the ASEAN Lecture (Presented on March 6, 2015 at UM

advertisement

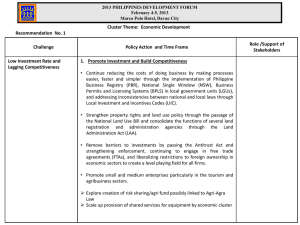

ASEAN Integration: Challenges and Opportunities ONE ASEAN COMMUNITY FORUM AVR 1, 2nd Floor, BA Bldg, University of Mindanao Bolton March 6, 2015 A presentation by Dir. Romeo M. Montenegro, Head of International Relations, Investment Promotion and Public Affairs, Mindanao Development Authority (MinDA) Economic Integration Structure Overarching institution Regional level Subregional level So what is economic integration all about? In the context of ASEAN… • Narrowing development gap • Achieving inclusive growth • Sustainable development ASEAN: ONE VISION, ONE IDENTITY, ONE COMMUNITY Hua Hin Declaration LAOS INDONESIA MALAYSIA PHILIPPINES SINGAPORE THAILAND MYANMAR 1st ASEAN Summit Cebu Declaration 1976 (MPAC) BRUNEI 1999 1995 1967 Master Plan of ASEAN Connectivity 1984 1997 2008 2007 2009 2010 2011 Treaty of Amity and Cooperation (TAC) Bali Concord III CAMBODIA VIET NAM ASEAN COMMUNITY 2015 ASEAN: Fast Facts • A very big and fast growing market • 10 member states at varying economic development • 610 million people, which is 8.8% of the world's population • Combined GDP of US$ 2.34 Trillion with an average GDP per capita of US$ 3,787 • As a single entity, it ranks as 8th largest economy in the world ASEAN: Fast Facts The ASEAN six major countries (values in US$): Country Indonesia Thailand Malaysia Singapore Philippines Vietnam GDP (nominal) GDP (Per Capita) 867,468,000,000 5,214 400,916,000,000 9,875 312,413,000,000 17,748 297,941,000,000 64,584 278,260,000,000 4,682 170,020,000,000 4,012 ASEAN: Fast Facts Human Development Index (HDI) Performance: Country Singapore Brunei Malaysia Thailand Indonesia ASEAN Philippines Vietnam Cambodia Laos Myanmar HDI (2013) 0.901 very high 0.852 very high 0.773 high 0.722 high 0.684 medium 0.669 medium 0.660 medium 0.638 medium 0.584 medium 0.569 medium 0.524 low ASEAN Dialogue and Development Partners • • • • • • • • • • ASEAN – Australia ASEAN – Canada ASEAN – China ASEAN – European Union ASEAN – India ASEAN – Japan ASEAN – New Zealand ASEAN – Republic of Korea ASEAN – Russia ASEAN – United States Means greater leveraging and market access FDI Inflows to ASEAN, 1995-2011 (US$ Million) FDI inflows to ASEAN have been expanding ASEAN Integration Aligned with the three (3) main pillars: 1. ASEAN Political Security Blueprint 2. ASEAN Economic Blueprint 3. ASEAN Socio-Cultural Blueprint ASEAN Economic Community Single Market and Production Base 1. 2. 3. 4. 5. 6. 7. Free flow of goods Free flow of services Free flow of investment Free flow of capital Free flow of skilled labor Priority integration sectors Food, Agri and Forestry Competitive Economic Region 1. 2. 3. 4. 5. 6. Equitable Economic Development Competition Policy Consumer Protection Intellectual 1. Property Rights 2. Infrastructure Development Taxation E-commerce Integration into the Global Economy 1. SME Development Initiative for ASEAN Integration 2. Coherent approach towards external economic relations Enhanced participation in global supply networks Dr. Cielito Habito; Philippine Business and the ASEAN Economic Community: Opportunities and Challenges; AEC Forum, April 2014 Dr. Cielito Habito; Philippine Business and the ASEAN Economic Community: Opportunities and Challenges; AEC Forum, April 2014 Tariff Reduction/Elimination with AFTA Member Sensitive List Highly Sensitive List Indonesia None Rice and Sugar Malaysia Swine, poultry, orchids, cabbages, bananas, pineapples, guavas, mangoes, and mangosteens, melons (including watermelons), papayas, durians, rambutan, langsat, starfruits, jackfruits, coffee, bamboos, rattans, tobacco and cigarettes Rice Myanmar Rice and Sugar None Philippines Swine, poultry, manioc (cassava), sweet potatoes, maize (corn), grain sorghum, and sugar Rice Singapore none None • Tariffs on products classified under the Sensitive List have not been eliminated and will instead have end rates of 5% • Longer timeframe for tariff reduction/elimination on rice and sugar Priority Integration Sectors PIS Services Sectors PIS Goods Sectors 1. Agro-based goods 2. Automotive products 3. Electronic and electrical goods 4. Fisheries 5. Rubber-based goods 6. Textiles and clothing 7. Wood-based products 1. 2. 3. 4. 5. Air Transport E-ASEAN Health Care Services Logistics Services Tourism Free Flow of Services Provides for greater mobility of ASEAN professionals to provide their services in the region Seven Mutual Recognition Arrangements (MRAs) concluded 1. 2. 3. 4. 5. 6. 7. Engineering Services Nursing Services Architectural Services Surveyors Medical Practitioners Dental Practitioners Accountancy Services In 2009, MRA on Tourism Professionals was adopted Business Implications • Expect increased competitive pressure • Need to increase efficiency • Master the rules • Safety nets? • Forum arbitrage • Pressure for better governance: margins for policy mistakes narrower KEY INITIATIVES IN PREPARATION FOR ASEAN INTEGRATION • • • • • • • Supportive Government Policies Funding Assistance/ Access to Financing Capacity Building provided by govt and private sector Seminars on doing business in Free Trade Areas Set up of National Competitiveness Council Industry Clustering approach Promotion of sustainable food production and strengthening of networks for R&D, techno transfers and farmers coops Now, the question is…Are we ready? We should be. We must be. Here’s why… Philippines Shifting to High Gears… received investment grade ratings from: 1st - Fitch (March 2013) 2nd - S&P (May 2013) 3rd - Moody’s (Oct 2013) World Economic Forum: Ranked 59th from 152 countries in the Global Competitiveness Index (GDI) HSBC: PH will be the 16th largest economy in the world by 2050 World Bank: PH dubbed as the “rising tiger of Asia.”… Institute of Chartered Accountants in England and Wales: PH adjudged as one of the “brightest sparks in the ASEAN region.”… Bloomberg: PH is the 2nd fastest growing economy next to China” Source: Mid-Year Philippine Economic Briefing 2013 But wait, let’s take another closer look… Official AEC Scorecard (As of July 2013) Implementation of AEC Scorecard Deliverables under Phase I – III (2008 – 13) ASEAN Member State Brunei Cambodia Indonesia Laos Malaysia Myanmar Philippines Singapore Thailand Vietnam Implemented Not Implemented Implemented Ahead Ongoing Total Measures* Implementation Rate** 297 290 289 287 307 294 302 304 307 307 48 56 58 57 44 51 47 38 43 41 18 17 18 16 20 17 19 19 20 16 71 72 72 74 69 72 71 69 69 73 434 435 437 434 440 434 439 430 439 437 86.8% 84.6% 84.1% 84.2% 88.1% 85.9% 87.2% 89.5% 88.4% 88.7% 5th Source: ASEAN Secretariat Assessing Competitiveness: Philippines vs ASEAN How are we faring? • • • • • • 6th in per capita GDP 6th in Global Competitiveness 6th in Ease of Doing Business 6th in Enforcing Contracts 6th in Logistics Performance 7th in Starting a Business • According to the National Competitiveness Council of the Philippines Assessing Competitiveness: Philippines vs ASEAN How are we faring? • • • • • • 7th in Information Technology 7th in Global Innovation Index 8th in Cost of Business 8th in Dealing with Construction 8th in Registering a Property 8th in Ease of Paying Taxes • According to the National Competitiveness Council of the Philippines Creating Productivity Index How are we faring? Out of 24 Asian Countries 1. 2. 3. 4. 5. 6. 7. 8. 9. Laos (9th) Singapore (10th) Indonesia (12th) Malaysia (13th) Thailand (15th) Vietnam (16th) Philippines (18th) Myanmar (22nd) Cambodia (24th) Creative Productivity Index: Analyzing Creativity and Innovation in Asia by ADB Assessing Competitiveness: Philippines vs ASEAN Areas we fared better: • 2nd in Population • 2nd in Adult Literacy • 4th in Corruption Perception Index • According to the National Competitiveness Council of the Philippines Why does it matter? FDIs net inflows, intra- and extra-ASEAN 2013 Total Net Inflow per Country (in US million dollars) Singapore 60,644.90 Thailand 12,999.80 Malaysia 12,297.40 Indonesia 18,443.80 Viet Nam 8,900.00 Brunei Darussalam 908.4 Philippines Lao PDR Myanmar 3,859.80 426.7 0 Cambodia 1,274.90 0.00 ASEAN Statistics 10,000.00 20,000.00 30,000.00 40,000.00 50,000.00 60,000.00 70,000.00 Critical Business Expansion Enablers in South East Asia (% of businesses) 36% Improve business environment 31% Promote regional trade 29% Facilitate regional investment 18% Generate business opportunities Government incentives 17% Increase talent availability and flow 17% 0% 5% Source: Accenture SEA Business Expansion Survey, 2011 10% 15% 20% 25% 30% 35% 40% Where is Mindanao economy in the context of ASEAN and global trade? Mindanao in the context of AEC 2015: The New Narrative Mindanao... worth taking another serious look next viable investment destination where investments yield high returns for peace Mindanao in Figures… Second largest Island in the Philippines (10.2 Million hectares) Population of around 22 Million Consists of 6 Regions, 26 Provinces, 33 Cities, 422 Municipalities, 10, 084 Barangays 41% of Mindanao’s total land area is certified Alienable and Disposable land 8 of the 18 major River Basins in the Philippines are in Mindanao 80% of the country’s total deposits of copper, nickel and gold are in Mindanao Progress on the Peace Process • Peace agreement signed in March 2014 • Bill on Bangasamoro Basic Law now in Congress • Bangsamoro political entity to be established by 2016 Structure of the Mindanao Economy The Mindanao economy is pegged at P 968.77B in 2013, or equal to 14.32% of the Philippine Economy. Growth Rate (%) 24% AHFF 0.99 45% Industry 31% 9.6 Services 6.3% GRDP INCREASE in 2013 7.08 Mindanao: The Philippines Food basket and Source of Major Industrial Crops Mindanao Priority Commodities Contribution to Philippines (in %) Aquaculture 74 Cacao 89 Coconut 58 Coffee 75 Pineapple 89 Banana 82 Corn 50 Poultry 19 Rubber 99.97 Palm Oil 90 Source of Raw Data: PSA-BAS Processed by: MinDA Poultry Aquaculture Cacao Rubber Banana Palm Oil Coffee Pineapple Corn Mindanao: The Philippines Food basket and Source of Exports vs Imports Major Industrial Crops Mindanao Oil Palm: 60,000 hectares • • • • • • • Agumil Kenram Filipinas Palmoil Carmen Univanich ABERDI Zanorte Bali Palm Oil East Malaysia and Eastern Indonesia: • 6.5 million hectares; • 35 million tons palm oil to 150 countries STRENGTHEN MINDANAO’S ROLE AS FOOD BASKET a major source of globally competitive agri-based products • One-third of Mindanao’s land area is devoted to agriculture pineapple oil palm canned sardines • One-third of the labor force is employed in the agriculture, fishery and forestry sectors. • Contributes more than 30% of the national food requirements Source of Raw Data: NSCB Processed by: MinDA banana seaweed tuna Exports vs Imports Mindanao’s total foreign trade increased by 14.96% in 2013 Trade Surplus increased by 59.65% EXPORT Increased Export earnings by 24.37% Imports Decreased by 1.3% IMPORT Our export destinations European Union: Coconut, Banana, Animal or vegetables oil , Fruits , Fish, seaweeds, Acyclic alcohols, Prepared or preserved fish Canada: Fruits, prepared or preserved fish USA: Banana, Coconut, fruits, Palm oil, live fish, animal or vegetables oil, Acyclic alcohols Switzerland: Gold, Fish , Coconut Africa: Coconut, Fruits, Bananas, nuts, Fish Russia: Fruits, Wood charcoal, Acyclic alcohol Japan: Banana, Wood charcoal, Fish, Fruits China: Nickel ores, Live Fish, Crustaceans, Animal or vegetable fats , Banana, Fruits, seaweeds Korea: Coconut, Banana, Fruits Middle East: Coco water, Banana, Fruits, animal vegetables Mindanao ASEAN: Coconut, Fruits, Fish, Acyclic Alcohol, Coco Water Source: NSO, 2012 Australia: Coconut, fruits, water, Nickel ore, prepared or preserved fish BOI-APPROVED INVESTMENTS IN MINDANAO (In million Pesos) Location 2010 Region IX 326.660 546.366 2,586.902 Nda Region X 2,837.030 2,688.006 3,648.996 48,123.32 Region XI 4,656.970 38,481.517 5,795.086 31,664.25 Region XII 504.177 65.00 1,222.875 6,530.70 Caraga 2,824.050 49,648.383 11,786.489 8,638.26 Total Mindanao Project Cost (Php in Million) 11,148.89 91,429.27 25,040.35 *94,956.53 Source: Bureau of Investments (BOI) Processed by: MinDA 2011 2012 2013 BOI-Registered Investment Projects in Mindanao CARAGA Region X Argusland Inc., Maharlika Agro-Marine Ventures Corp. FirstGen Mindanao Hydro Power Corp., Mindanao Mineral Processing and Refining Corp. Total Mindanao Project Cost: Php 94.96B* Region XI Region XII Communities General Santos, Inc., First Gen Mindanao Hydro Power Corp., Gensan FeedMill Inc., Kenram Palmoil Industries Inc., Phil. Best Canning Corp., Safi Agro-Industries Inc., Saranggani Agriventures. Please note, in 2013, RBOI-ARMM reported Php 1.46 Billion registered investments in ARMM (four projects, 157% higher than than the Php 569 Million registered investments in 2012. Azdevelopers Corp., Communities Davao, Inc., DMC Urban Property Developers, Francisco M. Soriano & Co., Franklin Baker, Hedcor Sibulan Inc., Hedcor Tudaya, Inc., Nakayama, PNX-Chelsea Shipping, San Miguel Consolidated Ppower Corp., Seaoil Philippines, Simmons Leather Goods. Vifel Ice Plant andC old Sotrage 94.88% of Mindanao’s Labor Force are employed Of the 20 people aged 15 to 64 in MINDANAO 19 of them are EMPLOYED But, of the 19, 5 of them are UNDEREMPLOYED Source: NSO Labor Productivity of Mindanao vs Luzon, per GVA share, FY2013 Latest Minimum Wage Rate Levels in Mindanao (Php) Non-Agri Agriculture Retail Services Handicrafts National Capital Region (NCR) 466.00 429.00 429.00 - Mindanao 208.00 312.00 245.00 302.00 260.00 296.00 235.00 Tourist Arrivals in Mindanao is growing… Mindanao Total Tourist Arrivals 4,581,704 4,363,116 2011 2012 Source of Raw Data: DOT-CO Processed by: MinDA More competitive electricity rates* Luzon: Php 10.10/kWh Visayas: Php 10.27/kWh Mindanao: Php 8.24/kWh *Electricity prices are the average of electricity price of all distribution units belonging to the same island group CITIES AND MUNICIPALITIES COMPETITIVE INDEX, 2014 OVER- ALL COMPETITIVENESS RANK 1 2 3 4 5 6 7 8 9 10 CITIES Makati Cagayan De Oro Naga City Davao City RANK MUNICIPALITIES 1 Daet, Camarines Norte 2 3 Kalibo, Aklan 4 5 Carmona, Cavite Nabunturan, Compostella Valley 6 Lubao, Pampanga 7 Isulan, Sultan Kudarat Polomolok, South Cotabato Manolo Fortich, Bukidnon Marikina City Iloilo City Cebu City 8 Manila City Valenzuela City Paranaque City Source : National Competitiveness Council General Trias, Cavite 9 10 Taytay, Rizal What steps are being taken to strengthen Mindanao’s enabling environment? BIMP-EAGA : Mindanao’s Platform to the ASEAN BIMP-EAGA • A test-bed for ASEAN protocols and agreements • A building-block towards achieving ASEAN Integration 2015 Strategic Pillars • Enhanced Connectivity • Food Basket Strategy (Agri) • Tourism Development • Environment • Socio-Cultural and Education (newest pillar adopted at 19th BIMP-EAGA MM on November 19, 2014 in Brunei Darussalam) BIMP EAGA Economic Growth Corridors & Transport Connectivity Sabah Development Corridor (SDC): • Agro-based Industry Sarawak Corridor of Renewable Energy (SCORE): • Palm Oil • Fish and Aquaculture • Livestock Mindanao Growth Corridors: • Tropical Fruits (Banana, Pineapple & Mango) • Rice • Poultry • Coconut • Mariculture Indonesia Growth Corridor • Corn • Fertilizer • Cement MINDANAO TRANSPORT & LOGISTICS NETWORK SUPPORTING MINDANAO DEVELOPMENT CORRIDORS Existing National Road Proposed ADB-PPTA Proposed MTPIP III Proposed JICA Logistics NORTHER MINDANAO GROWTH CORRIDOR Identified Projects under Mindanao Growth Corridors International Airport WESTERN MINDANAO GROWTH CORRIDOR Principal Airport Sea Port BIMP-EAGA Proposed Sea Linkage BIMP-EAGA Proposed Air Linkage SOUTHERN MINDANAO GROWTH CORRIDOR RORO Shipping Network International Gateway Strategic Tourism Destinations Davao- Manado Zamboanga – Muara Davao – GenSan – Bitung Zamboanga- Sandakan Davao- Kota Kinabalu Western Mindanao Economic Growth Corridor Region IX Area: Projects • Pulauan Port Alternate Road, Dapitan City • Dipolog Airport Improvement • Pagadian Airport Improvement • Liloy-Labason-Gutalac Road Upgrading • Pagadian Port Access road • Road Upgrading of Liloy-Lamao Port • Tumaga River Structural Improvement Measures Flood • Zamboanga Port Improvement • New Zamboanga International Airport Development • Balinsungay Irrigation project, Zamboanga City • Lower Sibugay River Irrigation System, Zambo Sibugay • Titay Valley Irrigation Project, Zambo Sibugay BIMP EAGA OSAC Mariculture Processing Complex BIMP EAGA Initiative on Non-Convention Sized Shipping BASILAN-SULU-TAWI TAWI-ZBO CORRIDOR - Concreting of Calugusan-BalasSengal Road to Lamitan City Port Sanga-Sanga Bangilan Road Section Improvement of the Bongao Port Concreting of Bato-Bato->LapidLapid Road, Panglma Sugala Bongao Port Improvement of Siasi Port Mindanao Industry & Trade Corridor Region X Area: Projects • Education: ICT and BPO/KPO Related Courses in CDO • Education: Agriculture, animal science, and food processing related courses in Bukidnon • Education: Technical Vocational Courses • Cold storage facilities in Bukidnon • Minerals processing in Manticao, Misamis Oriental • Mini-Hydro Primary Growth Center Secondary Growth Center Existing Power Plant Proposed/Indicativ e Power Plant Ongoing/Committed Power Plant Airport Seaport ARMM Area: Projects • Cassava processing in Parang and Marawi City • Aquaculture and aquaculture processing in Parang and Marawi City • Hydro Power Caraga Area: Projects • Education: Minerals development related courses • Education: Technical Vocational Courses • Coconut processing in Tandag City and Butuan City • Minerals processing in Surigao del Norte and Tubay, Agusan del Norte • Improvement of strategic roads to processing and business centers Southern Mindanao Economic Growth Corridor Cotabato Area: Halal Meat Processing Center in Cotabato City Projects: • Rubber Testing Center • Improvement of strategic roads to processing and business centers SOCCSKSARGEN Area: General Santos as the Food Business Center Projects: • Improvement of strategic roads to processing and business centers South Caraga Area: • Bislig City as Aquamarine Processing Center • Agroforestry Hub Projects: • Paper mill (Private) • Develop PICOP as Agro Industrial Zone • Improvement of strategic roads to processing and business centers Panabo Port Devt 100MW Geo 100MW PB118 32MW PB104 Tagum-Dvo-GSC High Standard Highways 58.69MW Dav light 3.70 MW Talomo Food Terminal Complex 56MW SPPC ASEAN RoRo Study ADB TA on CIQS Davao Area: Davao City as the Mindanao Business Center and ICT Hub Projects • International Airport (service improvement) • National Research Development for Banana in Davao City (USEP) • Improvement of strategic roads to processing and business centers Mindanao and EAGA Corridors Link Heights of Mt. Kinabalu to the depths of PPUR Western Mindanao and Sabah Festivals Mindanao Tourism Loop/Mindanao and North Sulawesi Festivals Existing Sea Link • Proposed Air Linkages Legend: Existing Proposed • Zamboanga – Sandakan (Pal Express) • Balikpapan – Kuching (MASwings) • Balikpapan- KK (MASwings) • Pontianak- Miri (Kalstar Air) • Tarakan – KK (Kalstar Air) Zamboanga – Sandakan (Passenger-Cargo Ferry) Existing Air Linkages Proposed Sea Linkages • Davao-Manado (Sriwijaya) • Davao – GenSan – Bitung • Puerto Princesa – KK (MASwings) • • KK – BSB (Maswings) Brooke’s Point – Labuan – Muara • Kuching - BSB (MASwings) • Zamboanga – Muara • Kuching – Pontianak (MASwings) • Tawau – Tarakan (MASwings) Mindanao Budget Allocation 258,610 In Billion Pesos 219,103 163,978 FY2011 FY2012 FY2013 Infrastructure Distribution of FY 2011- 2014 Budget by Region: (Based on GAA-Capital Outlays, Projects) NCR P54.27 B ($1.23B) (13.8%) NORTHERN LUZON P90.87 B ($2.07B) (23.1%) CAR, I, II, III VISAYAS P72.23 B ($1.64B) (18.4%) VI, VII, VIII SOUTHERN LUZON P76.84 B ($1.75B) (19.5%) IV-A, IV-B, V MINDANAO P99.12 B ($2.25B) (25.2%) IX, X, XI, XII, XIII TOTAL : P393.33 B $ 8.94 B * Excluding Inter-Regional/Nationwide-P132.10 B Inclusive Business Program Project Sites Uni Frutti – 6,000 ha Del Monte – 10,000 ha Dole Phils. – Pineapple Sumifru – 600 ha Kenram – CPO Mill Agumil Phils. – 10,000 ha PBGEA – Banana Export ICTSI Port Development ANFLOCOR Henry Chua Industrial Mr. Carlos Vargas / Dr. Mazaki Flatwood Solutions Malaysian Investor – 40,000 ha Khodian Holdings – 30,000 ha Jerry Taray Hejem Furigay Nestle Phils. Kennemer Foods Frankiln Baker Bill Ho E-vehicles Mindanao Power Development Reliability of Power Supply At the rate committed projects are being built, it looks like Mindanao will have more than enough power after 2015… 4000 3500 3000 2500 2000 Supply 1500 Demand 1000 500 MW 0 2014 2015 2016 2017 2018 2019 2020 Project Location Lake Mainit (25MW) = 2016 Puyo HEP (30MW) = 2015 Committed Private-Sector Initiated Power Projects FDC CFB Coal Fired PP (3x135 MW)=2016 - Wind, Biomass, Solar - Hydro Power - Coal Fired - Diesel Fired Limbatong HEP (9MW) = 2017 Mapalad Diesel Power Plant (15 MW)=Oct2013 GN Power PsagCorp Coal fired PP (3x135MW)= 2017 Peak Power Bunker Diesel Plant (5.2 MW)=Sep 2014 Green Power Bukidnon Biomass (40 MW)=2013 EDC Mindanao Geothermal 3 (50 MW)=June2016 Therm(a South (Aboitiz) Coal Davao (300 MW)=Mar/June 2015 Phil Bio Biomass (1.6 MW)=2017 SMC Davao Power Plant(Phase 1-300MW)=2015 & 2016 Peak Power Bunker Diesel Plant (20.9 MW)=Sep 2014 DOE List of Power Projects as of May 2014 - Committed Projects = 1,981.7MW Southern Mindanao (Sarangani) CFTPP (2x100 MW)= Sep2015 & Nov2016 Moving Forward Overcoming Challenges • Connectivity and accessibility difficulties • Infrastructure development challenges • Security and safety issues • Promotion Strategies – Product quality and branding • Human resource capacity Source: Dr. Tans Sri YenYen Our Strength: DEMOGRAPHIC DIVIDEND Turning odds to favor: Philippines has young and growing population Comparing Median Age: Philippines - 23.1 y.o. • • • • • Vietnam - 28.1 Indonesia - 28.5 Singapore – 31.5 China - 35.9 Japan – 45.4 With right skills and education, Philippines can sustain edge high labor productivity in ASEAN Source: Dr. Bernardo Villegas, University of Asia and the Pacific Our Strength: DEMOGRAPHIC DIVIDEND We have distint competitive advantage within ASEAN High level of tertiary education Adaptable and multicultural workers Fluent in English Familiar with the culture of the biggest market in the world, the U.S. Low labor cost Labor peace Source: Dr. Bernardo Villegas, University of Asia and the Pacific Alignment to Priority Sectors Integrating Mindanao. Daghang Salamat! www.minda.gov.ph info@minda.gov.ph