CDS spreads, selected CEE countries

advertisement

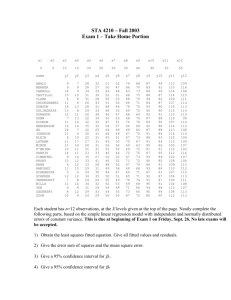

Hrvatska, SIE i tržišta u nastajanju: perspektive, diferencijacija i izbor tečajnog režima nakon krize? Boris Vujčić 6. Godišnja skupština HUKR Novi Vinodolski, 28, rujna 2009. CEE – Immediate Economic Prospects Current account (as % of GDP) Real GDP growth rate, annual Inflation, consumer prices (annual percentage change) Country forecasts Eurostat Consensus IMF IMF Consensus IMF 2009 2010 2009 2010 2009 2010 2009 2010 2009 2010 2009 2010 Bulgaria -1,6 -0,1 -4,0 0,4 -2,0 -1,0 -12,3 -3,6 3,6 3,0 3,7 1,3 Czech Republic -2,7 0,3 -3,5 1,2 -3,5 0,1 -2,7 -3,0 1,3 1,9 1,0 1,6 Estonia -10,3 -0,8 -13,5 -2,2 -10,0 -1,0 -6,5 -5,4 -0,5 -0,3 0,8 -1,3 Hungary -6,3 -0,3 -6,4 -0,7 -3,3 -0,4 -3,9 -3,4 4,8 4,4 3,8 2,8 Latvia -13,1 -3,2 -17,8 -4,0 -12,0 -2,0 -6,7 -5,5 3,4 -1,8 3,3 -3,5 Lithuania -11,0 -4,7 -15,3 -3,1 -10,0 -3,0 -4,0 -5,3 4,5 1,0 5,1 0,6 Poland -1,4 0,8 0,2 1,6 -0,7 1,3 -4,5 -3,9 3,3 2,3 2,1 2,6 Romania -4,0 0,0 -6,4 0,5 -4,1 0,0 -7,5 -6,5 5,7 4,2 5,9 3,9 Slovakia -2,6 0,7 -4,7 1,4 -2,1 1,9 -5,7 -5,0 2,3 2,6 1,7 2,3 Slovenia -3,4 0,7 -4,6 0,5 -2,7 1,4 -4,0 -5,0 0,9 2,2 0,5 1,5 - - - - -3,7 0,8 -4,1 -3,5 - - 4,6 4,2 -5,7 1,6 -4,2 -0,4 -1,1 -1,2 0,3 1,2 0,4 0,6 -4,2 0,0 Central and eastern Europe IMF GAS 31 August 2009 Euro area IMF GAS 31 August 2009 -4,0 -0,1 -4,3 0,6 CEE – Immediate Economic Prospects Unemployment rate total labor force) Budget deficit (as % of GDP) Country forecasts Consensus IMF IMF (as % of WIIW Credit growth, annual IFS Central banks 2009 2010 2009 2010 2009 2010 2009 2010 2008 June 2009 Bulgaria -0,4 0,1 - - - - 8,0 9,0 31,6 11,1 Czech Republic -5,2 -5,1 -4,1 -4,2 5,5 5,7 6,0 6,0 14,9 7,2 Estonia -4,2 -4,2 - - - - 10,5 13,0 6,6 -0,3 Hungary -3,9 -3,8 - - - - 9,0 8,8 18,5 14,3 Latvia -9,7 -8,2 - - - - 12,0 15,0 11,8 1,1 Lithuania -6,3 -5,3 - - - - 8,5 13,0 18,1 -0,2 Poland -5,4 -5,8 - - - - 12,0 11,0 36,4 27,4 Romania - - - - - - 8,0 9,0 34,0 11,2 Slovakia - - -2,9 -2,9 11,5 11,7 11,0 12,0 15,4 6,8 Slovenia -4,7 -4,0 -4,2 -3,7 6,2 6,1 5,5 5,0 - - - - - - - - - - - - - - 10,1 11,5 - - Central and eastern Europe IMF GAS 31 August 2009 Euro area IMF GAS 31 August 2009 7,8 II. Crisis and risk perception in the CEE CEE - since the beginning of the transition large capital inflows, mainly from the EU High penetration of foreign (EU/Eurozone) banks in domestic financial markets (70-98%) served as the main vehicle for large capital inflows Risk perception trends slowly reversed since the second half of 2007, with spreads skyrocketing post-Lehman Capital inflows to European emerging market countries 300 250 billion EUR 200 150 100 50 0 -50 2004 2005 2006 2007 2008a 2009b Investment of commercial banks, net Portfolio equity investment, net Direct equity investment, net Investment of other private creditors, net a Estimate. b Forecast. Sources: International Institute of Finance, Capital Flows to Emerging Market Economies, January 2009 and Bloomberg. BIS reporting banks' claims on CEE countries 170 Index December 2006=100 160 150 140 130 120 110 CEE countries (BG, CZ, HU, PL, RO, SK, SI) Source: BIS Croatia 3/09 12/08 9/08 6/08 3/08 12/07 9/07 6/07 3/07 100 1/1/08 1/2/08 1/3/08 1/4/08 1/5/08 1/6/08 1/7/08 1/8/08 1/9/08 1/10/08 1/11/08 1/12/08 1/1/09 1/2/09 1/3/09 1/4/09 1/5/09 1/6/09 1/7/09 1/8/09 1/9/09 basic points CDS spreads, selected CEE countries 900 800 700 600 500 400 300 200 100 0 Bulgaria Hungary Source: Bloomberg Czech R. Poland Croatia Romania Have the CEE region decoupled from the rest of the EM during crisis? In the seven post-Lehman months rating agencies (Moody’s, Fitch), IMF, Nobel Laureat (Krugman: Austria is the next country to go bankrupt) and the press (Financial Times) all pointed to the Central and East Europe as the most vulnerable/risky region Main argument: unsustainable external positions will have to correct as the large capital inflows of the last decade reverse – the CEE will be the most affected Were the CEE countries really decoupling from the rest of the EM? CDS Variation percentage of Emerging Countries Explained by the first Principal Component 100 90 80 % 70 60 50 40 30 May-09 Mar-09 Jan-09 Nov-08 Sep-08 Jul-08 May-08 Mar-08 Jan-08 20 Note: Analysis of Principal Component is made on 12 Central and Eastern Countries (Bulgaria, Croatia, Czech R., Poland, Romania, Russia, Slovak R., Slovenia, Serbia, Turkey and Ukraine) and also 12 countries of Latin America and Asia (Argentina, Brazil, Chile, Columbia, Mexico, Peru, Philippines, Indonesia, Malesia, Thailand, Vietnam). Sources: Bloomberg, CNB. Correlation with Principal Component 1.0 0.9 0.8 0.7 0.6 0.5 0.4 Note: Correlations with Latin America and Asia are not showed. Sources: Bloomberg, CNB. Ukraine Turkey Serbia Slovenia Slovak R. Romania Poland Hungary Croatia Czech R. Bulgaria 0.2 Russia 0.3 Changes in Yield on Countries Debt from Emerging Markets and VIX Index 1200 70 1000 60 50 800 40 600 30 400 20 200 10 Hungary Poland Lithuania Turkey Source: Bloomberg, JPM. Czech R. Slovak R. Croatia Bulgaria Jan-09 Jul-08 Jan-08 Jul-07 Jan-07 Jul-06 Jan-06 Jul-05 Jan-05 Jul-04 Jan-04 Jul-03 Jan-03 Jul-02 Jan-02 Jul-01 Jan-01 Jul-00 0 Jan-00 0 Romania VIX-right Regression Model Results Independent Variable Coefficient GDP gap -5.7 Inflation 20.3 Exchange Rate (HRK/EUR) % Change 7.1 External Debt/International Reserves 0.3 % Change of Export/GDP EU and EMU accession progress -9.2 -45.7 VIX Index Change 6.6 Constant 93 Adjusted R2 * Significant at the level of 5% Sources: CNB calculations 0.58 Residuals from the model by country 500 400 300 200 100 0 -100 Bulgaria Source: CNB calculations. Croatia Hungary 2008Q3 2008Q1 2007Q3 2007Q1 2006Q3 2006Q1 2005Q3 2005Q1 2004Q3 2004Q1 2003Q3 2003Q1 2002Q3 -300 2002Q1 -200 Lithuania Residuals from the model by country 600 500 400 300 200 100 0 Czech R. Source: CNB calculations. Poland Slovak R. 2008Q3 2008Q1 2007Q3 2007Q1 2006Q3 2006Q1 2005Q3 2005Q1 2004Q3 2004Q1 2003Q3 2003Q1 2002Q3 -200 2002Q1 -100 Turkey Model residuals by country BULGARIA_ Residuals CZECH_ Residuals CROATIA_ Residuals 400 150 600 300 100 400 50 200 200 0 100 0 -50 0 -200 -100 -200 -100 -150 -400 00 01 02 03 04 05 06 07 08 00 01 HUNGARY_ Residuals 02 03 04 05 06 07 00 08 01 LITHUANIA_ Residuals 300 02 03 04 05 06 07 08 07 08 07 08 POLAND_ Residuals 600 200 400 100 200 0 0 -100 200 100 0 -100 -200 -300 -200 00 01 02 03 04 05 06 07 08 -200 00 01 ROMANIA_ Residuals 02 03 04 05 06 07 08 00 01 SLOVAKIA_ Residuals 800 03 04 05 06 TURKEY_ Residuals 200 600 02 600 100 400 400 0 200 200 -100 0 0 -200 -200 -400 -300 00 01 02 03 04 05 06 07 08 -200 00 01 02 03 04 05 06 07 08 00 01 02 03 04 05 06 …and what about banks? Share of Bank Assets by the Bank Group which implies for the branches in SIE 50 40 % 30 20 10 0 Bayerische Landesbank Erste Group Bank AG Intesa Sanpaolo Raiffeisen Zentralbank AG Société Generale Unicredit SPA Bulgaria Czech R. Croatia Hungary Poland Romania Russia Slovak R. Slovenia Serbia Turkey Ukraine Source: Bankscope CDS spreads for parent banks 600 basic points 500 400 300 200 100 Unicredit S.p.A. Intesa Sanpaolo S.p.A. Société Generale Source: Bloomberg 8/09 7/09 6/09 5/09 4/09 3/09 2/09 1/09 12/08 11/08 10/08 9/08 8/08 7/08 6/08 5/08 4/08 0 Erste Group Bank Raiffeisen Zentralbank CDS Variation percentage of Emerging Countries Explained by the Principal Component 100 90 80 % 70 60 50 40 30 European banks May-09 Mar-09 Jan-09 Nov-08 Sep-08 Jul-08 May-08 Mar-08 Jan-08 20 American banks Note: Analysis of Principal Component is made on 4 Parent Banks (Erste Group Bank AG, Intesa Sanpaolo, Societe Generale i Unicredit SPA), 4 biggest european banks (Credit Suisse, HSBC, HBOS i Royal Bank of Scotland) as well as 4 biggest american banks (Bank of America, JP Morgan, Wachovia i Wells Fargo). Because of the missing data for Bayerische Landesbank and RZG AG for previous periods, they were not included in the analysis. Sources: Bloomberg, CNB. Correlation with Principal Component 1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 Unicredit SPA Societe Generale Raiffeisen Zentralbank AG Intesa Sanpaolo Erste Group Bank AG Bayerische Landesbank 0.2 Note: The biggest correlation of european and american banks are not included. Correlation Mean is taken with Principal Component of the biggest european nad american banks on the sample of week CDS change from 27th June 2008 to 15th May 2009. Source: Bloomberg, CNB. III. What exchange rate (monetary) policy options? For the CEE, the current, medium or long run option is the Eurozone Two countries have already joined – Slovenia and, recently, Slovakia This, however, is a double-edged sword – on the one hand it lowers risk perception and, thus, costs of financing, increasing the potential rate of growth, but on the other hand, government or EU/Eurozone shelter might increase the likelihood of poor policy performance In the future the name of the game will be unit labor costs, more than the exchange rate Current: exchange rates in CEE 120 Index, January 2004=100 110 HUF SKK 100 CZK 90 PLN ROL 80 HRK 70 Source: Bloomberg 7/09 4/09 1/09 10/08 7/08 4/08 1/08 10/07 7/07 4/07 1/07 10/06 7/06 4/06 1/06 10/05 7/05 4/05 1/05 10/04 7/04 4/04 1/04 60 ... exchange rate policy choice largely depends on currency substitution … Share of F/c loans in total loans, 2007 90 80 70 60 50 40 30 20 10 Source: IMF (2009) Czech Republic Russia Poland Bulgaria Ukraine Romania Lithuania Hungary Croatia Bosnia & Herzegovina Serbia Estonia 0 Latvia % Medium to long run: Intra-Eurozone real exchange rates 120 Ireland 115 Spain Netherlands 110 Italy Portugal Greece 105 France Bel / Lux 100 Finland 95 Austria 90 85 80 Germany Index 1999 = 100, ULC Total Economy 1999 2000 2001 2002 2003 Note: A rise in the index means a loss of competitiveness. Sources: Eurostat 2004 2005 2006 2007 2008 Real exchange rate 120 110 90 80 70 60 BGN/EUR CZK/EUR HUF/EUR PLN/EUR SKK/EUR HRK/EUR Note: The fall in the index denotes an appreciation of the currency. * deflated by consumer prices Sources: CNB; Eurostat; Bloomberg 2008 2007 2006 2005 2004 2003 2002 2001 50 2000 2000=100 100