Investment opportunities in Agribusiness

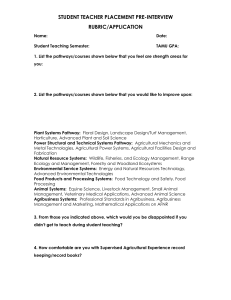

advertisement

Investment opportunities in Agribusiness Profit from overcoming global inefficiencies in feeding the world Premium Wealth Management – Vietnam Conference April 2012 Bill Barbour – Director, Investment Specialist Asia Pacific and MENA Important information Issued by Deutsche Asset Management Pty Limited Australia) Limited ABN 63 116 232 154 AFSL 298 626. This document is not an offer of securities or financial products, nor is it financial product advice. As this document has been prepared without taking account of any investors’ particular objectives, financial situation and needs, you should consider its appropriateness having regard to your objectives, financial situation and needs. The Fund referred to is issued by Deutsche Asset Management (Australia) Limited ABN 63 116 232 154 AFSL 298 626. To acquire units in the Fund, complete the application form that accompanies the current PDS, which you can obtain from www.ironbarkam.com or by calling client services on 1800 034 402. You should consider the PDS in deciding to acquire or to continue to hold the Fund. Although specific information has been prepared from sources believed to be reliable, we offer no guarantees as to its accuracy or completeness. The information stated, opinions expressed and estimates given constitute best judgement at the time of publication and are subject to change without notice to you. This document describes some current internal investment guidelines and processes. These are constantly under review, and may change over time. Consequently, although this document is provided in good faith, it is not intended to create any legal liability on the part of Ironbark or any other entity and does not vary the terms of a relevant disclosure statement. Past performance is not an indicator of future results. All dollars are Australian dollars unless otherwise specified. All indices are copyrighted by and proprietary to the issuer of the index. An investment is not a deposit with or any other type of liability of Deutsche Bank AG ARBN 064 165 162, Deutsche Asset Management (Australia) Limited ABN 63 116 232 154 or any other member of the Deutsche Bank AG Group and the capital value of and performance of an investment in the Fund is not in any way guaranteed by Deutsche Bank AG, Deutsche Asset Management (Australia) Limited or any other member of the Deutsche Bank AG Group. Investments are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Deutsche Asset Management (Australia) Limited is not an Authorised Deposit-taking Institution under the Banking Act 1959 nor regulated by the Australian Prudential Regulation Authority. 1 Our background Actively managed Global Agribusiness Fund to capture inefficiencies and misperceptions of agribusiness. Launched first global agribusiness investments and research in 2005, as of June 2011 over 5 billion USD in assets. Carefully cultivated network of global agribusiness experts in academia, supranationals (invited to roundtable discussion at the UN). Dedicated and seasoned global agribusiness investment team located in NY with strong focus on bottom-up research. Embedded in global thematic equity and trend analysis. Over six years of in-depth analysis at the farmgate, agri-IP, agriR&D roadmaps. 2 Source: Global Thematic Partners and DWS Investments The case for Global Agribusiness Global food prices hit all-time high – Agflation is back UN Food and Agriculture World Food Price Index Food prices ??? 4 Source: Bloomberg; : 30th September 2011 (Monthly data to 29th February 2012) Global food prices hit all-time high – Agflation is back UN Food and Agriculture World Food Price Index Supply shocks 5 Source: Bloomberg; : 30th September 2011 (Monthly data to 31st August 2011) Global food prices hit all-time high – Agflation is back UN Food and Agriculture World Food Price Index Future prices??? 6 Source: Bloomberg; : 30th September 2011 (Monthly data to 31st August 2011) Corn price – January 2000 to February 2012 USA – No. 2 Yellow Corn in US$ per bushel 7 Source: US Department of Agriculture as at 29th February 2012 Pressure on global supply/demand of grain According to the Japanese Ministry of Agriculture, the inventory ratio of grain will decrease to 15% in 2020 and is expected to fall below the safety zone defined by the FAO. Global Grain Consumption, Production, and Inventory Ratio 【1970~2010】 (Million tons) (%) 2 ,5 0 0 80 Total Grain inventory as a % of demand (RHS) 期末在庫率(右軸) 2 ,2 5 0 Grain Production volume (LHS) 生産量( 左軸) 70 2 ,0 0 0 消費量(左軸) Grain Consumption volume (LHS) 60 1 ,7 5 0 50 1 ,5 0 0 40 1 ,2 5 0 30 1 ,0 0 0 20 FAO Safety Zone 17~18% 750 10 500 0 1970 1975 1980 1985 1990 Source:Japan Ministry of Agriculture (As of February 2011) 9 1995 2000 2005 2010 Agribusiness – Inevitability Global forces or catalysts for change 1. Soaring global population 2. Rising incomes in the developing world 3. Limited agricultural land 4. Bio-fuels 5. Global warming – climate change These forces appear to be inevitable and unstoppable Source: Deutsche Asset Management 10 World population growth forecasts Almost 1 billion more people over the next decade Billions of people 11 Source: Population Division of the Department of Economic and Social Affairs of the United Nations Secretariat, World Population Prospects: The 2010 Revision, http://esa.un.org/unpd/wpp/index.htm,Monday, August 15, 2011; The simple income / Food formula Rising income = More food and higher protein consumption INCOME & EXTRA FOOD INTAKE* (*Incremental protien) 16 Source: UN FAO, IMF. 12 grams/day Grams per day 8 4 0 1 5 10 15 20 25 30 35 40 Income per capita ($US 000s) Source: CBA, Commonwealth Research (Updated as at 31 July 2011) 12 45 50 Meat demand and changing diets Creating unprecedented demand for grain Income versus meat demand in large consuming countries Kilos per person per annum 140 120 USA 100 80 Brazil 60 40 20 China GDP per capita (US$) 0 100 1000 10000 China Source: USDA, FAO, US Census; Date: 2008.12.31 13 Brazil USA 100000 Potential for an increase in food consumption 81% of the world population earns less than US $3,466 per annum 2006 Data Global income distribution in relation to world population Developing Countries Low Income Countries Lower-middle Income Countries Upper-Middle Income Countries High Income Countries 2,785 mn people 43% 2,506 mn people 38% 602 mn people 9% 631 mn people 10% GNI* < US$ 875 pa GNI < US$ 3,466 pa GNI < US$ 10,726 pa * GNI – Gross National Income on a per capita basis per annum 14 Developed Countries Sources: 1) Estimated Global Population: CIA, The World Factbook 2006 2) Income Group Classification: World Bank 2006. GNI > US$ 10,726 pa Potential for an increase in food consumption Around half of the world population still earns less than ~ US $4,000 per annum 2011 Data Global income distribution in relation to world population Developing Countries Low Income Countries Lower-middle Income Countries Upper-Middle Income Countries High Income Countries 828 mn people 12% 2,499 mn people 36% 2,484 mn people 36% 1,101 mn people 16% GNI* < US$ 1,005 pa GNI < US$ 3,975 pa GNI < US$ 12,275 pa * GNI – Gross National Income on a per capita basis per annum 15 Developed Countries Sources: 1) Estimated Global Population: CIA, The World Factbook, estimation as of July 2011 2) World Bank economies classification as of 18th July 2011 GNI > US$ 12,276 pa Farmland per person is declining Rising demand requires higher yield from agricultural land World Population (Billions) Farmland (Billions of Hectares) Farmland per person (Hectares) 1950 2.5 1.3 0.50 1975 4.0 1.4 0.40 2000 6.1 1.5 0.25 2020 7.8 1.5 0.19 16 Source: Population Division of the Department of Economic and Social Affairs of the United Nations Secretariat, World Population Prospects: The 2010 Revision, http://esa.un.org/unpd/wpp/index.htm,Monday, August 15, 2011; (utilising high variant data), Lehman Brothers and Global Thematic Partners Biofuels are competing for farmland 17 Rapid depletion of US Corn inventories Millions of tons Source :Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), Agricultural Commodities, September quarter 2011. 18 World biodiesel usage Source :Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), Agricultural Commodities, March quarter 2012. 19 World oilseed indicator price US$ per ton Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), Agricultural Commodities, September quarter 2011. 20 Climate change Increase in global extreme weather over the last century Global observations per annum 25 0 35 30 200 Droughts 25 Floods 20 150 15 10 0 10 5 0 5 0 0 1900 1920 1940 1960 1980 1920 1940 1960 1980 2000 1980 2000 16 0 140 35 30 120 Extreme Temperatures 25 20 Storms 10 0 80 80 15 60 10 40 5 20 40 0 0 1940 1950 Source: Scotia Capital - 2011 21 1900 2000 1960 1970 1980 1990 2000 2010 1900 1920 1940 1960 Scarcity: Potential 150 million hectares shortage of farmland Long-term supply not sufficient Estimated Acreage Increase by 2015 (mm ha) 56 Fragmented substance farmers in Africa, China, India, Eastern Europe require new incentive structures -144 70 171 153 Food Feed Bio-Fuels Source: Radar, USA – August 2009 22 Yield gains Many zoning restrictions in Brazil and Africa limit farmland expansion Total Demand Land ownership unclear in many developing agri regions Undervalued price of water and lack of infrastructure need to be considered when solving the land shortage formula Food consumption on the rise Forecast extra developing world demand - 2010 to 2015 Source: Societe General Cross Asset Research , January 2010 23 What is Global Agribusiness? “Everything from agricultural commodities to consumer products" Exchanges By products Chicago Board of Trade AWB SEEDS & FERTILISER Storage LAND/PLANTATION Processing Product Marketing Logistics Distribution WATER MACHINERY Meat Farm Aqua Grain Animals Fish FARMERS Grain Credit Land Arbitrage Bio-fuels Source: Deutsche Asset Management 24 From dirt to dinner table – Allocation along the value-chain UPSTREAM DOWNSTREAM Resource Owners Facilitators Value Adders Collectors/Distributors Land Agri. products Packag. Food Retailer Plantation Machinery Meat & Bev. Logistics Fertilizer Irrigation Aquaculture Distribution Seeds Infrastructure Forestry Services For illustrative purpose only. The above companies are not a securities recommendation. 25 Source: Global Thematic Partners, 2011 Opportunities High farm income good news for capital expenditure Farm income and capital spending (Diffusion Index) 27 Source: Kansas City Federal Reserve as of 28th February 2011 High farm income good news for capital expenditure Rising farm incomes spur spending on tractors (% change from prior year) 28 SourceUSDA, Association of Equipment Manufacturers; Note: 2011 Ag Equipment Sales are YTD through March Opportunity: Ag-Biotech Enhancing farm and land productivity through science Food production will have to increase 70% over the next 40 years* The population growth necessitates the use of transgenic crops. These are plants which have artificially introduced genetic material. Scientists develop these crops to obtain better quality, higher yield, pest control and resistance to weather volatility. Company examples include: – Monsanto (USA) – Syngenta (Switzerland) – Vilmorin & Cie (France) – KWS Saat AG (Germany) *Food and Agriculture Organisation, October 2009, The above companies are not a securities recommendation and are provided for information purposes only. 29 Global growth in genetically modified (GM) crops A huge investment opportunity - Essential to feed the word 30 31 Ag-Biotech example Monsanto’s “SmartStax” seed technology Monsanto has introduced seed technology breakthroughs for corn and cotton Seeds include herbicide tolerance and insect-protection genes for 8 different above and below ground insects This is forecast to enhance crop yields by 7% to 8% Source: Monsanto.com; 2009 and 2011 Wheat crop threat UG99: A potential future driver of famine A new Puccinia graminis fungus originated in Uganda and was discovered in 1999 (UG99). The fungus causes stem rust that eventually distract plant nutrients relevant for growth. Roughly 90% of the world wheat production has no protection against the virus. 40 million acres in US are currently susceptible to UG99 stem rust, placing annual production of over 2 billion bushels, worth $9 billion, at great risk. Wheat rust has spread 5,000 miles in the last decade. In June of last year scientists announced the discovery of two new strains in South Africa, the most important food producer yet infected. Directly impacts wheat growers, grain handlers, exporters, the US milling and baking industry, and consumers through lower crop yields, reduced grain supplies, poorer grain quality, and higher commodity prices. Global wheat crop could be severly threatened as scientists are concerned that UG 99 might spread as far as Russia and India. Source: The Economist: July 1, 2010 32 33 Opportunity: Aquaculture Substitution and increased consumption of protein Global fish demand forecast to increase by 26% to >50% by 2030* Current per capita consumption p.a. of 17 kgs = 26% demand increase by 2030 An increase to only18 kgs per capita p.a. = 50.9% demand increase by 2030 Most of this increase must come from Aquaculture, with largest growth in Asia Share of fish production 1997 Forecast share of fish production 2030 69% 37% 31% 31% Capture 69% 63% Aquaculture Stable Demand Capture Increase to 18 kgs per capita Aquaculture * Source: DeAM and United Nations & FAO: World Review of Fisheries and Aquaculture 2010, 2008 and 2006, and FAO Committee on Fisheries , Sub-committee on Aquaculture, Fourth Session, Puerto Varas, Chile 6-10 October 2008. Performance comparison: DAX Global Agribusiness Index vs MSCI World Index (in USD) DAX Global Agribusiness Index +117.73% MSCI World Index -3.15% 34 Source: Bloomberg as of 29th March 2012 Note: Commencement date 15th September 2006=100 Performance in USD. Past performance is not necessarily indicative of future performance. Performance comparison from global market bottom* DAX Global Agribusiness Index vs MSCI World Index (in USD) DAX Global Agribusiness Index +117.79% +90.59% MSCI World Index 35 Source: Bloomberg as of 29th March 2012 Note: * The MSCI World Index bottomed on 9th March 2009 =100 Performance in USD. Past performance is not necessarily indicative of future performance. Global food consumption and economic crisis Grain demand uncorrelated to GDP Scatter chart of world GDP growth and grain demand 5.0% 4.5% 4.0% World GDP growth 3.5% 3.0% R Squared = 0.0021 2.5% 2.0% 1.5% 1.0% 0.5% 0% -2.0% -1.0% 0% 1.0% 2.0% 3.0% Grain demand 36 Source: Citi Investment research and US Government sources (1980 to 2009) 4.0% 5.0% 6.0% Continuous growth in global demand for Grain and Oilseeds 1960 to 2011 (Recessions shown with red bars) Million Tonnes World grain and oilseed use 37 Source: US Department of Agriculture 2011 and Global Thematic Partners World stock of Grain and Oilseeds near historic lows Million Tonnes 38 Source: US Department of Agriculture 2011 and Global Thematic Partners. Stock to use ratio Grain prices Common based at 100 from 1st January 2010 to 31st August 2011 39 Source: Bloomberg as of 6th October 2011 (Active contracts from Chicago Board of Trade, Source data in UD Dollars) Past performance is not necessarily indicative of future performance. Grain prices Common based at 100 from 1st January 2010 to 6th October 2011 1st September 2011 40 Source: Bloomberg as of 6th October 2011 (Active contracts from Chicago Board of Trade, Source data in UD Dollars) Past performance is not necessarily indicative of future performance. CF Industries Holdings Inc. – US fertiliser company Share price in USD from 1st of July 2010 -36% 41 Source: Bloomberg as of 6th October 2011 This is not an investment recommendation and is for information purposes only. Past performance is not necessarily indicative of future performance. CF Industries Holdings Inc. – US fertiliser company Share price in USD from 1st of July 2010 2012 P/E = 8.95 2012 P/E = 5.70 42 Source: Bloomberg as of 6th October 2011 This is not an investment recommendation and is for information purposes only. Past performance is not necessarily indicative of future performance. CF Industries Holdings Inc. – US fertiliser company Share price in USD from 1st of July 2010 2012 P/E = 8.95 2012 P/E = 7.92 2012 P/E = 5.70 43 Source: Bloomberg as of 29th March 2012 This is not an investment recommendation and is for information purposes only. Past performance is not necessarily indicative of future performance. An interesting insight – correlations over time Two years daily correlation with Fund* MSCI World Market Vectors Agribusiness S&P GSCI Index Thomson Reuters / Jefferies CRB Commodity Index Dow Jones - UBS Commodities Index 0.68 0.49 0.47 0.46 0.44 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 Source: Bloomberg as of August 2011; Correlation data in USD. *DWS Global Agribusiness* is a US mutual fund and has not been registered in Australia with ASIC and is shown for information purposes only. Past performance is not necessarily indicative of future performance. 44 Australia - Agribusiness opportunities Sector contribution to total Australian GDP 2010-11 Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), Agricultural Commodities, September quarter 2011. 45 Australia - Agribusiness exports Exports in billions of AUD Sector = 2011 imports exceed exports 46 Source :Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), Agricultural Commodities, September quarter 2011. Listed Australian Agribusiness companies A small and limited opportunity set Company examples include: Market capitalisation – Australian Agricultural Company Limited $419 million – Elders Ltd $126 million – GrainCorp Ltd $1,477 million – Incitec Pivot Ltd $5,489 million – Nufarm Limited $1,139 million – Ridley Corporation Ltd $326 million – Ruralco Holdings Ltd $171 million Recent takeovers: – ABB Grain Ltd (Acquired by Viterra Inc – Canada) – AWB Ltd (Acquired by Agrium Inc -USA) 47 Source: Bloomberg and Deutsche Asset Management Market capitalisation data at close of business 7 th of October 2011 in AUD. The above companies are not a securities recommendation and are provided for information purposes only. Global Agribusiness An inevitable investment opportunity Rising prices for Agriculture & Food related products and investments Growing Global Population » Strongest Population Growth in Asia » Urbanization » Increase in life expectancy » Bio-fuels » Slowing Yield Gains Rising Incomes » Changing Weather Increasing Pollution » Land & Water Scarcity Limited Resources Source: Deutsche Asset Management 48 » Increasing demand for High-Protein food … » … and “healthy” quality food (Organic)