Peak Oil - Michigan Technological University

advertisement

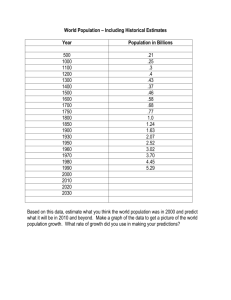

PEAK OIL The Looming Energy Crisis J. R. WOOD GEOLOGY DEPT. MICHIGAN TECHNOLOGICAL UNIVERSITY ANNUAL PRODUCTION OF CRUDE OIL ACTUAL & PROJECTED SOURCE: ASPO, 2004 U.S. energy consumption, 2001 US CRUDE CONSUMPTION USA-OIL 20 18 16 ANNUAL CRUDE OIL CONSUMPTION IN THE US & SOURCES Mb/d 14 Net import 12 10 NGL 8 6 Alaska Rest-USA 4 2 Texas 0 35 40 45 50 55 60 65 70 75 80 85 90 95 0 DEPENDENCE OF NATIONAL GDP ON OIL CONSUMPTION: 67 COUNTRIES GDP (PPP) GDP AND OIL CONSUMPTION WORLD ENERGY CONSUMPTION EXXON-MOBIL THE DEBATE OVER RESERVES: PESSIMISTS AND OPTIMISTS During the 1990’s, the debate over oil reserves generated controversy between the "pessimists" and the "optimists". OIL IS POLITICAL “Oil is so important that publishing reserve data has become a political act. Most of the dispute between the so-called pessimists (mainly retired geologists) and the optimists (mainly economists) is due to their using different sources of information and different definitions. The pessimists use technical (confidential) data, whereas the optimists use the political (published) data. “ Jean Laherrère "Future of oil supplies” Seminar Center of Energy Conversion Zurich May 7 2003 PESSIMISTS • the world is finite and so are its recoverable oil resources • all of the oil-bearing regions worth exploring have already been explored • the big fields have already been discovered • claim that official figures for proven reserves have been overestimated • world oil production is currently at its optimum (peak) and will decrease steadily •Geologists and physicists tend to hold this position. OPTIMISTS • hold a “dynamic” concept of reserves • believe that volumes of exploitable oil and gas are closely correlated to technological advances, technical costs and price • tend to be economists THE “FLAT EARTHER’S” PRODUCTION CURVE “… often assumed by economists that oil production can simply be increased to keep pace with consumption until the wells finally and suddenly run dry.” http://wolf.readinglitho.co.uk/index.html Summary: Optimists and Pessimists Will the hydrocarbon era finish soon? Oct. 2000 H. Rempel, Federal Institute for Geosciences and Natural Resources, Stilleweg 2, 30655 Hannover 140 40 120 35 100 80 Peak Discovery 1964 30 25 20 60 15 High Prices Curb Demand 40 10 20 0 1930 5 1950 1970 1990 2010 2030 Production, Gb/a Discoveries, Gb/a World - Regular Oil 0 2050 Ultimate : 1850 Gb To-date 2003: 920 Gb DISCOVERIES WORLD OIL DISCOVERIES Oil discoveries worldwide peaked at 90 Gb in 1964 (except for an exceptional, solitary peak year in 1948 of 147 Gb. It clearly shows the fall in discovery. Even the successes such as North Sea oil in the mid-1970s do not halt the trend,. “You have to find it before you can produce it “ Production mirrors discovery after a time lag Source: ASPO 3 YEAR AVERAGE Production mirrors discovery … Drilling more does not help After a time lag of ~35 years for the US Lower 48. Real Discovery Trend 60 Past Discovery 50 Future Discovery Production Gb 40 Past discovery by ExxonMobil 30 20 10 0 1930 1950 1970 1990 2010 2030 2050 Production mirrors discovery … … for the world? Drilling more does not help The Growing Gap between Discovery and Consumption 12 Drilling more does not help Gb/year 40 10 8 20 6 4 0 2 -20 1960 0 1970 1980 1990 2000 Wildcats (x1000) 60 BUT “OFFICIAL” PROJECTIONS CONFUSE … SOURCE: EIA & USGS Regular Oil How Much has been Found? 1700 Gb (rounded) When was it found? Peak discovery was in 1964 ESTIMATTES OF ULTIMATE RECOVERY “The attached graph shows 76 estimates of ultimate recover estimates published by major oil companies and serious scientific institutions. There is a consensus, ... from which only a few eccentric high estimates depart (that) ... the average works out at 1930 Gb, of which 920 Gb, or almost half (48%), have been consumed.” How Much has been Found? 1700 Gb (rounded) When was it found? Peak discovery was in 1964 Where is it? Regular Oil ME.Other East Produced W. Europe Reserves Yet-to-Find Africa L. America N. America Eurasia ME Gulf -250 -150 -50 50 150 250 350 450 RESERVE ESTIMATES RESERVES ARE: ORIGINAL OIL IN PLACE – PRODUCTION “RESERVE GROWTH” IS REAL BUT SOMETIMES HARD TO VERIFY RELIABLE DATA ARE HARD TO COME BY PRIME DIFFERENCE BETWEEN “OPTIMISTS” AND “PESSIMISTS” “Political” Reserves Companies officially under-report where they can. Stock Exchanges encourage underreporting Countries variously – Under-report based on company returns – Over-report, for example, for OPEC quota – Simply fail to update - 68 countries in 2003 Final Size 700 3rd Revision 800 2nd Revision 900 1st Revision First Report Proposal to Management Exploration SIZE “Reserve Growth” 1000 Large field Small fields 600 500 400 300 200 100 0 STANDARD SOURCES OF DATA STNADARD SOURCES •OIL & GAS JOUIRNAL •WORLD OIL •BP STATISICAL REVIEW •API (DOE) •OPEC “Reserves published as “proved” by Oil & Gas Journal (OGJ), World Oil, BP Statistical Review, American Petroleum Institute and OPEC, can be called “political” (or financial).” Jean Laherrère "Future of oil supplies” Seminar Center of Energy Conversion Zurich May 7 2003 OGJ and World Oil simply report what governments and companies send them BP uses OGJ & WO data but does not filter, QC or apply institutional knowledge API and OPEC are meant to be political World Discovery Cumulative Discovery, Gb The Popular Image 2500 2000 1500 1000 500 0 1930 1950 1970 1990 2010 Based on non-backdated revisions 2030 Reality and Illusion 2500 Cumulative Discovery, Gb Flat-earth illusion 2000 1500 Inflection due to falling Discovery Reality 1000 OPEC “quota war” 500 0 1930 1950 1970 1990 2010 2030 Final Size 700 3rd Revision 800 2nd Revision 900 1st Revision First Report Proposal to Management Exploration SIZE Evolution of Reporting 1000 Large field Small fields 600 500 400 300 200 100 0 Spurious OPEC Reserve Revisions OPEC PRODUCTION QUOTAS DEPEND ON STATED RESERVES THE TEMPTATION TO EXAGGERATE PROVED IRRESISTABLE Year 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Abu Dhabi 28.0 29.0 30.6 30.5 30.4 30.5 30.0 31.0 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 92.2 Dubai Iran Iraq 1.4 1.4 1.3 1.4 1.4 1.4 1.4 1.4 4.0 4.0 4.0 4.0 4.0 4.0 4.3 4.3 4.0 4.0 4.0 4.0 4.0 4.0 4.0 58.0 57.5 57.0 55.3 51.0 48.5 47.9 48.8 92.9 92.9 92.9 92.9 92.9 92.9 89.3 88.2 93.0 93.0 89.7 89.7 89.7 89.7 89.7 31.0 30.0 29.7 41.0 43.0 44.5 44.1 47.1 100 100 100 100 100 100 100 100 112.0 112.5 112.5 112.5 112.5 112.5 112.5 Kuwait Neutral Zone 65 6.1 66 6.0 65 5.9 64 5.7 64 5.6 90 5.4 90 5.4 92 5.3 92 5.2 92 5.2 92 5.0 95 5.0 94 5.0 94 5.0 94 5.0 94 5.0 94 5.0 94 5.0 94 5.0 94 5.0 94 5.0 94 5.0 94 5.0 Saudi Arabia 163 165 165 162 166 169 169 167 167 170 258 258 258 259 259 259 259 259 259 261 261 261 261 Venezuela 18 18 20 22 25 26 26 25 56 58 59 59 63 63 65 65 65 72 73 73 77 78 78 In billions of bbls. Misleading Reporting by BP Statistical Review 1200 Genuine revisions not back dated ! 1000 Gb 800 600 400 200 0 1970 1975 1980 Middle East 1985 1990 Rest of World 1995 WORLD OIL RESERVES - BP STATISTICS The BP statistics for the world's proved reserves of oil are unrealistic, showing the unsupported OPEC leap in the 1980s and a steady increase despite years when consumption was greater than discovery. Source: BP THE CRUDE OIL CRISIS So, what does it mean … • if WORLD CRUDE PRODUCTION IS PRESENTLY PEAKING, • if MOST OF THE WORLD’S OIL HAS BEEN DISCOVERED, • and if WORLD DEMAND CONTINUES TO GROW? if WORLD CRUDE PRODUCTION IS PRESENTLY PEAKING End of cheap oil Exxon stock anyone? Really a stretch, Dr. Wood Population crash? Just the perception that oil is peaking will be a problem • Financial markets can be counted on to react badly • Governments too; some may even consider going to war • General population will bear the brunt, esp. in poorer, undeveloped countries if most of the World’s oil has been discovered The OPEC/Middle East Crossoverv One consequence: •OPEC is expected to produce more than 50% of the world's oil around 2010, •How will Western economies cope? Oil production comparing OPEC with the Rest of the World. Source: ASPO •and if WORLD DEMAND CONTINUES TO GROW? 2003 TOTAL ENERGY CONSUMPTION 100 Qatar UAE Singapore 10 Iceland Canada KuwaitNorway USA O/P (TOE/C/YR) Belgium Australia Netherlands Finland Sweden Saudi Arabia Russia New Zealand France Korea (South) Austria Taiwan UK Germany Switzerland Japan Denmark Slovakia Ireland Spain Kazakhstan Italy Greece Turkmenistan Ukraine Lithuania PortugalVenezuela Bulgaria South Africa Poland Hungary Belarus Malaysia Iran Romania Uzbekistan Chile Azerbaijan AVE Argentina Mexico Thailand Brazil Algeria Turkey 1 China Egypt Ecuador Colombia Indonesia Peru Philippines Pakistan India Bangladesh 0.1 0.1 1 10 100 POPULATION (millions) 1000 10000 Population Trends – Less & More Developed countries may squeak by IF energy alternatives can be found and put on line quickly enough. If these population projections are at all correct, then less developed countries have no chance. Developed countries will not let their economies crumble under the oil threat. As long as significant quantities of oil remain, the developed countries will fight to maintain share. Less developed countries will suffer in comparison as they will be shut out of oil markets, probably even if they own the supplies. Source: UN Population Trend Data THE ANTHROPOLOGIST’S PERSPECTIVE? The Olduvai Theory of Industrial Civilization EXAGGERATED? PERHAPS, BUT THE OIL AGE WILL BE REMEMBERED AS A TIME WHEN MANKIND WENT THROUGH 100’S OF MILLIONS OF YEARS OF HYDROCARBON RESOURCES IN LESS THAN 200 YEARS. The Olduvai Theory: Sliding Towards a Post-Industrial Stone Age. Richard C Duncan, Ph.D. Institute on Energy and Man, June 27, 1996 THE CRITICAL IMPORTANCE OF GIANT FIELDS Saudi Arabia has over 300 recognized reservoirs but 90% of its oil comes from the five super giant fields discovered between 1940 and 1965. Since the 1970s there haven't been new discoveries of giant fields. IAGS, 2004, “New study raises doubts about Saudi oil reserves “ AAPG EXPLORER, JAN., 2005 GIANT OIL FIELDS* * >500 MILLION BBLS WORLD GIANT OIL FIELDS Fit Results 250 • HISTOGRAM CONTAINS 876 FIELDS WORLDWIDE Fit 1: Normal Number of data points used = 876 Average X = 1966.26 Standard Deviation = 21.5462 200 150 N • RATE OF DISCOVERY CLEARLY IN DECLINE 100 • DISCOVERY PEAKED IN 1966 50 0 1860 1880 1900 1920 1940 1960 1980 2000 2020 2040 2060 Saudi Arabia's Ghawar Field Discovered in 1948, Ghawar is the world's biggest oil field, 174 miles in length and 16 miles across and encompasses 1.3 million acres.Current estimates, for cumulative oil production are 55 billion barrels. Average production for the last 10 years is five million barrels per day. Ghawar accounts for more than one-half of all oil production in Saudi Arabia ANNUAL PRODUCTION OF CRUDE OIL SOURCE: ASPO, 2004 WORLD OIL & THE HUBBERT CURVE The yellow line in the graph is the Hubbert curve and shows how oil production would have expanded and then contracted if it had been governed solely by physical constraints. 40 120 35 100 30 25 80 20 60 15 40 10 20 5 0 1930 1950 1970 1990 World - Regular Oil Ultimate :1850 Gb To-date 2003 : 920 Gb 2010 2030 0 2050 Production, Gb/a Discoveries, Gb/a Peak Discovery 1964 140 The red line shows the amount of oil actually produced up to 2003 and what is likely to be produced in the future. The actual curve followed the theoretical curve very closely until the early 1970s when five OPEC producers gained control of more than 30% of the world market. This pushed up prices, limiting demand. High oil prices can be expected to cause world oil demand to stay on a plateau until around 2010. After that, output will fall whatever the price because fields will be becoming exhausted. All Oil & Gas 50 Production, Gboe/a Non-con Gas 40 30 Gas NGLs Polar Oil Deep Water Heavy 20 Regular 10 0 1930 1950 1970 1990 2010 2030 2050 ENERGY CONVERSIONS 1 BARREL OF OIL = 6.1 GJ = 5.8 X 10 6 BTU = 1,700 kilo-watt-hr (kWh) = 42 gallons (U. S) 7.2 BARRELS OF OIL = 1 ton of oil (= 42-45 GJ) “Reserve Growth” misleads “Reserve Growth” misleads. It is widely attributed to technology, market forces or good management, but is simply a reporting phenomenon. Proved Reserves grow by definition Proved & Probable Reserves do not Revisions have to be backdated to obtain a valid discovery trend. Data Sources Two trade journals Oil & Gas Journal and World Oil compile data given to them by governments but do not assess validity BP reproduces the Oil & Gas Journal – But does not reveal its own knowledge Industry databases give the best available data but is too expensive for most analysts to access Conclusion Most of the confusion and controversy derives from the unreliable reporting of production and reserves. It is not primarily a technical problem, but a political one. There are vested interests with good reasons to conceal and confuse Cumulative Discovery, Gb Hyperbolic Creaming Curve 50 40 30 20 10 0 0 500 1000 1500 2000 2500 Cumulative Wildcats Hyperbolic Model Actual 3000 3500 Size Distribution Size Mb 10000 100 1 1 10 100 Rank Actual Parabolic 1000 Yet-to-Find in New Areas All the larger provinces with Regular oil have already been found. The largest found in 50 years was the North Sea with about 70 Gb. It is inconceivable that anything near as large has been missed. There may be small new areas. But the discovery trend of a country based on its major productive provinces will not be much affected any small new ones. WAS IT ALL ABOUT OIL AFTER ALL? • Shell along with Chevron, BP and seven other oil giants, have won contracts to buy Iraq's new oil production of Basra Light crude. The contracts cover production from the Mina Al-Bakr port in southern Iraq from August to December of this year. • The sales contrast sharply with contracts signed by the previous regime of Saddam Hussein with Russia and France. "Unfortunately, not a single Russian company managed to clinch a contract, as we went for the best price," says acting oil minister Thamer Ghadhban. EXCERPTS FROM: “To the Victors Go the Spoils of War” CORPWATCH, 2004 WAS IT ALL ABOUT OIL AFTER ALL? • “Executive order number 13303 states "any attachment, judgment, decree, lien, execution, garnishment, or other judicial process is prohibited, and shall be deemed null and void", with respect to "all Iraqi petroleum and petroleum products, and interests therein.” • "Effectively Bush has unilaterally declared Iraqi oil to be the unassailable province of US oil corporations." Jim Vallette, Sustainable Energy & Economy Network of the Institute for Policy Studies, Washington DC. FROM: “To the Victors Go the Spoils of War” CORPWATCH, 2004 CRTITQUE OF OFFICIAL RESERVE ESTIMATES “According to BP, reserves increased dramatically in the 1980s and 1990s, from 670 billions barrels at the end of 1960 to 1147 billion barrels at the end of 2003. But most of the increase occurred in OPEC countries, mainly in the Middle East, in the second half of the 1980s. Saudi Arabia and Kuwait revised their reserves upward by 50%, while Venezuelan reserves were boosted 57% by the inclusion of heavy oil in 1988. The United Arab Emirates and Iraq also recorded large upward revisions in that period. Total OPEC reserves jumped from 538 billion barrels in 1985 to 766 billion barrels in 1990. As a result, world oil reserves increased by more that 30%. This hike in OPEC countries’ estimates of their reserves was driven by negotiations at that time over production quotas, and had little to do with the actual discovery of new reserves. In fact, very little exploration activity was carried out in those countries at that time. Total reserves have hardly changed since the end of the 1980s.” The Outlook, 2004 NEXT BIG THING: PEAK OIL “The peak-oil debate is getting more polarized and more rancorous—and, especially noteworthy, more politicized. So here's an immodest prediction: The peak-oil debate will be the Next Big Thing. The story with legs. The overarching theme that will resonate throughout the oil and gas industry for decades to come. It will be propelled forward in the public consciousness not only by serious debate within the industry itself but also on the political hustings and by antioil forces who can't seem to pry Americans out of their sport utility vehicles even as war rages in the Middle East and Chicken Little lies sacrificed on the Kyoto altar. Iraq and Saudi Arabia will figure largely in that debate. So will Russia and the Caspian. And Orinoco oil and Athabasca tar sands. And reserves accounting and transparency. And alternate energy viability. “ Bob Williams: Oil and Gas Journal, 2004 NEXT BIG THING: PEAK OIL CRITIQUE OF USGS RESERVE ESTIMATES “The USGS commenced its study of world oil following the shocks of the 1970s, and for many years issued sound evaluations at successive meetings of the World Petroleum Congress. But a departure came with the study of 2000, under the project’s new director, claiming a Mean estimate of the total discovery to 2025 of 3.3 trillion barrels. The following Figure illustrates the record of some 65 past estimates by major oil companies, serious institutions and the USGS itself, which average 1.93 trillion barrels, indicating that the latest USGS estimate is far from the consensus.” Examples of Depletion Evidence for peak and decline as demonstrated by examples of countries at different stages of depletion 30 10000 25 8000 20 6000 15 4000 10 5 2000 0 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb US-48 0.45 0.4 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 1930 180 160 140 120 100 80 60 40 20 0 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Germany 5 3000 4 2500 2000 3 1500 2 1000 1 500 0 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb United Kingdom 6 3500 5 3000 2500 4 2000 3 1500 2 1000 1 500 0 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Norway 12 1400 10 1200 1000 8 800 6 600 4 400 2 200 0 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Algeria 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 1930 1000 800 600 400 200 0 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Egypt 16 14 12 10 8 6 4 2 0 1930 4000 3500 3000 2500 2000 1500 1000 500 0 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Libya 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 1930 2500 2000 1500 1000 500 0 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Nigeria 6 1800 1600 1400 1200 1000 800 600 400 200 0 Discovery Gb 5 4 3 2 1 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Indonesia 2.5 1200 2 1000 800 1.5 600 1 400 0.5 200 0 1930 0 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Oman 45 40 35 30 25 20 15 10 5 0 1930 3500 3000 2500 2000 1500 1000 500 0 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Venezuela Mexico 3500 3000 20 2500 15 2000 10 1500 1000 5 500 0 1930 0 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb 25 30 7000 25 6000 5000 20 4000 15 3000 10 2000 5 1000 0 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Iran 140 12000 120 10000 100 80 60 40 20 0 8000 6000 4000 2000 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Saudi Arabia 35 14000 30 12000 25 10000 20 8000 15 6000 10 4000 5 2000 0 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb Russia 160 140 120 100 80 60 40 20 0 70000 60000 50000 40000 30000 20000 10000 0 1930 1950 1970 1990 2010 2030 2050 Production kb/d Discovery Gb World Canada Production kb/d 3000 2000 1000 0 1930195019701990201020302050 Regular Oil Tarsand etc IRAQ ASPO Main Point The data used in preparing the slides comes from many sources, but shows a general pattern of growth, peak and decline of discovery followed by production World Population “It has been estimated that, without hydrocarbons to provide energy, fertilizers and pesticides, agriculture could not support a population greater than two billion. This reduction would take us back to pre-20th century levels but the disruption to society and its infrastructure would probably mean a reversion to preindustrial revolution.” Paul Thompson Reading, England August 2004 Prices and Production over a complete Hubbert Cycle: the Case of the American Whale Fisheries in 19th Century Bardi : Sept. 2004, ASPO - The Association for the Study of Peak Oil and Gas, and The Dipartimento di Chimica - U. Firenze, Italy Saudi Arabia's Ghawar Field Discovered in 1948, Ghawar is the world's biggest oil field, 174 miles in length and 16 miles across and encompasses 1.3 million acres. Current estimates, for cumulative oil production are 55 (??) billion barrels. Average production for the last 10 years is five million barrels per day. Ghawar accounts for more than onehalf of all oil production in Saudi Arabia. (AAPG EXPLORER JAN. 2005) Hubbert’s Model: constraints Hubbert’s modelling technique has been variously applauded and criticised, but the constraints to its application have not been widely appreciated. It works well only: •where applied to a natural domain, unaffected by political or significant economic interference; •to areas having a large number of fields; and to areas of unfettered activity. Hubbert himself worked primarily on the US-48, which had the necessary characteristics to be well modelled by a single cycle. “ from THE HUBBERT CURVE : ITS STRENGTHS AND WEAKNESSES” by J.H. Laherrère, Oil and Gas Journal ms, Feb 18 2000 (http://www.dieoff.com/page191.htm) PEAK OIL: SOME CONSEQUENCES The world is not about to run out of oil, but production is about to peak. The sky does not fall in at peak, but the perception of the future changes. It is likely to lead to •severe political and economic tensions, including economic recession, •a stock-market crash, •and, financial instability from the huge flows to the Middle East. There are obvious dangers of misguided military intervention as the United States, Europe and the East vie for access to Middle East oil. The inequality between rich and poor nations will be more severe. Agriculture is at risk because it is now heavily dependent on synthetic nutrients and irrigation, both directly and indirectly dependent on petroleum. The global market may wither from high transport costs. from the Feasta conferencemoney, energy and growth’ March 2000. the imminent peak of global oil productionCOLIN CAMPBELL FLAT EARTH PRODUCTION CURVE Other experts, notably economists, assume that oil production follows this type of curve. As demand increases, the oil fields simply increase production, the two lines rising and falling together. Those who admit that oil is finite (and not all do) expect that the end will come suddenly as the oil fields simply run out. This is often known disparagingly as 'flat-earth economics' http://wolf.readinglitho.co.uk/index.html FUEL ENERGY DENSITY SOURCE: INTERNET ENCYCLOPEDIA US-48 COLIN CAMPBELL Oil Production Curve (actual and adjusted) The symmetrical Hubbert curve is often skewed as shown. For an individual area, it often turns out to be cheaper to buy oil elsewhere rather than extract the difficult remaining oil after the peak, thus reducing the downslope angle. In the case of world production, there will be nowhere else to go and it will be declining prosperity after the peak that will reduce demand. Oil Production (USA lower-48) 1930-2002 Because the USA has been producing longer than anyone else, largely unaffected by external matters, it shows the Hubbert Curve better than anywhere else. Production has been declining since the 1970s and, despite the efforts of the richest, most technologically advanced society in the world, has not been stopped. Source: ASPO Oil Discovery minus Consumption (world) The really important statistic is the difference between discoveries and consumption. Until 1980 (with the exception of 1972), discoveries exceeded production worldwide. Since then, the trend has been negative and we consume more oil than we produce. As discoveries continue to fall and consumption rises, it can only get worse. Source: ASPO Proved World Oil Reserves - J. Laherrère Compared to BP's chart of the world's oil reserves, Jean Laherrère's version, produced from creaming curves, seems much more realistic. As consumption outgrew discovery in the early 1980s, reserves fell as one would expect. Source: Jean Laherrère OIL PRODUCTION: ASSUMING R/P (FLAT EARTH) MODEL Many people (including some 'experts') assume that oil produced from a field follows the R/P ratio model: there is a fairly constant flow until near complete depletion when it suddenly drops. Actually, a single well is not unlike this and natural gas flow is somewhat similar. But it is nothing like most actual oil fields or oil provinces. SINGLE WELL PRODUCTION CURVE This chart shows how an individual oil well acts differently from the Hubbert Curve, with a long, fairly stable plateau rather than a peak. HUBBERT 4-WELL CURVE four individual oil wells when totaled begin to create the Hubbert Curve Hubbert Curve (8 wells) eight individual oil wells when totaled begin to resemble the Hubbert Curve. Given enough wells, a smooth curve will result. PEAK PRODUCTION AND RESERVE GROWTH The growth of reserves has little impact on peak production, as illustrated by the example of the Prudhoe Bay field in Alaska. The growth in reported reserves normally coincides with the onset of decline, prolonging the field’s life by extending the tail end of production. Aleklett, Uppsala Hydrocarbon Depletion Study Group, Uppsala University, Sweden Prudhoe Bay Cumulative Discovery against Production (World) Discovery and production curves for the World compared. Discovery peaked in 1964 when the discovery curve changed from a concave (growing) to convex (declining) slope. At this time, the production curve is at a similar position. The production curve will mirror the discovery curve with a time lag of about 36 years. FUTURE VIEWS “My view of the near future then is pessimistic, a view that the oil crisis will hit us hard with wars, famines and the environment drastically devastating the population. Assuming that we can avoid a nuclear war, I believe that the world would eventually settle down. It has been estimated that, without hydrocarbons to provide energy, fertilizers and pesticides, agriculture could not support a population greater than two billion. This reduction would take us back to pre-20th century levels but the disruption to society and its infrastructure would probably mean a reversion to preindustrial revolution.” Paul Thompson Reading, England August 2004 Coal fields of the United States. Oil shale in Green River Formation WILL TECHNOLOGY SAVE US? “New “technology”, which in fact is not new being as much as thirty years old for horizontal wells and 3D seismic, is being used already in most producing fields. It allows cheaper and faster production but does not add to the reserves themselves in conventional fields.” Jean Laherrère "Future of oil supplies” Seminar Center of Energy Conversion Zurich May 7 2003 Transport Efficiency This chart shows the relative efficiencies of different forms of transport taking into account the number of passengers carried and the energy needed to move each kilometer). If we are to deal with the energy crisis to come, we will have to alter our way of life to use more energyefficient forms of transport. Source: "Energy: A Guidebook" by Janet Ramage 1997 The point at which the supply begins to diminish is much more important economically than when the wells run completely dry. M Lawton and Tacildayus Andrews www.almc.army.mil/alog/ issues/JulAug99/MS406.htm The “production peak” is therefore the main event in the future history of oil extraction, a point which will mark the epochal change from cheap oil to expensive oil. Ugo Bardi to appear in Energy PolicyDipartimento di Chimica — Università di Firenze, Polo Scientifico di Sesto Fiorentino, 50019 Sesto Fiorentino (FI), Italy EUGENE ISLAND AN “ODD RESERVOIR” Odd Reservoir Off Louisiana Prods Experts to Seek a Deeper Meaning By CHRISTOPHER COOPER Staff Reporter of THE WALL STREET JOURNAL HOUSTON -- Something mysterious is going on at Eugene Island 330. Production at the oil field, deep in the Gulf of Mexico off the coast of Louisiana, was supposed to have declined years ago. And for a while, it behaved like any normal field: Following its 1973 discovery, Eugene Island 330's output peaked at about 15,000 barrels a day. By 1989, production had slowed to about 4,000 barrels a day. Then suddenly -- some say almost inexplicably -- Eugene Island's fortunes reversed. The field, operated by PennzEnergy Co., is now producing 13,000 barrels a day, and probable reserves have rocketed to more than 400 million barrels from 60 million. Stranger still, scientists studying the field say the crude coming out of the pipe is of a geological age quite different from the oil that gushed 10 years ago. Peak oil is a turning point for Mankind. The economic prosperity of the 20th Century was driven by cheap, oilbased energy. Everyone had the equivalent of several unpaid and unfed slaves to do his work for him, but now these slaves are getting old and won't work much longer. We have an urgent need to find how to live without them. - C.J.Campbell Peak Oil: an Outlook on Crude Oil Depletion Revised February 2002 DATA SOURCES - GAS & OIL There are two main sources of public data: the Oil & Gas Journal and World Oil, which are trade journals that compile information given to them by governments and others. They are not in a position to assess the validity of the information supplied to them. Another widely used source is the BP Statistical Review of World Energy. BP is in a position to evaluate the data, but prefers to reproduce the Oil and Gas Journal numbers, understandably not wanting to involve itself with sensitive issues that might affect its relationship with the host governments of the countries where it works. Lastly is the industry database, which is relatively reliable, but too expensive for most analysts to access. All these sources provide different numbers. IMPACT OF TECHNOLOGY “Great advances in seismic technology make it possible to see the smallest and most subtle trap. In general, this better knowledge has reduced the perceived potential, because it shows a dearth of large prospects. In other words, we can find a needle in a haystack, but it is still a needle. We did not need the resolution to find the giant fields of the past holding most of the world's oil. It means we have a much better knowledge of the endowment in Nature than we used to have.” (C.J.Campbell Peak Oil: an Outlook on Crude Oil Depletion - - Revised February 2002) USGS GAS& OIL ESTIMATES The US Geological Survey has failed to live up to its scientific reputation. It has assessed the Undiscovered Potential of each basin with a range of subjective probabilities. It has a Low Case for the most sure and a High Case for the least sure. The High Case itself has little meaning, being little more than a wild guess. The Low Case is consistent with the discovery trend, but The Mean value, which is the one publicized is meaningless because it is influenced by the High Case. This has been confirmed by experience in the real world because the Mean estimate is already 100 Gb short, five years into the study period. Its notion of "reserve growth" is also flawed. It is depicted as a technological dynamic when it is simply an artifact of reporting practice, not to be extrapolated into the future. (C.J.Campbell Peak Oil: an Outlook on Crude Oil Depletion - - Feb 2002) Over the past few years I have often been amazed by the degree to which the American public remains willingly uninformed, and despite my skepticism, I sometimes wonder about the validity of this statement: "The CIA owns everyone of any significance in the major media.“ --former CIA Director William Colby Revisited - The Real Reasons for the Upcoming War With Iraq: A Macroeconomic and Geostrategic Analysis of the Unspoken Truth by William Clark wrc92@aol.com Original Essay January 2003 -Revised March 2003 -Post-war Commentary January 2004 CONSEQUENCES - AN “EXPANDING EARTH” In May 2004, Simmons explained that in order for demand to be appropriately controlled, the price of oil would have to reach $182 per barrel. With oil prices at $182 per barrel, gas prices would likely rise to $7.00 per gallon. OIL COMPANY ENLIGHTENMENT Nobody knows or can know how much oil exists under the earth's surface or how much it will be possible to produce in the future BP STATISTICAL REVIEW 2004 Proved oil reserves at the end of 2003 are estimated to have been 1147.7 billion barrels. That represented an increase of around 12% over the end1993 figure of 1023.6 billion barrels, despite estimated cumulative production of almost 264 billion barrels during the intervening ten years, ie reserves replacement amounted to almost 400 billion barrels between end1993 and end-2003. BP STATISTICAL REVIEW 2004 THE CRUDE OIL CRISIS MAIN POINTS (CONT.) •CRISIS IS POLITICAL AND TECHNICAL • GOVERNMENT VERSION DIFFERS CONSIDERABLY FROM PROFESSIONAL OPINION • WORLD POPULATION GROWTH IS PART OF PROBLEM ELECTRICITY CONSUMPTION ELECTRICITY AND OIL CONSUMPTION OIL CONSUMPTION GLOBAL ENERGY CONSUMPTION EACH MAN WOMAN AND CHILD IN U.S. USES ABOUT 8 TONS OF ENERGY (boe) / YR This is about 2,352 gallons of gas/oil /yr Enough to drive around the world twice. The average citizen of Bangladesh uses less than 1/100 that amount in a (good) year. WORLD OIL CONSUMPTION The growth in the world's oil consumption doubles in about thirty years. Valleys and plateaus tend to be caused by recessions as in the 1970s and 1980s. The change in the previous year was a 2.1% rise. Source: BP WORLD CRUDE OIL: DISCOVERIES & PRODUCTION NOTES: WORLD CRUDE OIL 160 1. Discoveries precede production. Difference is reserves. 140 120 2. Trend is for discoveries to taper off. 80 3. Exponential increase in pre-1970’s production. 60 40 DISCOVERED 20 PRODUCED 2050 2040 2030 2020 2010 2000 1990 1980 1970 1960 1950 1940 0 1930 Gb/a 100 4. Area under both curves will be same at depletion. Lights out. PRODUCTION “The official forecast from the IEA/USDOE of 120 Mb/d in 2020 or 2030 seems too optimistic in front of the currently indicated poor economic performance, and seems almost impossible in term of supply.” Jean Laherrère "Future of oil supplies” Seminar Center of Energy Conversion Zurich May 7 2003 CREAMING CURVE This is an example of a creaming curve where the actual values (yellow) are compared to a hyperbolic curve (red). Where the curve becomes horizontal will show the total oil in the field. Source: ASPO Shell Cumulative Discovery Gb (gross) Hyperbolic Discovery Trend 80 1998 60 40 20 1950 0 0 1000 2000 3000 4000 5000 6000 Cu m. wildcats (Sh ell op erated ) Actu al Hyp erb olic p ro jection CRITIQUE OF INTERNATIONAL ENERGY AGENCY “We may conclude that the International Energy Agency (IEA) has delivered a forecast designed to fulfill the Agency’s political agenda, but between the lines it clearly sets out enough evidence to show that it is indeed no more than a political statement, far removed from what is attainable in the real world. The critically important message that emerges is that peak oil will come in the near future, and that a peak in 2030 is nothing more than a political posture. “ Kjell Aleklett, professor in Physics Uppsala Hydrocarbon Depletion Study Group Uppsala University, Sweden OPEC OPEC (The Organization of Petroleum Exporting Countries), is an international organization of eleven countries that rely heavily on oil revenues as their main source of income. OPEC was formed in 1960, and its current members are Algeria, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates and Venezuela. Its stated objective is to ”co-ordinate and unify petroleum policies among Member Countries, in order to secure fair and stable prices for petroleum producers; an efficient, economic and regular supply of petroleum to consuming nations; and a fair return on capital to those investing in the industry.” INTERNATIONAL ENERGY ORGANIZATION OECD AUSTRALIA AUSTRIA BELGIUM CANADA CZECH REPUBLIC: DENMARK FINLAND FRANCE GERMANY GREECE HUNGARY ICELAND IRELAND: ITALY: JAPAN: KOREA: LUXEMBOURG: MEXICO NETHERLANDS NEW ZEALAND NORWAY POLAND: PORTUGAL SLOVAK REPUBLICSPAIN SWEDEN SWITZERLAND TURKEY UNITED KINGDOM UNITED STATES “The IEA was established in November 1974 in response to this oil crisis as an autonomous inter-governmental entity within the Organization for Economic Cooperation and Development (OECD) to study energy supply and security, and advise the member nations accordingly. In general, OPEC is accepted as a political organization with its statements being coloured accordingly. What many do not realize is that the IEA is also a political organization and that its reports are highly coloured by the perceived best interest of its members. “ Kjell Aleklett, professor in Physics Uppsala Hydrocarbon Depletion Study Group Uppsala University, Sweden COMMENTS FROM ABROAD “The US energy crisis is just beginning, and is very dangerous. It may easily lead to a global disruption of the energy supply system.” ASPO NEWSLETTER #2, FEB. 2001 “ . . . the commercial value of oil and gas discovered by the 10 largest energy groups over the last three years is well below the sums spent to find them. In 2003, the top 10 oil groups spent about $8 billion hunting for oil, but only found about $4 billion worth of the stuff. Development spending on existing oil and gas properties has jumped from about $35 billion in 1998 to a record $50 billion in 2003. During the same time frame, exploration spending has fallen from $11 billion to $8 billion. ASPO NEWSLETTER #48, DEC. 2004 COMMENTS FROM ABROAD “The US energy crisis is just beginning, and is very dangerous. It may easily lead to a global disruption of the energy supply system.” ASPO NEWSLETTER #2, FEB. 2001 Even the U.S. government agrees that the amount of oil that can be pulled from the planet is finite. But it estimates that global oil production will likely peak in 2037, rather than in 2008. "All or nearly all of the largest oil fields have already been discovered and are being produced. Production is indeed clearly past its peak in some of the most prolific basins," the federal Energy Information Administration (EIA) said in a recent report on peak oil. ASPO NEWSLETTER #48, DEC. 2004 CONVERSION FACTORS AND ENERGY EQUIVALENTS Basic Energy Units 1 joule (J) = 0.2388 cal 1 calorie (cal) = 4.1868 J (1 British thermal unit [Btu] = 1.055 kJ = 0.252 kcal) 1 tonne of oil equivalent (toe) = 42 GJ (net calorific value) = 10 034 Mcal 1 tonne of coal equivalent (tce) = 29.3 GJ (net calorific value) = 7 000 Mcal Volumetric Equivalents 1 barrel = 42 US gallons = approx. 159 litres 1 cubic metre = 35.315 cubic feet = 6.2898 barrels Electricity 1 kWh of electricity output = 3.6 MJ = approx. 860 kcal Representative Average Conversion Factors 1 tonne of crude oil = approx. 7.3 barrels 1 tonne of natural gas liquids = 45 GJ (net calorific value) 1 000 standard cubic metres of natural gas = 36 GJ (net calorific value) 1 tonne of uranium (light-water reactors, open cycle) = 10 000 – 16 000 toe 1 tonne of peat = 0.2275 toe 1 tonne of fuelwood = 0.3215 toe 1 kWh (primary energy equivalent) = 9.36 MJ = approx. 2 236 Mcal The long-term price of oil in 2003 dollars through 2003 is shown in the attached graph. ... the volatility imposed by the difficult swing role of OPEC is over, and prices are set to rise to reflect the underlying supply constraints. The remarkable stability before the foreign companies were expropriated in the main producing countries stands out, and a future rise into the $40-60 range does not look altogether out-of place, still being below the 1980 spike. - James Dow, ASPO Economics Correspondent, Sept. 2004 OIL PRICE