C

H

A

P

T

E

R

2

TWO

Corporate

Strategy

Decisions

and Their

Marketing

Implications

McGraw-Hill/Irwin

©2008 The McGraw-Hill Companies,

1-1

All Rights Reserved

Ryanair

1991 pre low cost ad

Low cost no frills

Own planes Boeing 737s

Fast turn around 25 minutes on ground

Under utilized Regional airports

Lower fees, Best on time

Carry and stow own bags, no in-flight

services

Flight attendants pay for own training

and uniform

1-2 2-2

More Ryanair

Pays no fees to computer reservations

systems and no commissions

Competition from Major airlines

Easyjet

Marketing costs same per passengerkilometer

Too much growth?

Documentary

1-3 2-3

Scope, mission and intent

What business(es) should the firm be

in?

What customer needs, market segments,

and/or technologies should be focused

on”?

What is the firm’s enduring strategic

purpose or intent?

1-4 2-4

Discussion Questions

1. In defining their strategies,

should companies pursue

broadly or narrowly defined

missions?

2. What are the advantages of

each approach?

Marketing Myopia

Fit or Future

1-5 2-5

Exhibit 2.2

Characteristics of Effective

Corporate Mission Statements

Functional

Based on

customer needs

Broad

Specific

Transportation

business

Long-distance

transportation for largevolume producers of

low-value, low-density

products

Physical

Railroad

Based on existing business

products or

technology

Long-haul, coal

carrying railroad

Source: Adapted from Strategy Formulation: Analytical

Concepts, by C. W. Hofer and D. Schendel. Copyright ©

by West Publishing Company. All rights reserved.

1-6 2-6

Sustainable?

3% currently do a good job

2/3rds have code of ethics

Chevron

To bribe or not to bribe

1-7 2-7

1-8 2-8

Objectives

What performance dimensions should

the firm’s business units and employees

focus on?

What is the target level of performance

to be achieved on each dimension?

What is the time frame in which each

target should be attained?

1-9 2-9

Discussion Question

3. What are some common

performance dimensions and

measures used to specify

corporate objectives?

1-102-10

Specific

Measurable

Attainable

Relevant

Time-bound

Multiple objectives/Trade offs

1-112-11

1-122-12

Discussion Question

4. What kind of company resources

provide the foundation for

effective competitive and

marketing strategies?

What human, technical, or other

resources or competencies

available to the firm provide a

basis for a sustainable competitive

advantage?

1-132-13

Samsung

Korean

R&D

Marketing to improve brand

Changed Channel emphasis

1-142-14

Development Strategy

How Can the firm achieve a desired

level of growth over time?

Can the desire growth be attained by

expanding the firm’s current business?

Will the company have to diversify into

new businesses or product-markets to

achieve its future growth objectives?

1-152-15

Discussion Question

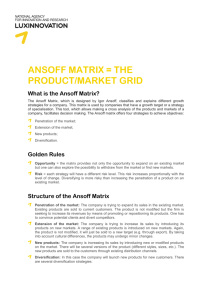

5. Ansoff says there are four

strategies for growing a

business. What are their merits

and drawbacks?.

1-162-16

Ansoff: Corporate Growth

Strategies

Current Markets

Current Products

Market penetration

strategy

New Products

Product development

strategy

New Markets

Market development

strategy

Diversification

strategy

1-172-17

Exhibit 2.5

Alternative Corporate Growth

Strategies

New

markets

Current

markets

Current products

New products

Market penetration strategies Product development

• Increase market share

strategies

• Increase product usage

Increase frequency of use

Increase quantity used

New applications

• Product improvements

• Product-line extensions

• New products for same

market

Market development

strategies

Diversification strategies

• Expand markets for existing

products

Geographic expansion

Target new segments

• Vertical integration

Forward/backward integration

• Diversification into related bus

(concentric diversification)

• Diversification into unrelated

businesses (conglomerate

diversification)

1-182-18

Resource allocation

How should the firm’s limited financial

resources be allocated across its

businesses to produce the highest

returns?

Of the alternative strategies that each

business might pursue, which will

produce the greatest returns for the

dollars invested?

1-192-19

Discussion Question

6. What models can we use at the

corporate level to help in

resource allocation decisions?

1-202-20

Resource Allocation: The

BCG Growth Share

Matrix

(Exhibit: 2.6.)

High

Stars

Question marks

5

4

6

Market

growth

10%

rate

Cash cows

7

(in

constant

dollars)

9

Low

10

2

1

11

Dogs

12

3

8

10

13

1

Relative market share

0.1

Source: Adapted from Barry Hedley, “Strategy and the Business Portfolio,” Long Range Planning 10 (February 1977).

1-212-21

Cash Flows Across Businesses

in BCG Portfolio Model

Growth rate (cash use)

(Exhibit 2.7.)

High

Question

marks

Stars

Cash

Flows

Low

Cash cows

High

Dogs

Relative market share

Low

Desired direction of business development

1-222-22

Resource Allocation: The GE

Nine-Cell Matrix

Business’s

competitive position

(Exhibit: 2.8.)

Industry attractiveness

High

Medium

Low

High

1

1

2

Medium

1

2

3

Low

2

3

3

1 Invest/grow

2 Selective investment/ maintain position

3 Harvest/divest

1-232-23

Factors Affecting the Creation of

Shareholder Value

(Exhibit: 2.9.)

Corporate

objective

Creating

shareholder

value

Valuation

components

Cash flow

from

operations

Discount

rate

Sales growth

• Operating

profit margin

• Income tax

rate

• Working

capital

investment

• Fixed capital

investment

Operating

Investment

• Value

Value growth

drivers duration

Management

decisions

Shareholder return

• Dividends

• Capital gains

Debt

• Cost of

capital

Financing

Source: Reprinted with permission of The Free Press, A Division of Macmillan, Inc., from Crating Shareholder Value by Alfred Rappaport.

Copyright © 1986 by Alfred Rappaport.

1-242-24

Cone Drive

What is the value of keeping current

customers happy?

Use customer equity

1-252-25

Sources of Synergy

What competencies, knowledge, and

customer-based intangibles (e.g., brand

recognition, reputation) might be

developed and shared across the firm’s

businesses?

What operation resources, facilities, or

functions (e.g., plants, R&D, salesforce)

might the firm’s business share to

increase their efficiency?

1-262-26

Discussion Question

7. Where do potential synergies

lie at the corporate level?

1-272-27

Knowledge-based Synergies

Learning organization

Centralized R&D

Corporate Identity and the Corporate

Brand

Disney/The Body Shop/Caterpillar

One brand name for all Cisco Systems, Siemens,

IBM

Dual Branding

Individual Branding

Synergy from shared resources

Sharing operational resources across

business units

Single plant

Single sales force

1-282-28