FCNR,FCCB & ADR n GDR

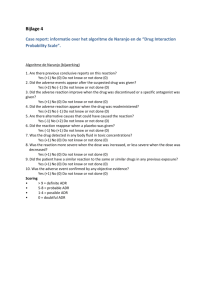

advertisement

At your service today… 205 – Amit 207 – Chandni Dev 210 – Devarsh Mapuskar 215 – Karan Shetty 217 – Kunal Pradhan 250 – Vindhya Kundnani FCNR FCCB ADR & GDR FCNR NRI Non Resident Indians – person resident outside India who is a citizen of India or a person of Indian origin who have settled abroad for indefinite period of stay either for business or for job NRI Accounts started in 1990 in India. To benefit the FX reserves. Accounts for NRI Repatriable accounts Non- Resident External Rupee Account (NRE Account) – Account maintained in INR. Foreign Currency Non-Resident (B) Account (FCNR (B) Account): FC account Maintained in Indian Banks. Accounts for NRI Non-Repatriable accounts Non-Resident Ordinary Rupee Accounts (NRO account)Savings, Current and Time deposits. Non-Resident Non-Repatriable term Deposits. Non-residents (Special) rupee (NRSR) Account Scheme with effect from 15.4.1999. FCNR Accounts FCNR Savings Account Current Account Recurring / FD’s FC Cheques Remittances FCNR Existing Accounts Currency Notes Savings A/C – FC earned transferred to India INR Rs. 10000 Min Amt 4% PA Current A/C – Ideal for NRI’s who earn ESOP’s from Indian Companies INR Rs. 25000 Min Amt FCNR Deposits – Protect exchange risk USD , EUR , GBP , JPY, AUD, CAD Min 1 yr – Max 5 yrs Settlement FC / INR cheque FCNR Convert to INR A/C Repay Loan in FC / INR Current Interest Rates Period USD GBP Euro JPY AUD CAD 1 Yr to < 2 Yrs 1.76% 2.59% 3.17% 1.56% 6.44% 2.85% 2 Yrs to < 3 Yrs 1.64% 2.32% 2.94% 1.37% 5.80% 2.65% 3 Yrs to < 4 Yrs 1.94% 2.57% 3.11% 1.40% 5.84% 2.86% 4 Yrs to < 5 Yrs 2.32% 2.86% 3.31% 1.44% 6.07% 3.07% 5 Yrs only 2.72% 3.14% 3.51% 1.51% 6.19% 3.27% Features and Benefits Attractive interest rate in FC Deposits Rupee overdraft upto 90% of deposit value Part Repatriation Tax benefit. Income earned from interest not taxable in India. Maintained in FC – No FX risk. Loans on certain percentage of FCNR accounts can be availed Repatriation Example Opening USD Rate INR 1000 50 50000 Closure 1250 P/L USD 40 Profit of $250 50000 250 Loss of $90.909 Opening USD Rate INR 1000 50 50000 55 50000 Closure 909.0909 P/L USD -90.909 Current State Current NRI Deposits in India (US$ Billion) FCCB Foreign Convertible Bonds What is a BOND? What is a BOND? A Bond is simply an Instrument; in which an investor agrees to loan money to a company or government in exchange for a predetermined interest rate.” When a corporation needs funds, one way is to arrange funds is from banks or borrow money. But a generally less expensive way is to issue (sell) bonds. The organization agrees to pay some interest rate on the bonds and further agree to redeem the bonds (i.e., buy them back) at some time in the future (the redemption date). What is FCCB? • Foreign Currency Convertible Bond is a type of convertible bond issued in a currency different than the issuer&apos;s domestic currency. • It is a quasi-debt instrument which are attractive to both investors and issuers. The investors receive the safety of guaranteed payments on the bond and are also able to take advantage of any large price appreciation in the company&apos;s stock. • Due to the equity side of the bond, which adds value, the coupon payments on the bond are lower for the company, thereby reducing its debt-financing costs. Total Outstanding FCCB’s Issue OF FCCB’s • An Indian company or a body corporate, created by an Act of Parliament may issue FCCBs not exceeding US $ 500 million in any one financial year to a person resident outside India under the automatic route, without the approval from Government or the Reserve Bank. • Where the amount of fund to be raised is to be USD 20 million or less the minimum maturity period should be not less than three years. • If the amount to be raised is more than USD 20 million and upto 500 million the minimum maturity period should not be less than 5 years. • FCCBs upto USD 20 million can also carry a call and put option provided the option shall not be exercised until minimum maturity period of 3 years has expired. WHY FCCBS ARE POPULAR? • Being hybrid instruments, the coupon rates on FCCB are particularly lower than pure debt or zero, thereby reducing the debt financing cost. • FCCB are book value accretive on conversion. • Saves the risk of immediate equity dilution as in the case of public shares. • Lucrative offer for investors :• Assured returns to investors on bond in the form of fixed coupon rate payments. • Ability to take advantage of price appreciation in the stock by means of warrants attached to the bonds, which are activated when price of a stock reaches a certain point. • Significant Yield to Maturity (YTM) is guaranteed at maturity. Lower tax liability as compare to pure debt instruments due to lower coupon rates. REMEDIES TAKEN BY GOVERNMENT • Promoters or issuers of foreign currency convertible bonds (FCCBs) may be allowed to buy back the bonds if they go in for prepayment. • Also, promoters are likely to be allowed to utilise the unused portion of the foreign currencydenominated borrowings parked overseas. This could also be utilised to meet the redemption pressure after the bonds mature. • It has now been decided to permit premature buyback of FCCBs. For the buyback of FCCBs out of rupee resources the RBI has fixed a minimum discount of 25% on the book value. The amount of the buyback is limited to US $50 mn of the redemption value per company wherein this window will be kept open till March 09. • To Buyback FCCB out of Foreign Currency minimum discount of 15% on the book value. Indian Scenario • Reliance Communication would most likely be the first company to announce buy back of its Foreign Currency Convertible Bonds (FCCBs) • R-Com had issued zero-coupon FCCBs in February 2007, to raise USD 1 billion. The bonds are now trading at a 35% discount to the issue price, meaning, its bonds worth has now come down to US$650 million • RCom, as it currently has over Rs.100 billion in cash reserves, which also includes about US$ 600 million worth of investments in mutual funds overseas • This move to buy back by Rcom is good, as it would help the company reduce its liability and also bring down its forex exposure. • Tata Motors has cumulative outstanding FCCBs worth Rs.44.87bn. • Compared to current market price of Rs.152 the FCCB’s is at a 85% discount compared to the conversion price. Considering the large capex program planned by the company and the downturn in automobile industry, shut down of production facilities, likely increase in borrowings to fund JLR, it could face difficulties in terms of cash flow management in near term future and is unlikely to opt for pre-payment option for FCCBs. • Thus many companies Like Tata Motors which are already under high debts are unlikely to buyback due to limited cash flows • Examples:SUBEX,AMTEK AUTOS,HOTEL LEELA et al. • Also $50million sum with limit of 25% discount is only a small step for large FCCB issues.Many companies will not be able to meet the requirements. Impact • Two to three years back Indian markets were on high growth and FCCBs became popular for raising funds from overseas market. • With the fall in the market, many FCCBs has gone down, which means no money and more problem in the market. • Issuing companies will now have to search for resources to repay the debt along with redemption period whenever it matures. For this companies will seek to fresh borrowings, with high interest rates, which in turn would impact their profitability. • Another option, which companies have is to reset the conversion clause, to bring it closer to reality. ADR & GDR Depository Receipt • Negotiable (transferable) financial security • Foreign publicly listed company COMPANY SHARE • Physical certificate • TYPES - ADR GDR IDR DEPOSITARY BANK INVESTOR What is ADR • ADR- American Depositary Receipts A negotiable certificate issued by a U.S. bank First Introduced in 1927 Represents a specified number of shares of a foreign company ADRs are denominated in U.S. dollars. How does ADR/GDR work ? • Let us take Infosys example – trades on the Indian stock at around Rs.2000/• This is equivalent to US$ 40 – assume for simplicity • Now a US bank purchases 10000 shares of Infosys and issues them in US in the ratio of 10:1 • This means each ADR purchased is worth 10 Infosys shares. • Quick calculation means 1 ADR = US $400 • Once ADR are priced and sold, its subsequent price is determined by supply and demand factors, like any ordinary shares. Process for ADR/GDR Releases Equity Shares Requests the bank to release of equity Shares Requests for buying ADR/GDR Gives Instructions to Issue ADRs/ GDRs Issue ADRs/GDRs Types of ADR Types of ADRs Unsponsored Level I Sponsored Level II Level III Private placement Unsponsored ADR Sponsored ADR • Initiated by the issuer • Exemption from full SEC reporting requirements • Depositary agreement is executed between the issuer and one selected depositary bank • Traded over the counter only • Capital raising is not permitted • Comply with the SEC's full registration and reporting requirements • Comply with the SEC's other disclosure rules • Can be listed any of the stock exchange • Recognition • It is more expensive and time-consuming •Similar to Level II ADRs •Allows the issuer to raise capital through a public offering of ADR •SEC reporting is more onerous •More expensive than Level I and II ADRs Restricted ADR • 144-A • Known as a Restricted ADRs (RADR) • Sale is made to only QIBs • Easy access to Private placement market of US • Regulation S • Shares are not registered with any United States securities regulation authority. • Shares are registered and issued to offshore, non-US residents. GDR – Global Depositary Receipts A bank certificate issued in more than one country for shares in a foreign company Offered for sale globally through the various bank branches Shares trade as domestic shares GDR – CUSTODIAN BANK – DEPOSITORY BANK • Custodian Bank located in same country • Works with the Depository Bank and follows instructions from the depository bank. • Collects, remits dividends and forwards notices received from the depository bank. GDR MARKET • GDRs can be created or cancelled depending on demand and suply • When shares are created, more corporate stock is placed in the custodian bank in the depositary bank account • The depositary bank then issues the new GDRs • Factors governing GDR prices are company track record, analysts recommendations, relative valuations, market conditions and also international status of the company GDR Listing • • • • • London Stock Exchange Luxembourg Stock Exchange DIFX Singapore Exchange Hong Kong Exchange Difference between ADR and GDR • Both ADR and GDR are depository receipts, and represent a claim on the underlying shares. The only difference is the location where they are traded. • Depositary receipts traded in USA – ADR • Depositary receipts traded in a country other than USA - GDR India- ADR and GDR • ADRs and GDRs are an excellent means of investment for NRIs and foreign nationals wanting to invest in India • By buying these, they can invest directly in Indian companies without going through the hassle of understanding the rules and working of the Indian financial market – since ADRs and GDRs are traded like any other stock • NRIs and foreigners can buy these using their regular equity trading accounts Indian Companies using ADR/GDR COMPANY ADR GDR Bajaj Auto Dr. Reddys HDFC Bank Hindalco ICICI Bank Infosys Technologies ITC L&T MTNL Patni Computers Ranbaxy Laboratories Tata Motors State Bank of India VSNL WIPRO No Yes Yes No Yes Yes No No Yes Yes No Yes No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No Yes No Yes Yes Yes Thank you...