Le marché des shampooings

advertisement

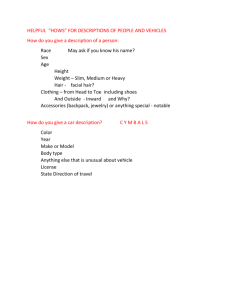

The Shampoo market 2004/05 The market figures 2004/05 The shampoo market represents a total of 535 million Euro. We are witnessing a slowdown in its growth (+3% against +6% in 2002). This mature market is therefore having to find new springboards for growth in sophistication and the value of the product. The provisional figures (Xerfi, hygiene and toiletries products, August) Estimation of shampoo production in 2004: +18% (following a slower growth rhythm in 2003 of +12%) The penetration rate of the shampoo market is 95% 2004/05 5% 4% 10% 2% 19% 8% 2 in 1 Anti-dandruff normal hair coloured hair 9% dry hair children fine hair 17% greasy hair anti-age 10% others 16% Division of shampoo sales depending on the different market groups (in %) 2004/05 The European market and its individual particularities 95 90 85 80 75 70 France Germany Italy Espagne Europe Allemagne Europe Série1 Spain Great Britain The number of shampoo users in the European countries (in %) With 90% and 91% respectively of users, Great Britain and Germany are the countries who use the most shampoos. 2004/05 Italy on the other hand register the weakest rate with 77% of users The evolution of the market 2004/05 The market characteristics: competition and opportunities The shampoo market is characterized by its particularly competitive and aggressive environment The hygiene sector and particularly the shampoo market remains with a structurally solid growth despite a bad consolidation and growing consumer price sensibility 2004/05 The product status evolution Originally, shampoo had a basic usage but consumers have vastly changed and evolved its status and image over the past few years. Today, the range of products is more complete, the offer more and more divisional and the target areas selected more and more specialised. The products are more sophisticated and valorised by specific ingredients, a frontal approach for the caring aspect and the creation of a concept. It should respond to the more precise basic needs of the consumer, who is becoming more and more exigent. 2004/05 A mature market supported by innovation The market growth in value is therefore linked to the politics of valorisation on all the segments as well as the emphasis placed on the technical nature and innovation. EXAMPLES OF INNOVATIONS Garnier Fructis Anti-Dandruff A shampoo that eliminates dandruff after the first wash and which prevents its re-appearance due to a zinc Pyrithiore formula. Organics Establishment of a shampoo specifically orientated for anti-age capillary care with collagen E Dow Corning HMW 200 non ionic emulsion. The integration in the formula of an ingredient which leaves a lasting fragrance of the shampoo on hair. Elsève Solar: After sun renovation shampoo Launch of an after sun shampoo which, due to a new Hydralium and UV filter system, protects and repairs dry hair in 2004/05 summer. The market is therefore very dynamic and we are witnessing a great number of launches, re-launches, the creation of new sub-segmentations and new brands. Therefore, during the first six months of 2004, the number of shampoo references increased by 5% in comparison with the same period of last year and the line size by 3%. NEW RANGES Mennen Sport Herbal Essences- Procter & Gamble The creation of a hygiene and caring range (with The creation of the Herbal Essence mark, range shampoo, deodorants, shower gels….) which touch of 8 shampoos based on natural ingredients. on Olympian values and which are constructed around the idea of energy, performance. Vivelle Dop- LaScad Timotei Clear Reinforcement of the Timotei range with the launch of a menthol anti-dandruff shampoo. The launch of a complete range of 4 shampoos Temptation: Defended fruits for normal hair, Extase rose for long hair, Ginger stimulating for fine hair, Crazy citrus for greasy hair. 2004/05 Le Petit Marseillais Apaisant aux extrait naturels de tilleul et d’iris bleu The launch of an anti-itching shampoo. Consumer needs 2004/05 Basic needs at the origin of the market The first basic needs of consumers are at the origin of the shampoo market. The products are used for cleansing, alleviating odours etc. The qualities looked for are efficacy, product performance (cleansing, purification, regeneration etc.). More sophisticated needs Today, basic needs are not enough for consumers. They are more and more exigent and are looking for a more personalized product, adapted to their needs. 2004/05 Well being has today become one of the principal needs of consumers. The products should produce pleasure and emotion and therefore make reference, most of the time, to nature. Colour protection. More and more women are colouring their hair and are looking for products that preserve their hair colour. Health and Care. Modern day life (stress, pollution, airconditioning, unbalanced diets etc...) damage the hair. Individuals are increasingly concerned and turn to products where the “innovation and natural technology” composition is important, to protect their hair. 2004/05 The distribution circuits 2004/05 The large scale distribution 8,7 3,1 is in full evolution. In 2003, it 0,4 mass distribution selectiv distribution chemists direct sales 87,8 Distribution of the total turnover figure for shampoos between the distribution circuits in 2003 (%) Source: Xerfi, Toiletries and hygiene products, August 2003. realised 87.8% of the shampoo turnover whereas the other sectors were experiencing progression difficulties (selected distribution and chemists, with a respective evolution of 0 and 0.3 point compared to 2002) or in recoil (-1 for direct sales). 2004/05 The players and their brands 2004/05 The shampoo market is a very competitive and particularly dynamic market. L’Oreal Paris is the market leader but the brands are continually fighting to obtain market shares. TOP 12 IN VOLUME IN 2003 TOP 12 IN VALUE IN 2003 Elsève 15.5% Elsève 18.1% Fructis 10.3% Fructis 11.4% Ultra Doux 8.5% Ultra Doux 8.2% Dop familial 7.3% Jacques Dessange 7.7% Jacques Dessange 6.1% Head &Shouders 6.5% Timotei 4.6% Dop familial 5.3% Palmolive 4.1% Timotei 4.2% Head & Shoulders 3.7% Dove 3.8% Dove 3.7% Jean Louis David 3.6% Organics 3.5% Organics 3.5% Pétrole Hahn 3.3% Pantène Pro V 3% Pantène ProvV 3.1% Pétrole Hahn 2.9% Source: Cosmétique magazine, juin 2003 2004/05 The segmentation 2004/05 In the face of a consumer need ever more exigent, we are assisting in a hyper segmentation of the market which makes it particularly complex. 1. By sex We are seeing the appearance of products targeted at men. This segment is in full evolution and growing. Mennen Sport The creation of a new brand 100% masculine. Mennen communicate on the masculine values of sport and performance. Elsève Homme Shampooing Doux ReDensifieur au régenium XY This shampoo responds to masculine needs linked to hair loss with a product which gives thickness and strength to hair. Head & Shoulders Pour Homme Anti-dandruff shampoo for men. 2004/05 2. By age This target is an essential element of the personal offer, notably for the younger population who need to be different and yet to be identified as a group. Mennen Sport Mennen Sport targets the 12-35 age group with a colourful packaging and a communication centred on sport. Vivelle Dop Vivelle Dop targets the 12-25 age group with packaging of acidulous colours and very modern fragrances. Organics Anti-Age with collagen E For mature hair. Ptit Dop/ L’Oreal Kids Very young target 2004/05 3. By use: - Individual - Family (example:Dop- the family format) 4. By hair characteristics 4.1. Type of hair - normal hair Elsève Shampoo Soft Vita-Max Fructis Normal hair Herbal Essences Equaliser Tonic Organics Daily Éclat Ultra Doux with natural grapefruit and green tea extracts Ultra Doux with hydrating vegetable milk Jacques Dessange Tonic Eclat Timotei with herbal extracts Palmolive Naturals with Aloe essence Palmolive Detangle and Brilliance Le Petit Marseillais with natural apple and olive leaf extracts 2004/05 - Dry hair Elsève Fortifying Anti Split Ends Nutra-Ceramide Fructis Dry and Damaged hair H&S Calming Dry Scalp Herbal Essences Soft and Silky Organics Nutrition Softness Ultra Doux with walnut and peach leaf oil J. Dessange Extreme Nutra dry and damaged JLD Total Repair Dove Repair Sunsilk Duo Keratin - Greasy hair Elsève Energy Citrus CR H&S Citrus Fresh Herbal Essences Purifying Freshness Ultra Doux Mint Timotei with lemon extracts Palmolive lemon and vitamins Sunsilk Aqua Minerals Le Petit Marseillais with natural nettle and lemon extracts 2004/05 -Greasy -All roots and dry ends hair Herbal Essences Hydra Regulator Fructis greasy roots and dry ends Jacques Dessange Soft Clay Timotei Equalising with raisin hair type H&S natural menthol Timotei with almond extracts Organics Express 2 in 1 Dop egg shampoo Pantene Pro V Extreme Softness Dove 2 in 1 Palmolive Natural with green apple and orange extracts 2004/05 4.2. Other characteristics - Dry hair with no volume Elsève Thickening Volume Non-Stop Fructis Fine hair H & S Extra Volume Herbal Essences Extra Body Organics Full Volume JLD Volume Express - Blonde hair Ultra Doux camomile for blonde hair Timotei with camomile extracts John Frieda Blonde Highlight Activating shampoo - brunettes Timotei Henna John Frieda Brilliant Brunette - Wavy/Curly hair Pantene Pro V Perfect Curls Sunsilk Aloe Serum for Wavy/Curly hair 2004/05 - Coloured hair Elsève Colour Care with UV Nutra filter UV Fructis Coloured Hair Herbal Essences Colour Intense J. Dessange Colour Revival JLD Colour Guard Le Petit Marseillais with olive oil and natural poppy extract Timotei with cotton extract Ultra Doux Fig and Rose Oil Sunsilk Colour Nutrium Dove Brilliance Care - Mid-length and Long hair H&S Smooth and Silky Elsève Doux Brilliance Alpha Jojoba Ultra Doux 2 in 1 with Vanilla Le Petit Marseillais with natural pear and oatmilk extracts Fructis Long and Strong 2004/05 5. By promise - Hydrating shampoos (Dove, Neutralia) - Nutritive shampoos (Fructis) - Treatment shampoos : Anti-dandruff (Head & Shoulders, Elsève Ultra Doux with natural extracts of thyme and blue eucalyptus, Herbal Essence, Organics, Timotei Clear, Palmolive…) Anti-itching/calming (Le Petit Marsellais) Anti-hair-loss (Elsève) - Smoothing shampoos (Pantene Pro V) - 2 in 1 shampoos (Dop, Dove, Head & Shoulders) - Shampoos advertising highlights, brilliance (John Frieda) - Anti-age shampoos (Organics) 2004/05 Appearance of a new segmentation: by season - Summer: Elsève Solar Hydralium and UV filter system Jacques Dessange (UVA and UVB filter, with extracts of vegetable and algae vitamins) - Winter: Wella anti-static shampoo 2004/05 The general olfactory trends 2004/05 The flowery and fruity notes are very much present on the shampoo market. Simple and natural, they give a fresh and soft appeal. Two notions very important on the shampoo market. Elsève shampoo for midlength/long hair with flowery/fruity notes of banana, blackberry and jasmine. The benefits of aromatherapy and essential oils on the scalp intervene more and more in the olfactory note of the shampoo. The aromatic and hesperidia notes convey the notions of freshness and cleanliness. Le Petit Marseillais AntiDandruff shampoo – myrtle and eucalyptus Ultra Doux shampoo with lemon/olive oil for dull and dry hair 2004/05 The fern notes, woodland and marine are also very much present; they are addressed particularly at the masculine consumer. Elsève Anti-Dandruff shampoo for men The avaricious notes are equally present on the market. They convey the notions of well-being and exoticism. We find them for example in the summer shampoos with sun protection. Elsève Solar shampoo with a fondant texture and an irresistible perfume with avaricious notes. 2004/05 To each type of shampoo … its own olfactory family Anti-dandruff and treatment shampoos The notes are above all aromatic (thyme, eucalyptus, mint) but hesperidia notes are equally present. These fragrances evoke freshness and cleanliness and also the appeasing and caring side of the product. The woodland notes are likewise present. Greasy hair shampoos The notes are above all hesperidia (lemon in particular, grapefruit, orange…) The green notes (apple, tea) and aromatic are equally present. They convey freshness and cleanliness (purifying effect) but also dynamism and energy. 2004/05 Dry and dull hair, reparative and nutritional The notes are soft, fruity, flowery but equally avaricious (caramel, coconut, vanilla, honey). The hesperidia notes are equally present for freshness and cleanliness. Hydrating, soft shampoos The notes are very cosmetic and evoke softness. We find therefore, milky, flowery (rose) and fruity (peach, pear) notes. They evoke cotton, cream, silk, almonds, vegetable milk. 2004/05 Brands and products – market positions 2004/05 Shampoo Softness & Care Shampooing Pleasure Shampoo Nature Shampooing Family ShampooTechnicity Shampooing Treatment & Health 2004/05 Shampoo Softness & Care Hair contains 10% water and as for skin, this quantity is essential for its health. Whatever the hair type, it needs hydrating regularly to stay beautiful. In fact, the more the scalp is hydrated, the better it resists to exterior aggressiveness (brushing, hair dryers and pollution). Soft and caring shampoos gently respect the hydration of the scalp and allow the hair to rediscover its vitality, strength and brilliance. This type of shampoo is addressed to all hair types. It allows the gentle preservation of coloured hair, brings softness and appeasing care with anti-dandruff shampoos and also more softness for longer hair. 2004/05 Shampoo Softness & Care Their formulas are soft, dermaprotective, pH neutral and hypo-allergenic (Neutralia). This type of shampoo could contain hydrating milk (Dove formulas contains ¼ of Dove hydrating cream) and is often associated to Neutralia softening ingredients such as almonds, vegetable milk and Aloe Vera. The texture is therefore creamy, unctuous and calls to mind silk and cotton. This particularity is found at the olfactory note level which is very cosmetic and soft. The products Total Softness shampoo from Neutralia Anti-Dandruff and Care shampoo from Neutralia Ultra Doux with hydrating vegetable milk 2004/05 The brands Dove Moisturising Milk shampoo for dry hair Dove 2 in 1 shampoo for all types of hair Ultra doux Shampoo Nature Nature is used in numerous ways on the shampoo market. This type of shampoo puts forward the virtues of natural ingredients on the hair: nourishing, fortifying, balancing (notably with citrus fruits for greasy hair), hair-lightening, calming (for antidandruff shampoos with aromatic ingredients) reparative …. 2004/05 Shampoo Nature Nature is associated with softness and caring but can also be associated with well-being and pleasure. On an olfactory level, the notes evoke the multiple facets of nature: freshness, cleanliness, well-being, exoticism etc. Fructis Palmolive Naturals Timotei Ultra doux Le Petit Marseillais The products Fructis Fortifying Hydra-Smooth Palmolive Natural Vitality and Brilliance with green apple and orange extracts Timotei with raisin extracts (greasy roots and dry ends) 2004/05 The brands Ultra Doux with natural grapefruit and green tea extracts Le Petit Marseillais appeasing with lemon tree and blue iris extracts Shampoo Pleasure This new type of shampoo corresponds to the new needs of the consumer, searching today for pleasure, well-being, a poly-sensorial experience. The shampoos offer, therefore, fragrances and textures that wake up the senses and offer the consumer the chance to dream... Shampoos are consequently becoming an experience, an agreeable moment for the consumer. The product is appreciated above its cleansing characteristics and performances. 2004/05 Shampooing Plaisir Nature is omnipresent to evoke pleasure. It allows the link between the virtues of natural ingredients (notably herbs and flowers for the new brand Herbal Essence) and an agreeable perfume. The notes trendy and young (notably acidulate and sparkling) are restored with the current flavours (Vivelle). The products Vivelle Gingembre stimulant Vivelle Extase de rose Vivelle Fruits défendus Vivelle Folie d’agrumes Herbal Essences Douceur et brillance (aux extrait d’églantier, jojoba et thym) Herbal Essence Hydra régulateur (aux extraits de bleuet, aloé vera et écorce de cerisier) 2004/05 Herbal Essence Tonic Equilibre (aux extraits de camomille, aloé vera et passiflore) The brands Herbal Essences Vivelle Shampoo Treatment - Health These shampoos could be anti-dandruff, dry scalp relief, hair-loss etc. Their formulas are extremely soft and allow for daily washing They are usually associated with aromatic notes (Thyme, Eucalyptus, and Mint) to evoke freshness and cleanliness and equally the calming side of the product or the soft flowery or fruity notes for the caring side. 2004/05 Shampoo Treatment - Health The brands Head & Shoulders Pétrole Hahn Elsève Homme The products Pétrole Hahn Force The Original Green Head & Shoulders Classic Head & Shoulders Freshness with natural menthol Head & Shoulders Citrus Fresh Elsève Anti-dandruff for Men 2004/05 Elsève Thickening shampoo for Men Shampoo Technicity This type of shampoo puts forwards the creativity, the technical aspect and the efficacy of the products and their formulas: silicones, magnesium salts, vitamins, UV filter systems, purifying agents, concentrated essential oils, serums etc. These shampoos reinforce, fortify, repair, protect, revitalise, purify, nourish and relax the hair. Specific formulas are appearing to respond to the new preoccupations: curly hair, smooth hair, anti-age formula, sun protection, shampoo for blonde hair etc. 2004/05 Shampoo Technicity The brands Elsève Pantène Pro V The products Organics Anti-Age with Collagen E Organics Hydra Purity Elsève Solar Elsève Intensely Smooth Kéranove Hydra Purity Pantene Pro V repair and protective care Sunsilk Volume shampoo Sunsilk Aqua Minerals shampoo Sunsilk for Perfect Curls Jacques Dessange Active Termo 2004/05 Jean Louis David Total Repair John Frieda Highlight Activator Kéranove Jacques Dessanges Jean Louis David John Frieda Shampoo Family This type of shampoo is targeted at the whole family with an economic price, large bottles and simple olfactory notes, agreeable and appreciated by all. The offer is not largely segmented and responds to the most basic requests. The formulas are usually soft and apply to all hair types. The products DOP Egg Shampoo DOP Soft Vanilla 2004/05 DOP 2 en 1 Soft Almond The brands Dop The trends to follow 2004/05 The hyper segmentation Consumers are looking for targeted products to which they can correspond. The idea of belonging to a group and to be, at the same time, different is a strong consumer tendency. The segments follow therefore the particular strong growth areas: - Products for men - Products by age section (for example 12-25 years) - Products for blondes/brunettes Nature This is a particularly strong axe in the beauty hygiene sector. It represents numerous symbols: softness, well-being, freshness etc. Consumers appreciate natural components and the natural trends (products with essential oil bases highlighting quality raw materials) seem the most interesting to follow. 2004/05 Pleasure and well-being This tendency corresponds to the new consumer requests, looking today for pleasure, well being; a poly sensorial experience. The shampoo products inspire spa or aromatherapy concepts. 2004/05 2 0 0 4 2 0 0 5 Collection Floressence Shampoos For men shampoo: NEW MAN 34337 For a particular type of hair: - normal hair: CLAIRBAL CLAIRY - dry hair: NUTRI - greasy hair: APPLEMINT 2004/05 34363D 34009B 34263G 9483B For particular characteristics: -coloured hair: ACTIFCOLOR 34032C - brunettes: ANITA 34331H For particular promises: - hydrating shampoo: HYDRA 34021D - solar shampoo: SOLAR 34385D - anti-dundruff shampoo: NO PELL ANTIPELL 34421D 34342 2004/05 This publication is for information purposes only. It is not exhaustive. This document cannot be used for a publication without mentionning the origin. Marketing Department 2004/05