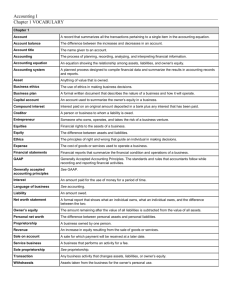

Accounting Vocabulary

advertisement

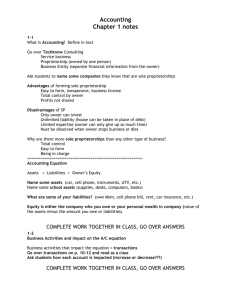

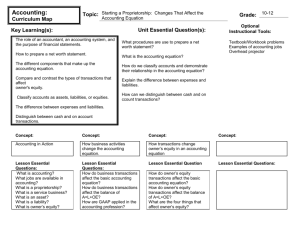

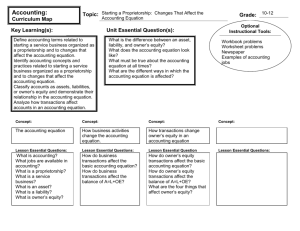

Accounting Vocabulary Accounting Financial information Planning Goal setting Needs assessment Recording Keep track of where money comes from and where it is going Accounting (cont’d) Analyzing Where is our money coming from Where is our money going How do we compare with our competitors Did we improve when compared with last period Interpreting What does the information mean for the future health and viability of our company Accounting System A planned process for providing financial information that will be useful to management Organized Computer-based (?) Consistent Transparent Accounting Records Organized summaries of a business’ financial activities Journals Ledgers Worksheets Reports Financial Statements Financial reports that summarize the financial conditions and operations of a business Balance Sheet Income Statement Statement of Cash Flows Supplemental information Legal Requirements Service Business A business that performs an activity for a fee Does not manufacture (produce) anything Examples include…….. Proprietorship A business that is owned by one person Most common form of business in the US Income from a proprietorship represents personal income for the owner Partnerships are proprietorships owned by 2 or more people A proprietorship is not a separate legal entity Asset Anything of value that is owned Cash Supplies Prepaid insurance Account receivables Other assets include: inventory, equipment, land,……… Liability An amount owed by a business Accounts payable Other liabilities include: short term debt, long term debt, ……………………….. Equities Financial rights to the assets of a business Common and preferred stock Ownership in the company Proprietorships do not sell any form of stock Owner’s Equity Assets – Liabilties The value of a company once its obligations are subtracted from what it has Capital is a part of Owner’s Equity Owner’s Equity represents what the company is worth What does negative Owner’s Equity mean? Business Ethics The use of the principles of right and wrong in making business decisions Scandals have led to new regulations regarding financial reporting Ethics impact all aspects of business Increased media scrutiny of corporate wrongdoing has raised consumer awareness The Accounting Equation Assets = Liabilities + Owner’s Equity What we own = What we owe + what we are worth End of Section 1 Transaction A business activity that changes assets, liabilities or owner’s equity Sale Purchase Investment Account A record summarizing all the information pertaining to a single item in the accounting equation Assets include cash, supplies, prepaid insurance, accts. receivable Liabilities include acct. payable Owner’s equity includes capital and drawing Account Balance The amount in an account. Represents the cash value of an account Account balances are not negative Capital Account Primary component of Owner’s Equity Investment in the company Plus Net income Minus Net loss Minus Drawing Drawing is the amount an owner takes from the business for personal use End of section 2 Revenue An increase in Owner’s Equity resulting from the operation of business Sales is the primary revenue account Sale on Account A sale for which cash will be received at a later date Money owed to a company from a sale on account is an account receivable Receivables represent what customers owe a company Receivables are assets Expense A reduction in Owner’s Equity resulting from the operation of a business Expenses represent the cost of doing business Rent Supplies Delivery Miscellaneous Utilities Withdrawals Assets taken out of the business for owner’s personal use Cash is the most common Problems can arise if the owner withdraws too many assets from a business Withdrawals are accounted for in the Drawing account