEMENT • • • • operating, financing and investment activities flow of cash in and out of the business source of funds (in): a, c, d, e, h application of funds (out): b, f, g, i a) c) e) g) i) trading profits b) purchase of assets sales of assets d) borrowing issuing of shares f) payment of dividends trading losses h) depreciation provisions repayment of loans • profit: - tax – dividends – retained / net profit • costs • expenses • total sales or turnover • overheads List them in the usual order: PROFIT AND LOSS ACCOUNT • profit: - tax – dividends – retained / net profit • costs • expenses • total sales or turnover • overheads List them in the usual order: turnover, costs, expenses, overheads profit • the last day of the financial year • company’s assets • liabilities • stockholders’ funds Classify as assets or liabilities: debtors creditors goodwill patents accounts receivable loans and bonds trade marks accrued expenses taxes interest accounts payable stock mortgage buildings vehicles overdraft BALANCE SHEET • the last day of the financial year • company’s assets • liabilities • stockholders’ funds Classify as assets or liabilities: debtors creditors goodwill patents accounts receivable loans and bonds trade marks accrued expenses taxes interest accounts payable stock mortgage buildings vehicles overdraft • HW: RB p 36 – Vocabulary exercises