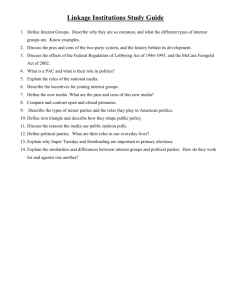

7 – Budgeting and Cost Estimation

advertisement

Budgeting and Cost Estimation Budgets defined Two major approaches Pros and Cons Behavioral issues Financial issues 7-1 Projects Make the Best of Scarce Resources 7-2 Developing a Project Budget Three major elements Forecast what will be needed Labor and material How much will it cost? When will it be needed? Thus, the budget reflects the project plan, time-phased, in dollars 7-3 NASA’s Pathfinder Rover: Mars on a Shoestring 7-4 Why Budgeting for Projects is Tougher By definition, projects are unique, nonrecurring efforts So there’s often little history, little tradition to rely on Further, projects can last for years More uncertainty, more risk 7-5 Potential Project Life Cycles, Figures 7-1 and 7-2 7-6 Two Major Approaches to Budgeting Top-Down Bottom-Up Each has advantages . . . And disadvantages as well 7-7 Top-Down Budgeting Based on managerial judgment, and historical data History can include actual costs from similar projects, adjusted for differences and for inflation Start at the top, and allocate down through the WBS 7-8 Pros and Cons of Top-Down Budgeting Pros Quick, simple Fair accuracy overall, though individual elements may be in error Small tasks need not be individually identified Cons Limited buy-in by junior managers Senior managers views may be biased Using data from dissimilar projects, or old projects, can mislead 7-9 Bottom-Up Budgeting Starts at the bottom of the WBS, with the people who do the work Then costs are aggregated upward Overhead, project reserves, and profit have to be added in 7-10 A Format for Gathering Data on Project Resource Needs, Figure 7-3 7-11 Pros and Cons of Bottom-Up Budgeting Pros More accurate, in detailed elements The benefits of participative management Differences of opinion can be resolved Cons Overlooking a task can be a costly error Time-consuming to prepare Estimates can be padded at every level 7-12 Behavioral Issues in Budgeting Different perspectives, based on managerial level Senior people tend to underestimate, junior people tend to overestimate Lower levels tend to arbitrarily add reserves, upper levels to arbitrarily delete them Bottom Line: Any system can be gamed So know what the games are . . . 7-13 Behavioral Issues in Budgeting: Emanon Aircraft Corporation Loss of business: Problem or symptom? Keep asking “Why?” Emanon loses business. Why? . . . Because bids are too high. Why? . . . Because material estimates are inflated. Why? . . . Because purchasing is adding its own reserve. Why? . . . Because they were burned once, and don’t want to be burned again. 7-14 Financial Issues Worth Considering: Inflation Inflation can distort estimates in different ways Actual costs from the past will be less than comparables for today – the older the data, the greater the disparity Long-duration projects can create special problems Six percent inflation doubles cost in just 12 years . . . . . . And 6% is low in much of the world 7-15 Financial Issues Worth Considering: Learning Rate As output doubles, labor hours per unit decrease by a fixed percentage For example, the first unit of output takes 1,000 hours, and the learning rate is 80% Unit Labor hours req’d for that unit 1 1000 2 800 4 640 8 512 7-16 Effects of Ignoring the Learning Curve, Figure 7-4 7-17 Excel® Template for Cost Estimation, Figure 7-5 7-18 Excel® Formulas for Figure 7-5 7-19 Estimation Template Using Ratios, Figure 7-7 7-20 Formulas for Figure 7-7 7-21 Case: The Stanhope Project 7-22 From: The Stanhope Project, Labor Buildup 7-23 Reading: Three Perceptions of Project Cost 7-24 From: Three Perceptions of Project Cost (Figure 2) 7-25 From: Three Perceptions of Project Cost (Figure 3) 7-26