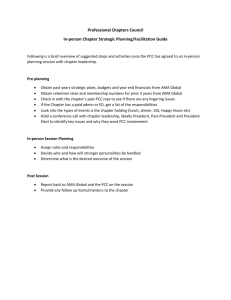

Syllabus - Portland Public Schools

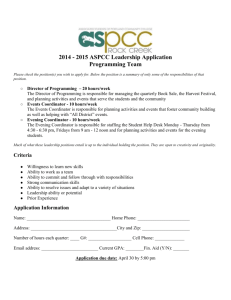

advertisement

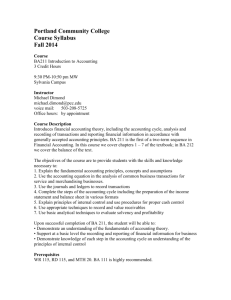

Franklin High School – Marshall Campus Clara Cook, Business Technology 3905 SE 91st, Portland, OR – Room C44 503-916-5140 Ext 81432 E-Mail: ccook@pps.net 2015-2016 Accounting 1-2—BA 111 Introduction to Accounting Credit Hours: 3 Lecture/Lab Hours: 100 PCC Dual Credit Handbook http://www.pcc.edu/prepare/head-start/dual-credit/documents/student-handbook.pdf. PCC Website: http://www.pcc.edu Textbook: Century 21 Accounting 8E Text Century 21 Accounting 8E Workbook Course Description: Introduction to Accounting presents double-entry accounting as related to service and merchandising businesses. This course covers the accounting cycle, including journalizing, posting to the general ledger, and preparation of financial statements, petty cash, bank reconciliations, combined journals, special journals and payroll. Intended Outcomes for the course Upon successful completion of BA 111, the student will be able to: Explain the conceptual foundation of the double-entry accounting model Demonstrate a basic understanding of the steps in the accounting cycle Apply knowledge of accounting procedures Outcome Assessment Strategies The application of basic accounting knowledge should be emphasized in assessment strategies, and should include: 1. Written examinations which demonstrate the ability to do accounting procedures as well as understand accounting principles and concepts. 2. Problem assignments which demonstrate the application of appropriate accounting procedures. 3. Any combination of the following: attendance and participation, or practice sets. At the beginning of the course, the instructor will detail the methods used to evaluate student progress and the criteria for assigning a course grade. Course Content (Themes, Concepts, Issues and Skills) Definition of accounting Accounting equation Accounting elements Transaction analysis Double-entry accounting an debits and credits Journals and ledgers Accounting Cycle Worksheet Adjustments Financial statements Closing entries Cash basis and modified cash basis accounting Petty cash funds Bank reconciliations Payroll Accounting Merchandising transactions Subsidiary ledgers Special journals COMPETENCIES AND SKILLS Apply the double-entry accounting model to the analysis and recording of common business transactions using a manual system of journals and ledger accounts Perform the steps in the accounting cycle to include the preparation of: worksheets, adjustments, financial statements, closing entries and trial balances Prepare bank reconciliations and related journal entries Apply payroll procedures to include the calculation and recording of employee earnings and payroll taxes GRADING CRITERIA Summative and formative including completion of accounting problems, vocabulary, chapter tests, quizzes, and analysis of final Simulation. Grades are based on a percentage scale according to total points earned. Tests 45-50% Assignments 45-50% 90-100%=A, 80-89%=B, 70-79%=C, 60-69%=D, 60%=F Statement for PCC Grading Guidelines For specific information related to PCC grading guidelines, Please refer to the PCC Dual credit Handbook accessible through your high school teacher and located online at http://www.ppc.edu/prepare/head-start/dualcredit/documents/student-handbook.pdf. Information related to Add/Drop/Withdraw deadlines is also detailed in the Handbook. Attendance and Make-Up Policy Students may come in for assistance, make-up work, etc during office hours on Wednesdays and other pre-arranged times Students may re-do test to achieve a higher grade. Code of Student Conduct Refer to PPS Student Handbook Flexibility Statement The instructor reserves the right to modify course content and/or substitute assignments and learning activities in response to institutional, weather or class situation.