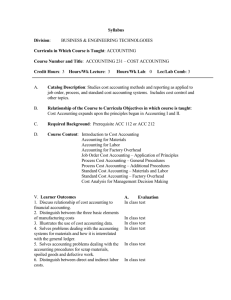

Introduction to Managerial Accounting

advertisement

Job Order Cost System Module 5 ACG 2071 Created by M. Mari Fall 2007-1 Cost Accounting Systems Job order cost Provides separate record of the cost of each quantity of the product that passes through the factory Process cost system Costs are accumulated for each of the department or processes within the factory Job Order Accounting A major aim is to determine the cost of producing each job or job lot. Job sheet Is a separate record maintained for each job While a job is being manufactured, its accumulated costs are kept in Goods in Process Inventory When job is finished , costs are transferred to Finished Goods Inventory Purchase of Materials Date Account Raw materials inventory Accounts payable Debit Credit XX XX Example Purchased $8,000 worth of materials for use in production on account Date Account Raw materials inventory Accounts payable PR Debit Credit $8,000 $8,000 Requisition of Materials Date Account Debit Work in process Total direct materials used Factory overhead Total indirect materials used Materials inventory Credit Total materials used Example 2 Material usage is shown below, record the material used Job # Materials 125 $4,500 126 $4,250 127 $4,000 128 $3,500 129 $3,000 Indirect $2,000 TOTAL $21,250 Example 2 Date Account Work in process Factory overhead Raw materials inventory Debit Credit $19,250 2,000 $21,250 Factory Labor Date Account PR Debit Good in process Direct labor Factory overhead Indirect labor Wages payable Credit Total labor costs Example 3 To the right, you will find a distribution of labor costs between jobs. Please record the labor used. Job # Labor Direct labor hours 125 $5,000 200 126 $4,900 175 127 $4,500 150 128 $4,000 125 129 $3,500 100 Indirect $1,500 TOTAL $23,400 830 Example 3 Date Account Work in process Factory overhead Wages payable Debit Credit $21,900 1,500 $23,400 Factory Overhead Costs Date Account Factory overhead Various accounts PR Debit Credit Total actual overhead costs Total actual overhead costs Allocating Factory Overhead Cost allocation – the process of assigning factory overhead costs to a cost object Activity Base – measure used to allocate factory overhead Predetermined factory overhead rate = Estimated total factory overhead costs Estimated Activity Base Examples Example 4: The corporation estimates FO at $500,000 for the next period. The corporation uses direct labor hours as its activity base and estimates 50,000 total direct labor hours Predetermined rate = Estimated FO Costs Estimated activity base = $500,000 50,000 DLH = $10 per direct labor hour So factory overhead is applied at rate of $10 for each hour of direct labor charged to the job. Examples Factory overhead costs are $500,000 for the next period. Factory overhead is determined as a percentage of direct labor costs. If direct labor costs is $750,000, what is the factory overhead rate? Predetermined rate = Est. Factory overhead Est. Activity Base = $500,000 $750,000 = 67% Factory overhead is applied at a rate of 67% of direct labor costs. For each dollar of direct labor charged to the job, 67 cents is charged to factory overhead. Applying Factory Overhead The factory overhead account is applied based on the predetermined rate. Date Account Work in process Factory overhead PR Debit Credit Total factory overhead applied Total factory overhead applied Example 6 Below is the manufacturing information for Bunny. Factory overhead rate is $50 per direct labor hour. Record the application of factory overhead to the jobs listed below. Job # Mtrls Labor DL hr 125 4500 5000 230 126 4250 4900 175 127 4000 4500 150 128 3500 4000 125 129 3000 3500 100 Indirect 2000 1500 Totals 21250 23400 780 FO Example 6 Job # DLhr FO 125 230 230 X $50 per direct labor hour = $11,500 126 175 175 x $50 = $8,750 127 150 150 x $50 = $7,500 128 125 125 x $50 = $6,250 129 100 100 x $50 = $5,000 Indirect Totals 780 $39,000 Example 6 Date Account Goods in process Factory overhead PR Debit Credit $39,000 $39,000 Example 7 Taxon Corporation applies factory overhead at the rate of 75% of direct labor costs. Record the application using the following information: Job # Labor Factory 125 126 $5000 $4900 $5,000 x 75% = $3,750 $4,900 X 75% = $3,675 127 $4500 $4,500 X 75% = $3,375 128 $4000 $4,000 X 75% = $3,000 129 $1500 $1,500 X 75% = $1,125 TOTAL $14,925 Example Dat e 7 Account Goods in process Factory overhead PR Debit Credit $14,925 $14925 Factory Overhead Factory Overhead Account Debit Actual factory overhead costs greater than estimated and applied factory overhead costs Credit Actual factory overhead costs less than estimated and applied factory overhead costs Disposal of Factory Overhead Since Factory overhead is an EXPENSE account, it must be closed at the end of the period. The balance of the account is closed into COST OF GOODS SOLD Date Account Cost of Goods Sold Factory overhead P Debit Credit Debit if underapplied by the balance in the account Credit if overapplied by the balance in the account Debit if overapplied by the balance in the account Credit if underapplied by the balance in the account R Example Example 7: The balance in the factory overhead account is $50,000, the corporation applies $60,000 to work in process. Record the disposal of the balance. The factory overhead account has a credit balance of $10,000 after the entry to apply factory overhead to work in process. Example Factory overhead Debit Credit $50,000 $60,000 Actual factory overhead costs Factory overhead costs applied $10,000 balance Over-applied factory overhead Date Account Debit Factory overhead $10,000 Cost of goods sold Credit $10,000 Example Example 7: The balance in the factory overhead account is $100,000, the corporation applies $95,000 to work in process. Record the disposal of the balance. The factory overhead account has a debit balance of $5,000 after the entry to apply factory overhead to work in process. Example Factory overhead Debit Credit $100,000 $95,000 Actual factory overhead costs Factory overhead costs applied $5,000 balance Under-applied factory overhead Date Account Cost of goods sold Factory overhead Debit Credit $5,000 $5,000 Transfer of Finished Goods Date Account Finished goods Work in process Debit Credit Total manufacturing costs Total manufacturing costs Example 9: Suppose that jobs 125, 126, and 127 are completed. Record their transfer to finished goods inventory. Job Mtrl Labor FO Total 125 $4500 $5000 $6900 $16400 126 $4250 $4900 $5250 $14400 127 $000 $4500 $4500 $13000 Total $43,800 Transfer to Finished Goods Dat e Account Finished goods inventory Goods in process PR Debit Credit $43,800 $43,800 The jobs are kept in Finished Goods Inventory until they are sold to the customer. Then they are transferred to Cost of Goods Sold Transferred to COGS Date Account Cost of goods sold Finished goods PR Debit Credit Total cost Total costs Example Using the information in example 7 above, assume that jobs 125 which costs $16,400 to manufacture has been sold for $75,000 on account. Record the entry. Date Account Accounts receivable PR Debit $75,000 Sales Cost of goods sold Finished goods Credit $75,000 $16,400 $16,400