Budgeting

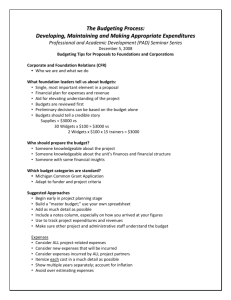

advertisement

Budgeting MSCM8615 1 Overview of Financial Management Balancing Mission and Finances! Planning: Define Mission Prioritize goals Assess Resources Financial, human (volunteers, members, staff), infrastructure, community Budget and Control Measure Results and Report Look at example of Diocese of Bridgeport 2 Planning Establish the organization's mission. What is an example of an organizational mission? Develop a strategic plan to meet that mission. The strategic plan is a broad set of organizational goals and the primary approaches for reaching them. Set long-range plans for achieving the goals defined in the strategic plan. Prepare budgets that show how management expects to obtain and use the resources needed to meet those goals. 3 Budgets Master Budget operating budget revenues and other support expenses cash budget capital budget functional Special types of budgets program budgets Fundraising event performance budgets flexible and zero-based budgets 4 Two Approaches to Budgeting Centralized or Top Down Model - Priorities are set at the top of the organization and imposed on the operating units. More control but less staff involvement. Decentralized or Bottom Up Model - Operating units prepare budgets based on their perceptions of needs. Less control but more involvement. Lots of negotiations. Risk of losing sight of overall objectives. Most organizations use hybrid approaches incorporating elements of both methods. 5 The Budget Process A process of planning and control. A look ahead at what an organization can and can't do. The Budget Cycle - Preparation – based on guidelines – normally done by responsibility center managers - Review and Adoption - Implementation and Control - Evaluation of Results and Feedback 6 Budget Process, cont’d From page 65: Set goals Establish objectives Design programs Prepare budget Budget approval Monitor progress 7 Budgeting Formats Line item or object of expense - e.g., salaries, benefits, supplies, rent, etc. Responsibility Center - units for which individual managers are held accountable, e.g., liturgical, administration, development Program Budgets include both revenues and expenses for specific programs run by the church. Generally, both Responsibility Center and Program budgets are supported by line item detail. 8 Line Item Operating Budget 9 Revenue Contributions Program fees Investment revenue on endowment Total revenue Expenses Salaries Supplies Bad debts Interest Rent Total expenses Profit/(loss) $ 97,980,000 120,000 50,000 $ 98,150,000 $ 78,900,000 15,400,000 2,200,000 400,000 3,100,000 $100,000,000 $ (1,850,000) The Operating Budget Revenue and Other Support is a forecast of resource inflows into the organization. – Revenues are earned from the sale of goods and services and the receipt of contributions and grants. Support refers to just contributions and grants. Expenses represent the resources that an organization uses up in carrying on its activities. A surplus or profit is the excess of revenues and support over expenses; a deficit or loss is an excess of expenses over revenues and support. 10 Operating Budget Example Revenue Collections Program fees Endowment earnings Total revenue $ 97,980,000 120,000 50,000 $ 98,150,000 Expenses Salaries Supplies Bad debts Interest Rent Total expenses Change in Net Assets $ 78,900,000 15,400,000 2,200,000 400,000 3,100,000 $100,000,000 $ (1,850,000) 11 The Cash Budget Cash Budgets plan for an organization's cash inflows and outflows. Beginning Cash Balance + cash receipts Subtotal: Available Cash - cash payments Subtotal: Total Cash Payments Balance before borrowing, repaying or investing + borrowing or – repayments or investments Ending Cash Balance Note distinction between accrual-based revenue and expense versus cash receipts and payments! 12 Cash Budget Example Millbridge’s urban planner for social services is working on the budget for the town’s day care center. The center allows lower income citizens to hold jobs. The Center is paid each quarter by the county and state to care for children. The state pays 50% of the amount that it is billed in the quarter immediately following billing and 50% two quarters after receiving a bill. The county pays 100% of the amount it is billed three quarters after receiving the bill. Parents are also required to pay the Center for caring for their children. Parents pay the full amount that they owe on the first day of the quarter that it is due. Based on the operating budget on the next slide, how much cash can the Center expect to collect in the 4th quarter? 13 Revenues by Quarter Revenue State County Parents Quarter 1 Quarter 2 $ 20,000 $15,000 25,000 30,000 5,100 4,800 $50,100 $49,800 Cash Collection for Fourth Quarter State 50% of 2nd Qtr. + 50% of 3rd Qtr. County 100% of 1st Qtr. Parents 100% of 4th Qtr. Total Quarter 3 $10,000 35,000 5,200 $50,200 Quarter 4 $ 5,000 40,000 5,000 $50,000 Cash $ 7,500 5,000 25,000 5,000 $42,500 Note the difference between the cash and revenue for the quarter!!! 14 The Capital Budget Capital Budgets plan for the acquisition of high-value, long-term (> 1 year) assets. Capital Budgeting will be discussed next week 15 Program Budgets Program budgets include both revenue and expenses for the major activities of an organization. Helps managers focus on sources of profits and losses of programs that could be expanded or discontinued. Revenues Meals on Wheels $40,000 Expenses 37,000 Profit/(Loss) 16 $ 3,000 CCD ElderDrive Total $ 18,000 $0 $ 58,000 17,000 20,000 74,000 $1,000 $(20,000) $(16,000) Program Budget Example Charity Church sponsors a three-day youth camp in Bear Mountain Park. Charity provides a $500 grant for the event and collects $130 from each camper. The camp director expects 40 campers to attend and anticipates the following expenses: Campground fees Bus transportation Equipment rental Meals $350 $1,225 $40 $65 For 3 days (60 rider capacity) Per camper Per camper Determine the special purpose budget for the camp. Show revenues and expenses by line item, and show the expected profit or loss. 17 Budget - 40 Campers Revenue Camp tuition Church subsidy Total revenue Less Expenses Campground rental Bus transportation Equipment rental Meals Total Expenses Surplus/Loss 18 $ 5,200 500 $ 5,700 $ 350 1,225 1,600 2,600 $ 5,775 $ (75) Responsibility Center Expense Budget Responsibility Center Budget Liturgical FY2010 $ 600,000 Development 100,000 Administration 200,000 Total 19 $ 900,000 Functional Budgets Functional Budgets focus on the major functions performed by an organization. This format is often used to report to outsiders. Let’s look at some examples of budgeting templates from the Diocese of Bridgeport: 20 Flexible Budget Organizations often experience more or less volume than budgeted. Flexible budgets look at expected revenues, expenses, and net income under different volume assumptions. The key to flexible budgeting is the identification of: Fixed Costs - which do not change with volume. Variable Costs - which do change with volume. Flexible budget results are normally shown in a sideby-side columnar format. A flexible budget is a form of "What if?" analysis. 21 Flexible Budget Example Charity Church sponsors a three-day youth camp in Bear Mountain Park. Charity provides a $500 grant (F) for the event and collects $130 (V) from each camper. The camp director expects 40 campers to attend and anticipates the following expenses: Campground fees Bus transportation Equipment rental Meals $350 $1,225 $40 $65 for 3 days (F) (60 rider capacity) (F) per camper (V) per camper (V) Provide a flexible budget assuming a 10% increase in the number of campers. 22 Budget Revenue Camp tuition Church subsidy Total revenue Less expenses Campground rental Bus transportation Equipment rental Meals Total expenses Surplus/loss 23 40 campers $5,200 500 $5,700 $ 350 1,225 1,600 2,600 $ 5,775 $ (75) 10% Increase 44 campers $5,720 500 $6,220 $ 350 1,225 1,760 2,860 $ 6,195 $ 25 Meals for Homeless Flexible Budget Example Meals Delivered Revenue Donations (F) City (V) Total Revenue Expenses Salaries (F) Supplies (V) Rent (F) Other (F) Total Expenses Surplus/(Deficit) 24 35,000 40,000 45,000 $105,000 52,500 $157,500 $105,000 60,000 $165,000 $105,000 67,500 $172,500 $ 46,000 87,500 12,000 6,000 $151,500 $ 6,000 $ 46,000 100,000 12,000 6,000 $164,000 $ 1,000 $ 46,000 112,500 12,000 6,000 $176,500 $ (4,000) Performance Budgeting Operating budgets attempt to plan the resources needed to accomplish certain outcomes or results that the organization hopes to achieve. But the budgeting process focuses on resource negotiations and uni-dimensional output measurements. Performance Budgeting asks managers to define goals, plan their resource needs, and measure the achievement of various goals and objectives. Does this measure outcomes or outputs? Can simple measures tell the whole story, or are we back to the questions of efficiency and effectiveness? 25 Incremental Versus Zero-Based Budgeting Incremental budgeting starts with current revenues and expenses and projects next year by adjusting for inflation, volume, efficiency, technology, etc. Zero-Based Budgeting - calls for a total reevaluation of all programs and activities. - requires that decision packages be prepared for each separable activity or level of activity. - ranks the packages. - selects packages for adoption or rejection. 26 Forecasting Forecasting is done using three approaches: - Subjective methods when there are no historical data. - Time Series methods when the future is expected to follow an historical trend. - Causal Modeling which tries to forecast based on statistical relationships among several factors. Forecasting is an art. Models should be tested before use and experience should be brought to bear when appropriate. 27 Factors in Revenue Forecasts Economic conditions Endowment Investment Decisions Price Setting - historical approach - what we always got. - market approach - what others charge. - quantity maximization - do as much as possible while staying solvent. 28 Regression Analysis for Forecasting Independent/Dependent Variables Ordinary Least Squares analysis Cautions Plausibility Goodness of Fit Statistical Significance Reasonableness of Assumptions 29 The Human Element in Forecasting Consider how the results will be used. Is the past a good predictor for the future. Does the forecast result make sense? 30 Behavioral Aspects of Budgeting People are the key to success in budgeting Goal Divergence vs Goal Congruence Motivation is critical Allow staff input in budget process Provide incentives – carrot or stick Raises Bonus 31 The Holy Land Trip Budget The Budget Question: Can the church successfully run a teen trip to the Holy Land? The Issues: - Does the trip fit within the church's mission? - What is the market for such trips? - How many teens will come on the trip? - How much revenue can the church expect to collect? - What will the expenses be? 32 The Holy Land Trip Budget The Process: - Do a first estimate of the budget. - Examine the assumptions and develop alternatives. - Ask what happens if your forecasts and key assumptions are wrong. Lessons from the Case - Budgeting requires thought. - Budgeting requires estimating. - The more facts that are available the better. 33