PROJECT FEASIBILITY

advertisement

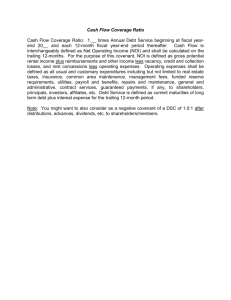

PROJECT FEASIBILITY “Does the Input =the Output?” or “Can It Work?” The Stages of the Development Process • • • • Creating the Concept Testing the market Evaluate Site Costs Pro Forma – Income – Expenses • Finding Tenants • Permanent Financing • Construction Finance • “Gap” Financing • Construction – Under Budget – Within schedule • Managing Property • Selling the Asset • Starting Over Sponsored by: U. S. Department of Housing and Urban Development TDA, Inc. Presented by: Logistics Agenda Handouts Breaks Restrooms Questions “Parking Lot” Who is here? Introductions Session Rules Keep it informal Ask questions Share your experience Use your manual - take notes on the pages Enjoy the number crunching Module 1 Underwriting What is Underwriting? – Determining facts – Making reasonable assumptions – Analyzing risks – Making recommendations to minimize risks Public v. Conventional Conv. Lenders consider: • market risk • borrower risk • project risk • portfolio risk Public Lenders also consider: • public purpose • regulatory compliance • affordability • gap analysis Market Risk • Rent-up risk • Maintenance of occupancy & rents • Maintenance of collateral value Borrower Risk The Five C’s: – – – – – Cash Capability Creditworthiness Character Collateral Project Risk • Completion risk • Financial feasibility risk • Collateral risk The Shift to “Market” • Market v. jurisdiction/service area • Customers v. clients • Product v. service • Demand v. needs • if we build it, they will come • LI housing doesn’t have to compete Market Risks • • • • • • Rents above market Rents unaffordable Excess capacity; slow absorption Competitive disadvantage Market won’t sustain occupancy Property won’t maintain value Scope of Borrower Analysis Assessing risks that the borrower will complete the project, considering: • Organizational structure • Business experience & qualifications • Financial condition & prospects • General credit history Key Borrower Questions • What type of borrower? – New v. existing entities – For-profits v. not-for-profits • Who are the “key principals”? – Creditworthiness of principals – Personal liability – Recapture requirements Five C’s of Borrower Risk • • • • • Cash Collateral Creditworthiness Capability Character Cash: Equity & Liquidity • How much equity is committed • Timing, amount & source of equity – Cash – Land – Contribution of Fees • What else is available...if needed? Collateral • Completion guarantee • Operating guarantee • Portfolio: – Overall stability, profitability, liquidity & vulnerability of other assets in portfolio – Diversification of portfolio – Other direct & contingent liabilities – Cross-collateralization What to Look at: Collateral • • • • • • • Net worth Schedule of real estate investments Notes on contingent liabilities Level of reserves/escrows Potential refinancings (e.g., balloons) Trends in property cash flows Market factors Creditworthiness • • • • Loan payment history Current debt load Current performance Discrepancies Capability • • • • • • Legal entity Experience: projects of similar scope Prior collaboration of team members Loan history (incl. defaults) Property management performance Not-for-profit issues How to look at Capability • • • • Financial statements: debt load Credit report: payment history Lender contacts Property inspections Character • Subjective judgments: – Likelihood to perform/stick with it – Integrity/live up to commitments • Look at: – Past development performance – Physical/management condition – References on past debt performance & problem resolution Financial Statements • Used to identify “current” problems – losing $$ on operations – not enough cash to meet obligations • Used to identify “potential problems” – look at trends • Used to identify “source of problems” Module 2 Analyzing Project Risk Analyzing Project Risk Development Budget Budgets are... • • • • Estimates Iterative Dynamic Linked The Budgets Development Budget • Sources Operating Budget • Revenue • Uses • Expenses • NOI • Cash Flow Development Cost Analysis • Underwriters do their own estimates & analyze variance from developer’s budgets • All development costs analyzed: • Acquisition cost • Construction cost • Soft costs, esp. developer fees • Development Sources: gap analysis Project Selection • Look the gift horse... • Watch out for problem sites • unsuitable location • topographical & subsoil conditions • environmental problems & wetlands • Beware complex projects • You & me against the market... • The neighbors Acquisition: Cost v. Value • Requiring an independent appraisal • public $ often first in, used for acquisition • often non-arms-length transactions • Valuation methods • Valuing low-income housing • Loan-to-value issues Construction Issues • Environmental Issues • Davis-Bacon Act • Procurement Process – M/WBE, EEO, Section 3 • Housing Quality • Contingency • Deadlines: readiness to proceed Fee Analysis • Fees are for services rendered; (return on equity is separate) • Use of consultants • Program/Lender’s fee limits • Split of fees in joint venture • Identity of interest & non-arms-length transactions Other Soft Costs • • • • Marketing Initial Operating Deficit Capitalized reserves Relocation • The Operating Pro Forma Operating Expenses Rents & Revenue Issues • Mix of incomes • Rent Limits: CDBG,HOME, LIHTC, Other • Utilities & utility allowances • Market issues: • street rent v. limits • vacancy/collection loss • Affordability of rents • Rent adjustments in the future Debt Service • Paid from income after expenses (NOI) • Debt service coverage requirements • Capitalize NOI to determine value and maximum loan Operating Analysis Key Operating Measures: • Net Operating Income (NOI) • Cash flow (ROI/ROE) • Debt coverage ratio • Break-even ratio Module 3 Analyzing Project Risk II: Putting Together Sources of Funds Balancing the Budgets • • • • Financial feasibility/viability analysis “Front door” v. “back door” analysis Closing the Gap Gap funding source impacts The Budgets Development Budget • Sources Operating Budget • Revenue • Expenses • Uses • NOI • Cash Flow Public Financing Issues • Computing maximum public subsidy • affordability standard • • • • Layering Regulatory overlap Deferral terms Enforcement & recapture mechanism General Financing Issues • • • • • • Equity required Firmness of other commitments Inter-creditor issues Rate/order of disbursements Overruns Balloons & other long-term issues Case Study Steps 1 & 2 Gross/Net Income (Steps 1 & 2) No. Rent - Util Revenue 1 BR ___ ____ ____ ______ 2BR ___ ____ ____ ______ Gross Potential Income =______ Vacancy/Coll. Loss 5% -______ Effective Gross Income =______ - Operating Expenses -______ Net Operating Income (NOI) =______ Step 3 Calculate 1st Mortgage Debt: NOI _______ Divide by: Debt Serv. Cov. /_______ NADS =_______ Divide by: Mortgage Constant /_______ Maximum Loan =_______ LTV Ratio (Loan/$370,000) =_______ Step 3, cont.. Calculate Net Available for PRI Loan NOI _______ - 1st Mortgage Debt Service -_______ Net Available =_______ Divide by: Mortgage constant /_______ Max. PRI Loan (<$50,000) =_______ Step 4 Uses Acq. $15,000 Constr. $285,000 Soft Costs $60,000 ---------Total $360,000 Sources Equity 1st Mortgage PRI Public Loan(s) --------Total$ Gap Wrap-up • Review of highlights • Next Steps • Questions Evaluations Thank you for your time and attention.