Instructor’s Manual – McGraw-Hill’s Taxation, by Spilker et al.

Chapter 25

Transfer Taxes and Wealth Planning

INSTRUCTOR’S MANUAL

Learning Objectives

1. Outline the basic structure of federal transfer taxes.

2. Describe the federal estate tax and the valuation of transfers, and compute taxable

transfers at death and the federal estate tax.

3. Summarize the operation of the federal gift tax and the calculation of the federal gift tax.

4. Apply fundamental principles of wealth planning and explain how income and transfer

taxation interact to affect wealth planning.

Teaching suggestions

The unified transfer taxes operate through a formula applied to cumulative transfers taxed using a unified

tax rate schedule. This integrated formula takes into account the cumulative effect of transfers in

previous periods when calculating the tax on gifts in the current period. Likewise, lifetime transfers are

included in determining the estate tax on assets transferred at death. The most difficult aspect of the

unified formula is understanding how the tax computation avoids a double tax on prior transfers. This is

accomplished by subtracting the tax on the earlier transfers from the total tax. Ironically, while the unified

formula is designed to increase the likelihood that the current transfers will be taxed at a higher marginal

tax rate, the combination of tax rate reductions and increases in the unified credit have virtually

eliminated the progressivity of the tax rate schedule.

Many instructors may prefer to begin the discussion of transfer taxes with the gift tax rather than the

estate tax. For this reason, in the latest edition we switched the order of the material in this chapter.

The chapter provides very light coverage of advanced topics such as the generation skipping tax, QTIPs,

and transfers that are testamentary substitutes (e.g., transfers with a retained life estate). These advanced

topics are best avoided in an introductory class.

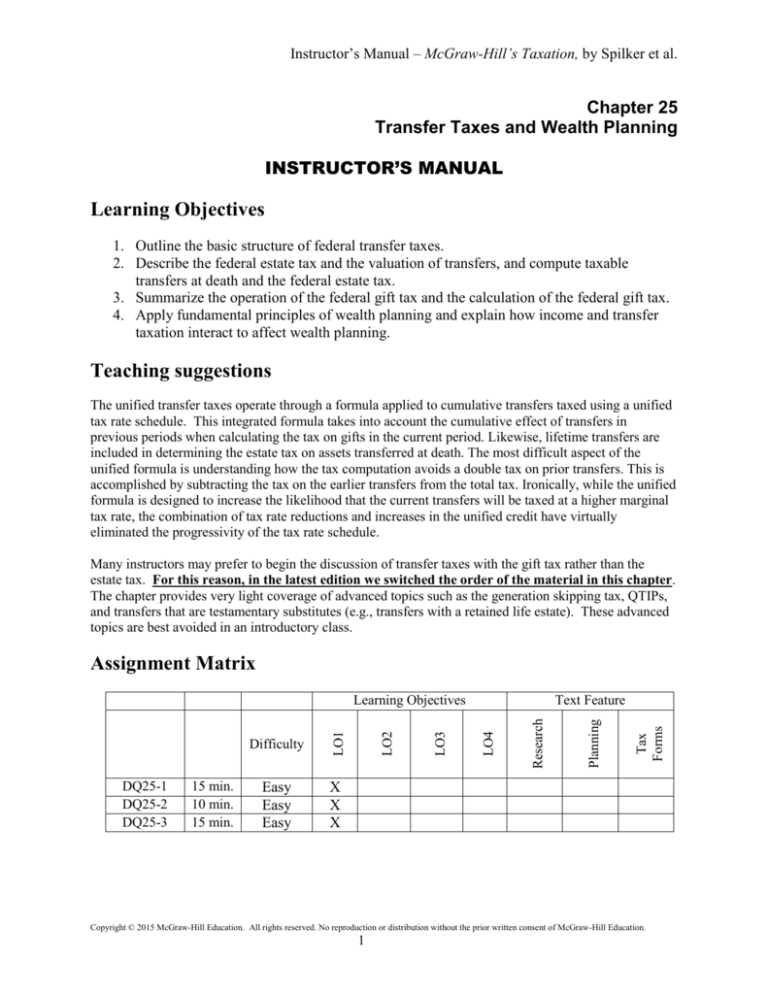

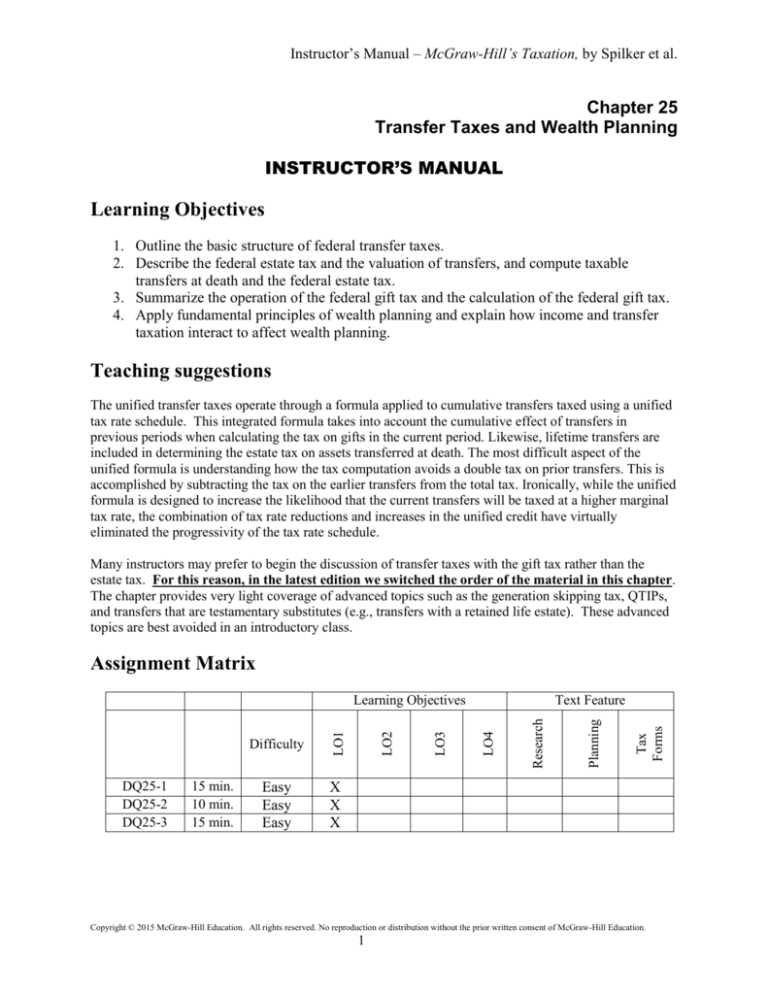

Assignment Matrix

DQ25-1

DQ25-2

DQ25-3

15 min.

10 min.

15 min.

Easy

Easy

Easy

Tax

Forms

Planning

Research

Text Feature

LO4

LO3

LO2

Difficulty

LO1

Learning Objectives

X

X

X

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

1

Instructor’s Manual – McGraw-Hill’s Taxation, by Spilker et al.

DQ25-4

DQ25-5

DQ25-6

DQ25-7

DQ25-8

DQ25-9

DQ25-10

DQ25-11

DQ25-12

DQ25-13

DQ25-14

DQ25-15

DQ25-16

DQ25-17

DQ25-18

DQ25-19

DQ25-20

DQ25-21

DQ25-22

DQ25-23

DQ25-24

DQ25-25

DQ25-26

DQ25-27

DQ25-28

DQ25-29

DQ25-30

DQ25-31

DQ25-32

DQ25-33

P25-34

P25-35

P25-36

P25-37

P25-38

P25-39

P25-40

P25-41

P25-42

15 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

20 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

10 min.

30 min.

20 min.

15 min.

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Medium

Medium

Medium

Medium

Medium

Easy

Tax

Forms

Planning

Research

Text Feature

LO4

LO3

LO2

Difficulty

LO1

Learning Objectives

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

2

Instructor’s Manual – McGraw-Hill’s Taxation, by Spilker et al.

P25-43

P25-44

P25-45

P25-46

P25-47

P25-48

P25-49

P25-50

P25-51

P25-52

P25-53

P25-54

P25-55

P25-56

P25-57

P25-58

P25-59

P25-60

P25-61

P25-62

P25-63

P25-64

CP25-65

CP25-66

CP25-67

CP25-68

15 min.

15 min.

15 min.

20 min.

15 min.

15 min.

15 min.

15 min.

15 min.

15 min.

15 min.

15 min.

15 min.

30 min.

20 min.

20 min.

20 min.

20 min.

20 min.

20 min.

20 min.

20 min.

30 min.

45 min.

45 min.

45 min.

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Medium

Medium

Easy

Medium

Medium

Medium

Medium

Medium

Hard

Hard

Hard

Hard

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

Tax

Forms

Planning

Research

Text Feature

LO4

LO3

LO2

Difficulty

LO1

Learning Objectives

X

X

X

X

X

X

X

X

X

X

X

X

X

X

Lecture Notes

1) Introduction to Federal Transfer Taxes

a) Define the following terms

i) Testamentary transfers – transfers at death.

ii) Intervivos transfers – lifetime transfers.

b) Common features of the Federal transfer taxes

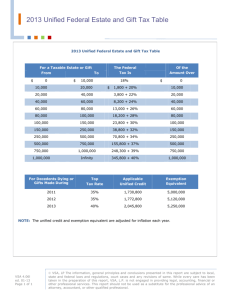

i) Property transfers, whether made by gift or at death, are subject to transfer tax using a

common (slightly progressive) tax rate schedule.

ii) The 2015 unified credit exempts cumulative transfers by gift or at the time of death up to

$5.43 million – the amount of tax for the UC is calculated using the current rate schedule.

iii) Note that the exemption equivalent is indexed for inflation starting in 2011.

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

3

Instructor’s Manual – McGraw-Hill’s Taxation, by Spilker et al.

iv) Each transfer tax allows a deduction for transfers to charities and surviving spouses (the

charitable and marital deductions, respectively).

v) Refer to Exhibit 25-1 for Unified Transfer Tax Rates.

vi) Valuation

(1) Property is included in the transfer tax based (gift, estate or GST tax) at fair market value

on the date of the transfer (with the exception for the altnerative valuation date for estate

tax).

(a) Fair market value is defined by the willing-buyer, willing-seller rule as: “the price at

which such property would change hands between a willing buyer and a willing

seller, neither being under any compulsion to buy or to sell, and both have reasonable

knowledge of the relevant facts.”

(b) The executor can elect to value the estate on an alternate valuation date, six months

after death, if it reduces the gross estate and estate tax.

(c) Work through Example.

(2) Valuation of remainders and other temporal interests

(a) Future interests are valued at present value, calculated by estimating the time until

the present interest expires.

(b) The present value calculation uses the §7520 interest rate published by the Treasury.

(c) If the present interest is measured by a person’s life (a life estate), then we estimate

the delay by reference to the person’s life expectancy as published in IRS tables.

(d) We value a present interest such as an income interest or life estate by subtracting the

value of the remainder interest from the total value of the property.

(e) Value of remainder interest = (Future payment)/ (1+r)n

(f) Refer Exhibit 25-4 for Discount Factors for Estimating the Value of Remainders.

(g) Work through Example.

2) The Federal Gift Tax

a) Refer to Exhibit 25-3 for The Federal Gift Tax Formula.

b) Transfers Subject to Gift Tax

i) Gifts Excluded from the Gift Tax

(1) Incomplete and revocable gifts.

(2) Payments for support obligations or debts.

(3) Contributions to political parties or candidates.

(4) Medical and educational expenses paid on behalf of an unrelated individual.

ii) Work through Example.

iii) The Annual Exclusion

(1) Most gifts are eligible for an annual exclusion of $14,000 (2015) per donee per year.

(2) Gifts of present interests qualify for the exclusion.

(3) Gifts of future interests placed in trust for a minor can also qualify for the exclusion.

(4) Work through Example.

c) Taxable Gifts.

i) Gift-Splitting Election

(1) Work through Example.

ii) Marital Deduction

(1) Deduct gifts of property to a spouse in computing taxable gifts.

(2) Transfers of terminable interests in property, such as a life estate, will not generally

qualify for the deduction.

(3) The deduction is limited to the value of property included in taxable gifts.

(4) Work through Example.

iii) Charitable Deduction

(1) Work through Example.

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

4

Instructor’s Manual – McGraw-Hill’s Taxation, by Spilker et al.

d) Computation of the Gift Tax

i) Work through the Example.

ii) Prior Taxable Gifts – tax is calculated using current tax rate schedule.

iii) Unused Unified Credit – calculated using current tax rate schedule on unused portion of

exemption equivalent.

(1) Work through Example.

(2) NOTE: track exemption equivalent used in prior years – not the unified credit.

iv) Refer to Exhibit 25-5 for Form 709 Gift Tax Return for Harry Smith.

3) The Federal Estate Tax

a) Refer to Exhibit 25-6 for The Federal Estate Tax Formula.

b) The Gross Estate includes property owned at death (the probate estate) and certain transfers

effective at death (this property is not technically owned at death and is not included in the

probate estate).

i) Probate is the process of gathering property possessed by or titled in the name of a decedent

at the time of death, paying the debts of the decedent, and transferring the ownership of any

remaining property to the decedent’s heirs.

ii) The gross estate consists of the fair market value of property possessed or owned by a

decedent at death plus the value of certain automatic property transfers that take effect at

death.

iii) Specific Inclusions

(1) The testamentary transfers can occur without the help of a probate court because the

ownership transfers by law at the time of death.

(2) Example: Property held in joint tenancy with right of survivorship, which legally

transfers to the surviving tenant upon the joint tenant’s death.

(3) Tenants in common hold divided rights to property and have the ability to transfer these

rights during their life or upon death so this property is included in the probate estate.

(4) Jointly owned property

(a) When a decedent’s interest is a tenancy in common, a proportion of the value of the

property is included in the gross estate that matches the decedent’s ownership

interest.

(b) The amount includible for property held as joint tenancy with the right of

survivorship depends upon the marital status of the owners.

(c) Refer to Exhibit 25-7 for Amount of Jointly Owned Property Included in Gross

Estate.

(5) Transfers within three years of death

(a) Work through Example.

(b) Note that these transfers are “grossed up” for the amount of gift taxes paid (if any) at

the time of the transfer. If this was not the case, then the gift taxes paid would escape

the estate tax.

(6) Gross Estate Summary

iv) The Taxable Estate

(1) Administrative Expenses, Debts, Losses, and State Death Taxes reduce the taxable estate

(a) Work through Example.

(2) Marital and Charitable Deductions

(a) Work through Example.

(3) Computation of the Estate Tax

(a) Adjusted Taxable Gifts

(i) Adjusted taxable gifts are added to the taxable estate in calculating cumulative

taxable transfers.

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

5

Instructor’s Manual – McGraw-Hill’s Taxation, by Spilker et al.

4)

5)

6)

7)

(ii) Lifetime gifts are not subject to double tax because the tax on cumulative

transfers is reduced for current taxes on adjusted taxable gifts.

(iii) Work through Example.

(b) Unified Credit

(i) The unified credit eliminates transfer taxes on estates with minimal lifetime and

testamentary transfers.

(ii) The credit is applied after reducing the total tax on cumulative transfers for taxes

payable on adjusted taxable gifts.

(iii) Refer to Exhibit for The Unified Credit and Exemption Equivalent.

(iv) Work through Example.

(4) Refer to Exhibit 25-8 for Form 706 Estate Tax Return for Bob Smith.

Wealth Planning Concepts

a) The Generation-Skipping Tax

i) The generation-skipping tax (GST) is a supplemental tax designed to prevent the avoidance

of transfer taxes (both estate and gift tax) through transfers that skip a generation of

recipients.

b) Income Tax Considerations

i) A fiduciary entity is a legal entity that takes possession of property for the benefit of a person.

ii) An estate is a fiduciary that comes into existence upon a person’s death to transfer the

decedent’s real and personal property.

c) Transfer Tax Planning Techniques

i) Serial Gifts

(1) A serial gift strategy saves gift taxes by converting a potentially large taxable transfer

into multiple smaller transfers that qualify for the annual exclusion.

(2) Work through Example.

ii) Surviving spouses are also allowed to claim the unused unified credit of a deceased spouse

(DSUE) thereby allowing a total 2015 unified credit of up to $10.86 million ($5.43 x 2).

iii) Bypass Provisions

(1) Bypass provisions in a will or bypass trusts reduce estate taxes by using the unified credit

of the deceased spouse, transferring some property to beneficiaries other than the

surviving spouse.

(2) Contrast the bypass provision with the DSUE (deceased spouse unused unified credit)

and note that the bypass provision provides some marginal benefits by allowing for

control of the property rather than passing the property directly to the surviving spouse.

(3) Work through Example.

iv) The Step-Up in Tax Basis

(1) Testamentary transfers allow a step-up in tax basis to fair market value, thereby

eliminating income tax on unrealized appreciation.

(2) Lifetime gifts eliminate transfer taxes on post gift appreciation.

(3) Work through Example.

d) Integrated Wealth Plans

i) Work through Example.

Conclusion.

Summary.

Key Terms

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

6

Instructor’s Manual – McGraw-Hill’s Taxation, by Spilker et al.

Discussion points

Ethics box (page 25-6)

Rudy should file a gift tax return if he does not intend to enforce collection of the “loan.”

Although only Rudy knows the truth of his intentions, but he should also consider that

whether a transfer of money is interpreted as a loan or gift will be determined by the facts

and circumstances surrounding the transfer.

Facts that will point to a loan include whether there the loan is evidenced by a note

payable, whether Rudy takes collateral for the loan, and whether he takes steps to collect

the loan should any payments be missed.

Suggested Activities

One way to cover the topics in the class is to assign and work one of the comprehensive problems in

class. Student teams can be assigned to work each part of the problem on the board or fill in the formula

on the overhead.

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

7