MurphyUSA Digital Marketing Strategy 2011-2012

advertisement

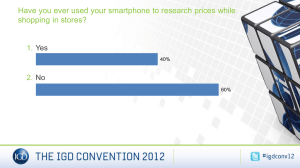

MurphyUSA Digital Marketing Strategy 2011-2012 The Goals • To align strategic business themes & objectives with the customer lifecycle and experience • To integrate interactions between company & customer across a variety of channels, devices, media, and geography • To amplify company messaging through organic customer experiences, both digital & off-line The Five Phase Approach Market Analysis Competitive Analysis Key Trends Define the World Define the Mission Linking World:Mission Communication What Where When How In-house Capabilities Weekly Reporting Vendor-Partner Capabilities Monthly Dashboarding Timeframe, Budget, Expected ROI Quarterly Review Success/Kill Guidelines Actual ROI These five phases are universal and apply to every campaign, every initiative, and every strategic implementation within every business unit at MurphyUSA. Research Market Analysis “Who are our customers?” Initial market research suggests the following demographic information about our current retail customer segments: “The Wal-Mart Shopper” • Ages 26-50 • Skews female – “Modern Mom” • Driving less than twenty miles every day in a sedan or small SUV • Frequency of visit is every 7-10 days • “Budget novices” - take belt-tightening measures, but not analytical about it “The Commuter” • Ages 30-50 • Skews male • Lives in high-growth, quickly developing areas – suburban & exurban • Drives at least forty miles every day, likely in a mid-size sedan or larger SUV • Frequency of visit is every 3-4 days Research Market Analysis “Who are our customers?” Both customer segments are fairly uniform in their psychographic information: • Enjoy low-cost outdoor recreation on the weekends with friends, often paired with lowcost, low nutrition food (examples: day trips to the lake; backyard barbecues) • Married with both partners contributing economically; high school to some college • “Country-lite” – no rural life history, but identify with rural values paired with modern conveniences and indulgences (example: ownership of a pink gun) • Soft religious audience; strong on family values • Uses technology to socialize; nascent users for brand interaction & e-commerce • “Budget novices” – recognize the need for a household budget, but are pulled away from their budgets by the perception of “value” – often saves money for the family’s future (college, house, car, vacation, etc) • Dream of winning the lottery, though typically only play larger jackpots • Are smokers or dippers; those who “quit” still indulge with a trigger; strong gum audience Research Market Analysis “Who are our customers?” There are two major needs & demands from our customer segments: • Price-Conscious This need is primarily articulated toward the price of gasoline. This need skews into “The Wal-Mart Shopper” audience as the primary decision-making factor when shopping for gasoline. Frustrated by the variations in gas prices, this audience regularly turns to the internet and mobile applications to solve their need and take control of their purchase decision. Addressing this need requires one of two potential tacks: broad-based advertising of lowest prices OR of highest value. However, this audience is fickle and difficult to trap into loyalty programs or cross-sell gimmicks. The switching costs are very low for this audience and up to 60% of our total customer base falls into this need. • Convenience-Conscious This need is articulated as a primary decision factor by “The Commuter” and a secondary factor by “The Wal-Mart Shopper.” Commuters spend a significant portion of their day in a car, likely on the same or similar route every day at high-traffic times and any stops are typically scheduled or routine. Shoppers are stop-and-go, but seek single stop solutions when the price or value is right for the product. Addressing this need requires personalization of the experience. This audience sticks to a routine so loyalty programs may not actually generate loyalty, but will reduce the chance of switching so long as convenience is maintained. Research Market Analysis “Who are our customers?” Revenue Attractiveness Comparison Wal-Mart Shopper Visits/Month Avg Spend/Month Audience Size Revenues/Month Impact of +1 Visit/Month Additional Revenues/Month 3 $69 35% $362,250,000 $92 $120,750,000 Commuter Visits/Month 8 Avg Spend/Month $184 Audience Size 10% Revenues/Month $276,000,000 Impact of 5% Loyalty Increase Additional Revenues/Month $51,750,000 Assumptions Unique Customers/Month Average Spend/Visit 15,000,000 $23 Research Market Analysis “Who is MurphyUSA?” Quick Facts: • 1123 stores (2011); grow to 1180 stores in 2012 • Located in 23 states, primarily through the Southeast: Southeast Alabama Florida Georgia Mississippi North Carolina South Carolina 64 97 77 48 69 45 STORE LOCATIONS Appalachians Southwest Arkansas 59 Colorado 1 Kentucky 36 Louisiana 59 Missouri 46 New Mexico 6 Tennessee 74 Oklahoma 50 Virginia 3 Texas 234 North Illinois Indiana Iowa Kansas Michigan Minnesota Ohio 26 32 21 1 23 7 41 • $30m/day in gasoline sales; $0.01-0.02 profit margin/gallon of gasoline • $150m/mo in cigarette sales; $6m/mo in smokeless tobacco • $9m/mo in lottery sales (only 970 stores) • $3m/mo in beer sales (only 238 stores) • $10m/mo in soft drinks; $1.3m/mo in candy; $1m/mo in snacks; $1m/mo in dispensed beverages (hot, cold & frozen) Research Market Analysis “Who is MurphyUSA?” Research Competitive Analysis “Who are the market players?” Three types of market players: • Incumbent Competitors These are established retail gas outlets who offer similar products & services, including Exxon Mobil, Chevron Texaco, QuikTrip, Raceway, 7-11, CircleK, BP, and many others. • New Competitors These are new & horizon retail gas outlets who can potentially disrupt the marketplace, including bulk outlet stores (Costco, BJs), grocery stores (Kroger, HEB), and travel centers (Pilot, Loves). • 3rd Party Vendors These are vendors who supply our retail & merchandising side – and supply other outlets with similar product mixes. These include Phillip Morris, RJ Reynolds, Coca-Cola, Dr. Pepper, McLane, and many others. • 2nd Party Vendors / Partners These are partners who provide MurphyUSA with a direct benefit, but may indirectly compete with our retail & merchandising funnels. These include Lowe’s & Wal-Mart. Research Key Trends “What’s happening in the industry?” Three major competitive actions: (1) Loyalty Programs Many competitors are offering generic, broad-based loyalty programs based on gasoline usage. Rewards in loyalty programs are solely price-based; very little interaction otherwise. MurphyUSA: no loyalty program; e-Offers program for coupons (2) Private Label Branding Many competitors, especially QT and 7-11, are creating & distributing private label brands to compete with other major vendors such as Frito-Lay, Coca-Cola, and more. Retail margin on a private label brand is significantly greater than those with third-party vendors, and vendors have not responded (to date) by pulling product or perks. MurphyUSA: private label energy drink, isotonic drink; launching chips & soda line in 2012 (3) Convenience, Convenience, Convenience The industry is interested in speed of service, convenient locations, extended hours of operation, one-stop shopping, grab & go foodservice, fast transactions, variety of merchandise, and other traits speaking to time-starved consumers. MurphyUSA: among the fastest pumps in the US; conveniently located next to or immediately around Wal-Mart; “first to open, last to close”; fresh food @ Express Research Key Trends “What’s happening with consumers?” Consumers are more empowered than ever to make decisions – and are flooded with information (and noise) regarding brands, products, services, and everything in between all the time, 24/7, one websites, mobile phones, email, snail mail, television – everywhere they look. Yet with an economic downtown, most consumers are cutting back on their spending – and won’t return to their old spending habits when/if the economy rebounds. Instead, consumers are turning to technology to help get the best value for themselves, their friends, and their family. These consumers are smart, savvy, and driven by online research to find the best price, peer recommendations to find the best service, and social platforms to stay up to date on favorite products. The result: studies show that consumers who are engaged on digital platforms increase their spending on household purchases by 23% and make 19% more trips to retail outlets than average consumers. (Nielsen, 2011) Strategy Define the World “Our base assumptions” MurphyUSA Core Values Integrity: do the right thing Humble Leadership: work as a team to serve & support Superior Performance: measure & execute Responsibility: own your job Listen & Communicate: with all stakeholders Celebrate! Vision & Purpose Internally referred to as “cheap & cheerful” – MurphyUSA is a high volume, low cost operation synonymous with “low price” and “friendly service” to create & ensure a customer-oriented environment. Strategy Define the World “Our base assumptions” The goal: to actualize our vision, purpose, and values throughout the entire customer lifecycle, driving brand recognition & loyalty through an innovative, technology-enabled marketing program. Brand Loyalty Stimulus Research Purchase Consume Needs Wants Desires Information Price Convenience Experience Experience Strategy Define the Mission “What are we setting out to accomplish?” • To align strategic business themes & objectives with the customer lifecycle and experience • To integrate interactions between company & customer across a variety of channels, devices, media, and geography • To amplify company messaging through organic customer experiences, both digital & off-line Strategy Stimulus The goal is to stimulate & enhance an actual or perceived need in the consumer. * Currently, this need is commodity-based (“I need gasoline in my car”) This particular need is primarily reactive, not proactive, and based on an actual, physical, near-immediate need. * Highly difficult to generate loyalty based on a reactive commodity need. Market forces & industry norms disrupt loyalty behaviors as well as marketing messaging based on price, features, or benefits. * What we want to accomplish: Desire (“I want MurphyUSA gasoline in my car”) Character & value traits of MurphyUSA can motivate intentional actions, driven by desire, if these traits are clearly embodied & expressed by BOTH the consumer & by MurphyUSA. To accomplish this goal: clearly articulate & fully embody the “story” of MurphyUSA meshed with the “story” of the consumer. This goal is wholly different than the rest of the industry, who focus instead on masking the commodity need with a myriad of short-term, generic, and narcissistic “look at me” distractions that do not create genuine desire. Strategy Research The goal is to get quick & reliable information to the customer to best fulfill an expressed need, driving the customer to the point of purchase. * Currently, information to fulfill the need for gasoline is non-standard. Information needs include: pricing; store location; availability of fuel type; store amenities; retail product selection * Most gasoline consumers perform research while already in the car, driving around; mobile technology adoption is steadily growing to assist this particular informational need. * Branded apps are one way to convey this information, but necessitates prior loyalty or proactive behavior; need a broad amplification of this information on/with highly trafficked platforms * What we want to accomplish: standardization of information across all MurphyUSA-controlled channels; amplification of information across major geo-local platforms & information aggregators, such as Google Places, Bing Businesses, Yelp, GasBuddy, etc; creation of automatic push notifications for changes to locations, pricing, amenities, etc for both casual & loyal consumer use. To accomplish this: singular, aggregated, web-based, API-based internal database to push information to consumers in a reliable, expedient manner across all channels. Strategy Purchase The goal is to create a positive, memorable customer experience while on-site. * This is the point where all messaging, information, and expectation MUST be actualized and come true for the customer on-site. Currently, we (attempt to) differentiate on price & convenience, two major drivers in the gasoline purchase decision. However, as noted in the stimulus phase, price fluctuates on uncontrollable market conditions and convenience is a short-term moving target – what is convenient in one trip may not be convenient for another. * What we want to accomplish: differentiation of customer experience. Currently, we look to technology to differentiate our brand from others – but need to find that truly differentiated experience from other gas stations & convenience stores. - Implementation of island vending machines (to integrate pump & vend at a singular point of purchase) – December 2011 - Mobile sites, mobile apps, Murpay system - existing - Still need to maintain speed of service (necessary for high volume business model) Strategy Consume The goal: create genuine use and enjoyment from the product & purchase experience. * This is the ‘second moment of truth’ – did the brand promise live up to the product & purchase expectations within the customer, whether brand OR customer created? * What we want to accomplish: unique & fulfilling customer experience to exceed expectations AFTER purchasing gas/merchandise and leaving MurphyUSA. - What did we promise to the customer? Did we fulfill? - Did we do what we told the customer we would do? - Did we make an emotional connection with the customer? * To accomplish: post-purchase follow-up = “just ask!” Provide strong feedback mechanisms that are well-monitored & can be immediately shared to the customer network AND to MurphyUSA management teams. These can be CRM-driven once CRM & POS are integrated for proper follow-up on customer emotional satisfaction. Strategy Loyalty The goal is to develop repeat visitors, transforming them into brand advocates. * This is the point where brand promises are realized, validated, and internalized in the customer – eventually moving to a point where the customer trusts the brand enough to externalize their perception of the brand. * What we want to accomplish: brand trust through our advocates. People trust their families, their friends, and individual leaders – so it’s time to harness the power (and wisdom) of crowds to create the trust needed for brand loyalty. It’s not only about creating a good experience – it’s about creating an experience worth talking about again and again and again. * Consumer trust is the product of (confidence + familiarity). * Confidence is developed out of our skills & abilities to do what we say we will; Familiarity is developed from a shared experience & common philosophy. * This is the point where we’ve reliably delivered on our brand promises + moved away from the consumer “you” to the relationship of “you + MurphyUSA” to emphasize the shared experiences and common philosophy, driving return visits to MurphyUSA. Strategy Linking the World to Mission “What are the critical factors for success? (1) Our customers are mobile, but device use within the lifecycle is spotty. - Either need to drive mobile device use OR provide alternative mechanisms & partnerships to drive stimulus & research phases (2) Show, don’t tell – the MurphyUSA story is about our customers and is everevolving to showcase our shared values, experiences, purpose from a customer perspective. - With this in mind, focus on multiple forms of media, as well as temporal significance in the content (3) It’s time to have a deep conversation with our customer segments. - Best to unite our customers into organic segments and immerse ourselves in their conversations. What are their needs, worries, hassles, joys – and how can we best align ourselves with our customers? (4) Strengthen the internal bonds between the business units within Murphy Oil - Customers (should) see MurphyUSA as one seamless entity that sells fuel, and merchandise, speaks to customers in a single voice, and interacts with the community as one holistic , well-oiled, high volume machine. Design Communication “What is it we are trying to communicate? Our Unique Competitive Positioning: We can focus on a number of factors, including: Benefits - What are the benefits of shopping/fueling at a MurphyUSA? Value - What value can we provide our customers? Results - Can we point to specific, causative results stemming from MurphyUSA? Solutions - Do we provide solutions to pains, hassles, concerns of our customers? Individual Partners - How do our vendor relationships translate into a unique advantage? Service - What kind of services do we offer that no one else does? Specialty - Do we specially specialize for particular niche customer segments? Customer Feedback - How vocal are our customers with feedback and innovation? Credibility - Are we especially credible with our audience – and if so, why? Visibility - Do we enjoy great visibility, press, or savvy real estate locations?