Ohio, the Region, and Licking County's Future 03-19

advertisement

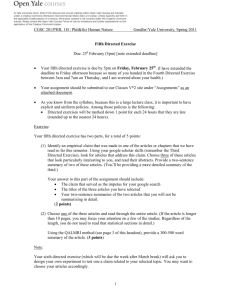

Ohio, the Region, and Licking County’s Future Charlotte Batson a March 22, 2012 Charlotte Batson • Expertise in Economic Development and Shale Oil/Gas • Petroleum Engineer with expertise in oil and gas field operations, lease sale evaluations, and oil/gas price analysis • Project work on the Shale Gas Supply Chain for the Pittsburgh Regional Alliance • Author of articles on Shale Oil and Gas, including “How Shale Gas is Redefining the Energy Landscape” in the January, 2012 Site Selection • Appointed to the Mississippi Energy Policy Institute (MEPI) in 2009 by Gov. Haley Barbour © Batson & Company 2012 2 Agenda • Perspective on Current Situation • Opportunities for Licking County • Workforce • Local Impacts • What’s Next? © Batson & Company 2012 3 US Oil Production Reverses Decline 12000 10000 8000 Alaska 6000 Offshore GOM (Fed + State) Onshore US 4000 2000 2008 2004 2000 1996 1992 1988 1984 1980 1976 1972 1968 1964 1960 1956 1952 1948 1944 1940 1936 1932 1928 1924 1920 1916 1912 1908 1904 1900 0 Source: EIA © Batson & Company 2012 4 Upstream Drivers • Leasing – “Use it or lose it” – Oil plays drawing attention from low-priced gas – Industry much less “boom and bust” • Oil Price: Instability in the Middle East – Another Arab Oil Embargo? – Development plans likely being accelerated © Batson & Company 2012 5 Where is the Utica Shale? © Batson & Company 2012 6 Not Just in Eastern Ohio! © Batson & Company 2012 7 The Map Can’t Keep Up Source: ODNR © Batson & Company 2012 8 Hold on to Your Hat! • Operators: Chesapeake/Total, Enervest, Anadarko, Chevron, others • Chesapeake: 25,000 wells over 20 years • 2012 Drilling: +40% in Ohio over 2011 • Rigs: +300% over 5 years (Ohio O&G EEA) • Potential for 200,000 b/d by 2020 (pass La.) © Batson & Company 2012 9 Current BHI Rig Count © Batson & Company 2012 10 Variety in the Supply Chain Exploration • Seismology • 3D or 4D Computer Imagery • Logging • Data Interp. Gathering and Transportation •Pipelines •Compressors •Tanks •Meters and Control Stations •Inspection Tools Drilling • Rig and other equipment • Casing and tubing • Mud, cement and chemicals Processing •Heaters •Scrubbers •Separators •Fractionation Equip •Fischer Tropsch •Catalysts •Vessels Hydraulic Fracturing Completion • Pumps • Proppants • Chemicals and other additives • Water Environmental Mitigation • Valves • Screens and Filters • Perforating Equipment • Packers Marketing and Sales •On-site Mobile Water Treatment • Filters •Local Water and Wastewater Treatment © Batson & Company 2012 •National integrated marketers •Producer marketers •Aggregators, Brokers •Petrochemicals •Gas-to-Liquids 11 Central Ohio Existing Industries • Aerospace • Polymers and Plastics • Chemicals • Steel • R&D • Auto © Batson & Company 2012 12 Upstream Opportunities • Supply Chain – Resource-limited – Includes logistics and transportation, especially frac sand and water – Drilling rigs, OCTG, equipment, mud, cement, chemicals, crew supplies, etc. • Local Business: 18 month contracts • Access to the Resource – Nucor – Shell © Batson & Company 2012 13 Licking County: Well-positioned © Batson & Company 2012 14 Midstream In Flux • • • • Asian LNG demand exploding Available capacity in existing lines Gathering lines Chesapeake – $900M NGL processing, pipeline (M3 Mid., EV En. Ptnrs.) – $500 million, 70 miles of pipeline (AEP, Spectra) • Enterprise Products Partners: prop. ethane pipeline from OH/PA to the Texas ethane hub © Batson & Company 2012 15 Opportunities for Utilities • Electric Utilities – EPA regs – conversion of 28 GW coal-burning generation to gas – Ohio – 80% of its electricity from coal – AEP’s pipeline announcement • Gas Utilities – Customers switching from heating oil and propane – Columbia Gas rates 19% lower than last year – PA gas utility cut rates by 52% © Batson & Company 2012 16 Downstream: Refined Products • Stimulated by crack spreads and abundant supply • Asia: Demand for refined products exploding • 2011: US was a net exporter of refined products for the first time since 1949 • Polymers: important part of the shale supply chain expected to benefit from oversupply © Batson & Company 2012 17 Oversupply and New Products • Stimulated by natural gas oversupply • LNG – Cheniere: $6B Sabine liquefaction facility for export to Asia – Have $8B+ in contracts for 7 mtpa (2 trains of 4 approved) • New Products – Sasol: $10B LA facility to convert natural gas to diesel • Exports to Asia – South Korea, Japan, China, India © Batson & Company 2012 18 Chemicals and Fertilizers • Stimulated by low natural gas price (feedstock) • Chemicals ◦ US overtaking Middle East as global low-cost leader ◦ Ethylene crackers: Shell, Dow, Sasol studying ($4.5B) ◦ Reviving nitrogen based products “Prices are rising amid tight supplies for the building blocks of everything from diapers and packaging to autos and consumer electronics”, said Andrew Liveris, Chairman/CEO, Dow Chemical © Batson & Company 2012 19 And Let’s Don’t Forget.. Vehicles!! • Effective cost < $2/gal • Fleets converting to natural gas • Chesapeake and GE partnership – Natural gas and hybrid vehicle mfg. – Fueling infrastructure • Companies incl. UPS testing LNG vehicles (ships) • Jet fuel © Batson & Company 2012 20 Workforce • Full Employment • Competition for Workers • Construction Jobs • “Boom vs Bust” • Workforce Training & Housing © Batson & Company 2012 21 Impacts to Licking County • Roads • Other: noise, dust, hours of operation, etc. • Municipal Budgets • First Responders • Information to the Community © Batson & Company 2012 22 What’s Next? • “Perfect Storm” of Opportunities – Upstream – Midstream – Downstream • Job Creation • Management of Impacts © Batson & Company 2012 23 Thank You © Batson & Company 2012 24